The global economic landscape is changing, and this has only been expedited by economic turbulence caused by the recent pandemic. Digital payments have already replaced cash in many countries, and while central banks across the world debate the implication of Central Bank Digital Currencies, it is becoming clear how blockchain is rebuilding the global economy.

In this article, we discuss how blockchain technology is playing a pivotal role in reestablishing the current global financial infrastructure. We’ll also take a look at some of the most exciting use cases for blockchain technology that are helping to redefine how we transact with each other and how we view money.

As followers of the blog will know, we have already discussed COVID-19 and crypto, and the implications of the ongoing pandemic on the cryptocurrency sector. However, on a much larger scale, blockchain technology and crypto can potentially help rebuild the global economy, as the “fourth industrial revolution” is picking up steam. For some background on practical blockchain technology use cases, be sure to check out Ivan on Tech Academy and the blockchain courses available there!

A New Era For Finance And Technology

Although the media have claimed Bitcoin has died (several times), it appears that cryptocurrency and blockchain technology is increasingly becoming a cornerstone of the new financial era. Let us take a look at some of the ways in which blockchain is reshaping the global economy.

Pressure on The Banks

Savings accounts with traditional banks are becoming largely redundant, with many banks charging you just to hold your fiat currency while it is devalued. Decentralized finance protocols such as Compound and Aave offer a seriously compelling alternative to traditional financial services. Staking, lending, and borrowing protocols are great examples of how blockchain is rebuilding the global economy. Cryptocurrency yield is quickly replacing traditional interest accounts, and the banks are under pressure to step up or else get left behind.

The US banking giant JP Morgan has consistently criticized cryptocurrency over the years, with chief executive Jamie Dimon famously branding Bitcoin a “fraud” in 2017.

The stance taken by JP Morgan has changed dramatically in recent years, with Jamie Dimon reportedly holding talks with Brian Armstrong, CEO of centralized crypto exchange Coinbase. JP Morgan has already made agreements with Coinbase competitor Gemini to cooperate in processing transactions, signaling merger of blockchain-based institutions, and major banks.

Traditional financial institutions are becoming increasingly intertwined with well-regulated cryptocurrency exchanges. JP Morgan released the JPM coin in 2019, a stablecoin pegged to USD. As commercial banks look to capitalize on this new technological frontier, this trend could continue. If the United States central bank fails to bring any form of CBDC offering, commercial banks such as JP Morgan would be well-positioned to capitalize.

If commercial banks outpace central banks in cryptocurrency adoption, we could see an entirely new economic landscape, whereby central banks hold far less control than the commercial banks they have been propping up for years.

Institution and Enterprise

The growing confidence in cryptocurrency is evident by the huge amounts of money moving into the space from institutional investors and enterprises.

Bitcoin Treasuries displays a list of publicly traded companies investing a percentage of their asset holdings in Bitcoin. The first mover was MicroStrategy, putting in an initial $250 million into Bitcoin. As more institutional investors flood into the market, the company has since put in a further $200 million. At the time of writing, there are a total of over 786,000 Bitcoin being held by large public enterprises.

This is just the beginning, with an anticipated ‘wall of money’ expected to hit the cryptocurrency market taking the Bitcoin value up to as high as $1million by 2025 according to a recent statement from Real Vision CEO, Raoul Pal, who has said he is now converting his gold investments into Bitcoin.

Smart Contracts

Smart contracts have allowed money to be programmable, to move from one address to another, upon specified measures being met. The transparency, immutability, and efficiency of smart contracts are changing how we transact, and the number of different types of contracts that are being created and implemented is growing exponentially.

Smart contracts display an immutable ledger of transactions, removing disputes between receipt of delivery, or invalid temperatures of goods in transit, for example. Smart contracts are the underlying foundation of all decentralized applications and are synonymous with the use of blockchain across global industries.

Gold

Gold has been the ultimate store of value for thousands of years due to its limited supply, durability, and fungibility. Gold became the basis for many national currencies and is still perceived as a superior store of wealth to fiat currency.

This made complete sense before the dawn of the internet, but as we move into this exciting new digital era, the practicalities of owning physical gold make it less appealing to younger generations.

The verification, transportation, and secure storage of gold are problematic, particularly in the digital age. Bitcoin and other cryptocurrencies, however, are perfectly suited to a demographic that lives online.

