Decentralized finance (DeFi) continues to make waves in the crypto space with $7.22 billion in total value locked in, according to DeFi Pulse. Amazingly, over $6 billion of those funds have entered the market since June 2020! And throughout this year, DeFi continues to be the prime-mover driving the upcoming bull market.

With all the interest in DeFi, have you tried to understand it but were overwhelmed by all the unfamiliar expressions and acronyms? If so, you’ve come to the right place. Simply bookmark this list of DeFi terms, and you can easily return here to scan through a wealth of information.

What is DeFi?

Put simply, DeFi is a financial ecosystem, mainlt built on the Ethereum blockchain composed of different platforms and protocols. With DeFi, you can move cryptocurrency tokens around, trade them, lend and borrow them. This creates a more efficient, and in many cases more profitable, financial ecosystem! Best of all, DeFi is open to anyone, meaning it is technically accessible to hundreds of millions of currently unbanked.

This guide is organized like the DeFi ecosystem itself:

- DeFi Terms and Acronyms

- Aggregators

- Asset Management

- Decentralized Exchanges (DEXs)

- Decentralized Money Markets

- DeFi Tokens

- DeFi Wallets

- Derivatives

- Insurance

- On-Boarding

- Stablecoins

I. DeFi Terms and Acronyms

This section is a list of the most popular DeFi terms and acronyms you’re likely to encounter when researching the space:

DeFi Terms (A-B)

AML

Anti Money Laundering. It refers to the laws and regulations designed to prevent criminal activity.

AMM

Automated Market Makers (AMMs) disrupt the traditional way that buyers and sellers come together. So, instead of two parties coming to an agreement, traders can instead interact directly with a smart contract.

Arbitrageurs

Arbitrageurs provide liquidity as they seek to profit off the market inefficiencies between exchanges.

aTokens

This refers to Aave Tokens.

Auditing

Some of the biggest “fails” in DeFi occur via smart contract hacks or bugs. Thus, audits done by professional security teams can help put investor’s minds more at ease. (See Trail of Bits).

Bitcoin Maximalist

Aka “Bitcoin Maxis.” These are tribalists who believe with religious fervor that Bitcoin is the one true cryptocurrency. They can’t see the potential for DeFi because they’ve been tainted by the earlier ICO “pump and dump” schemes.

Black Swan

Black swan events are unpredictable occurrences that can carry severe consequences. In DeFi, the MakerDAO Black Thursday is an example of such an event.

Bonding Curves

Bonding curves allow token prices to increase when new tokens are purchased. And they allow prices to decrease when existing tokens are redeemed.

Borrowing Rate

This is the rate a borrower will pay to borrow tokens. The Borrowing rate will always be higher than the Lending rate.

DeFi Terms (C)

Censorship Resistant

A protocol is censorship resistant when a central party cannot invalidate transactions. DeFi offers immutable transactions on the Ethereum blockchain. Whereas, FinTech giants like PayPal can and do censor politically unpopular individuals.

CEX

Centralized Exchange. Binance and Coinbase are examples of CEXs. Acting as centralized authorities, they take custody of a user’s funds on deposit.

Coins

Tokens can have a wider functionality than being a means of payment like a coin. However, most people use the terms “tokens” and “coins” interchangeably. (See Tokens.)

Collateral

This an asset used to secure a loan. In the traditional world of finance, one might put up their home as collateral to secure a cash loan. In DeFi, one puts up cryptocurrency tokens as collateral to borrow other tokens.

Collateralization Ratio

To borrow tokens from a DeFi lending protocol, one must put up more collateral than the loan is worth. Typically this amount runs between 125% to 150% of the loan amount. However, protocols can use different collateralization ratios. Users must maintain the designated ratio to prevent liquidation. (See Liquidation Ratio).

Cryptocurrency

This is the digital currency used to lend, borrow, and trade on DeFi platforms. Also referred to as “crypto,” “tokens,” or “coins.” (See Tokens.)

