Keeping up to date and staying informed in crypto can be exceedingly difficult. Crypto never sleeps, so information is extremely time-sensitive and can come from many different sources you might not expect. Among other techniques, fundamental analysis is key to staying on top of the latest happenings in the crypto space. But what is fundamental analysis for cryptocurrency?

The average crypto trader spends a good portion of their day analyzing charts and patterns, waiting for trading signals, and buying and selling opportunities. Technical analysis is a key tool in observing market behavior in real-time and making judgments based on statistical probabilities. This is a double-edged sword, however, as many crypto investors and traders can become too myopic on the statistics, and fail to see what’s going on outside of the charts.

In this article, we’ll take a look at the broader factors that can have an effect on the sentiment in cryptocurrency markets and explore some of the things to consider when investing in cryptocurrency.

Before delving into the specifics of fundamental analysis, you should have a solid foundation to start from. Specifically, Ivan on Tech Academy provides all the basic – and advanced – education you need to make it in the cryptocurrency industry. Let Ivan on Tech Academy be your starting-off point in the crypto sector, just as it has been for thousands of others, and enroll today!

What Is Fundamental Analysis For Cryptocurrency?

So, what is fundamental analysis all about? Fundamental analysis is the process of gathering all the available information about an asset you’re looking to invest in. This could include things like the use cases for the project, the team behind it, or the community supporting it.

When we zoom out for a moment, we gain a greater perspective of the cryptocurrency markets and the blockchain industry, allowing us to consider some of the macro factors that can shape the sector, and the impact of social, economic, and political discourse.

Factors in Fundamental Analysis – Global Events

In times of crisis, people need a way to ensure that their wealth is safe and secure. A crisis can also accelerate technological innovation and encourage governments to experiment with new technologies earlier than planned to prevent a crisis from worsening.

While global crises can be devastating, it is often during these times that some of the biggest developments are made in society and technology.

When social norms are broken, people need to look at new ideas to re-establish the status quo. Catastrophic global events can often be a catalyst for new developments in many sectors, and as blockchain is present sector-wide, the industry can be affected by socio-economic tensions, civil unrest, and pandemics.

Factors in Fundamental Analysis – The Economy

When an event takes place that affects the entire global economy, this is a major consideration when implementing fundamental analysis for cryptocurrency. Has the event in question caused fear, or put the status of national fiat currencies into jeopardy?

This could have a short-term negative effect on the price of cryptocurrencies but as we have seen, just like gold, people turn to cryptocurrency, in particular Bitcoin, as a store of wealth, a way to preserve purchasing power, and a hedge against inflation.

Factors in Fundamental Analysis – The Stock Market

Bitcoin has shown varying degrees of correlation between both gold prices and the stock market over the years. When the stock market takes a hit or reacts negatively to global events, investors often experience fear, uncertainty, and doubt, forcing them to exit the market, often at a loss.

The knock-on effect this has on the cryptocurrency markets is usually quite predictable. When the stock market dumps, the crypto markets tend to follow suit. Recently, however, Bitcoin in particular has shown a decrease in correlation with the stock market.

This correlation is inconsistent, but it is frequent and recurring. Bitcoin may appear to be correlated to gold for some time, moving in the opposite direction to the stock markets. Or, as we saw in March, stock market crashes can have a major impact on the crypto markets.

That being said, as the average crypto investor matures, this volatility presents many buying opportunities when dips occur. Weaker hands are leaving the space and crypto investors are often not afraid of a 40% dump if they believe in the project they have invested in.

Factors in Fundamental Analysis – Investors

This year, several esteemed investors and wealth managers have shown support for cryptocurrency on national television, with many investors that had previously cast doubt on cryptocurrency now suggesting that Bitcoin should be a staple investment in any portfolio.

Investment gurus, members of government and other public figures openly supporting Bitcoin are helping to change public opinion and increase the potential for cryptocurrency mass adoption.

