As an L2 aggregator, Polygon has a wide variety of decentralized products and services. This reports covers everything Polygon, from

Issue 11

December 23, 2022

Exploring Celo Ecosystem and Shibarium L2

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. The holiday season has arrived and 2022 will soon be drawing to a close. We’ve all had a turbulent year and are still in the depths of the crypto winter. It’s been a total contrast to 2021, but it’s always worth remembering the cycles and roughly where we are within them.

We’re in the middle of the Bitcoin halving cycle and the middle of a macro cycle. This is the first crypto bear market where the global economy has also been in a bear market. We’ve looked a lot at the interest rate decisions of the FED this year because for most of it Bitcoin and crypto prices were correlated with US stock markets.

There was a time when Bitcoin was meant to be a hedge against inflation but it hasn’t panned out like that for people who’ve entered over the past couple of years. The next halving will take place in around 500 days. So in April/May 2024 the block reward will reduce from 6.25 to 3.125 BTC per block. In future cycles it may still become the hedge and Bitcoiners will always remind you that there’ll only ever be 21 million Bitcoins.

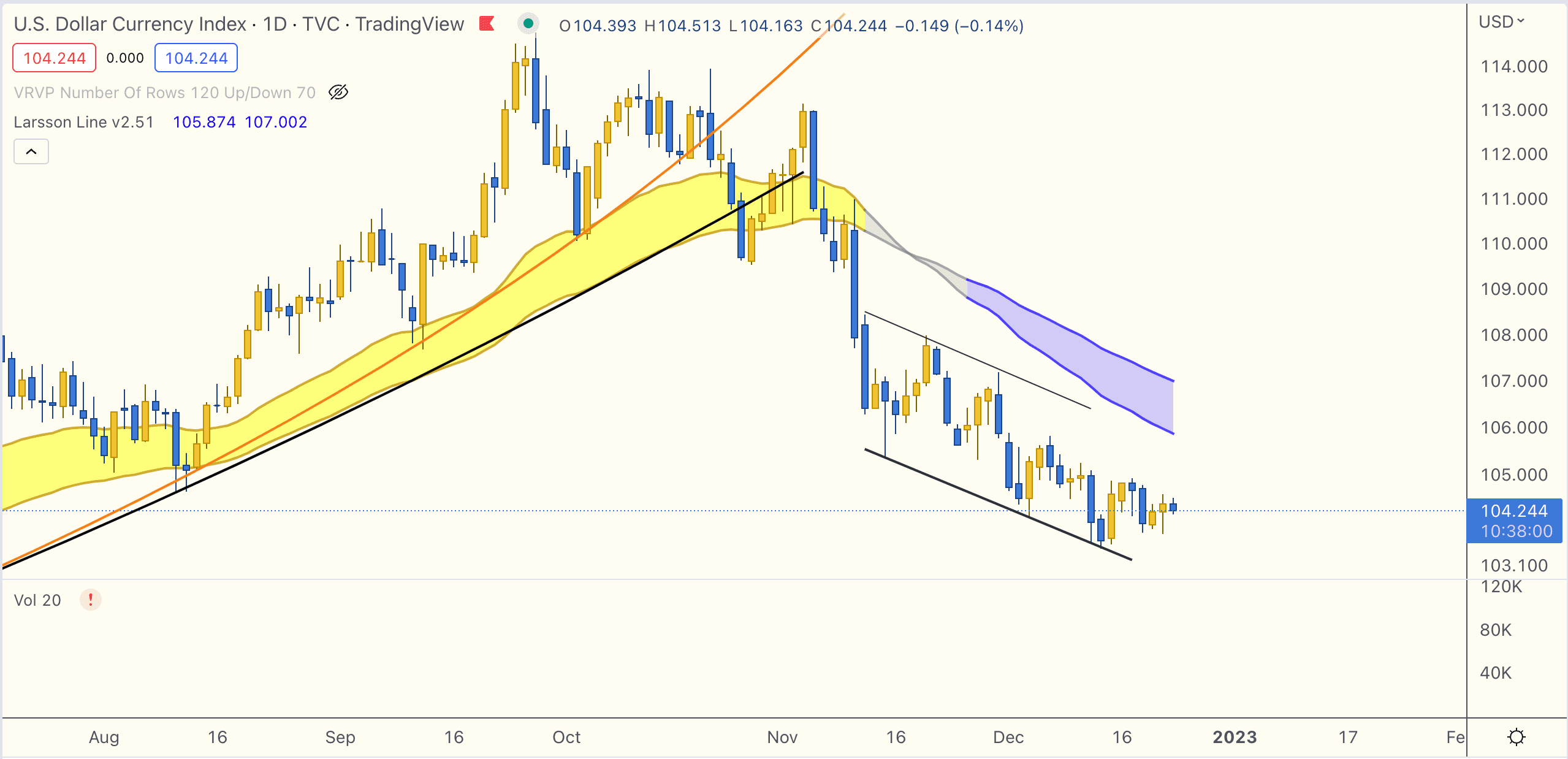

As for the global Macro outlook, there’s decades of data available on economic cycles here and the FED is very regularly vocal on the role they play in economic cycles. They have a set of tools which they use to control money supply and their often stated prime objective is a 2% inflation target. There’s a range of opinions on when they will make the pivot, but most forecasts are between Q2 and Q4 2023.

