Synthetix is the name of a decentralized, synthetic-asset exchange. “Synthetics,” on the other hand, are financial instruments that simulate other instruments. They play a big role in the world of traditional finance. And this is what the company, Synthetix, aims to bring to the world of decentralized finance (DeFi)

But, before we dig into the role that Synthetix plays in the DeFi space, let’s look at the traditional role that synthetics have always played. We’ll start with derivatives.

What are Derivatives?

A derivative is a security that derives its value from an underlying asset (or group of assets). Futures, swaps, and options are all examples of derivatives. The derivative holds no value in and of itself. Its value is based on its underlying asset(s).

Underlying assets can be things like stocks, bonds, and currencies. Bitcoin could be an underlying asset. Thus Bitcoin’s intrinsic value could drive the price of a derivative.

Since a derivative’s value comes from the fluctuations of its underlying asset, traders can profit from them. So, if a trader purchased a derivative based on Bitcoin, they could profit off movements of the Bitcoin price without ever having to purchase Bitcoin directly.

Traditionally, traders have used derivatives to hedge, speculate, or to provide leverage for their other holdings.

What are Synthetics?

A synthetic is a financial instrument that is made up of one or more derivatives. So, one synthetic could contain a future, a swap, and an option. Three derivatives in this case. In turn, the derivatives would simulate the price behaviors of their underlying assets which could be stocks, bonds, or gold. Make sense?

In traditional finance as well as DeFi, synthetics simulate other instruments. So, why would an investor purchase them?

Cryptocurrency-based, synthetic assets can expose traders to different assets without having to hold the asset itself. So, a user could hold a synthetic asset in gold without having to leave the cryptocurrency ecosystem. Their synthetic could track the value of gold without the user having to buy gold. Now, that’s exciting.

Speculators helped drive the development of traditional financial markets in the past and speculation continues to be the primary use-case for crypto assets. Speculators play a key role because they provide liquidity. Liquidity reduces transaction costs and increases access for market participants.

Liquidity is the key to synthetics as well. There is no point in creating a synthetic if the underlying assets are too illiquid.

Synthetics and DeFi

One of the challenges with DeFi is bringing real-world assets (like fiat currencies) on-chain. Sure, there are fiat-collateralized stablecoins like Tether (USDT). But for many traders, mere price exposure would suffice. Synthetics provide a way to trade real-world assets on the blockchain without the need to hop around to a myriad of exchanges.

Also, since the DeFi space has issues with liquidity, synthetics could help ease the pain while helping traders hedge positions and protect their profits. Not to mention the communication issues associated with going cross-chain.

With synthetic exposure to prices, traders wouldn’t always need to directly purchase the asset itself. This alone could help negate the necessity of cross-chain communication with smart contracts on other exchanges.

The DeFi space already deploys Synthetics, but their potential remains largely untapped. That’s where protocols like Synthetix come into play.

What is Synthetix?

Synthetix is more than just another token trading platform. It allows users to mint and trade synthetic assets on Ethereum. With Synthetix, users have a way to bet on the prices of real-world assets using ERC-20 tokens. These tokens are called synthetic assets or “Synths.” They can track the price of underlying assets such as stocks, currencies, and precious metals (to name a few).

Synthetix is similar to MakerDAO. With Maker, a user has to lock up ETH to create DAI. Likewise, with Synthetix, one can lock up Synthetix Network Tokens (SNX) to create synthetic USD (sUSD). Did you notice the little “s” in front of USD? You guessed it. It stands for synthetic. What will these guys think of next?

So, users will need to lock up collateral (SNX) to create a synthetic asset (sUSD). At some point they will also need to pay the piper to reclaim their collateral, but we’ll get into that later.

How to Use Synthetix

Hodlers can stake their SNX to create new Synths to trade. Or they can just sit back and rake in fees and rewards from the Synthetix exchange (hopefully). But trading Synths is the main purpose of Synthetix. Traders can long or short an underlying asset on the platform. They do this by using Synths to hold other cryptocurrencies.

For example, a trader could buy a synthetic MKR token (sMKR) that reflects the price of MKR. However, they would not own an actual MKR token nor would they obtain any voting rights like normal hodlers would.

Regardless of whether one prefers staking or trading, to create a new Synth, one must stake 800% of the Synth’s value in SNX tokens. Note that supply and demand dynamics are at play here. The more SNX that gets locked up as collateral, the less supply there is. The lower the supply, the more valuable it becomes. Presently, about 85% of the total supply of SNX is locked.

The Benefits of Staking SNX

Here are a couple of incentives for users to stake their SNX tokens:

- Exchange rewards.

Each trade on the exchange generates approximately 0.3% in fees. These fees are in turn distributed to SNX stakers each week. - SNX Price Increases.

The protocol unlocks an equal part of a staker’s SNX whenever the price of SNX increases. That means if a staker locks up $10 of SNX and the price doubles, half of the new value is unlocked. So, the staker could leave $10 of SNX staked and take this extra $10 of SNX and stake it to mint more Synths (if they so choose).