Crypto Wallet

These wallets store public and private keys allowing users to send, receive, and store tokens. The tokens reside on the blockchain and the wallet accesses them. (See Web 3.0 Wallets).

cTokens

These are Compound’s native tokens. When a user supplies assets to the Compound protocol, they receive cTokens. These in turn represent claims on the asset pool.

DeFi Terms (D)

DAO

Decentralized Autonomous Organization.

Decentralized Exchange

(See DEX).

DeFi

DeFi is short for Decentralized Finance – and refers to the whole of the decentralized financial ecosystem currently under development.

DeFi Pulse

DeFi Pulse is a website that lists the latest rankings and analytics of DeFi protocols.

Deflationary Token

Tokens are “deflationary” if a percentage is permanently removed from the marketplace over time. Buy-backs and burns are a popular way of destroying tokens. This causes scarcity which hopefully makes the price rise. (See Token Burns).

dApps

Decentralized applications. These are digital apps that run on a blockchain outside the control of a central authority.

Derivatives

A derivative is a security that derives its value from an underlying asset (or group of assets). Futures, swaps, and options are all examples of derivatives. The derivative holds no value in and of itself. The value is based on its underlying asset(s).

DEX

A DEX, or decentralized exchange, is a type of cryptocurrency exchange. It operates like a stock exchange, except it is run by smart contracts. These smart contracts enforce rules and execute trades. Unlike a Centralized Exchange (CEX), a DEX does not take custody of a user’s funds.

DeFi Terms (E-G)

ERC-20

This is the technical standard used for smart contracts on the Ethereum blockchain. ERC-20 defines the list of rules that Ethereum tokens must abide by.

ETH

ETH stands for Ethereum tokens. These are digital assets built on the Ethereum blockchain.

Ethereum

Ethereum is an open-source, decentralized blockchain that utilizes smart contracts.

Etherscan

Etherscan is a block explorer for the Ethereum blockchain. It is used to research and validate transactions.

Flash Loan

Flash Loans are futuristic and next-generation DeFi and native to the crypto space. A borrower can take out a flash loan with no collateral. However, it must be repaid within the same block or the entire transaction is canceled.

Flash Swaps

Similar to Flash Loans. A user can withdraw a token and use it before paying for it.

FOMOFear of Missing Out. If you’re new, you’ll hear this term used all over the crypto space not just in DeFi.

Game Theory

DeFi protocols can utilize game theory mechanics to incentivize users to perform certain actions like provide liquidity.

Gas

Gas is used to calculate fees on the Ethereum network. Every smart contract execution on the Ethereum network requires gas. When the network is more congested, gas prices are higher.

Governance Tokens

ERC-20 tokens have always been a form of money, but governance tokens also act like legislative certificates. They allow the hodler to vote on changes to the protocol.

DeFi Terms (H-K)

Hodl (Hodling, Hodler)

This term is frequently used in the crypto space, and is a play on the term holding. Notice the “d” and “l” are switched around. “Hodling” refers to one who holds tokens as in a “buy-and-hold” strategy.

ICO

Initial Coin Offering. It is crypto’s version of an IPO in the stock market.

Impermanent Loss

Impermanent loss can occur if one token in a trading pair is more volatile. Trading pairs of stablecoins results in no, or minor impermanent loss. When trading a volatile token like ETH, however, impermanent loss can result. If ETH moves away from its price point when liquidity was provided, impermanent loss results. However, if ETH’s price returns to the original entry point, the loss goes away. That’s why it’s called an impermanent loss rather than a “permanent” one.

KYC

Know Your Customer. KYC guidelines fit into the broader scope of Anti-Money Laundering (AML) policies in traditional finance. There is no KYC or AML in DeFi.

DeFi Terms (L-M)

Lending Rate (Supply Rate)

Users can lend tokens and earn an annualized return. Rates vary depending on the DEX, the liquidity pool, and the token.

Liquidation

In DeFi, liquidation applies to borrowers. They can have their collateral liquidated if they don’t maintain the set collateralization ratio. (See Collateralization Ratio).