Because the US$ plays the role as the world reserve currency, with around 60% of the world’s foreign exchange reserves being held in US$, the monetary supply, controlled by the FED, has large influence over other markets. For much of this year the dollar became the safe haven, when during this part of the cycle, money flowed away from risk assets and into the so-called safe haven.

The FIAT bubble actually gets bigger each cycle and each round of quantitative easing. If, for any reason, confidence in the dollar (and the US) decreases as a global reserve asset this bubble would be under threat. Think of all the deleveraging that’s occurred this year in crypto and put that on a global scale. But for the time being they can’t just stop the money-printing or the global economy would collapse.

So bar any global catastrophes or revolutions the global economy will enter the next cycle of quantitative easing. Look for the inflation numbers to come down to reach the interest rate in percentage terms before any change in policy. For reference the most recent CPI data came in at 7.1% and the current FED interest rate is 4.50% with implied expectations of a peak at 5%. When the numbers cross, look out for the pivot and it could well time with the buildup to the next halving!

Wherever you are, I hope you have a fantastic holiday season. No matter what’s happened in the industry this year, just make the most of enjoying time with the people who are most important to you!

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

December 23rd, 2022 | 13:30

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds.

Disclosure: I hold Bitcoin and Ethereum exposure, both through company ownership and in my personal capacity, as ETP price tracker certificates in ISK through my bank.

Trend Analysis

Bitcoin (BTC)

Bitcoin remains in downtrend

Bitcoin (DOMINANCE)

At top of major range. Watching for breakout.

