The recent week’s Bitcoin price rally highlights the changing appetite for Bitcoin and cryptocurrencies. A mere decade ago, you could have been laughed at for suggesting that your boss or company should consider investing in Bitcoin. Until recently, cryptocurrency was not even considered a legitimate investment or asset class, and unworthy of focus. However, times are changing, rapidly. Today, there are several publicly-traded companies invested in cryptocurrency.

At the time of writing, more than 4% of all Bitcoin in circulation is held by institutions. Largely, this is a hedge against inflation. Institutions are scooping up more Bitcoin than can be mined each day, leaving many crypto exchanges dry. The scarcity of Bitcoin is being felt by traders and investors on all steps of the ladder. Nevertheless, the fact that large publicly-traded companies are investing in cryptocurrency can be seen as a bellwether of the growing interest in the sector.

In this article, we explore some of the reasons that institutional investment in cryptocurrency is on the rise. Additionally, we take a look at some of the different publicly-traded companies invested in cryptocurrency and what this means for the markets. For anyone enrolled in Ivan on Tech Academy, however, the fact that businesses are waking up to crypto won’t come as a surprise.

Rather, Ivan on Tech Academy has been offering a Blockchain Business Masterclass, which breaks down blockchain businesses, for months. Additionally, the Ivan on Tech Academy’s Blockchain for Enterprise course shows how behemoths such as Coca-Cola, Microsoft, EY and others are already using blockchain technology. Enroll in Ivan on Tech Academy to get similar inside knowledge!

Publicly-Traded Companies Invested in Cryptocurrency

Why Are Companies Investing In Bitcoin?

So, why are companies investing in Bitcoin? To summarize this, one first needs to understand where Bitcoin fits in the context of the global financial markets. Bitcoin was created shortly following the 2008 financial crisis. At the time, governments infamously had to ‘bailout’ companies and banks that were deemed ‘too big to fail’. Sadly though, many lost their homes, savings, and pension funds. The use of quantitative easing stepped up around that year, deflating the dollar value with every note printed. This year has been a surprise for most. The pandemic has left the global economic infrastructure on its knees, with QE being used throughout the majority of nations. Governments left, right, and center are pressing the print button to try and save their economy. However, money is debt. Theoretically, this debt needs to be paid back, and can only be done so in two ways. Either, increase taxes or increase inflation rates.

The world is seeing unprecedented amounts of debts piling up, and it doesn’t seem to be slowing down any time soon. Within a single month during this pandemic, more US dollars have been printed than in the previous two centuries combined. Publicly-traded companies and large institutions have also been financially aided by the government, whether they asked for it or not. Businesses have billions of US dollars as cash reserve assets. However, their faith in the dollar is in question. As companies begin to recognize the devaluation of the dollar, they are looking elsewhere for a store of value for their assets. To understand more about how money works, make sure to read Bitcoin vs Stocks vs Gold.

7 Publicly-Traded Companies Invested In Cryptocurrency

Grayscale

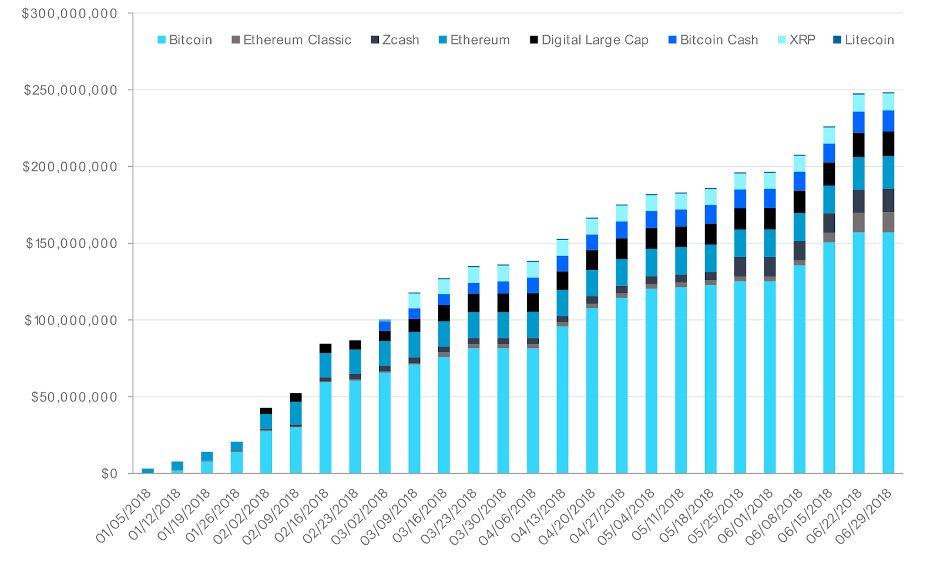

Established back in 2013 by Digital Currency Group, Grayscale is perhaps the biggest name in institutional crypto investment.