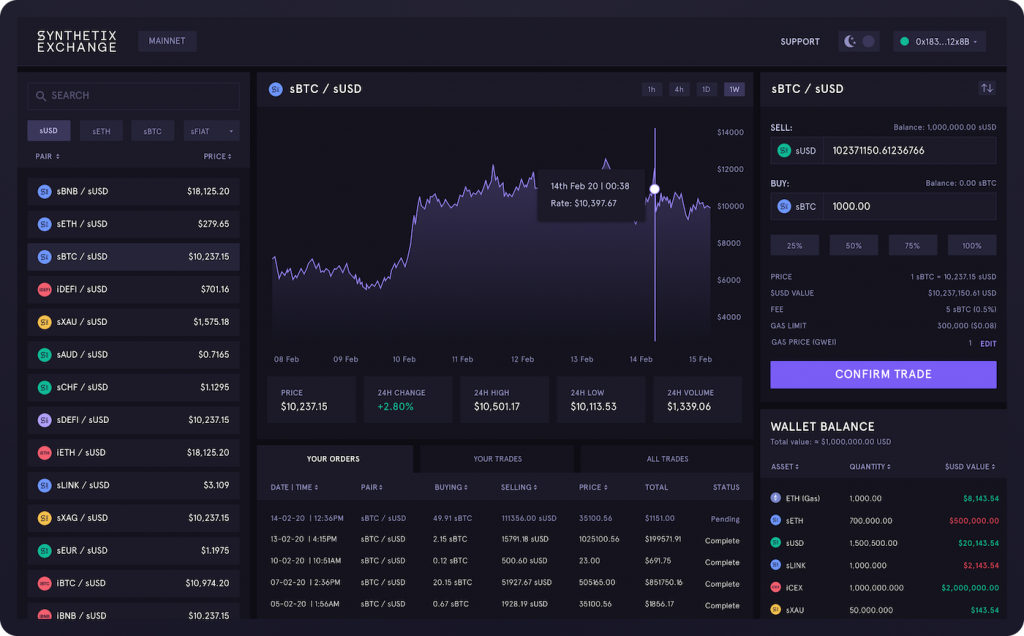

The Synthetix Exchange

Mintr is the exchange where users can mint Synths. It is a decentralized application (dApp) the trader uses to interact with Synthetix smart contracts. It is where users will stake their SNX as collateral to mint Synths.

The collateralization ratio is set to 800% (at present). This ensures there is enough collateral to absorb any large price shocks that might come down the pipe. There is a small buffer around this number that allows for minor fluctuations. But a staker will be unable to claim any fees until they restore the 800% ratio. To make a claim, stakers can either mint or burn Synths depending on whether their ratio is above or below the magical number.

Minting Synths

As mentioned before, a user can mint sUSD by locking up their SNX as collateral. SNX stakers incur debt whenever they mint Synths, however. And this debt can fluctuate based on the supply of Synths and the exchange rates. Here are the steps once a user connects their Metamask or hardware wallet:

- The smart contract checks that the Collateralization Ratio is above 800%.

- If so, the user’s debt (the value minted and stored as sUSD) is added to the Debt Register.

- The smart contract assigns the debt to the staker.

- The smart contract instructs the sUSD contract to issue the new amount.

- The newly minted sUSD goes to the users wallet.

So, sUSD will go straight to the user’s wallet after the transaction is confirmed. The Synths can then be traded on the exchange.

The process of minting can be confusing at first and minters can make profits or incur losses. So, users should test with small amounts until they figure out what’s going on. A good minter should understand the system and know how to manage debt and claim their rewards if they want to be successful. But, to unlock their SNX and exit the protocol, the user must repay the debt by burning Synths.

Burning Debt

Let’s say a staker mints 100 sUSD by locking up SNX. To later unlock and retrieve their SNX, they must burn 100 sUSD. However, their debt will fluctuate along with the exchange rates while they were staked. So, they may need to burn more or less than the original 100 sUSD worth of debt. Here’s the process:

- The smart contract removes the user from the Debt Register.

- The sUSD is burned.

- The total supply of sUSD is updated.

- The amount of sUSD in the user’s wallet is updated.

- The user can now transfer their SNX.

When a staker burns 100% of their debt, the Debt Register will reset to zero. And the staker will no longer be a part of that debt pool.

As you can see, the entire process is peer-to-contract, as opposed to peer-to-peer. Conversions between Synths occur with smart contracts. There are no third parties, no registration or log-in requirements, and thankfully, no KYC.

How to Trade Synths

But most people just want to trade Synths. Here’s how. Once a user has connected their wallet to the Synthetix Exchange they will see their available ETH and Synths displayed on the left side. They will need two things to trade: ETH to pay for transactions and Synths to trade with.