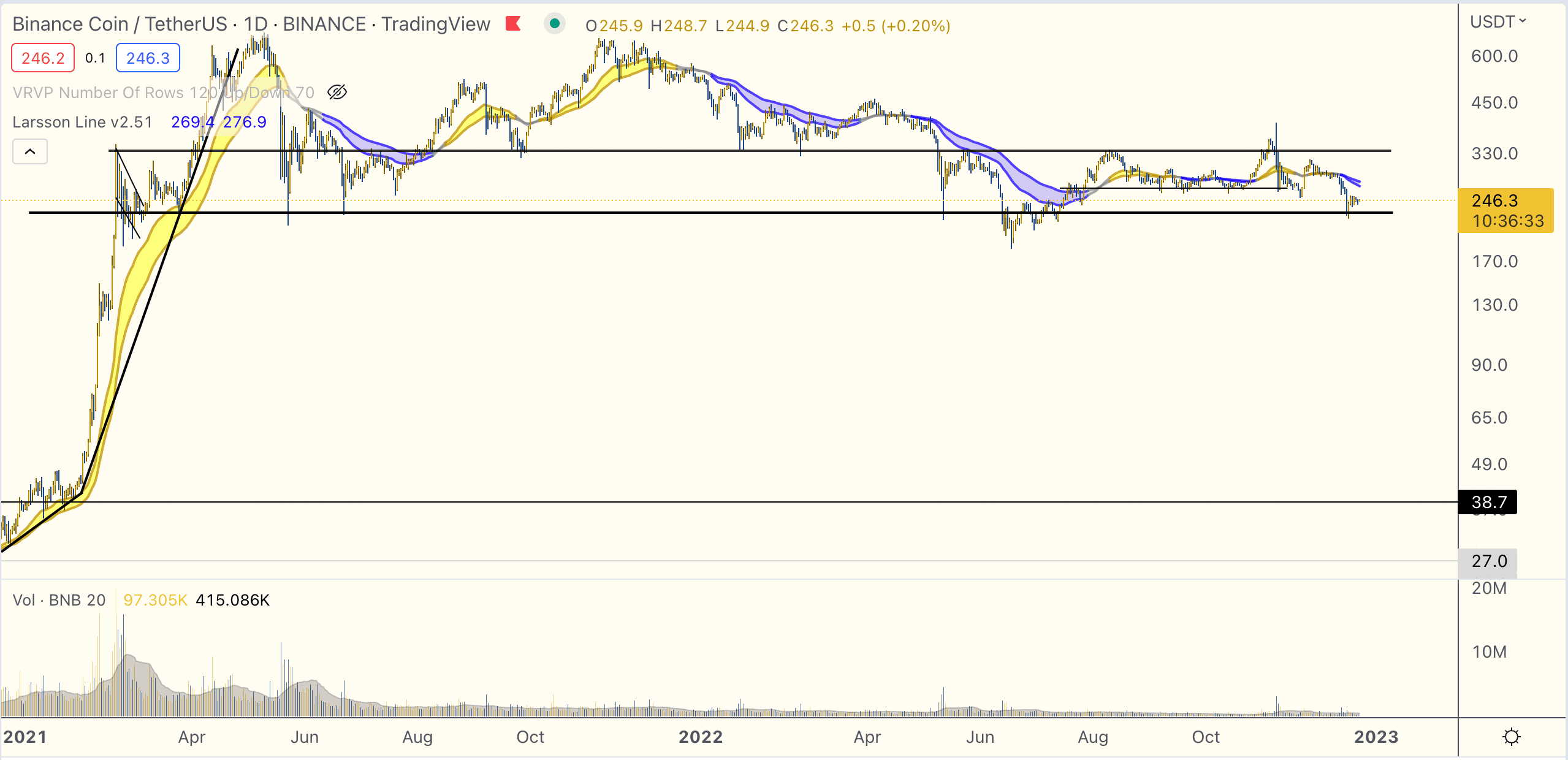

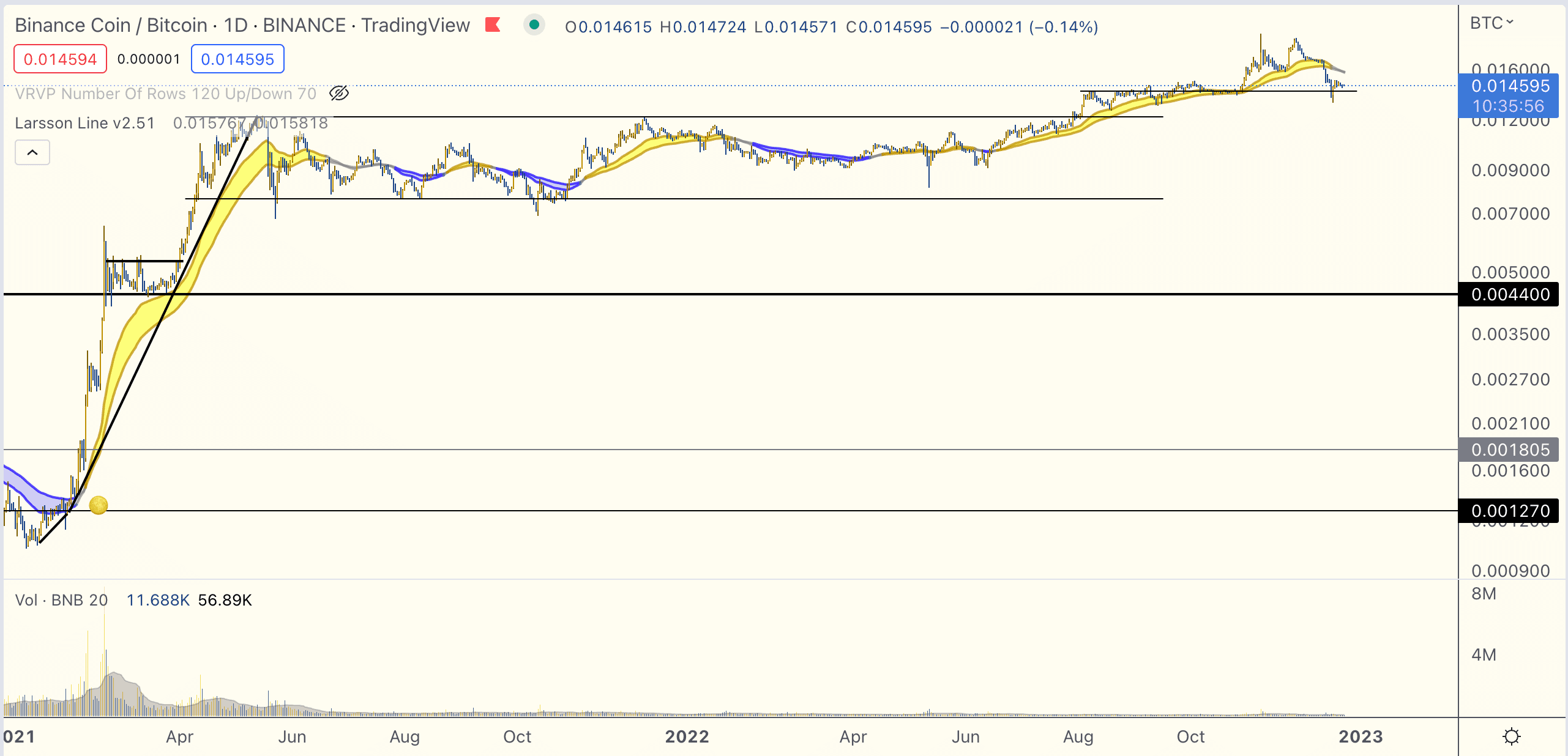

Binance (BNB)

Still holding major supports.

