Derivatives are one of the most sophisticated and mature instruments in the financial market. One of the most exciting things about DeFi is that it allows developers to recreate traditional financial instruments in a decentralized context. The DeFi derivatives market has garnered a lot of steam.

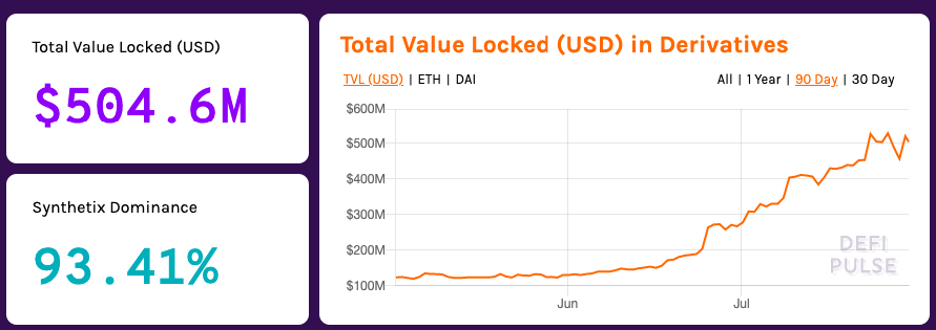

As per DeFi Pulse, DeFi derivatives applications have >$500 million locked up, with Synthetix being the clear market leader. If properly executed, DeFi derivatives can bring a whole new class of investors and institutions. But before we do so, let’s look into the definition of financial derivatives.

What are derivatives in finance?

In finance, a derivative is a contract that derives its value from an underlying entity’s performance. The contract specifies the exact conditions under which two parties can transact with each other. These conditions include:

- A predetermined time period.

- The resulting value of the entity and definition of the underlying variables.

- Contractual obligations and the notional amount.

The entities defined by the derivative contract can be cryptocurrencies, commodities, stocks, bonds, interest rates, and currencies. These contracts can add a whole new layer of complexity by having other derivatives as the underlying asset as well.

As a concept, derivatives have been around for a long time. Back in the 18th century, the Dojima Rice Exchange used to list rice futures.

While all this is pretty cool, just understanding the definition of financial derivatives is not enough. You need to gain a full comprehension of the real value of this market.

How big is the derivatives market?

The derivatives market is humongous. As per the Bank for International Settlements (BIS), in the first half of 2019, the total notional amounts outstanding for derivatives contracts is around a whopping $640 trillion! However, the gross market value of all these contracts falls significantly to approximately $12 trillion.

Why should I invest in derivatives?

There are several reasons as to why you should look to invest in derivatives.

- They allow you to hedge or mitigate your risk.

- They link your asset performance to external events. Eg. Exit position A if event E occurs.

- Derivatives enable you to interact with an asset even if you don’t have direct access to the asset itself.

- They allow you to use leverage such that a tiny movement of the underlying asset can result in large overall profits.

- They minimize your risks via arbitration, i.e., buying and selling assets simultaneously from multiple markets.

- Derivatives enable you to profit immensely from making accurate predictions. For instance – accurately determining an asset valuation after three months.

Different types of derivatives

To understand the true utility of derivatives in finance, we need to look into the different types of contracts available.

There are several classifications that we can make here to gain a deeper understanding of the subject. Firstly, let’s look into the derivatives market itself. There are two kinds of markets out there:

- Over The Counter (OTC): Parties engage in these contracts directly and privately. The underlying asset is not on any Exchange. Investment banks usually use OTC derivatives.

- Exchange-Traded: Derivatives made with assets listed on stock exchanges are exchange-traded derivatives. The terms of the contract are predetermined and are public.

Now, let’s look into the financial derivative contract. The most popular ones here are:

- CDO: Collateralized Debt Obligation (or CDOs) are a pretty infamous class of derivative contracts since they were mostly responsible for the 2008 financial collapse.

- Swaps and CDS: Swaps allow investors to change their assets or debts for another one of similar value. CDS stands for Credit Default Swap.

- Forwards: An OTC financial derivative that buys or sells an asset at a previously agreed-upon value on a specific date in the future.

- CFD: Contracts of difference or CFDs enables you to buy or sell a certain number of units of a particular asset based on the fluctuation in its price via leverage.

- Futures: Buy or sell an asset on a future date at a predetermined price.

- Options: Buy or sell an asset on or before a future date at a predetermined price.

Cryptocurrencies and Derivatives

While the finance world initially thought of cryptocurrencies as its red-headed stepchild, things have changed over the last 2 – 3 years. It turns out that derivatives and cryptocurrencies can perfectly complement each other.

Think about it; the most defining aspect of cryptocurrency prices is their volatility. By using derivatives, it could actually be possible for you to profit from these wild price swings. The traders can also “short” their positions and profit even in a market that’s currently in a downtrend. To do this, you must take the following steps:

- Borrow assets from a third-party, like an exchange/broker, and sell them on the market just before you expect the price to go down.

