So far, 2021 has seen the price of Bitcoin surge to new all-time highs. This was primarily driven by the 2020 Bitcoin bull run, which spilled over into 2021. Although the price of Bitcoin has recently seen a significant correction from its 2021 all-time high, it can still be interesting to compare Bitcoin’s recent 2021 bull run with previous bull runs. January of 2021 has seen a lot of price action in the crypto market, and a good way to stay calm in a volatile market is to look at what has come before. Consequently, investors can better understand current market performance and Bitcoin price predictions.

Bitcoin’s perceived price potential has varied dramatically throughout the years. However, since late 2017, Bitcoin price predictions have continuously fluctuated in tandem with the crypto industry’s overall sentiment. Nevertheless, the increasingly widespread adoption of Bitcoin and blockchain technology has drawn high-profile investors’ attention in recent years, prompting much discussion about Bitcoin price predictions. Furthermore, major companies’ growing adoption of blockchain technology has massively boosted the industry’s perceived legitimacy in the eyes of the masses.

In this article, we’re going to look at some of the factors that played into the recent Bitcoin bull run. We’re also going to discuss different Bitcoin price predictions from various investors and why cryptocurrency education is crucial for preserving wealth. Would you like to learn how to invest in Bitcoin safely? Avoid scams and securely protect your wealth? Ivan on Tech Academy’s Crypto Basics course offers step-by-step video guides to help you on your crypto journey! Also, if you’re interested in gaining a deeper understanding of what Bitcoin is and how it works, see our Blockchain & Bitcoin 101 course today!

Understanding The Bitcoin Bull Run 2021

So, first of all, let’s go through what a bull run is. For anybody unfamiliar with the economic terms, a ‘bull market’, or a ‘bull run’, shows an increase in an asset’s price action. Conversely, a bear market shows the price decreasing. Historically, Bitcoin bull runs have occurred roughly every four years or so. Naturally, this has been due to a variety of different factors, as with any market performance.

Nevertheless, one of the more unique aspects of Bitcoin is its deflationary nature. As per the Bitcoin whitepaper, every 210,000 blocks (which happens approximately every four years), the mining rewards are cut in half. This is known as the ‘halving’ event. This instantly makes Proof of Work mining for Bitcoin 50% less profitable, often causing miners to make a loss. When Bitcoin mining does become unprofitable, the eventual increase in demand has generally driven up the price of Bitcoin to the point where mining soon becomes profitable again.

As the Bitcoin network and Bitcoin adoption continue to grow, logic dictates that surging demand will drive up the price of Bitcoin. What’s more, there will only be 21 million BTC ever mined. Around a quarter of these have already been lost through users losing their hardware wallets or private keys.

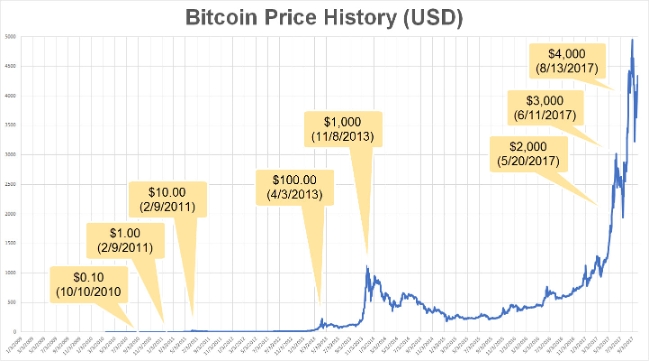

Looking at the Bitcoin price history, Bitcoin appears to form peaks every 3 to 4 years before bottoming out in a two-year bear market. With each peak comes a sharp dump and an obvious change in trend. Bitcoin will often dump between 20-30% as a healthy correction within a bull market. However, following its peak, Bitcoin has then dumped more than 80% each time.

Previous Bitcoin Bull Run Price History

2011 Bitcoin Bull Run – Bitcoin reached price parity with the US dollar on February 9th, 2011, when 1 USD equaled 1 BTC. This year saw Bitcoin peak at $31, followed by a 94% dump where Bitcoin’s price fell to $2. This was the first major top for Bitcoin.

2013 Bitcoin Bull Run – 2013 was another significant year for the world’s premier cryptocurrency, as one Bitcoin rose to a price of $100 on April 1st, 2013. The price then fell substantially, before taking off to reach $1,153 by year’s end. This was a 37x increase from Bitcoin’s peak before 2013. Following this, however, Bitcoin then fell by 85% from this peak, down to $173 in early 2015.

