Decentralized finance, or DeFi, is rapidly opening up new opportunities through democratising finance. Have you ever dreamed of starting a hedge fund but thought it was too expensive? If that is the case, you might want to consider starting a DeFi hedge fund instead. That is now possible through using solutions such as Melon. This is a decentralized asset management platform that allows anyone to set up and manage a hedge fund. But, before we get into all the things Melon can do, let’s look at how a traditional hedge fund operates.

Hedge funds are wildly popular largely because of the lore that surrounds them. To the average person, the world of hedge funds is all about glitz and glam. Theirs is an insider’s game where savvy traders strategically allocate billions of dollars to generate obscene profits. They make the kind of money average traders can only dream about.

Hedge fund managers are mythical figures in the financial landscape. They’re like the magicians of money who take wild risks and enjoy minimal regulation. Throw in a few high-profile bandits like Bernie Madoff and it only serves to add to the folklore.

Introduction to Hedge Funds

Big money players initially set up hedge funds to avoid the increasing regulations that mutual funds were subject to. They also designed these funds to hold both long and short positions. By doing so, fund managers could generate profitable returns regardless of whether the markets went up or down. Essentially they hedged their trading positions, hence the name, “hedge funds.”

Hedge funds are not available to the average person. That’s because the initial investment required to join is typically between $100k to $1 million. And with minimal regulations, they have an advantage over other large, institutional investment vehicles.

People love to hear stories about the billions made by characters like George Soros, but the fund managers you don’t hear so much about are those who crash and burn their funds by taking on too much risk.

That’s why for savvy investors, picking a hedge fund isn’t so much about looking at the returns as it is analyzing the risks they’re taking and how risk is distributed. On the surface, the risks can seem small. But if risks are correlated, even small ones can add up to one big financial spanking. All that needs to happen is for one “fail” to trigger the others to collapse.

The Traditional Hedge Fund

Funds are just portfolios of assets. Investors provide their capital to these funds, but they do not decide which investments to make. Portfolio managers do. They pick the assets and the investors pay them management fees.

The fund is a separate legal entity in which investors can participate by buying shares. The hedge fund will include a mandate that dictates what kinds of assets the fund can invest in. That way, investors know what will be done with their money. So long as the fund manager is honest, that is. For example, if a portfolio manager bought oil stocks, he would breach the mandate if it specified the investments were strictly going into precious metals.

Problems with the Traditional Hedge Fund

To prevent fraud or errors, a custodian bank will hold the investor’s funds. Thus, when an investor buys shares, they essentially hand over control of their assets. Only the portfolio manager can move the funds around to various investments. But a third party administrator ensures the funds are only investing in the assets specified in the mandate. And not into some wild, speculative adventure outside its parameters.

Administration Costs

Third-party admins also ensure the proper valuation of funds. They see to it that all transfers are properly received. As a further measure, an external auditor audits the administrator each quarter.

In addition to that, back-office employees need to be hired (about five for each investment professional). These include auditors, more administrators, custodians, and transfer agents. Not to mention all the accompanying legal docs, fees, and custody banks that need to be involved.

Third-Party Costs

Nearly every stage of the process involves some type of third party each carrying additional costs. And every time a new person gets involved, there is a chance that dishonest behaviors or errors will take place. Unscrupulous individuals like Bernie Madoff are always lurking around big money arenas like hedge funds.

All this reporting and third-party oversight were intended to make the shark-infested waters safer for investors and create transparency. But traditional hedge funds are still about as transparent as the Hudson River. And huge layers of bureaucracy have resulted. Guess who ends up paying for all that? Investors. The current system is complex, inefficient, needlessly expensive, and at the end of the day, still not very secure.

Start-up Costs

Besides operation costs, starting up can cost as much as $50k and take up to eight weeks (depending on the jurisdiction). The Cayman Islands, Ireland, and Luxembourg are jurisdictions of choice for hedge fund operations.

But moving beyond the glitz of exotic locations, a challenging part of running a hedge fund is dealing with clients. Even a small number of clients require weekly reports. Someone (or a team of people) has to keep the clientele updated on entries, exits, fees, etc. A mountain of paperwork can quickly ensue which means more administration.

Even though hedge fund regulations are lighter than for a mutual fund, staying compliant requires plenty of audits. All of this makes running a hedge fund costly and inefficient—not to mention opaque as a black mirror.