On-chain analytics show that there are a record number of whales accumulating vast amounts of Bitcoin, and with publicly traded companies such as Greyscale, Microstrategy, and Square pumping huge amounts of cash into the crypto markets, it’s only a matter of time before cryptocurrency is universally accepted as a legitimate investment.

Factors in Fundamental Analysis – Politics

Political discourse plays a huge role in fundamental analysis for cryptocurrency. Political decisions can affect the industry in many different ways, so it’s something to keep in mind when making investments.

Uncertainty in politics makes investors wary of making significant moves. People are reluctant to make big financial plays when the hands of power are in the balance. Policies can change quickly and what may have been a good deal, to begin with, could result in serious upset if governmental policies change the outcome of any investments.

Some countries are imposing strict capital controls which often leads to capital flight. With recent reports of several centralized exchanges shutting down due to state enforcement, a good understanding of regional regulations is key to staying ahead in the crypto markets.

Factors in Fundamental Analysis – Regulation

There are several ongoing inquiries and investigations into nefarious activity within the crypto space that have been dragging on for years. The industry is young, and up until recently has been highly unregulated.

This is, however, changing quickly. As many fintech firms, payments processors, and traditional financial institutions look to implement blockchain-based services into existing business models, the need for higher crypto regulation is evident by the ever-evolving regulatory landscape.

What’s more, this process is compounded by crypto firms looking to integrate with the legacy system. Highly regulated crypto exchanges such as Kraken are looking to implement traditional banking services alongside cryptocurrency offerings with the introduction of crypto banks.

San Francisco-based crypto firm Kraken recently received a US banking license which will allow the company to provide banking services in the state of Wyoming, with plans to expand in the near future. Additionally, crypto banks could play a major role in expediting crypto regulation.

If you want a deeper understanding of cryptocurrency regulation, along with the benefits and drawbacks of crypto regulation, be sure to visit Ivan on Tech Academy. More than 20,000 students have already enrolled in the Academy, and right now you can get 20% off when joining with the promo code BLOG20.

Regulation – Benefits and Drawbacks

It could be argued that increased regulation and centralization is bad for crypto. Equally, by implementing blockchain technology at an institutional level, it is difficult to ignore the scope for increased innovation and reduced friction.

With better regulation, it will be easier to tackle crime, and interoperability with the traditional financial sector could be streamlined, but more importantly, higher levels of regulation could help to bring trust into the space and help change public perception of cryptocurrency.

If the increase in centralized crypto custodians results in a heavily regulated industry, it could spell the end for many non-KYC exchanges such as Bitmex. The big money coming into crypto is not coming in through sketchy exchanges that could be put under investigation at any time.

The serious money is coming in through highly-regulated, reputable establishments that loook to push the utility of crypto-based financial instruments into the mainstream, which can only be achieved by playing by the rules. If we want to see more crypto pension funds or even a Bitcoin ETF, regulation will be paramount to making it happen.

Regardless of where you stand on this, it is something to bear in mind. Crypto regulation is evolving, and this can have a serious impact on the market.