The Grayscale Bitcoin Trust (GBTC) is an ETF-type financial instrument. The trust gives investors exposure to Bitcoin, without the need to hold private keys or take custody of their assets. The trust was launched on September 25, 2013, and, at the time of writing, Grayscale has more than 500,000 BTC in assets under management according to Bitcoin Treasuries, making it the largest publicly-traded company invested in crypto.

Grayscale’s Bitcoin Trust was the first crypto-investment vehicle to attain SEC reporting status. The trust gives investors exposure to Bitcoin in the form of a security, removing many of the challenges faced by traditional investors looking to gain exposure to digital assets.

The firm has since diversified, offering a range of different ETF-like investment vehicles for several major cryptocurrencies. These include Ethereum, Bitcoin, XRP, Bitcoin Cash, ZCash, and Ethereum Classic. Grayscale offers single currency products alongside diversified index-like products. As a result, this helps investors gain a broader perspective of crypto markets, and the opportunity to understand how the industry operates. Broader exposure to cryptocurrency by institutional investors not only boosts asset prices but also provides a stronger foundation for a potential bull cycle based on retail investment alone.

This month, the firm announced that there is currently $10.4 billion in assets under management. Despite the majority of this being held in the GBTC trust, Grayscale has witnessed growth in all other single-asset trusts. The Grayscale Ethereum trust often goes unnoticed, but it is the second cryptocurrency investment vehicle to attain SEC reporting status. Despite the overwhelming majority of AUM residing in the GBTC trust, the Ethereum trust is garnering increasing attention from investors.

MicroStrategy

Established in 1989 by Michael Saylor and Sanju Bansal, MicroStrategy provides business intelligence software and cloud-based services for data analysis. Beyond this, the firm develops software to analyze data to inform business decisions, and develops mobile apps.

After an initial $425 million Bitcoin purchase in August of 2020, MicroStrategy currently holds 38,250 BTC under management. The value of which has appreciated dramatically in recent months to a staggering $731,282,625 at the time of writing. With an average buying price of $11,111 per BTC, both the CEO and the company have made substantial returns in just a few months. By moving the company’s reserves into Bitcoin as its primary reserve asset, MicroStrategy’s Bitcoin earnings have outperformed the rest of the company’s financial performance.

In October this year, Saylor announced that he personally hodls 17,732 BTC, purchased at an average price of $9,882 per BTC. Saylor made this investment before the company decided to make Bitcoin its primary treasury reserve. Shortly after the announcement of its Bitcoin allocation, MicroStrategy’s share price rose by 38%, showing strong demand for indirect exposure to Bitcoin.

Square

Headed by Twitter co-founder Jack Dorsey, Square has been at the forefront of digital payments since introducing cryptocurrency services to Cash App in 2018. Unsurprisingly, Square was one of the first major PLCs to publicly endorse cryptocurrency. Recently, Cash App allocated approximately $50 million into Bitcoin, equating to around 1% of the company’s cash reserves.

Cash App began offering Bitcoin trading in 2018, allowing users to buy and sell Bitcoin from within the app. The San Francisco-based team believes that cryptocurrencies enable economic empowerment, aligning with the company’s objectives.

Square’s mobile payment service Cash App reported over $1.63 billion in Q3 of 2020 from Bitcoin alone. In comparison with the same period of the previous year, this is an increase of over 1,000%. Square’s Q3 earnings report shows that the company generated $1.63 billion in revenue from Bitcoin, landing a gross profit of $32 million, up 15x from the previous year.

Resultantly, the BTC revenue generated during this period represents approximately 54% of Square’s $3 billion net revenue. Interestingly, 80% of revenue generated by Cash App in the same period came from Bitcoin. If you yourself believe that you would be a good fit for crypto trading, be sure to first attend Ivan on Tech Academy’s blockchain courses. Learning more about this burgeoning asset class is one of the best ways to become a rational investor.

Galaxy Digital

Galaxy Digital is a holistic financial and investment service, bridging the gap between the institutional and cryptocurrency worlds. Founded by the Bitcoin permabull Mike Novogratz in 2018, the company offers a wide variety of services. Galaxy Digital aims to help institutions understand and invest in blockchain technology and digital assets. Furthermore, businesses can turn to Galaxy Digital for investment and trading advice. Alternatively, they could seek Galaxy Digital for making principal investments or asset management and holdings.

Galaxy Digital Holdings has been featured on the Toronto Stock Exchange (TSX) with the symbol GLXY. Since the company’s inception, it has invested and partnered with some of the largest businesses in the blockchain space. These include Block.One, which was part of the funding and development of the EOS blockchain in 2018. Later that year, Galaxy Digital partnered with High Fidelity – an open-source VR gaming platform. Another venture capital investment of $52.5 million was agreed in partnership with BlockFi, which offers 3 main products. BlockFi offers users the chance to buy and trade crypto, get crypto-backed loans, in addition to storing funds in a high interest-bearing account.

