Those looking into the DeFi field will likely come across the term “yield farming”. Yield Farming is the process of putting crypto tokens to productive use in a decentralized finance (DeFi) market to earn interest. Yield Farming takes place on the Ethereum blockchain, and yes, it is a way to earn passive income on Ethereum. But “hodling” ETH tokens is not the same thing as Yield Farming.

This kind of farming is a creative process. It is also a managed process where “farmers” typically hop from one protocol to the next to maximize returns. However, farmers can also employ “set it and forget it” strategies.

Yield Farming became popular with the release of Compound’s COMP governance token. When word got out that farmers could reap Annual Percentage Yields (APY) over 100%, things took off. At present, there is over $4.5 billion Total Value Locked (TVL) in DeFi according to DeFi Pulse.

Governance tokens like COMP offer hodlers the option to vote on the protocol’s future. But they also act as incentives for Liquidity Providers (LPs) to move assets onto their platforms. As you get more involved with DeFi and specifically with Yield Farming, you will hear a lot more about LPs. They grease the wheels of the DeFi engine. And essentially that’s what Yield Farmers are. They are the LPs for the various protocols in the DeFi space.

Governance Tokens

The biggest use case for Ethereum has been tokens. During the initial coin offering (ICO) boom, newly created tokens were all the rage. Unfortunately, the boom attracted loads of scammers peddling what’s popularly referred to as “Sh*t Coins.” All the pump-and-dump schemes of this era incited bitcoin maximalists to stereotype every token on Ethereum with the label “sh*t coin”. And many “Maxis” are still caught in that feedback loop to this very day. Because of the past stereotypes, it’s been hard for most of them to move on and grasp the vast potential of DeFi.

ERC-20 tokens were always a form of money, but fast forward to the present-day governance tokens. You’ll find they act more like legislative certificates than just money. They not only allow the hodler to vote on changes to the protocol, but they can also increase in value. For example, hodlers of the MKR token can vote on changes that govern borrowing costs on Maker, and how much savers can earn, etc. We’ll talk more about governance tokens a bit later.

How DeFi Yield Farming Works

In the amazing world of DeFi, you can lend and borrow tokens without first having to fill out loads of forms. Try getting a loan in the traditional financial space. You won’t get to first base without some middleman asking for your info and forcing you to spend time filling out all their “necessary” paperwork.

DeFi lets you play with tokens, move them around, trade them, lend and borrow them – you name it. All you need is a Web 3.0 wallet and some tokens to get started.

Simple Examples of Yield Farming

In these examples, we’ll throw around the names of some protocols that you may or may not be familiar with. We’ve already covered most of these in past articles so we won’t go too much in-depth. You can read “A Brief Introduction to DeFi” if you’re still not sure what it is.

At the most basic level, a Yield Farmer can simply shuffle assets around in Compound chasing the pool that offers the best APY whilst weighing potential profits against the risks.

Stacking Yield

Certain protocols will issue tokens to farmers providing liquidity to their pool. The farmer can then search out other platforms to stake their new token in that will generate even more yield.

For example, a farmer could become an LP by supplying 1,000 USDT to Compound. And let’s say they receive 1,000 cUSDT in return. Notice the small “c” prefix. These cTokens denote Compound’s native tokens.

Now, Balancer is an Automated Market Maker (AMM). So, this same farmer could put their new tokens into a Balancer Pool that accepts cUSDT tokens. And let’s say that the farmer could earn some yield from the transaction fees based on the liquidity they provided in the Balancer Pool. So now the farmer is earning interest off of two platforms: (1) The 1,000 USDT sitting in Compound and (2) the 1,000 cUSDT sitting in Balancer.

So, the savvy farmer will always be on the lookout for edge cases where they can earn the most yield. It is uber cool that a farmer can generate yields from multiple platforms with only one single source of liquidity.

Gaining Leverage with COMP

Here’s a simple strategy that used to work on Compound:

- Lend USDC.

- Borrow USDT against it.

- Swap USDT to get more USDC.

- Lend the USDC again.

- Borrow more USDT, etc.

The good folks over at Compound governance closed this loop so it no longer works. However, this kind of thinking is what leads the savvy Yield Farmer to find creative ways to make more profits. While the average trader would have been satisfied to earn interest off USDC once, sophisticated farmers took it a step further.

Remember, the point of this introductory article is not to provide tips or exact strategies, but to show what others have done in the past to open up your mind to the possibilities.