Liquidation Ratio

This is the level at which the collateralization ratio dips that can trigger a liquidation. These ratios vary between DeFi protocols. (See Collateralization Ratio).

Liquidity

Liquidity is the availability of liquid assets. It is mega-important for DeFi protocols since fees, slippage, and overall UX improves with greater liquidity.

Liquidity Mining

See Yield Farming.

Liquidity Pools

These are pools of tokens available to be exchanged amongst traders.

Liquidity Provider

These users supply liquidity to liquidity pools in the form of tokens.

LP

Liquidity Provider.

Market MakerMarket makers provide trading services for traders to keep markets liquid. In DeFi, you’re likely to read about Automated Market Makers (See AMM).

MetamaskMetamask is a popular Web 3.0 wallet used in DeFi. Other wallets you may hear about are the Coinbase Wallet and Argent. (See DeFi Wallets)

DeFi Terms (O-P)

Off-Chain

Off-chain transactions occur “off” the blockchain network. Since these are not broadcast across the blockchain, they are low/zero-cost transactions.

On-ChainOn-chain transactions are crypto transactions that occur on the Ethereum blockchain. These are subject to gas fees.

Oracle (or Price Oracle)These are feeds that provide necessary price data to DeFi protocols. Hackers do try to manipulate asset prices, however. (See Oracle Attacks).

Oracle Attacks

Hackers looking to manipulate the price feeds will launch these kinds of attacks. Smart contract hacks and bugs pose some of the biggest risks to DeFi users. (See Price Oracles).

Over-CollateralizationOver-collateralization means that borrowers must put up more collateral than they borrow. This ensures that lenders don’t lose their funds should a borrower default. (See Collateralization Ratio).

P2CShort for Peer-to-Contract.

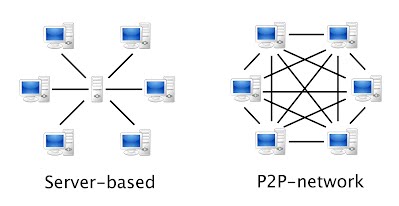

P2P

Short for Peer-to-Peer.

Permissionless

Permissionless means that anyone can create and use dApps. No central authority can grant or revoke permission to an individual.

Price OraclesThese are feeds that provide necessary price data to DeFi protocols. Hackers do try and manipulate asset prices, however. (See Oracle Attacks).

Pump and DumpThis term became synonymous with the ICO boom. Hucksters would launch a new “futility” token and pump money into it initially. After the price pumped, they would dump it—selling it for quick profits. DeFi tokens have the advantage of being utility tokens rather than futility tokens.

DeFi Terms (R-S)

RENRen is known in the DeFi space for its interoperability. This protocol can port assets across blockchains. This is very important for those who wish to move Bitcoin tokens to the Ethereum blockchain.

SlippageThe difference between the expected price of trading two assets and the actual price. Slippage is most frequent during times of high volatility or in illiquid pools.

Smart ContractsThese are automated, self-executing agreements between two parties. Smart Contracts allow two parties to directly communicate with each other without a third-party intermediary.

Smart Contract Hacks

These hacks pose some of the biggest threats to those using DeFi.

Stable Interest Rate

Stable rates in DeFi are not the same as fixed interest rates. They are just a stable type of variable interest rate based on things like a 30-day average.

Stablecoins

Cryptocurrency volatility can be frightening to the mainstream. That’s why stablecoins are the building blocks of the DeFi ecosystem. Their job is to remove volatility and ensure stability. By pegging to something like the U.S. dollar, this is accomplished.

Synthetics

A synthetic is a financial instrument that is made up of one or more derivatives. Synthetics are complex financial instruments. They provide exposure to assets without the investor having to buy them directly.

DeFi Terms (T-U)

TokensThese are assets on the blockchain. Tokens can have a wider functionality than being a means of payment like a coin. However, you’ll hear people use these terms interchangeably.

Token BurnsRefers to the permanent removal of tokens from circulation. Token buy-backs and burns are popular ways of destroying tokens. This causes scarcity. (See Deflationary Token.)