These operating costs present a high barrier to entry for newcomers looking to start one.

The Melon Solution

Melon is a decentralized asset management protocol that allows anyone to set up and manage their hedge fund. The layers of bureaucracy needed to run a traditional hedge fund are not necessary with the Melon protocol. With Melon, you can quickly and easily create your fund of digital assets. You can get followers and new investors by showing off your track record. You can long or short specific tokens.

The DeFi Hedge Fund

This is all due to DeFi. Whether it be about looking for arbitrage opportunities, market making, flash loans, derivatives. DeFi is one huge sandbox that allows anyone to make complicated trades formerly reserved for the rich and well connected.

We mentioned that the traditional hedge fund takes about eight weeks and between $20k to $50k to set up. Guess what the set-up costs are with Melon? Less than $50 and about ten minutes to set up! That’s right. Now for those acquainted with DeFi, this may not be that surprising. But imagine pitching these prices to the uninitiated? They wouldn’t believe it.

However, to be successful at hedge fund management is not quite as easy as setting one up in the DeFi space. A good DeFi hedge fund manager has to be able to analyze markets on multiple levels. They must be able to gauge things like market sentiment and be on the lookout for black swan events. They have to understand technical and fundamental analysis, passive investments, arbitrage, yield farming, and so forth.

DeFi Fund Managers

To get started though, a fund manager only needs to define the rules of the fund and deploy it to the blockchain. And since the blockchain records transactions immutably, there is no need for complicated and expensive audits. Not to mention, Melon is a non-custodial protocol, so investors remain in control of their digital assets which they can redeem at any time.

Fund performance is also on-chain so both fund managers and investors can track performance transparently. And with the transparent blockchain, Ponzi schemers will no longer be able to fool investors with bogus reports showing incredible past gains.

The blockchain keeps performance reporting honest and reduces the ability for single actors to defraud naive investors. Eliminating the need for third parties and admins helps slash operating costs as well. This allows fund managers to pass the savings on to their investors.

Admins Replaced by Smart Contracts

Melon provides a platform for fund managers and investors to operate in a way that is secure, transparent, efficient, and dramatically less costly. Melon replaces the majority of fund admin tasks with smart contracts. This drastically reduces the costs of setting up and running a transparent, audited, and fully compliant fund on the blockchain.

Each set of smart contracts on the Melon protocol performs a specific function found in traditional hedge funds, like:

- Accounting

- Asset Custody

- Fee Distribution

- Investment

- Trading

It also performs other functions that financial intermediaries like custodians, fund admins, and transfer agents would normally do. Melon is paving the way for a new type of asset management with protocol level integrations. These integrations enable other features such as:

- Trading

- Price feeds

- Derivatives

Also, smart contracts work together to set the parameters and enforce the fund’s rules. This frees up the fund manager to better focus on the important things like which assets to invest in, risk management rules, and what amount of management and performance fees to charge.

A Truly Transparent Fund

Normally this would have to be documented in a legal prospectus and controlled by financial intermediaries. But with a DeFi hedge fund like Melon, investors can have a transparent relationship with the fund. They know that the pool of digital assets will be managed according to the mandate.