Return on Investment

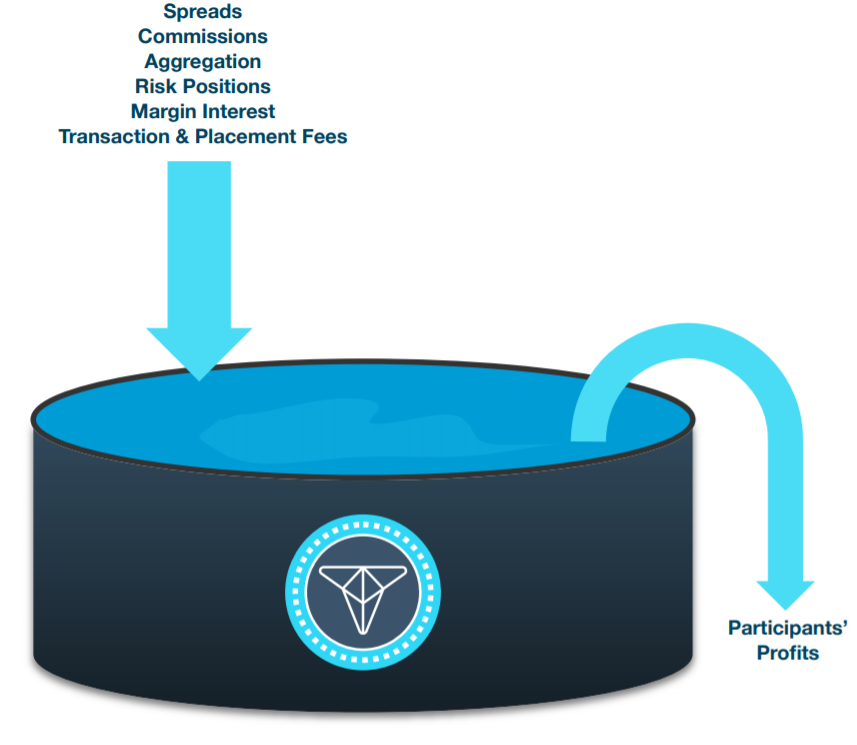

Yield Farmers can earn returns with transaction fees, token rewards, and capital growth.

- Transaction fees

Transaction fees vary between protocols and their various pools. On Balancer, users set the fees at the time of the pool’s creation. They can range from 0.001% to 10%. On Uniswap, the fees are a flat 0.03%.

LPs typically get the percentage of fees, but governance token holders can take some as well. It depends on the protocol.

- Token rewards

Token rewards can be used as incentives to LPs when they’re offered. These are typically the governance tokens mentioned earlier.

- Capital growth

When the fees, rewards, and assets are offered in stablecoins, it’s easier to predict future income. Other tokens can make this procedure more challenging as they’re more likely to fluctuate in price.

Where to Harvest Yield

The three places to harvest yield are in money markets, liquidity pools, and incentives.

1. Money Markets (Lending and Borrowing)

Lending tokens is the simplest way for a farmer to earn yield. And decentralized money markets like Compound and Aave are in the top three TVL on DeFi Pulse. Farmers can deposit stablecoins and start earning returns instantly.

Rates are generally better on Aave because it offers both a variable interest rate and a stable one. The stable rate tends to work better for borrowers, while lenders will be more attracted to the variable. Compound, however, offers its COMP governance token as an added incentive to both lenders and borrowers.

Remember that DeFi money markets require borrowers to over-collateralize their loans. That means farmers have to deposit more than they can borrow. Why would anyone want to do that? Well, after tallying up all the fees, rewards, and incentives, it can be worth the farmer’s time.

On lending protocols, it can cost $20 worth of collateral for a $10 loan. Borrowing causes the most confusion for those from the traditional world of finance. Since DeFi requires over-collateralization, “noobies” often ask, “Why on earth would I put up more tokens to get fewer back?” This is where Yield Farmers work their magic.

Over-collateralization ensures that lenders don’t lose their funds should a borrower default. The important thing to remember about over-collateralized loans is that the lender must maintain the collateralization ratio to avoid liquidation. These kinds of loans are never a “set it and forget it” type of scenario. Borrowers need to keep an eye on the collateralization ratio.

2. Liquidity Pools

Liquidity is mega important for DeFi protocols. Fees, slippage, and overall user experience improve with greater liquidity. And for the founders, liquidity allows them to borrow from their users rather than having to hit up venture capital firms.

Liquidity pool

Liquidity pools offer better yields than the money markets. However, greater risks go hand in hand with greater rewards.