Cryptocurrency is borderless, intangible, and accessible. It’s a no-brainer that future generations will turn to Bitcoin as a store of wealth. Nothing can compete with mathematically verifiable scarcity.

On top of this, it was recently reported that the world’s largest untapped gold mine has been discovered in Siberia, holding approximately 40 million ounces of gold. The scarcity of the precious metal is dubious, unlike Bitcoin, which has a hard-capped supply of 21 million.

Just as we move towards a cashless society, in years to come, it would appear that Bitcoin is primed to become the number one hedge against inflation for future generations. As traditional assets become less practical for the modern age, we will continue to see new use cases that showcase how blockchain is rebuilding the global economy.

Interoperability

The narrative has moved from “Ethereum Killer” to Etherum scaling solutions. Interoperability is beginning to replace tribalism in the crypto space, with developers coming together to build blockchain ecosystems that can coexist with different platforms.

Polkadot for example aims to maximize the potential of Ethereum, rather than directly compete with it. This interoperability is what is driving so many people to build new and innovative scaling solutions to work in harmony with existing blockchain infrastructure.

The community is building together, bridging many different blockchains to achieve a common goal of decentralized, permissionless financial freedom that can co-exist with traditional financial infrastructure.

Replacing Industries

Many different industries are now embracing blockchain technology. From supply chain management, healthcare, and gaming, there are several emerging industries showing how blockchain is rebuilding the global economy. Moreover, the fourth industrial revolution is further accelerating this shift.

Beyond the fintech space, several other sectors stand to be disrupted by blockchain technology. Soon, we could see voting taking place on the blockchain, while the insurance sector could be heavily disrupted by the introduction of blockchain-based insurance.

Though non-fungible tokens are largely used for gaming and art, mortgages could soon be facilitated by smart contracts and NFTs. As the technology develops, all industries that operate in the fields of intellectual property, rights and ownership could see a huge uptick in the adoption of NFTs.

DeFi

The desire to earn yield is present throughout the financial world. Despite the strong favourability of the number one cryptocurrency, Bitcoin can’t facilitate this without Ethereum. Decentralized finance is one of the most obvious examples of how blockchain is rebuilding the global economy.

Expedited by the yield farming frenzy, crypto yield is now replacing savings accounts offered by banks. The yield farming hype is slowly beginning to die down whilst other, more sustainable projects, are seeing an increase in the number of users.

Long-standing, tenable platforms that have survived the previous 2017 bull cycle and 2018 bear market such as Aave and Maker, are welcoming an influx of new users, with DeFi Pulse indicating a higher TVL (total value locked) than ever before.

Decentralized finance platforms are offering financial tools and services, similar to those of the traditional financial system. However, with the users in mind and not paying a large cut of profits to shareholders, the returns and rewards across DeFi platforms are far more substantial than the legacy services can offer. Interest rates vary between coins and platforms, you can even check Staking Rewards for the latest interest rates of the top-performing coins.