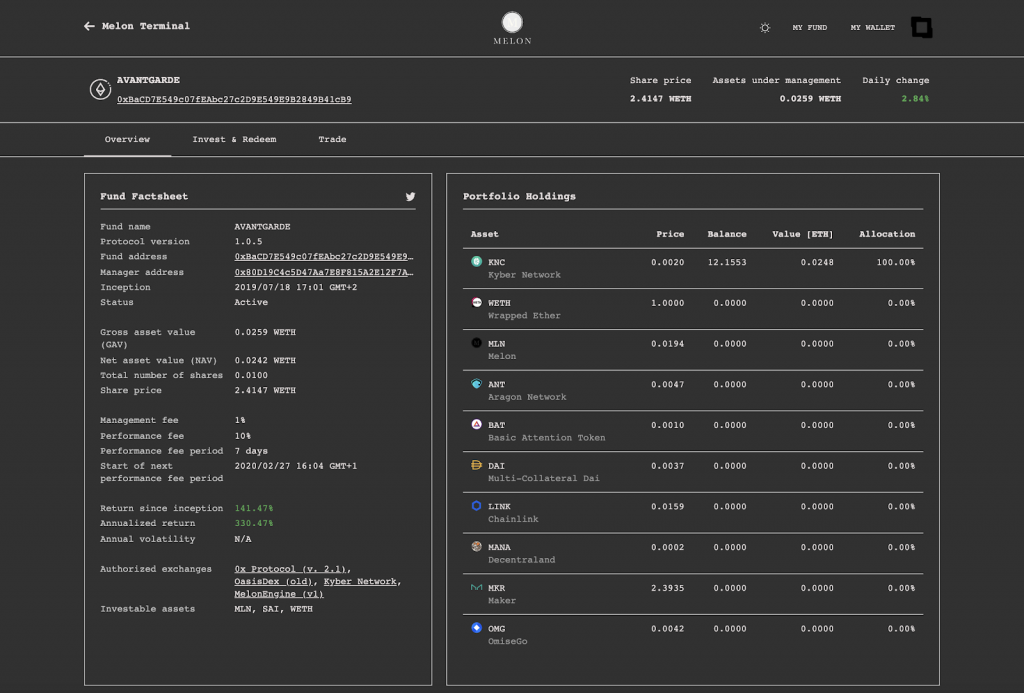

After the fund is up and running, the Melon Monitoring Tool makes it easy to view on-chain data. Managers can extract reports over various periods to comply with any investor or regulatory requirements.

And Investors can manage their funds in the Managed Funds tab. In the Melon Terminal, investors can check which funds are performing well.

Investors can also view the assets under management (AUM). And the fund’s fact sheet contains lots of useful information. Like what kind of portfolio the fund manages, the allocation percentage, when they started, the management fees, etc. Viewers can also add different benchmarks with which to judge the fund’s performance against various assets.

Melon Governance

The Melon Council is a decentralized autonomous organization (DAO) that governs the protocol. It is responsible for protocol upgrades and defining the parameters of the network. The Melon Council’s mission is primarily to foster innovation and preserve the integrity of the protocol.

The Melon (MLN) Token and Gas Fees

On the Ethereum blockchain, gas fees are collected on transactions. The Melon protocol collects gas fees:

- When users set up a new fund.

- When investors invest in a fund.

- When users claim any fees or rewards.

These gas fees are referred to specifically as “asset management gas.” And essentially, the MLN token is used for asset management gas. However, to keep the barriers to entry low, Melon does not charge trading or redemption fees.

Gas fees are collected in ETH. They are then transferred to the “Melon Engine Smart Contract.” The smart contract swaps the ETH for MLN and burns them. This buy-and-burn model was set up to link network usage with the MLN token value.

Each year, the Melon protocol inflates by 300,600 MLN tokens. The Melon Council decides on how to allocate the tokens and they can burn unspent tokens at year’s end if there is excess.

Lastly, audits and bug bounties help maintain the protocol’s security.

The Future of DeFi Hedge Funds

What does the future hold for DeFi hedge fund protocols like Melon? It is designed for users to manage their wealth along with the wealth of others. And for such a ridiculously low cost and start-up time, what’s not to like about the future?

Melon’s token model may have added an extra layer of technical issues, however the way they send a portion of the gas back into the protocol is forward-thinking. Of course, there are other alternatives if you’re looking to start a DeFi Hedge Fund. BeToken is one, but you have to be careful because if you don’t invest and trade you will have your stake liquidated.

Conclusion

On the Melon blog, the founders insist that they aren’t trying to disrupt asset management. They are simply focused on automating the way traditional asset management has always been performed. As they say, it isn’t the “what” it’s the “how” that they’re creating.

If protocols like Melon are indeed the future of hedge funds then we can happily say goodbye to the countless financial intermediaries and their multiple points of failure. We can say goodbye to the excessive admin costs and the endless regulations that ultimately compel investors to rely on trusting corruptible human beings. In short, we can say goodbye to the high barriers to entry which have kept hedge fund investment out of the hands of all but the uber-rich. And that can only be a good thing.

Have you ever dreamed of starting a DeFi hedge fund? If so head over to Ivan on Tech Academy, the premier online blockchain academy. There you can learn more about Melon, DeFi hedge funds, and other DeFi protocols. Start your blockchain education today!