2017 Bitcoin Bull Run – In January of 2017, Bitcoin flirted with its November 2013 high. However, it was initially rejected before smashing through this price level a few months later in April. Bitcoin continued to pump throughout the year, until peaking at around $20,000 in December. This, at the time, 2017 Bitcoin all-time high represented an approximately 17x increase from its previous 2013 peak.

Bitcoin Bull Run 2020

Ever since Bitcoin’s explosive bull run in late 2017, Bitcoin and crypto enthusiasts have been waiting for Bitcoin’s next breakout. Nevertheless, Bitcoin went on to endure a long “crypto winter” during 2018. Although Bitcoin had a slight trend change in 2019, it was eventually rejected at around the $13,000 level. In 2020, following the announcement of an international lockdown and a historic worldwide stock market crash, Bitcoin bottomed out in March of 2020, at just over $3,500. This was a sharp drop of around 50% overnight when the looming premise of the 2020 pandemic startled stock markets and crypto markets alike. However, many eventually started buying the dip and the price began to rise again.

It’s fair to assume that 2020 will go down as one of the most turbulent and testing years in generations. It’s worth noting that, during a pandemic featuring an economic crash, Bitcoin outperformed countless other assets. In fact, investors who bought Bitcoin in March of 2020 were looking at nearly tenfold returns by the end of 2020.

On May 11th, 2020, the third Bitcoin halving event occurred. Mining rewards were reduced from 12.5 BTC per block to 6.25 BTC. The halving event is often seen as a bullish signal to Bitcoin traders, as it effectively cuts the supply of Bitcoin in half through halving mining rewards and improving fundamentals. As such, Bitcoin halving events have historically been attributed to laying the foundation for rising Bitcoin prices. However, this doesn’t happen overnight, and nobody knows when exactly this will happen. It was just over seven months later, on December 17th, 2020 that Bitcoin surpassed its previous 2017 all-time-high at around $20,000.

Bitcoin Bull Run 2021

2021’s Bitcoin bull run has, so far, taken the price of Bitcoin to an all-time high of more than 40% of its price at the end of 2020. Specifically, Bitcoin entered 2021 at just over $29,000 and continued to rise to $41,900 on January 8th. Although the price of Bitcoin has since fallen substantially, Bitcoin is still up this year. Although crypto trading indicators suggest that Bitcoin’s bullish trend was recently broken, this price of Bitcoin is still higher now than when 2021 began, even at which point it was an all-time high.

According to CNN, as Bitcoin’s price has dropped by roughly 20%, the asset has now technically entered into a bear market. Whilst the percentage of the price-drop can not be argued, the report is not entirely accurate. As previously mentioned, 20-30% dumps have been common during Bitcoin bull markets as these offer healthy price corrections.

Without the correct trading tools and indicators, it can be difficult to determine the change in trends. Several analysts argue that “it’s different this time” with the bull run being triggered so far by institutional investment. Any recent price dip for Bitcoin has been quickly snatched up again, which is a bullish signal.

This has led many to suggest there might be less drastic pull-backs and corrections than seen in previous bull markets. However, Bitcoin is designed to be cyclical. Therefore, we can anticipate another bear market at some point following the Bitcoin bull run. There are a wide array of speculations as to when the bull run will peak. From us already surpassing it to the end being some time in September or December 2021. Some believe the peak will be early 2022!

Bitcoin Price Predictions 2021

Following the recent Bitcoin bull run, there has emerged a plethora of different Bitcoin price predictions. What’s more, these Bitcoin price predictions vary massively. Although the recent Bitcoin bull run has slowed down, with Bitcoin trading around $32,000 at the time of writing, there is still a wealth of bullish crypto and Bitcoin price predictions. It is no longer uncommon with Bitcoin price predictions ranging from $50,000 to $100,000. Crypto Asset Analyst at eToro, Simon Peters, reported to Finextra that “Bitcoin is well on track to hit my price target of $70,000 – $90,000 by Christmas 2021”. This coincides with crypto analyst PlanB’s estimations based on Bitcoin’s stock-to-flow ratio. In a tweet, PlanB stated that by Christmas 2021, “Bitcoin should be, or should have been above $100,000”.

However, as the Bitcoin hype grows, the on-chain analyst Willy Woo stated in December 2020 that double this price would be on the lower end of a Bitcoin price prediction. Specifically, Woo tweeted “My Top Model suggesting $200K per BTC by the end of 2021 looks conservative, $300K not out of the question”.

