Those in cryptocurrency or blockchain circles will likely have heard of decentralized finance, commonly referred to as DeFi. The DeFi sector has grown hugely over the past few months and can be understood as a movement of projects that can substantially boost financial inclusion. This comes as “banking the unbanked” is a real challenge faced by people worldwide. Could the DeFi sector hold the keys to banking the unbanked? Some people certainly believe so.

Specifically, DeFi can be seen as advancing the use case applications of blockchain technology from simple value transfers – such as with crypto transfers – to increasingly complex financial uses. In fact, decentralized finance looks to offer decentralized alternatives to traditional financial instruments, as well as entirely new financial products. This is why many herald decentralized finance as a potential paradigm shift for finance.

As such, DeFi potentially holds the keys to massively disrupting the traditional financial services sector. The recent advancements made in the DeFi field would be impossible without blockchain technology, the technology underpinning both decentralized finance and cryptocurrencies. Nevertheless, DeFi also lends itself exceptionally well to banking the unbanked. First of all, however, are you looking for a bit of background regarding blockchain and Bitcoin? If so, Ivan on Tech Academy has the courses for you.

Over 20,000 students have already enrolled in Ivan on Tech Academy. Right now, you can get 20% off if you register using the exclusive promo code BLOG20. Those looking to learn more about decentralized finance should first start with understanding the crypto basics, Ethereum, the history of money and Bitcoin, and should, of course, check out our DeFi beginners course as well as our advanced DeFi course.

Introduction to The Unbanked

For many people in the Western world, managing your day-to-day affairs without a bank account would seem nearly impossible. However, although most people in developed nations have access to financial service providers such as banks, a large portion of the world’s population does not. What’s more, it is hard to overstate the importance of financial service providers. Granted, organizations such as banks grapple with significant structural issues, which are likely even more glaring to cryptocurrency fans than to the average layman. Nevertheless, banks are essential for doing everything from opening a bank account to getting loans. Those without a bank account are usually referred to as “the unbanked”.

A World Bank study from 2017 found that nearly 2 billion adults all around the world are unbanked. Moreover, this lack of financial services infrastructure prevents people from being able to have a financial identity. The societal issues caused by this are easy to spot, as some form of access to financial services is crucial to furthering global prosperity and wealth. Essentially, helping to “bank the unbanked” through a micro-credit initiative is what earned the Bangladeshi businessman Muhammad Yunus and Grameen Bank the Nobel Peace Prize in 2006. Although this didn’t solve the problem, it highlights the global importance of banking the unbanked.

In fact, “financial inclusion” is one of the United Nations’ key 2030 Sustainable Development Goals. More specifically, financial inclusion is judged to be a central enabler in reaching other sustainable development goals, including ending hunger, eradicating poverty, achieving economic empowerment of women, reaching gender equality, promoting jobs and economic growth, supporting industry, innovation, and infrastructure, as well as lowering inequality. Put simply, it is easy to see why “banking the unbanked” is such an important task. Nevertheless, this challenge can be daunting to tackle head-on.

Why Are The Unbanked Unbanked?

So, how did the unbanked even become unbanked in the first place? A large part of the problem has to do with systemic issues related to the banking industry. Traditional banks’ perceived reluctance to help boost financial inclusion is due to a myriad of issues. First of all, expanding financial service branches to reach 100% of the global population is seen as a risky move by banks. Many areas of the world lack any existing financial infrastructure, and it would, therefore, be prohibitively expensive to build out support for financial service providers in these areas. Furthermore, there is no guarantee that the banks would make their money back on such a venture.

Financial Services

What’s more, even if the necessary financial infrastructure for financial services providers – e.g., bank offices – existed all around the world, it is unlikely that traditional banks would approve complex financial services such as loans to people living on the fringe of society. Traditional financial service providers are not altruistic – rather, they seek to maximize the return on their investments and minimize both investment and risk. Consequently, many banks worldwide require clients to have a certain minimum balance to open a checking and savings account, meaning people with low income may not meet the banks’ stringent requirements. In addition to this, many people also have a deep distrust of the banking system, which is especially prevalent among young people, among those who have experienced a banking crisis, and in nations grappling with corruption. Incidentally, these are also the countries that generally struggle with having large numbers of unbanked or underbanked individuals.