Token RewardsToken rewards can be used as incentives to LPs. These are typically offered in the form of governance tokens.

TokenomicsThis combines the two words “token” and “economics.” It refers to the quality of a token.

Trading FeesPlatforms charge trading fees that vary between the various pools. On Balancer, for example, fees are set at the time of the pool’s creation. They can range from 0.001% to 10%.

Trail of Bits (Auditing)Some of the biggest “fails” in DeFi happen via smart contract hacks or bugs. Therefore professional security audits can help put investor’s minds at ease. You will often see the name “Trail of Bits” when researching DeFi auditing firms.

TransparentTransparent transactions are public so anyone can audit them. While transactions on the Ethereum blockchains are public, users can remain pseudonymous.

TrustlessTrustless refers to transactions that can be securely validated without the need for trusting a central party.

TVLTotal Value Locked. If you go to DeFi Pulse you can see the top DeFi protocols organized by TVL.

UIUser Interface.

Underlying AssetUnderlying assets are typically used in reference to derivatives. They can be things like stocks, bonds, and currencies. Even Bitcoin can be an underlying asset. (See Derivatives).

UX

User Experience

DeFi Terms (V-Z)

Variable Interest RateThese rates typically fluctuate based on supply and demand for an asset.

Voting RightsThis refers to rights given to hodlers of governance tokens. They can vote on issues that will affect the protocol’s future.

Web 3.0 WalletDeFi users will need a Web 3.0 wallet such as Metamask, Coinbase Wallet, or Argent. These can be used in conjunction with cold-storage wallets like Trezor or Ledger.

Yield

The earnings that are generated on an investment.

Yield Aggregator

A well-known yield aggregator in DeFi is yEarn. It shifts tokens between various protocols to maximize yield for its users.

Yield FarmingYield Farming is the process of putting tokens to productive use in a DeFi market. This is done to earn passive interest income. It requires manually searching protocols for the best interest rates. Or one can utilize a Yield Aggregator.

Yield OptimizerA protocol that maximizes yield. (See Yield Aggregator.)

yTokensRefers to “yield optimized tokens” such as yUSDC, yUSDT, and yDAI. The “y” prefix refers to the yEarn protocol.

II. Aggregators

Yield aggregators shift tokens between various protocols to maximize yield.

yearn.finance (yEarn)yEarn has evolved into an ecosystem of protocols that aims to maximize APY.

III. Asset Management

Below is a list of platforms that help users track their holdings.

BalancerBalancer is an asset management platform and a non-custodial portfolio manager.

InstadappInstadapp allows users to manage funds across numerous protocols.

ZapperZapper helps users manage their assets in one interface.

IV. Decentralized Exchanges (DEXs)

DEXs allow users to trade assets without having to transfer custody to a central authority. Users can stay in control of their funds while trading tokens.

0x Protocol0x is a permissionless liquidity protocol on Ethereum.

dYdXdYdX is a DEX. It offers permissionless lending and margin capabilities for ETH, USDC, and DAI.

BalancerBalancer is an asset management platform. It acts as an automated portfolio manager and liquidity provider.

KyberSwapKyber Network is an on-chain liquidity protocol. It offers seamless token swaps.

UniswapUniswap is a popular on-chain protocol for token exchanges.

V. Decentralized Money Markets

The fastest-growing sectors of DeFi are in borrowing and lending. Users simply deposit funds to earn interest from borrowers.

AaveThis is a decentralized money market protocol. It enables users to lend and borrow cryptocurrencies trustlessly. Aave distinguishes itself from its peers with Flash Loans.

CompoundCompound is a decentralized protocol for the borrowing and lending of crypto assets. It is similar to Maker, except Compound supports multiple assets.

CurveAnother well-known DeFi project is that of Curve Finance. This is making many ask the question “what is Curve Finance?“. Put simply, it is a platform that makes use of liquidity pools and bonding curves for efficient stablecoin trading.

dYdXdYdX is one of the behemoths in the DeFi space. So, what is dYdX? It is primarily a permissionless platform. It supports lending, borrowing, and margin trading.