Uniswap is one example. It is an automated market maker (AMM) that offers at least one pair of ERC-20 tokens to trade. DeFi is often described as Lego building blocks, and when one platform is successful, others tend to borrow from it to build something new.

Balancer came along offering their BAL governance token which is similar to what COMP is to Compound. Balancer competes with Uniswap, so it will be interesting to see if the BAL token incentivizes any of the Uniswap faithful to jump ship. And if that happens, how long will it be before Uniswap comes up with its governance token?

Uniswap, Balancer, and Curve

Both Uniswap and Balancer pay fees to LPs for supplying tokens. On Uniswap, the pools are distributed between two tokens 50/50. Whereas on Balancer, there can be up to eight assets with custom weightings. Each time someone trades in one of these liquidity pools, fees are generated for the LPs.

Uniswap pools have provided some nice returns to LPs over the past year. However, traders must consider impermanent loss when using Uniswap. Balancer Pools can reduce impermanent loss since the pools don’t need to be allocated on a 50-50 basis. And, users can earn Balancer governance tokens (BAL) by providing liquidity to a pool.

Other liquidity providers like Curve Finance came along and then Curve teamed up with Synthetix to push a liquidity pool on Curve. And on it goes…

Curve eliminates impermanent loss by offering trades between tokens pegged to the same value as their pool of stablecoins offering USDC, USDT, and DAI, etc. However, trading volumes on pools like these will be lower.

So, Curve eliminates impermanent loss, while Balancer and Uniswap garnish higher fees.

3. Incentives

Yield Farmers can also be rewarded with incentives. Synthetix introduced a pool offering its SNX token as a reward. At the time of this writing, the sUSD and sBTC pool on Curve offers SNX as an added incentive. And Ampleforth also rewards LP’s in Uniswap’s AMPL-WETH pool with its AMPL tokens.

A savvy Yield Farmer will eyeball these incentives carefully to seek out the most lucrative token opportunities whilst avoiding the low-performers.

Profitable Yield Farming

Whilst the price of ETH flat-lined in a boring trading range for most of June and July, smart farmers were still able to earn passive income off it. Farming strategies based on low volatility can be fraught with peril however since the potential for rapid price fluctuations is always imminent in crypto. A farmer with a low-volatility ETH strategy would have had to liquidate their positions quickly when ETH started popping in late July.

The more risk-averse will be drawn to earning stablecoins by becoming an LP on Curve. Liquidity pools on Balancer or Uniswap might be a better option for larger holders. Regardless, the best Yield Farming strategies will be customized to fit a farmer’s risk tolerance, capital holdings, and whether they want to “set and forget” or monitor their positions regularly.

Impermanent loss and liquidation are two hazards that can wreak havoc on the Yield Farmer. Tight collateralization ratios will need closer monitoring to avoid liquidation. The same goes for the risk of impermanent loss on Uniswap. It will require careful monitoring or some kind of alert system. Albeit, there are strategies to mitigate potential losses with crypto derivatives.

A farmer also has to consider the time horizon. They can’t be bouncing from protocol to protocol eating up gas costs all the time since the cost of using Ethereum right now is higher than usual. Depending on factors like which pool on which protocol they’re in, it may require longer holding periods to generate enough APY to cover the gas and trading fees.

The Risks of Yield Farming

Yield Farming is never risk-free. In the same way droughts, pests, and floods can ruin a real farmer’s crops, there are factors in DeFi that can wreak havoc on a Yield Farmer’s crops as well. The major risks come from smart contracts, exchange rates, price oracles, platform risks, and black swan events.

Binancer became subject of a hack earlier this year

We already covered the Balancer hack in a previous article, and we’ll dig into the other risks in future articles. For now, just know that you can earn higher interest rates in DeFi because it’s frankly a riskier place to put your money. There is no FDIC protection, and interest rates can vary week-to-week or even day-to-day, so calculating how much interest you will earn over a year can be tricky.

The Future of Yield Farming

The COMP governance token was a big hit in the DeFi world and got things rolling. Although nothing good lasts forever, DeFi is still in its infancy and devs will no doubt come up with new and creative ways to optimize liquidity incentives. Token holders in positions of governance will no doubt green-light more projects with new ways for its users to profit. And Yield Farmers will no doubt come up with new and creative ways to increase their yield.

Do you want to become a Yield Farmer? Or how about creating the next explosive niche in DeFi? If that sounds appealing to you, then check out Ivan On Tech Academy and begin your education in DeFi today.

Author: MindFrac