To obtain Synths, a user can buy sUSD with their ETH. Once the transaction is complete, the user will have sold ETH for sUSD. Now they can use sUSD to trade for other Synths. Selling ETH for sUSD would be a natural trade if the user thinks that the price of ETH will drop.

Available Synths

There are currently five categories of Synths:

- Fiat currencies:

Including sUSD, sEUR, sGBP, sJPY, and sCHF. - Cryptocurrencies:

Including sBTC, sETH, and sBNB. - Inverse cryptocurrencies:

Including iBTC, iETH, iBNB, iMKR, iTRX, iXTZ. - Cryptocurrency indexes:

Including sCEX and iCEX (a basket of Central Exchange tokens and their inverses). - Commodities:

Including sXAU and sXAG (gold and silver).

To reiterate, Synths are different from real assets. They only track the price of an asset. Also, when you see the prefix “i” it denotes the inverse. So, if a trader predicts the price of Bitcoin will drop, they could purchase its inverse token, iBTC.

Trading on the Synthetix Exchange comes with many advantages over the typical DEX that is based on order-book—much less a Centralized Exchange. No order books means full-on peer-to-contract trading and price feeds (supplied by oracles) determine the Exchange rates. We’re talking about a world full of advantages here, such as liquidity, zero slippage, and permissionless, on-chain trading.

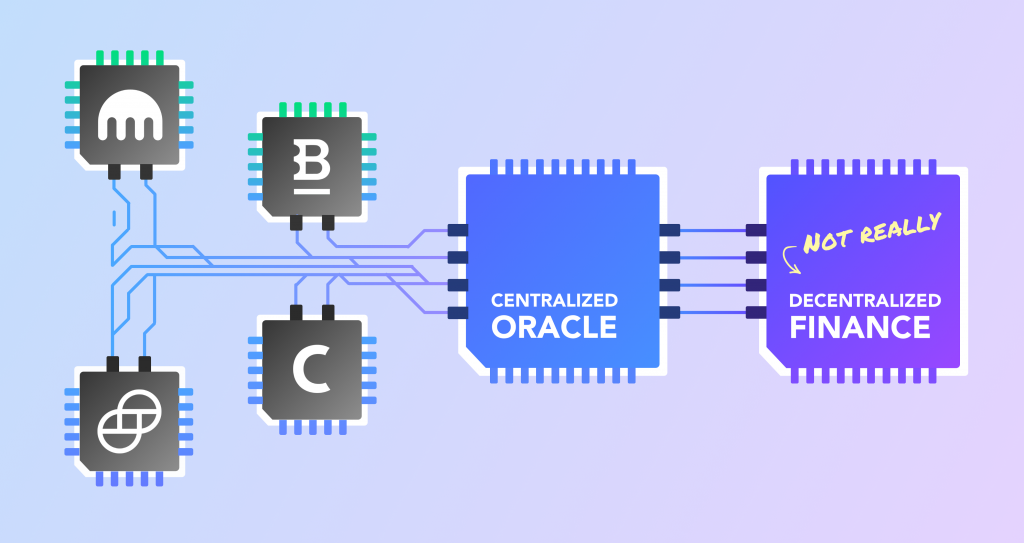

Price Oracles

Oracles use an algorithm that determines the price of an asset by pulling data from various sources. Oracles determine the value of Synths. At the time of this writing, both Chainlink and Synthetix provide the price feeds. In the future, Synthetix will move to Chainlink’s independent node operators exclusively. This will serve the spirit of DeFi well as the oracle system will bring reliable information without needing to trust any central parties.

Risks Involved with Synthetix

As mentioned, a user’s debt can fluctuate alongside fluctuating exchange rates. The price of SNX could, therefore, fluctuate for reasons unrelated to the Synthetix Exchange. This could happen because many crypto asset prices move in correlation to Bitcoin or Ethereum. So, the debt that is created when staking SNX to mint Synths, also creates a concurrent risk. Because to exit the system the user may need to burn more Synths than they originally minted.

The Future of Synthetix in DeFi

Synthetix has provided one of the most complex protocols on Ethereum to date. Censorship-resistant assets are where it’s at. And one can only imagine what the future holds with new Synths coming down the pipe.

As mentioned, Synthetics provide exposure to assets without having to buy them directly. They are complex financial instruments. And while they are very exciting, they have gotten the overly excitable crowd in the global economy into loads of trouble in the past. Likewise, they could wreak havoc in the DeFi space in ways we haven’t yet imagined at this early stage in the game.

Nonetheless, synthetics have played a major role in the evolution of traditional finance and they will undoubtedly do so in DeFi as well. It’s still early on, but it will be fascinating to see what developers will be able to come up with next.

If you want to become a developer. Or if you just want to learn more about minting, staking, or trading Synths, please visit the Ivan On Tech Academy today. Entire courses are dedicated to DeFi that will help you along in your journey.

Author MindFrac