Banking The Unbanked with DeFi

However, blockchain technology and DeFi turns this traditional notion on its head. Specifically, the advent of blockchain means that payments can be arranged in a safe and efficient manner at a low cost. What’s more, DeFi doesn’t even require anything more than a compatible cellphone or computer to access a wallet or financial services. As such, there is suddenly no need for classic requirements for financial inclusion, such as having a credit card or being connected to a bank.

As such, DeFi looks like it can solve many of the issues that are to blame for a large portion of the world’s unbanked. The readily accessible nature of DeFi, as well as how it replaces traditional centralized financial service providers with Ethereum smart contracts, means virtually anyone can take advantage of DeFi solutions. Moreover, the DeFi sector is huge and encompasses everything from digital assets to decentralized applications (dApps), smart contracts, and various protocols.

What is DeFi?

DeFi is short for “decentralized finance”, and is an industry and movement that utilizes blockchain technology in order to provide people with intermediary-free transfers of funds, peer-to-peer (P2P) lending, and a variety of other financial instruments. Just like Bitcoin and other cryptocurrencies, the DeFi sector is open to anyone. Put simply, the DeFi sector has the lofty goal of offering blockchain-driven or cryptocurrency alternatives to traditional financial services. Although this may sound ambitious, it is not impossible.

A financial services system built on blockchain technology is not only potentially more inclusive than traditional services – it can also be significantly more versatile. First and foremost, its blockchain capabilities mean that the DeFi sector can be considerably more transparent than the traditionally opaque banking sector. Greater transparency is an essential step to boosting trust, regardless of the systems.

Having a decentralized financial system that is built using a public blockchain could provide anyone with readily available access to financial services, wherever or whoever you are. DeFi does not only offer greater geographic access to financial services; it also brings greater temporal accessibility. Unlike traditional banks, DeFi solutions are largely automated and can function twenty-four hours a day, seven days a week. Consequently, transfers can happen at any time during the day or week, and are processed significantly faster than using traditional financial services.

In fact, cryptocurrencies and the DeFi sector enable nearly instantaneous transfers over large distances and national boundaries. The largely automated nature of DeFi services also means that DeFi solutions are significantly cheaper than traditional financial services. As such, DeFi does not provide any single slight improvement on conventional banking. Instead, it is objectively materially superior to legacy banking systems, which is why the interest for DeFi is quickly ramping up.

DeFi Drawbacks?

So, why haven’t decentralized finance caught on more yet? Granted, many cryptocurrency fans and blockchain enthusiasts are already getting into DeFi, but this is a relatively small subset of the global population. As we will touch on later, one major factor is the lack of DeFi education and awareness. Nevertheless, there is also the issue that the DeFi field is still relatively young, and there are only a few workable DeFi products available on the market.