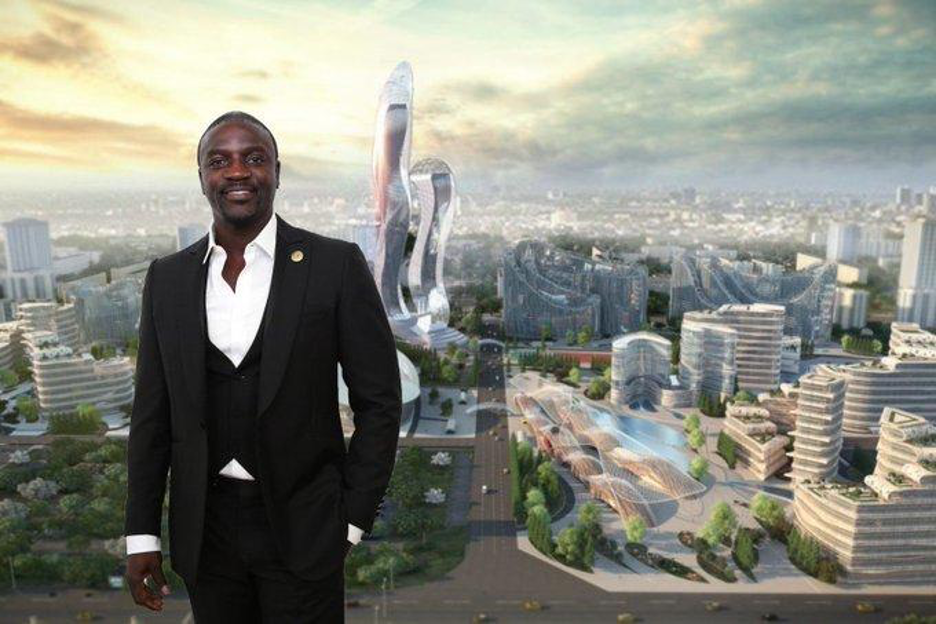

Akon City

International superstar Akon has been working hard to develop the revolutionary crypto-powered Akon City in Senegal. The city will be powered by the AKOIN cryptocurrency and will foster innovation and nurture talent from the continent in many advanced fields, helping place Africa at the forefront of technological innovation.

The network effect of this initiative is incredible, spreading to several parts of the continent, exhibiting how blockchain is rebuilding the global economy by building a city that harnesses the greatest minds in technology, healthcare, and finance.

If you type “Bitcoin” into Google Trends, you will see that there is a modest amount of search volume globally now, compared to the peak of the 2017 bull run. If you look a little closer though, you might notice that several countries in the continent of Africa appear to be showing a great deal of interest in Bitcoin, with search volumes far exceeding those of other countries. Nigeria in particular is showing a rapid increase in cryptocurrency adoption, both as a hedge against inflation and as a way to pay for goods and services.

Financial Inclusion

Even before the economic impact of the pandemic was truly felt across the globe, many countries were already experiencing hyperinflation of national currencies. The use of cryptocurrency as a store of wealth and as a way to pay for goods and services has been accelerating in developing nations for many months.

When troubled economies finally implode, those holding cryptocurrencies have an ace up their sleeve. Cryptocurrency is borderless, permissionless, and censorship-resistant. Even when strict capital controls are implemented, cryptocurrency has helped to preserve the wealth of people throughout the world.

When the global economy grinds to a halt, many people are subject to severe economic uncertainty, and millions are faced with financial turmoil. The proliferation of cryptocurrency adoption in developing countries has leveled the playing field and assisted in bringing financial inclusion to those that might not have previously been able to generate or protect wealth.

Currently, there are an estimated 1.7 billion people without access to banking services. Cryptocurrency is open to anyone, regardless of nationality, economic status, or stability. Cryptocurrency could end world poverty by providing opportunities to people in emerging economies that would otherwise have little means to generate wealth.

Remittances

The ability to make cross-border payments at low-cost from, anywhere in the world puts cryptocurrency at the forefront of payment technologies. Every day, more people across the world are opting for blockchain-based services to send money overseas.

Remittances made using the SWIFT payment service are often costly and can take several days to process. Cryptocurrency renders many traditional financial frameworks obsolete as transactions can be made at any time of day, from anywhere in the world with an internet connection within minutes.

Cryptocurrency payments are quickly becoming the method of choice for people in all parts of the world because of the low-cost, secure transactions they facilitate.

How Blockchain Is Rebuilding The Global Economy: Conclusion

Many cryptocurrencies are not the same high-risk tradeable asset they were seen as back in 2017. With the true value of Bitcoin finally being realized, people are recognizing the long-term value proposition of cryptocurrency and choosing to hodl for the future rather than make high volume trades.

The type of speculation in the industry is changing. We’ve gone from speculating on a project actually making it to market, to speculating on how successful a project could be by merit of its utility and adoption. Moreover, the global economic crisis has created an opportunity for the world to rethink how economies work and to question the role of banks and governments. Technology is changing to meet the demands of consumer behavior, and so too must the legacy financial system.

Young investors with a higher risk appetite could make life-changing gains in the cryptocurrency markets with a modest amount of capital. Much like the Robin Hood craze, many turned to crypto trading during lockdown both as a way to pass the time and for the opportunity to make some gains while out of work.

During the March crash, many older investors were inclined to cut their losses and withdraw any investments that might be in jeopardy. Younger generations, however, saw this as a great opportunity to enter the market.

Decentralized finance could be a short-lived, high-risk experiment, or it could be a logical alternative to a broken financial system. What is clear though, is that blockchain utility is higher than ever. Across many different sectors, it is becoming increasingly apparent how blockchain is rebuilding the global economy and helping to optimize outdated financial infrastructure. Find out more about blockchain at the blockchain education site Ivan on Tech Academy!