Bitcoin

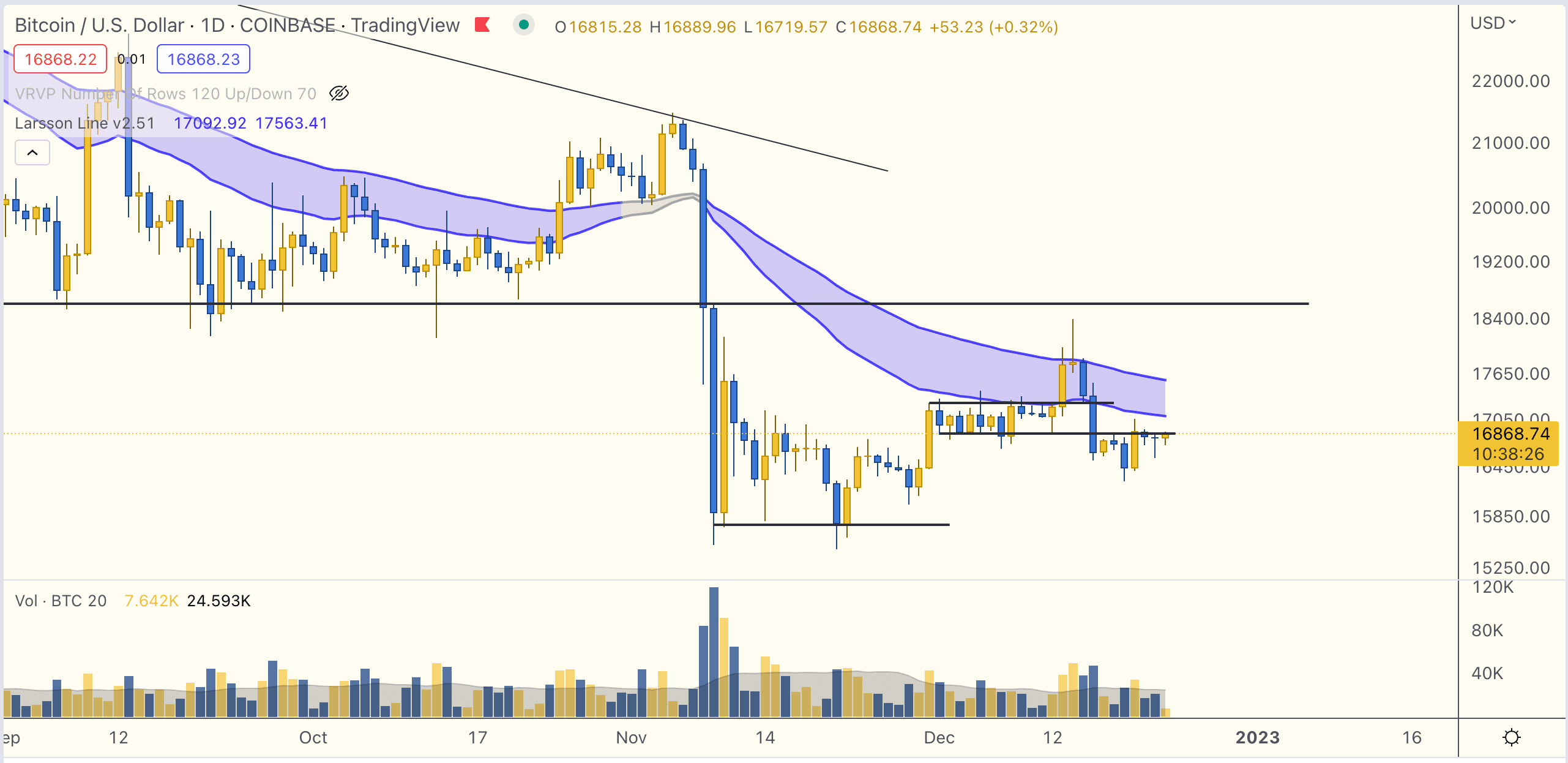

(BTC) Bitcoin remains in downtrend

Price is unchanged from last week. The trend remains down. Previous support has turned into resistance.

There is little point in looking at anything else except Bitcoin right now. Altcoins are just a leveraged bet on the next direction of Bitcoin at this point of the market. I want to see a clear resolution of the BTC/USD chart first before looking further at alts. Perhaps with one exception given the current FUD wave. We’ll come to that.

Short term price movements are often less reliable, but the support from the first week of December has turned into resistance this week. Not a great look after the huge rejection from the major $18,600 support with the trend down (Larsson Line solid blue).

The only light in the tunnel for Bitcoin bulls is that DXY has not made any meaningful recovery and made no bottom pattern. Should it continue down despite the gloomy macro narrative, that probably sets speculative assets up for a recovery. For that reason, I wouldn’t dare to short BTC here.

With Larsson Line solid down for Bitcoin, I’m happy to stay almost completely on the sidelines.