At the time of writing, Galaxy Digital currently holds 57% of their liquid assets in Bitcoin and other cryptos. This makes Galaxy Digital one of the most heavily-committed publicly-traded companies invested in cryptocurrency. Proving to be a smart move, the business invested a basis price of $134 million into Bitcoin. Today, this investment is worth over $315 million.

Hut 8

The cryptocurrency mining company Hut 8 is specifically Bitcoin-focused with its mining output. Hut 8 uses a pioneering combination of software, hardware, and blockchain-management expertise to host data centers and mining rigs in the most optimal, efficient capacity.

Located in Alberta for the cheap electricity costs, the mining company predominantly uses natural gas and wind power. Hut 8 is named after the building in Bletchley Park, where Alan Turing created Christopher – the basis of the first computer that decoded the Enigma machine that led to the winning of World War II.

Turing transformed cryptography, creating the foundations for computer science, artificial intelligence, and blockchain technology. Hut 8 currently holds 35% of its assets in 2954 Bitcoin. Since their investment a matter of a couple of months ago, their returns are nearly 50%. The current value of their Bitcoin assets value stands at approximately $55.8 million.

Cypherpunk Holdings Inc.

Cypherpunk Holdings aims to make it easy to invest in Bitcoin and privacy tech. Founded in 1995, the company provides exposure to cryptocurrency through custodial services aided by Coinbase and Trezor. Using the ticker HODL, Cypherpunk is listed on the Canadian Securities Exchange (CSE) and shares are available to buy through most North American and European Brokers.

The team is led by CEO Antanas Guoga, an established investor and businessman, and successful high-stakes poker player. Guoga is a former member of the European Parliament and has gathered an array of accolades for his diverse work.

Additionally, the team is made up of a strong board of crypto-savvy professionals with an excellent track record in various sectors. The company sights minimum overheads and streamlined operations to offer exposure at both retail and institutional level in an obscure and exciting new sector.

Voyager Digital Ltd

Voyager Digital (Canada) Ltd is traded on the Canadian Securities Exchange (CSE) under the ticker VYGR. Established by esteemed Wall Street and Silicon Valley entrepreneurs and based in New York, the crypto-asset broker offers cryptocurrency custodial services to retail and institutional investors.

In October of this year, Voyager announced that the firm would acquire French Crypto exchange LGO Markets. As a Canadian Securities Exchange-listed (CSE) company, the merger grants access to the European retail market, expanding on LGO’s institutional client base.

This comes after a string of partnerships with various exchanges we announced, aimed at increasing mass adoption of cryptocurrency to a broader market. Furthermore, Voyager intends to issue a business license for virtual currencies, issued by the New York State Department of Financial Services (NYSDFS) by the end of the year. By adhering to and encouraging more stringent crypto regulation, publicly-traded companies invested in Bitcoin help to legitimize the asset class.

Publicly-Traded Companies Invested in Cryptocurrency Conclusion

With Paypal and Cashapp purchasing more than 100% of newly mined Bitcoin, 2020 really has been the year for institutional crypto adoption. Legacy payment infrastructure is quickly being updated, and payments firms are rushing to get a piece of the pie. As crypto mass adoption soars, companies are beginning to realize that to stay relevant, they must adapt.

The number of publicly-traded companies invested in cryptocurrency is increasing exponentially. Surprisingly, ex-crypto skeptic Paul Tudor Jones recently claimed that he holds 1% of his portfolio in Bitcoin. This is quite the turnaround from the esteemed investor’s previous remarks about cryptocurrency.

This list is only a fraction of enterprise-level crypto adoption. Naturally, there are many companies eager to follow suit. publicly-traded companies invested in cryptocurrency will help progress the retail investment in the space. Furthermore, with increased adoption, regulatory obligations will become streamlined as mass adoption takes over. With more clear and understandable guidelines and restrictions around crypto, the easier it will be for new users to onboard.

From this, we can conclude that publicly-traded companies invested in cryptocurrency set a positive example to fellow institutional, retail, or individual investors alike. Bitcoin is finally getting public recognition for its value propositions, with the influx of demand driven by institutional investors. Businesses are finally realizing that Bitcoin is a safe store of wealth, which can only lead to further development, innovation, and adoption. From the energy sector to the fashion industry and supply chain management, blockchain technology is finding its place in every industry. Consequently, it is hardly surprising that publicly-traded companies are becoming invested in cryptocurrency. Nevertheless, this means that blockchain education in companies still needs to catch up, to make the most of the cryptocurrency revolution.