- After that, when the asset’s price has gone down, you can purchase the same amount of token for a reduced price and profit from a positive price movement.

Notable institutes involved with crypto derivatives

Let’s take a quick look at some of the institutions that are offering crypto derivatives.

#1 CBOE

Back in December 2017, the Chicago Board Options Exchange (CBOE) launched Bitcoin futures trading. This was a massive milestone for the cryptocurrency industry. The exchange has recently revealed their intentions to launch cryptocurrency-related exchange-traded notes (ETNs) and exchange-traded funds (ETFs). Along with CBOE, the Chicago Mercantile Exchange (CME) had launched Bitcoin futures as well.

#2 Grayscale Investments

Grayscale Investments is a trusted authority on digital currency investing. They have been doubling down on their cryptocurrency derivatives. Michael Sonnenshein, the managing director, stated that they would bring the total number of crypto-related investment funds to eight.

#3 TrueEx

TrueEx is a New York-based exchange that has partnered with Consensys to form a regulated derivatives marketplace for digital assets. The two main goals of this partnership are to:

- Create a benchmark rate for ETH.

- Build the infrastructure needed to promote the wide adoption of digital assets.

How can derivatives have a positive impact on cryptocurrencies?

A thriving derivatives market can have two huge impacts on the crypto market:

- The most obvious way it can impact the crypto market is by boosting liquidity and trading volumes for lesser-known altcoins. Bitcoin is – far and away – the most popular cryptocurrency in the world and consistently enjoys high trading volumes. However, the rest of the coins don’t enjoy that level of popularity and volume. Having interesting derivatives contracts with these altcoins will definitely go a long way in boosting their trading volume.

- As more private players bring in legitimate derivative contracts into this space, it will force the global financial watchdogs to take cryptocurrency regulations more seriously.

DeFi derivatives

DeFi derivatives are a whole new class of crypto derivatives that have come into prominence over the last year or so. The reason why investors are so excited about DeFi derivatives is that while it can provide all the services expected from a traditional derivatives platform, it also opens up the doors for innovative crypto-native contracts. Examples of such innovative contracts include:

- Hash swaps: A miner can sell off a portion of their mining power to a buyer for cash. This presents further income opportunities for miners that are not wholly dependent on cryptocurrencies.

- Electricity futures: Miners can also enter into a futures contract to purchase electricity at a predetermined price at a pre-agreed time in the future. This turns their electricity costs from variable to fixed.

DeFi Derivatives Examples

#1 Synthetix

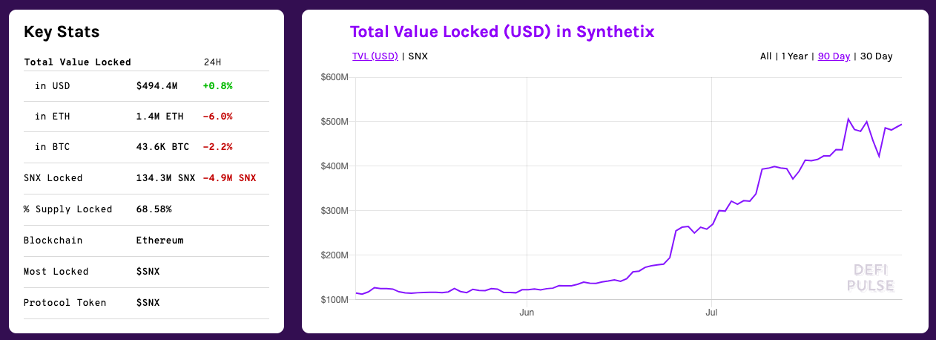

Synthetix is the third-largest DeFi application (as per total value locked in) and the largest derivatives platform on DeFi Pulse.

As of writing, Synthetix has a TVL (total value locked) of $494.4 million. It’s a multi-tier issuance platform, collateral type, and exchange that allows for the creation and exchange of a special class of tokens called “synths.” Through Synthetix, you can get your hands on a wide variety of assets such as Bitcoin, US dollars, gold, Tesla, etc.

Synths, or synthetics, are financial instruments that simulate other financial assets while altering their primary characteristics. Synths can offer a high degree of flexibility, customization, and ease of use. Users can buy them using any of the tokens/assets accepted by the base platform. But, aside from all this, synths offer three main primary functionalities, namely:

- They can lower overall funding costs.

- They can be used to insert liquidity into the market and allow users to hedge their risks.

- It uses a combination of financial instruments and derivatives to recreate any security/asset’s cash flow.

Synthetic features:

- Synthetic enables permissionless synth creation. These tokens are tied to the value of real-world assets.

- SNX, its native ERC20 token, is used as collateral to create Synths. All synths are overcollateralized to 800% to offset market volatility.

- sUSD – the native stablecoin – fuels all the trades on Synthetic.

- Transaction fees collected go to SNX holders and synth miners. This incentivizes synth creation.