MakerMakerDAO locks in ETH and makes the stablecoin DAI. Users can then lend, borrow, or save DAI.

yearn.finance (yEarn)yEarn is a yield aggregator. It shifts tokens between various protocols to maximize yield for its users. yEarn Finance is rapidly making a name for itself. If you are interested in why, read this guide explaining what Yearn Finance is.

VI. DeFi Tokens

BALBalancer’s native governance token.

COMPCompound’s native governance token.

CRVCurve’s native token.

DAIMaker’s stablecoin.

KNCKyber Network Crystals’ native governance token.

LENDAave’s native token.

MKRMKR token holders govern the Maker Protocol.

RENThe Ren Protocol acts as an interoperable bridge. With Ren, users can port assets like Bitcoin to Ethereum. This enables Bitcoin hodlers to participate in DeFi.

SNXThe native token of Synthetix.

YFIThe native token of yearn.finance.

ZRXThe governance token of the 0x protocol.

VII. DeFi Wallets

To participate in DeFi, users will need a Web 3.0 Wallet. These can be used in conjunction with cold-storage wallets such as Trezor or Ledger.

ArgentUsers can buy ERC-20 tokens directly with a credit card on Argent. They can also store, send, borrow, and earn interest by using the wallet.

Coinbase WalletThe Coinbase Wallet is non-custodial. It was developed by the popular CEX, Coinbase.

MetamaskMetamask is a popular crypto wallet in the DeFi space.

VIII. Derivatives

A derivative is a security that derives its value from an underlying asset (or group of assets). Futures, swaps, and options are examples of derivatives. The derivative holds no value in and of itself. Its value is based on its underlying asset(s).

AugurAugur is a DeFi prediction market on Ethereum.

dYdXdYdX is a powerful DEX that supports spot, margin, and perpetuals trading.

SynthetixWith Synthetix, users have a way to bet on the prices of real-world assets using ERC-20 tokens. These tokens are called synthetic assets or “Synths.” They can track the price of underlying assets such as stocks, currencies, and precious metals.

IX. Insurance

DeFi is far from risk-free. Traders can lose their funds in a variety of ways like smart contract hacks, smart contract bugs, oracle hacks, or black swan events. Hence, the rise of DeFi insurance protocols to alleviate some of the risks.

NexusNexus Mutual is a decentralized insurance provider.

OpynOpyn allows users to hedge ETH risk and protect DeFi deposits.

X. Onboarding

To participate in DeFi, users must first convert their fiat to cryptocurrency—specifically ERC-20 tokens. Here are some platforms that can help new users do this.

ArgentWith the Argent wallet, users can use a credit card to purchase ERC-20 tokens directly. With these tokens, they can jump straight into DeFi.

BinanceBinance is a leading CEX that can help onboard users from fiat to crypto.

CoinbaseCoinbase is also a CEX but they have launched the Coinbase Wallet for DeFi.

WyreWyre is a crypto-friendly payments company that offers crypto-to-fiat solutions.

XI. Stablecoins

Volatility can be frightening to traders coming from the world of traditional finance. That’s why stablecoins are a fundamental building block of the DeFi ecosystem. Their job is to remove volatility and ensure stability by pegging to something like the U.S. dollar. But they can also peg to baskets of assets or other cryptocurrencies. The top three are:

- Dai (DAI)

- Tether (USDT)

- USD Coin (USDC)

Some of the other stablecoins you will see are:

- Gemini Dollar (GUSD)

- Paxos Standard (PAX)

- Reserve (RSV)

- Terra (TERRA)

- TrueUSD (TUSD)

- USD Coin (USDC)

- Wrapped Bitcoin (WBTC)

We hope this Encyclopedia of DeFi terms will provide you with a handy reference guide and help you navigate the space easier. To learn more about DeFi and get the best blockchain education available anywhere, enlist in Ivan on Tech Academy.

Author MindFrac