One of the main draws of cryptocurrencies such as Bitcoin is that they are decentralized. However, at what point does crypto’s interoperability with the traditional financial system make it all part of the same centralized entity as legacy financial systems? As you will likely know, Bitcoin can be traded like a stock or share, and crypto exchanges are acting increasingly as traditional banks, so is crypto becoming centralized? Some signs are arguably pointing towards that. However, as this is going on, the world of decentralized finance (DeFi) is flourishing. So, what is the state of crypto – is it in risk of becoming centralized, or is crypto truly decentralized?

New decentralized finance (DeFi) projects are popping up almost every day, with many of them being unaudited, unregulated and more or less decentralized. In this article, we’re going to look at the spectrum of decentralization within the crypto space, and how different schools of thought are creating tribalism within the blockchain community, while simultaneously spurring innovation and healthy competition in an evolving industry. Let’s, therefore, look at whether crypto is becoming centralized, and take a closer look at the “Bitcoin maximalism vs blockchain innovation” argument.

Ivan on Tech Academy is one of the top online cryptocurrency and blockchain education platforms available, and can be your guide to the DeFi and crypto sector. Enroll today and get unparalleled access to world-class blockchain courses!

Maximalism vs Innovation

The age-old argument of decentralization over composability is beginning to evolve. As Bitcoin has acted somewhat like a stablecoin throughout the past months, many “Bitcoin maximalists” (sometimes referred to as “maxis”) have turned to Ethereum to explore the exciting world of DeFi.

Even though projects like the Lightning Network will continue to innovate on the Bitcoin blockchain, there’s no denying that much innovation is also happening on other blockchains, particularly in DeFi, which is heavily dominated by Ethereum-based platforms.

The idea of interoperability is ushering in a new age of blockchain development and collaborations. Blockchain projects such as Polkadot are making it easier than ever for different blockchains to interact and interoperate with each other, which doesn’t sit well with some Bitcoin OGs that think everything that isn’t Bitcoin, is a scam.

The truth is, blockchain as an industry is evolving. Different projects are facilitating all kinds of innovative bridges between blockchains, making the network effect of cryptocurrency grow in tandem with the crypto-ecosystem. As layer-two solutions become more advanced, and composability and interoperability continue to be facilitated, there will likely be less tribalism throughout the crypto community as it matures.

The innovation and collaborations in question mean that there is certainly money to be made, however, with the multitude of projects and blockchain businesses cooperating, the revenue from cryptocurrency projects will be distributed across the globe, making it difficult to monopolize the diverse and ever-evolving blockchain industry.

Ethereum

For many Bitcoin maximalists, Ethereum can be seen as a thorn in their side. Since its inception, Ethereum has aimed to fill in many of the perceived flaws in the Bitcoin protocol. Ethereum, with the introduction of smart contracts, has played a key role in building the rapidly expanding decentralized finance ecosystem. Simply put, DeFi developers have – with the use of Ethereum – created products and services that Bitcoin could have offered if the developer community had agreed on changes to the protocol.

Consequently, Ethereum has enabled a platform for developers to build projects for financial freedom. DeFi offers services that are censorship-resistant and do not discriminate. For citizens of countries with struggling economies and capital controls, DeFi offers a way to preserve and cultivate wealth which would be impossible under strict political regimes. That being said, when compared with Bitcoin, Ethereum is somewhat centralized as co-founder Vitalik Buterin still plays a major role in the project.

Visa also recently advertised for an Ethereum developer position after stating publicly that the payments giant intends on harnessing the many advantages of the blockchain as we move into a new paper-less financial paradigm.

Decentralized Finance

The rise in trading volume on decentralized exchanges shows that the crypto community is evolving. Uniswap recently surpassed Coinbase in 24-hour trading volume, suggesting that centralized exchanges must adapt, or die. That being said, most are adapting, with staking rewards offered on many different CEXs and an array of new features being integrated into trading platforms.

With the recent distribution of the UNI token, decentralized finance protocols are showing that, despite investor interests, projects want to become more decentralized. Decentralized Autonomous Organizations (DAO) allow the community behind a project to make decisions on the future of the protocol, with governance tokens seeing a huge spike in popularity.

Centralized Exchanges

Coinbase, the largest centralized cryptocurrency exchange is currently valued at over $8 billion. Rumors have been circulating that the company is planning an initial public offering (IPO) that would allow shares in the company to be traded freely on the stock market. This is huge for crypto, but is it a good thing or a bad thing?

If the goal is mass adoption and exposure to cryptocurrency, then yes, perhaps this is a good thing. But as Bitcoin’s price becomes increasingly correlated with the stock market, thanks in part to exchange-traded funds and other financial instruments, the decentralized nature of Bitcoin diminishes. At worst, this could result in Bitcoin becoming just like any other tradable asset, ignorant to the many benefits that the cryptocurrency offers.