- SNX stakers take on counterparty risk of other users’ synthetic position allowing Synthetic to use a pooled collateral mechanism.

dYdX

dYdX is a hybrid platform that offers DEX lending and leverage and was founded in mid-late 2017 by Antonio Juliano. They have raised around $12M – $2M in a seed round and $10M in a Series A round lead by Paradigm.

One of the most fascinating aspects of dYdX is its approach to margin trading. In finance, margin trading is a method by which investors can procure more assets than they can afford. dYdX offers margin via the following methods:

- Isolated margin: In this method, you isolate a specific amount of funds as part of a trade with certain leverage. This leverage determines how much the investors need to lock up as a deposit. If liquidation does occur, the losses are capped by the size of the isolated funds.

- Cross margin: In this method, you utilize all the assets in your dYdX balance as collateral. For example, by using cross margin, you can convert your deposited ETH into DAI to earn higher interest rates on your lending.

dYdX features

- Liquidation auctions have open participation. Anyone can purchase liquidated collateral at a discount.

- Any asset supplied to dYdX can consistently earn interest even when used in an open position.

UMA

Universal Market Access, or UMA, allows for the creation of decentralized, globally accessible financial markets of Ethereum. In the process, it provides exposure to a wide variety of assets. UMA achieves this by:

- Creating a workable framework for self-enforcing financial contracts.

- Build secure oracles with economic guarantees.

UMA helps in creating a protocol where two parties can easily design and build their own financial contracts. Every single financial contract consists of the following five components:

- Public addresses of the parties involved.

- Margin accounts of the parties involved.

- The economic rules that will calculate the value of the contract.

- Functions that maintain margin balances

- An oracle that verifies the authenticity of the data source

UMA’s native governance token (also known as UMA) is used to vote on protocol decisions and challenge reference indexes. UMA also happened to be the first major DeFi token made available to the public via an Initial Uniswap Listing.

UMA opens up the gates for financial innovators to pool their creativity and come up with offerings beyond the standard fiat world’s scope. Some examples of these offerings are as follows:

- US & Global Equities

- Cryptocurrency Dominance

- DeFi Total Value Locked

- DEX Market Share

- Perpetual Swaps

- Tokenized Yield Curves

- Futures

- Private Pension Plans

- Insurance and Annuity Products

UMA allows its users to tokenize the price of anything via a powerful combination of self-enforcing contracts and a provably sound decentralized oracle design.

Nexus Mutual

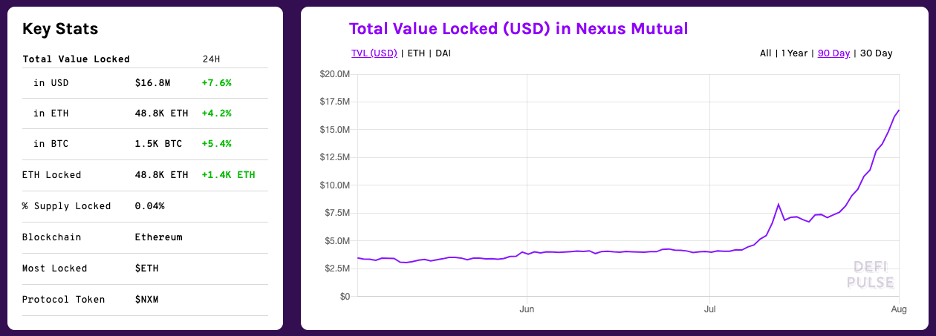

Nexus Mutual is an open Ethereum protocol that allows its members to pool their resources and share potential risks. As of now, Nexus Mutual has a TVL of $16.8 million.

Anyone can become a Nexus Mutual member by paying a fee in ETH. Only these members can participate in the network, buy Cover, and hold NXM – its native token. Members are entitled to a share of any capital help over what’s required to pay potential claims. Apart from being used as a staking token, NXM is also used for governance and economic incentivization.

Nexus has a product called “Smart Contract Cover,” which allows members to hedge their risk against a potential financial loss caused by smart contract misuse. Some features of the Cover are as follows:

- It is customizable as per the user’s needs.

- For sophisticated dApps, coverage can extend to directly-related contracts, coverage duration, and the amount of ETH locked in.

- The Cover is priced in NXM, but Nexus allows payment in ETH or DAI.

- Stakers get rewards only when the Cover is bought for that contract.

- If the contract is deemed unsafe by the community, the stake locked up in it may get slashed.

Conclusion

Let’s look at what all we learned in this article:

- Definition of financial derivatives and their many use-cases.

- “Traditional” crypto derivatives as offered by institutes.

- The scope of DeFi derivatives.

- Different DeFi derivatives application.

As we reach the end of this article, we genuinely hope that you can now safely answer this question – what are derivatives in finance moving towards? In other words, what is the future of the finance landscape going to look like?

The answer, of course, is DeFi. As we move into a more decentralized future, DeFi will undoubtedly seep into all aspects of finance and the global economy.

Speaking of which, do you want to learn more about DeFi? If so, then check out our blockchain courses at Ivan on Tech Academy. We have some of the industry’s best experts on the subject, giving you hours of valuable content on DeFi and its use cases.