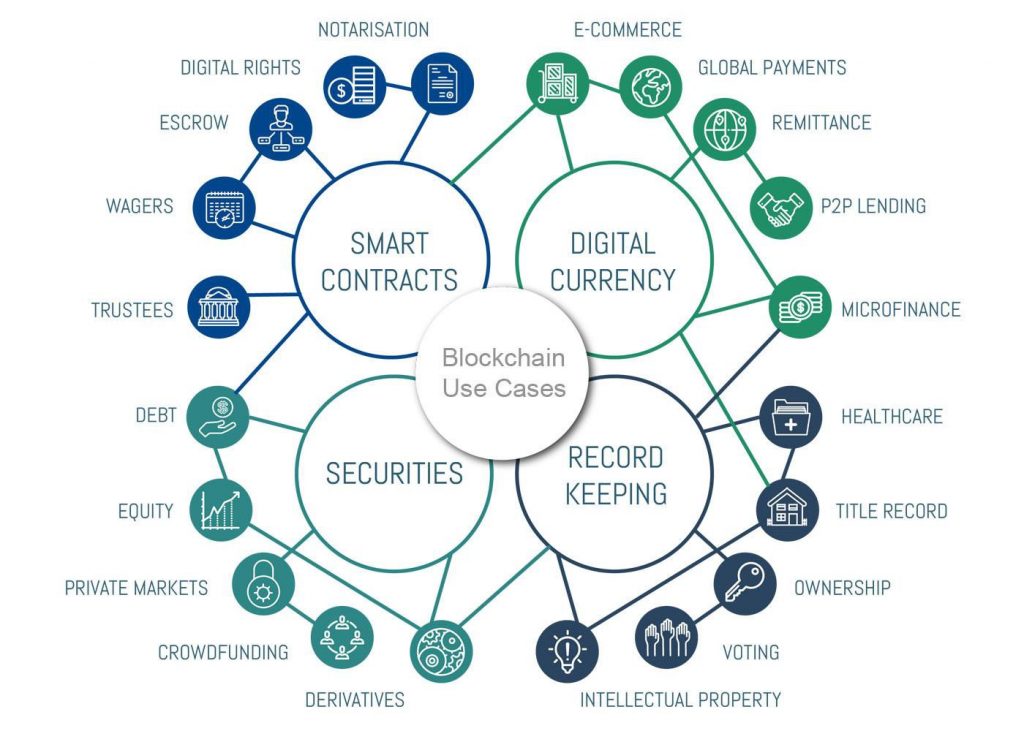

Factors in Fundamental Analysis – Use Cases

Though it may seem obvious to some, the use cases of a cryptocurrency project are generally the key to its success. What is the value proposition of this project, and how is it being utilized to increase engagement?

If a platform regularly introduces new features and improvements to its protocol, chances are they are committed to expanding the user base of the platform. Many crypto projects hit the market with a simple offering, often with one or two core features. With continued development and the addition of new features, the use cases for crypto projects can increase exponentially.

Looking at some of the most successful altcoins of the year, most of them offer a range of compelling use cases and continue to add innovative new features as the platform develops. The utility of a token or coin as part of a cryptocurrency project is often what determines the true value of the asset, so that’s something to bear in mind next time you wander into the altcoin forest.

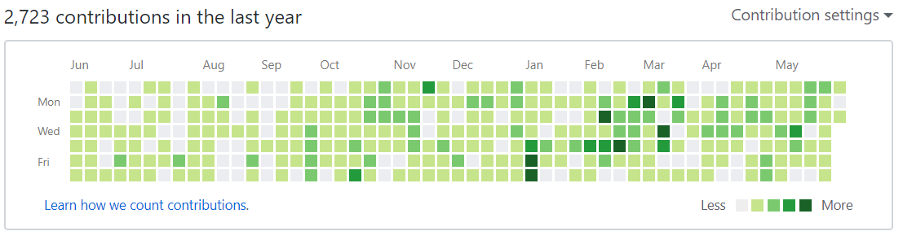

Factors in Fundamental Analysis – Development

One of the easiest ways to see how a project is progressing is by looking at how much time is spent on development. An active Github repository can show potential investors how much work is going into a project.

If a project shows no activity on Github, has little social media engagement, and an inactive community, it shows that the project is perhaps not active. This should ring some alarm bells for investors, as inactivity and a lack of development from a crypto project shows that the project is not innovating. Innovation is key in blockchain, so if a project is stagnant, then one might question the value proposition of the investment or the legitimacy of the project.

Factors in Fundamental Analysis – Announcements

In the digital age of social media, it has never been easier to engage with an audience or community. A great deal of the hype around cryptocurrency comes from announcements made on social media platforms by cryptocurrency projects.

Social media marketing plays a crucial role in keeping the crypto community in anticipation of the latest updates with announcements of announcements! Everyone is online these days, so by providing the crypto community with a steady stream of news and updates keeps the excitement alive for potential investors.