Whichever way you look at it, by going public, crypto exchanges are putting power into the hands of shareholders, which could in turn harm the industry. There is an ongoing debate about venture capital in crypto, as to whether or not it is an essential part of a project’s success, or if it denatures the decentralization within the crypto space.

For retail investors and newcomers, centralized exchanges will continue to play a vital role. But as the crypto community becomes more experienced in decentralized, self custodial protocols, the benefits of CEXs are reduced to merely being fiat on-ramps.

CeDeFi

On September 1st, the centralized crypto exchange Binance introduced a $100 million support fund for the Binance Smart Chain (BSC) to help new DeFi projects get a leg-up in the game while helping bridge various blockchain projects, adding liquidity, and assisting in the auditing process. BSC works as a parallel blockchain to the main Binance Chain that allows for the deployment of smart contracts, plus new staking functions for the native BNB token.

Binance has introduced a range of new features that are either explicitly aimed at DeFi users, or offer many of the features found in DeFi such as lending, borrowing, and staking.

So far, several successful new projects have gained traction through implementing the Binance Smart Chain, and it is now possible to yield farm with BNB loans. So, is crypto becoming centralized?

The term “CeDeFi”, meaning centralized decentralized finance, accurately represents the position of Binance in the crypto space. On the one hand, this could be viewed as a bad thing, as by definition, centralization is not a favorable quality of a DeFi project. However, a centralized exchange that facilitates interoperability between blockchains and exposes new users to the world of DeFi and supports up-and-coming projects, seems to be a good thing. This could assist Binance in monopolizing the space, or it could encourage other CEXs to follow suit and support DeFi projects, rather than viewing them as a rival.

When you add to this to the fact that Binance has recently introduced the new crypto debit card ‘Binance Card’, it seems like there is a merger occurring between the traditional financial system and decentralized finance.

Regulation

There are also some regulation issues related to centralized crypto organizations. With the centralized exchange Coinbase handing over user data to the UK tax authorities, crypto taxes have never been more important. There is an increasing number of countries clamping down on crypto taxes, with tax return forms requiring an explicit declaration of any digital assets.

Coinbase also recently introduced the Coinbase Analytics program, which hands over user data to the US federal government. This has caused some concern among the crypto community. Despite Coinbase insisting that this data will only be used to tackle nefarious activities, it could also be used for other means to track people on the blockchain, infringing on user privacy.

Some fear that this is crypto becoming centralized, with the intertwining of CEXs with banks and the state a cause for concern, however, many agree that better regulation is needed for the mass adoption of crypto to grow. If this works as it should, it could be a catalyst for a positive step toward regulatory progression, which could help stabilize crypto markets and onboard new users.

If you are looking to better understand Ethereum or Bitcoin, then Ivan on Tech Academy is the place for you. Ivan on Tech Academy already has over 20,000 students enrolled in its various crypto and blockchain courses, and consistently produces real-life success stories. As such, Ivan on Tech Academy is the only blockchain education platform that can take you from zero previous knowledge to blockchain hero status. If you enroll using our exclusive BLOG20 promo code, you can get 20% off when enrolling in the Academy.

Crypto Banks

There are now a wide variety of crypto banks and banking services, both custodial and non-custodial. However, there is a huge spectrum of how banks and crypto firms interact with one another and the relationships they are forming. For example, the Ethereum solutions platform Consensys recently acquired the Quorum blockchain from major US bank JP Morgan. Meanwhile, projects such as Monolith offer fully decentralized, self-custodial banking services.

Then, somewhere in the middle, we have Kraken, the centralized crypto exchange that just received a US banking license enabling cryptocurrency to be bought, sold, and held with ease. This move could expose millions of new users to cryptocurrency and help to normalize it as the old crypto-stigma dissipates.

Mining

There is already a growing concentration, or centralization if you will, of Bitcoin mining taking place, with the majority of hash power on the network coming from just a handful of huge mining farms. This is, however, in a state of flux. As new regulations arise in various geographies, and mining rigs become outdated, crypto mining is becoming a cottage industry, with many everyday people making a passive income from mining cryptocurrency independently.

Ethereum’s transition from Proof of Work to Proof of Stake lowers the entry barriers for becoming a blockchain node or validator. PoW requires extremely expensive firmware, alongside the initial investment of large amounts of energy, before seeing a return on mining.

Ethereum 2.0 validators must stake a minimum of 32 ETH – although this is still a substantial amount of money, it is far cheaper than becoming a Bitcoin PoW miner. In addition to this, projects such as ANKR are helping scale decentralization by offering staking pools for popular blockchain networks. This allows people of a much wider budget to become a node or validator of their favorite blockchain, within a few simple steps.

Institutional Investment

The exponential rise of institutional investment into cryptocurrency runs the risk of concentrating vast amounts of cryptocurrency among a small group of high net-worth individuals. If this were to happen, Bitcoin could see price stability or even price manipulation.

