Axelar Deep Dive

Introduction

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. The CPI data pump from last week has fizzled out and in crypto we’re back to pre-release prices. The momentum in traditional markets has also slowed but they’re better holding their ground.

It feels like one of those moments where the crypto news cycle is beginning to change and gradually the fear is starting to creep in again. Is the flip from bullish to bearish justified though and has anything really changed in the past week.

Notably Canadian exchanges have begun to enforce a $30,000 (CAD) total annual buy limit on restricted coins for their users based in Ontario. This was following the Ontario Securities Commission announcing new regulations and a total yearly buy limit on any digital assets except BTC, ETH, BCH and LTC. There’s been a big pushback from Canadians who are affected by this as well as the greater crypto community on fears that similar regulations could be applied elsewhere.

Earlier in the month TornadoCash was thrown into the fire with US rules normally applied to lists of sanctioned countries. The same rules are being applied to any wallet which has ever interacted with the protocol. Anyone from the US who interacts with any wallets associated with Tornado Cash could now be fined and imprisoned. USDC has also blacklisted any wallet address which has been sanctioned.

In a twist and turn of events, one of the sanctioned wallets sent 0.1ETH to a range of known high profile wallets. These wallets belong to people such as Logan Paul, Randi Zuckerberg and Jimmy Fallon. In a technique known as ‘dusting’ the theory is the otherwise innocent owners of these wallets could now fall foul of US sanctions because they’ve received something from the sanctioned wallets. That wouldn’t seem fair of course.

For the past few years there’s been so much made about data protection and regulations for protecting privacy. So why then go after a decentralized protocol which was designed to protect privacy. For example Vitalik had used Tornado Cash to protect the privacy of those who he’d made donations to during the Ukraine crisis. In that instance it wouldn’t seem fair to sanction those entities.

With the collapse of Terra Luna and the bankruptcies of Voyager, Celsius and others there is a growing call for better regulations to protect people. But the question is how and where to fairly apply existing regulations, how to create new regulations in users best interests or even whether people need to be ‘protected’ when educating them to protect themselves could be a better option.

What’s happening now is regulations designed for different generations are being applied to the new and evolving crypto world. It’s not always going to work in practice and we’re probably right in the middle of years of the emerging debate. There are no easy answers and there are those on all sides of the debate.

Knowing how long legislation processes take and how fragmented the different government departments and personnel are in their opinions, then it could still be a long time to get consistency and consensus on what is the fairest treatment of this new technology and movement.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

With Great Respect,

Ivan Liljeqvist

Cryptocurrency Market Overview and Analysis

Technical Analysis Report August 19th, 2022 10:45 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday

movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods

of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information,

I will adjust my opinion accordingly.

Disclosure: I hold Bitcoin, Ethereum, Luna and Solana ETP price tracker certificates in ISK through my bank. Through company ownership I also hold small exposure to misc. additional tokens.

Trend Analysis

Bitcoin (BTC)

Still no gold flip in LL.

Ethereum (ETH)

ETH/BTC looking good.

Binance (BNB)

BNB/BTC still holding its breakout.

Cardano (ADA)

Hesitating.

Solana (SOL)

SOL/BTC right key support.

Bitcoin (DOMINANCE)

Range bound between 40-48%.

Wet blanket continues

As mentioned in previous reports, Bitcoin started lagging behind the Stock markets – by a lot.

Why? Fear of Mt Gox coins coming out soon? Macro worries affecting the most speculative assets the most? Who knows, but what we can say with certainty is that someone is selling.

I have gotten a lot of FOMO driven messages in my inbox this week, that we are missing the breakout. Well, here you go. The rising wedge broke down, as that pattern often does.

Personally, since Larsson Line hasn’t flipped gold yet, I’m quite happy to wait for more clues about what is really going on before taking any bigger actions.

Web3 Wallet: Start Guide

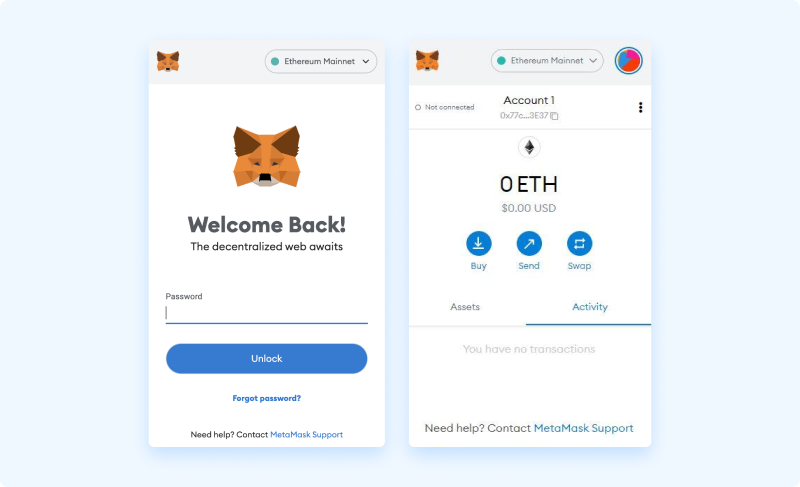

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

Bitcoin dominance remains range bound, as drawn below.

A range can break out in either direction and it’s usually a mistake to try to guess in which direction, before it has actually happened.

At one point it will, and that will be my clue for how to position myself between BTC and alts for the next major move of the markets.

The chart is here shown with 3 day candles.

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Axelar Deep Dive

Introduction

Going cross-chain has never been more accessible and frictionless. This advancement is thanks in part to the interoperability offered by EVM-compatible networks, streamlining development and standardizing functionality across several chains. There are currently a variety of protocols that tackle cross-chain interactions in their own unique ways. These implementations include cross-chain bridge and Dex aggregation, messaging and routing protocols, and a variety of contract execution methods. This report aims to go in-depth and analyze one of the cutting-edge tools pioneering a chain agnostic zeitgeist.