A project may go quiet for a while, but if they are active on Github and its roadmap shows a major update on the horizon, announcements can have a major impact on the crypto market. In particular, when a coin is listed on a major exchange, the price often spikes considerably as the news spreads.

New partnerships and collaborations between cryptocurrency projects have proven to be a significantly bullish indicator on occasion. Although many of these announcements are insignificant, some can cause serious price action for the cryptocurrencies involved.

Factors in Fundamental Analysis – Trends/Cycles

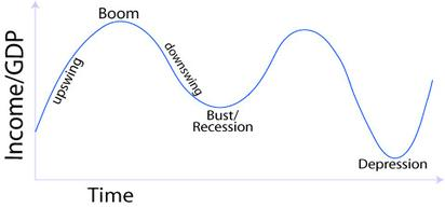

Economies and markets are cyclical. Capitalism is essentially designed in such a way that a “boom and bust” every 70 years or so is expected. The crypto market is no different. The Bitcoin halving event that occurs approximately every four years cuts miner’s block rewards by 50%. Historically this has been a catalyst for a bull market following an extended bearish period.

These long-term trends can last months or years, but between these cycles, there are several altcoin cycles that emerge in line with current trends. This summer we saw some consistent narratives throughout the height of the alt cycle.

Decentralized finance (DeFi) became the hottest trend in crypto this year after decentralized money markets such as Aave, Compound and Maker popularized collateralized lending and borrowing on the blockchain. Non-custodial Decentralized exchange Uniswap attracted record trading volumes throughout Q3, resulting in a wave of DeFi projects and applications emerging in hopes of catching the DeFi hype train.

Another key narrative this year has been the use of oracles. To get real-world data onto the blockchain reliably for use in smart contracts, almost every Defi platform relies on oracles. Oracle providers such as Chainlink and Band Protocol performed extremely well during the recent alt cycle and are expected to continue to flourish in the coming months.

Factors in Fundamental Analysis – Adoption

Cryptocurrency adoption is on the rise. With major players such as Paypal, JP Morgan, and Visa all looking for a piece of the pie, many skeptics are finding it difficult to ignore the fact that perception is changing, and cryptocurrency is becoming a legitimate asset class.

The implementation of blockchain technology on an enterprise level is driving mass adoption like never before. Projects such as Origin Trail and Baseline Protocol are bringing the blockchain to major industries in a variety of interesting ways, including the use of public blockchains to integrate with and update internal systems, to the use of blockchain in supply chain management, healthcare, and the fashion industry.

Blockchain gaming is also helping to push crypto adoption, with a thriving non-fungible token (NFT) market helping to create in-game economies where players can buy and sell rare or unique items that are tokenized on the blockchain.

The scope for blockchain adoption is huge. Soon we could see NFTs being used for putting mortgages on the blockchain and there is a good argument for election votes to be counted on the blockchain too. As education in the field continues to progress, and more people learn about the potential use cases for blockchain-based applications, the more factors there will be to consider when investing in cryptocurrency.

Summary – Fundamental Analysis For Cryptocurrency

There are numerous factors to consider when trading and investing in cryptocurrency. Fundamental analysis, combined with technical analysis and on-chain analysis, can provide an all-encompassing perspective of the cryptocurrency landscape, helping you to make the best, most informed decisions possible, whether you are day trading or hodling for the long-term.

The biggest driving factors in almost every market is emotion and sentiment. By having an ear to the ground and understanding what drives market sentiment, the use of fundamental analysis for cryptocurrency gives traders and investors a perspective that cannot be observed on any chart.

Nevertheless, the most important factor to take into account when conducting fundamental analysis is to have a solid understanding of the underlying technology. Crypto and blockchain education is imperative to comprehending what is happening in the space. What’s more, you can get a world-class crypto education at Ivan on Tech Academy, and choose between dozens of crypto courses. Check it out today, and join one of the most vibrant blockchain education communities anywhere!