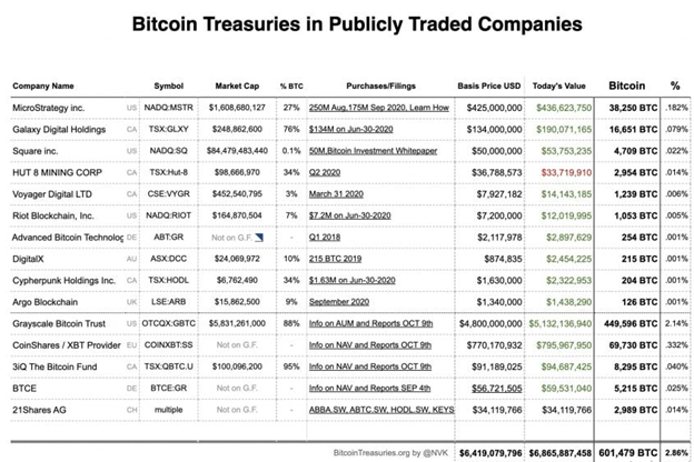

According to bitcointreasuries.org, at the time of writing approximately 2.2% of all Bitcoin in circulation is held by 18 publicly traded companies, that’s 612,944 BTC, worth over $7 billion. This list is growing exponentially, with huge companies adding Bitcoin to their balance sheets almost daily. With private hedge funds and investment firms rushing to add Bitcoin to their portfolios, we’re also seeing tech giants like Microstrategy and Square buying up substantial amounts of the cryptocurrency.

Enterprise

By now, most major corporations are either considering the use of blockchain or adopting blockchain technology, if they aren’t using it already. With companies such as Microsoft and Coca-Cola using the Baseline Protocol to leverage blockchain technology, it seems reasonable that many other huge companies will follow suit. The rapid increase in blockchain education for enterprises suggests that big businesses have no intention of slowing down when it comes to implementing blockchain technology to optimize working practices.

Some may argue that big businesses utilizing blockchain are denaturing cryptocurrency, but the innovation being harnessed in these developments is undeniably compelling, and can be seen as a bullish indicator for crypto. It must also be considered that any enterprise building on an Ethereum private blockchain has little to no impact on the centralization of the Ethereum public blockchain.

Standardization

The standardization of data is massively efficient and uncoordinated across many sectors, wasting time, energy, and money every day due to clunky systems and an absence of compliance standards. Thanks to blockchain technology, however, this is rapidly changing. The standardization of data in supply chain management and the medical industry means that several parties can access the same data sources in a trustless way, without intermediaries.

Ensuring that compliance standards are highly-regulated in the food and medical industries is paramount to the success of the industries themselves, and the people they serve.

By using the blockchain in this way, data could become centralized. For example, if one particular healthcare company gained a monopoly of the network that shares medical records on the blockchain, this could be dangerous and open to manipulation. However, the upside potential is that businesses operate more efficiently, wasting fewer resources, and hospitals and medical centers can be optimized to cut out the unnecessary intermediaries and the outdated record-keeping process.

Is Crypto Becoming Centralized? Conclusion

The exponential rise in total value locked in DeFi is not necessarily representative of the number of new users, but the innovation and advancements in usability on decentralized platforms are making it easier than ever for novice investors to reap the benefits of DeFi.

Although some wonder if crypto could kill the banks by rendering them obsolete, the fact that centralized exchanges are pushing towards becoming crypto banks suggests an eventual merger of the two could possibly play out.

This tribalism could just be a teething period as the blockchain industry evolves into several sub-sectors of the industry. Bitcoin is not used in the same way as Ethereum, just as BlockFi is generally not used in the same way as Aave or Uniswap, but very similar things can be achieved with each of these platforms, with outcomes tailored to the needs of each user.

If the blockchain can be used to redesign the antiquated and inefficient global monetary system effectively for the better, then centralization is a good thing in this case. However, if the growth of cryptocurrency is stifled by knee-jerk regulation, and un-informed guesswork about the threat it poses to the traditional financial sector by policymakers, then we could see crypto become a complicated regulatory minefield, which would slow adoption. If mass adoption is on your list of things that are good for crypto, then this is bad news of course.

But, if you truly believe that more distance between the legacy system and cryptocurrencies is key to decentralization and that decentralization is key to the success of crypto, then maybe this type of stifling isn’t such a bad thing after all. It wouldn’t be much fun if all the innovation in crypto was captured by major corporations; governmental bodies gaining authority over cryptocurrency was hardly part of Satoshi Nakamoto’s dream.

The crypto sector is a fascinating one, and can be hard to get into. However, Ivan on Tech Academy offers countless crypto courses that can guide you to all things related to cryptocurrency and blockchain technology. Check out our many courses if you want to learn more about decentralization and centralization, and join the blockchain revolution!