Axelar enables cross-chain communication that goes beyond bridging. Explore one of the cutting-edge tools pioneering a chain-agnostic future.

Issue 17

January 20, 2023

Aptos Ecosystem Deep-Dive

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. The US Justice Department declared a major international cryptocurrency enforcement action and Genesis’ Crypto lending business has filed for bankruptcy protection, yet so far BTC is holding the line at $21k! …will the pump continue?

This year has got off to a good start with some of those sweet green weeks we’ve been missing for a long time. It’s great to have some of the excitement back but let’s zoom out and consider whether it’s going to be sustainable throughout this year and what the prevailing narratives will be.

One indication that a bear market has come to an end is when the price doesn’t significantly react to bad news. The troubles at Genesis have been known about for several months in what’s a gradually developing situation, so that news could have been priced in already. The Justice Department news was somewhat of a surprise, however some movement from regulators in 2023 had been anticipated.

One of the ongoing narratives this year is therefore likely to be continued clampdowns on decentralized technology and DeFi, what the Justice Department terms cryptocurrency. Along with continued trials of CBDC’s and plans or pilot tests by governments to encourage their use.

As before we can look to the US to see what their moves are and garner indications on similar policies throughout the western world, particularly the G7. Last year the G7 made announcements urging swift regulation of crypto assets and their desire to have them meet the same standards as the rest of the financial system. 6 months prior the G7 had laid out guidelines for CBDC’s.

The European Union is also leading on their plans for a Digital Euro and will begin to draft their legislation this month with a proposal for the actual legislation targeted for Q2. The European Central Bank has previously stated that they see stablecoins as a threat. So it’s important that in the crypto industry we continue to try to lead on the narrative of the benefits of decentralized tech as a counterweight to CBDC’s.

Having a parallel financial system is of course worrying the existing financial system and probably governments who are grappling with how to control it. But ideally the crypto industry will be able to keep going with the narrative of an alternative choice. One for those who value their freedom, privacy and liberty- many of the original Bitcoin values.

The need for regulations to protect normal people from the disasters we saw last year is not the same thing as the need for a government controlled CBDC. We mustn’t conflate the two, because there are distinct benefits for having a system which is free from government control- not to mention all the other use cases such as NFT’s, Metaverse and Digital Identity that are emerging with blockchain technology.

There’s going to be an ongoing delicate balance between the old systems and the new. It’s like a changing of the guard and there’ll be people with opinions on both sides for a while, but keep going with the creation and active use of all the wonderful new things and eventually we’ll reach consensus on what’s best for the average person.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

January 20th, 2023 | 09:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds. I don’t give advice to buy or sell specific assets. The education and software tools are timeless and generic for any asset. Rather than relying on subjective market opinions, I apply the principles of technical analysis formulated in 1930s on historical charts. Anyone can apply the same process and get the same result. Technical Analysis does not predict the future. It is a tool to find setups for controlled risk/reward. Larsson Line does not predict the future. It is a mathematical formula for trend expression. My objective with this report is to help you reflect on your own analysis, not to replace it.

Disclosure: I hold Bitcoin and Ethereum exposure through company ownership and in my personal capacity, as ETP price tracker certificates through my bank.

Trend Analysis

Bitcoin (BTC)

Trend is up!

Ethereum (ETH)

ETH/BTC trend is up.

Binance (BNB)

A mixed bag.

Solana(SOL)

Reached target.

Polygon Matic

Hitting up against resistance.

Cardano (ADA)

Trend down.

XRP

Ranging.

Bitcoin (DOMINANCE)

Hitting up against resistance.

Bitcoin

Trend is up

Finally the Bitcoin trend is up! Larsson Line is gold! 🥳

As shared in last Friday’s report, I took an entry on Jan 10th at $17,433 even prior to the gold flip, as on that day price cleared both the $16,871 resistance and the $17,260 resistance.

I hesitated once, sold, changed my mind and bought back. I still hold the entry.

And now that the trend is up, I’m interested in buying more

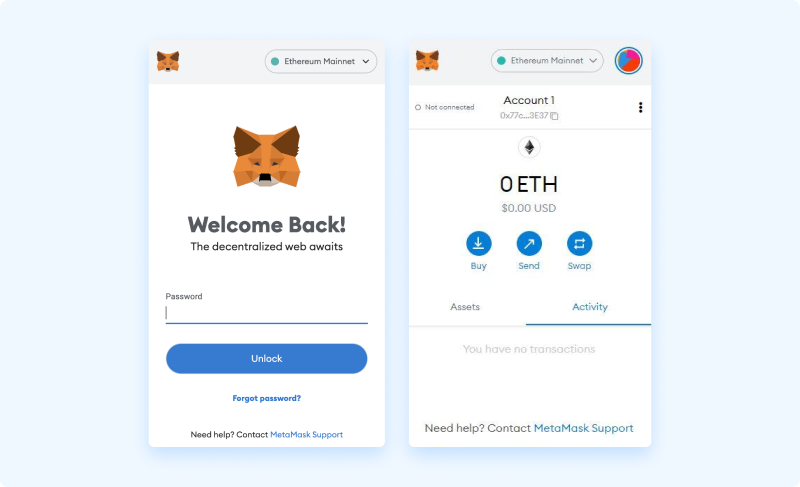

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet or the mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

APTOS Ecosystem Deep Dive

Introduction

As the blockchain industry continues to evolve, new challenges emerge; for these reasons, new projects surface to solve these challenges. Ethereum was the first project to build a blockchain where other developers could build native decentralized applications in the form of smart contracts. So far, the Ethereum experiment has proven inefficiently handling many executions securely and at scale. To solve the scaling problem with Ethereum, side chains and Layer 2 (L2) solutions have emerged to leverage the security of Ethereum while allowing for cheap and fast transactions. Moreover, there have also been so-called “Ethereum” killers or Layer 1(L1) blockchains which try to achieve thousands or tens of thousands of transactions per second while being secured and decentralized. Aptos is one of the most recent L1 blockchains, which comes with many interesting innovations and promises a whopping 130k transactions per second.

People Also Read

In this issue we explore the Celo ecosystem, a mobile-first blockchain protocol, and Shiba Inu's upcoming Layer 2 blockchain which

Exploring some of the projects which made it to the finals of the Moralis x Google Defining Defi Hackathon sponsored