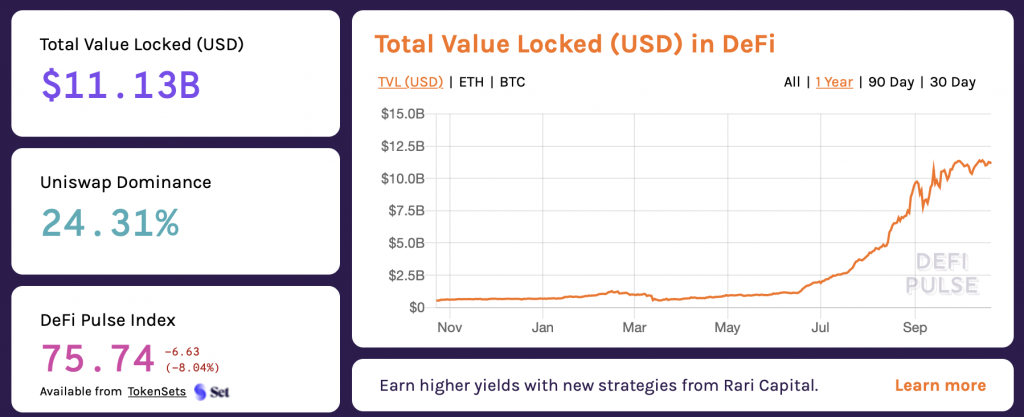

DeFi Pulse

This looks to only be a passing phase, however, as the DeFi field has a market capitalization of over $370 billion, according to CoinGecko, and a total value locked (TVL) – the amount of crypto held in DeFi – of over $11 billion, according to Defi Pulse. However, even though interest and funding for DeFi are clearly there, let’s look at some of the current DeFi drawbacks that exist.

Smart contracts can, in a very broad sense, be said to “power” the entire DeFi space. Although smart contracts is what enables some of the DeFi sector’s advantages over traditional financial service providers, programmers need to be careful. Smart contracts that haven’t been properly vetted can cause significant problems and lead to the loss of funds. For example, unaudited code was the case with Yam Finance, which is now a DeFi project seemingly in limbo.

Yam Finance intended to offer a stablecoin with a 1:1 peg to the US dollar, and its smart contract was intended to destroy or create tokens as the price fluctuated. Nevertheless, a bug caused the number of tokens created to increase exponentially. Yam Finance’s governance system did not allow for an easy fix for this problem, and the Yam Finance team eventually branded the problem “unfixable”, leading to a 98% drop in the project’s token (YAM) within 24 hours.

DeFi Education

However, the main barrier to greater adoption of DeFi systems is simply that many people still aren’t aware of its advantages, or even its very existence. This is a problem that the blockchain industry has previously grappled with as well. If one is to truly “bank the unbanked”, then the unbanked need to be aware of the solution to their problems. Nonetheless, this can be difficult to accomplish when even many banked people are unaware of DeFi and the various decentralized finance solutions out there.

As such, you should visit Ivan on Tech Academy to get a better sense of the cryptocurrency sector as a whole, and the DeFi industry in particular. Ivan on Tech Academy offers countless blockchain courses, tips on blockchain research tools, a vibrant forum community and daily blog posts relating to all things crypto and DeFi. Enroll today and learn all about the advantages and specifics of DeFi!

Banking The Unbanked with DeFi – Conclusion

So, it should be clear that the DeFi sector holds a lot of potential. Not only could it dramatically overhaul the traditional finance sector, it could also provide a valuable alternative to banking the unbanked. Giving the roughly 2 billion unbanked people around the world access to decentralized financial services and instruments, which can perform the same things as traditional finance providers at a fraction of the cost, could have a radical impact on global prosperity and wealth.

For example, DeFi-driven P2P loans could allow people in developing countries to kickstart careers or realize their dreams, much like Grameen Bank’s micro-credit loans have done in developing countries since the 1980’s. However, unlike micro-credit loans, DeFi P2P loans could instead be free from exorbitant rates, potential corruption and loan sharks.

This all paints a rosy picture for the future of DeFi, and suggests that decentralized finance could be one of the best chances we have for banking the unbanked. Seeing how DeFi is open to everyone with a compatible cell phone or computer, it is the first initiative that could truly bank the millions of unbanked.

At the same time, it is important to recognize that DeFi does not automatically solve the issue of banking the unbanked just by existing. Rather, it should be seen as what it is; a relatively early exploration of the potential held by blockchain technology for boosting financial inclusion. Nevertheless, people all around the world need to discover DeFi and get educated regarding decentralized finance to truly comprehend its benefits. The best place to get your blockchain education is, without a doubt, Ivan on Tech Academy. Join the Academy today and supercharge your blockchain knowledge!