Anthony Pompliano also tweeted “Bitcoin is a 10x improvement on gold. We will one day see a $1M Bitcoin price, which is only 2x the gold market cap. Everyone is underestimating Bitcoin’s potential”.

According to Dan Held, Head of Business Development at crypto exchange Kraken, a $1 million Bitcoin in 2021 is not out of the question. In an interview with Altcoin Daily last December, he stated that he believes Bitcoin could reach $1 million by the end of this year. This is due to a “perfect storm” of excessive monetary printing, or quantitative easing (QE), and business closures. Held states, “Bitcoin was built and planted during the 2008 financial crisis to solve a problem of trust and storing value with governments”.

Crypto Education Is Vital

It’s easy to get swept up in the hype as a crypto bull market gathers steam, and when there are different bullish Bitcoin price predictions out there. However, you should always do your own research before investing in any asset class. Granted, there are numerous lofty Bitcoin price predictions for 2021, but this just makes it even more important to make sure you have a proper cryptocurrency education.

Despite several attempts to censor, ban, or discredit cryptocurrency, the tides have changed. The mass adoption of cryptocurrency has created a thriving industry at the forefront of financial and technological innovation. The blockchain industry as a whole has matured incredibly fast.

Blockchain technology is quickly becoming adopted by major companies and businesses in every sector. Furthermore, the demand for cryptocurrency has skyrocketed in recent months, as a wall of institutional money hits the markets. Cryptocurrency can sometimes appear intimidating at first, however, being in control of your wealth doesn’t have to be difficult. Moreover, understanding the crypto markets’ cycles is vital to get a better sense of the markets. You should also learn the best ways to securely store your coins, such as in cold storage on a hardware wallet.

We are still in the early stages of the global adoption of cryptocurrency. As you’re reading this now, why not take your understanding further and get ahead of the curve. Ivan on Tech Academy is not just for programmers or people aspiring to be programmers. The Academy is available to anyone who wants to gain an education in cryptocurrency and blockchain technology. Ivan on Tech Academy covers everything from learning how to purchase Bitcoin for the first time, to upgrading your current programming skills to work in an emerging tech industry. Make sure to check out Ivan on Tech Academy today!

BSI Indicator

Crypto trading is more competitive than ever. Even professional traders need all the help they can get. Unfortunately, the crypto markets are often front-run by trading bots, making time-sensitive decision making more important than ever. Moreover, the ability to make well-informed decisions based on statistical data and probability, rather than gut feeling and emotion can be the difference between making gains or losses.

The truth is, to make the most of the Bitcoin bull run, traders need all the help they can get. With so much noise and hype around Bitcoin, it can be difficult to know where to look and what to factor into your decision making when trading. If this sounds familiar, then the Ivan on Tech Bitcoin Strength Index (BSI) Indicator is an essential trading companion for trading Bitcoin.

It’s practically impossible to time the exact top of a bull run by simply looking at a price chart. However, the Ivan on Tech BSI Indicator combines technical analysis with on-chain analysis to display a visual trend cloud, on a short or long timescale. With several indicators combined, the BSI indicator gives real-time insights into on-chain sentiment. This allows you to time trades before they play out on the charts. Make sure to read our BSI Crypto Trading Indicator article to learn more!

Summary – Understanding Bitcoin’s 2021 Bull Run and Bitcoin Predictions

Bitcoin’s price has long shown to be cyclical in nature. However, we don’t know how high it will go or how long these cycles last. There is a wide range of Bitcoin price predictions and timings for a 2021 peak (or, perhaps 2022) – or can the price peak for this cycle even be behind us?. Some are random numbers made up in somebody’s head, others are based on strong technical, on-chain, and fundamental analysis. It is important that you have your own individual crypto trading strategy that suits your risk-appetite and situation. The easiest way to keep up-to-date with what is happening with both on-chain and technical analysis is by using the Ivan on Tech BSI Indicator.

Several indicators suggest that Bitcoin’s price may experience some volatility or sideways movement in the near short term. However, this could be the perfect opportunity for the savvy trader to capitalize on price fluctuations in the crypto markets.

To truly make the most of the crypto markets’ opportunities, it’s important to have a firm grasp of technical analysis and a robust trading strategy. If you want to take your trading game to the next level, the Algorithmic Trading and Technical Analysis course at Ivan on Tech Academy can teach you how to automate your trading and backtest your strategies. Used in conjunction with the BSI indicator, you have the ultimate all-in-one trading solution!