Bitcoin

Dominance

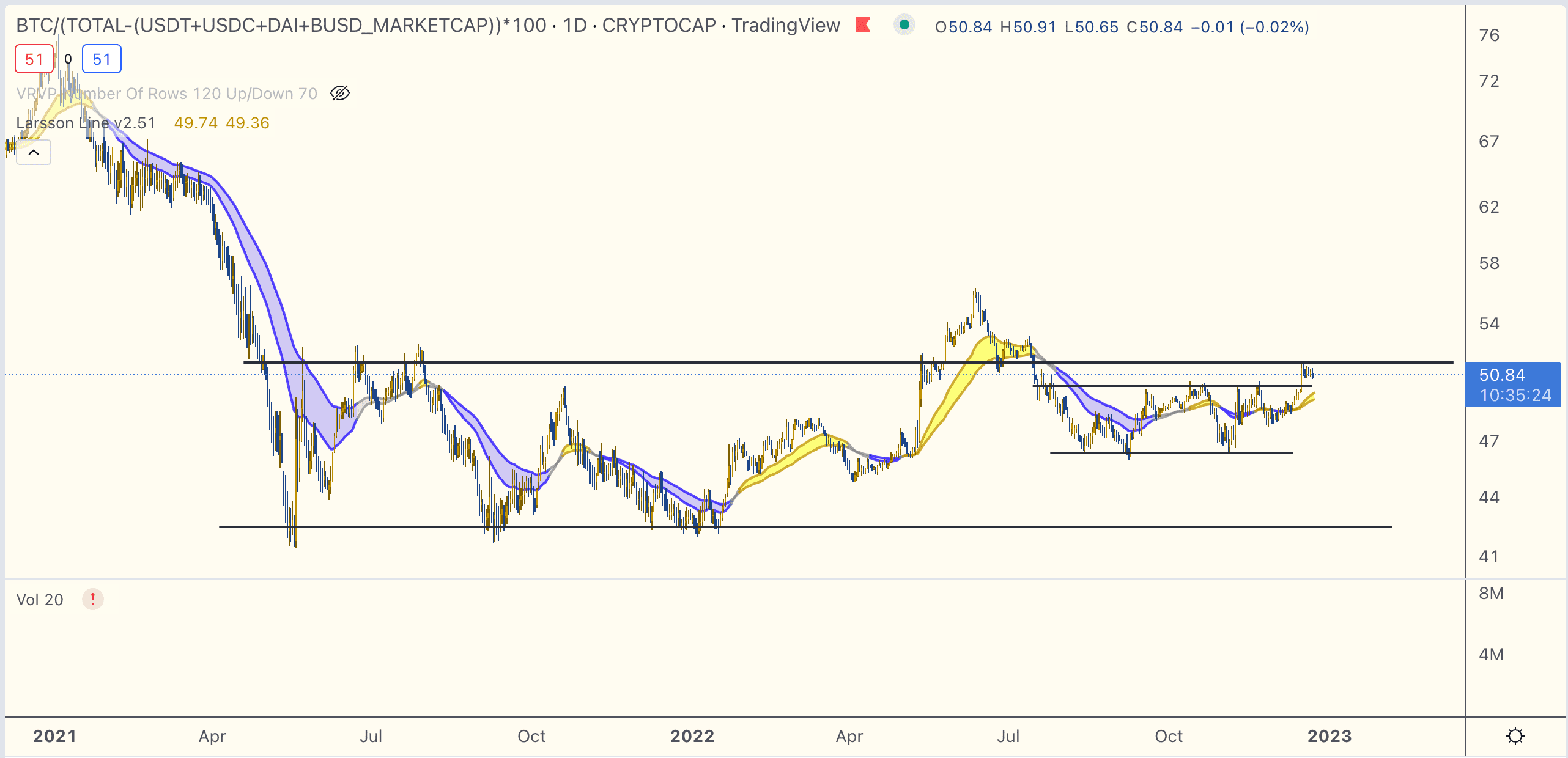

Bitcoin dominance excluding stablecoins broke out of its mini-range, indicating that investors are wary of alts and runs to safety in the form of BTC. This ratio is now hitting up against the major resistance area.

I wrote last week to be careful with any alt exposure and should this resistance break up too, even more so.

Binance

(BNB)

As you might recall from previous videos, the CEL chart, the LUNA chart and the FTT chart told the truth, even when the fundamentals and public appearances were very hard to see through. Now we’re in Binance FUD season. So what is it this time, just FUD or something real?

Fundamentals first. I’ve tried to read anything and I can’t see any signs of any actual issue. But then again, that was pretty hard to uncover with the previous companies despite them missing billions of dollars. So let’s assume that whatever the real situation is, we won’t know.

But if there is an issue, perhaps we can guess what they would do. The logical thing for the company Binance, as well as the inner-most circle of people, would be to free up some money right? And how would you do that? By selling some of probably their biggest asset, BNB tokens I suppose, in the billions of dollars (compare CEL, LUNA and FTT). And they would have to do that BEFORE disclosing any signs of real trouble, or they can never get the liquidity.

Now note that this detective methodology isn’t fool proof, because there could be another way they could free up money: They could aggressively defend the BNB price level and then take loans against that asset. You probably remember how Caroline publicly tried to defend the $22 support on FTT.

But still. Judging from the previous 3 examples we have at hand, it seems generally harder to hide the truth in the chart than on social media.

So are they selling huge quantities of BNB?

Let’s check.

If there’s been any major sell-offs in BNB, I just don’t see it. If anything, it’s held really stable since June . Sure there’s been a drop through November and December but the drop is comparably small given the FUD (which for sure is causing retail to sell) and support levels are holding on both charts.

But should these levels start breaking and price plummets on high volume, better watch out folks!

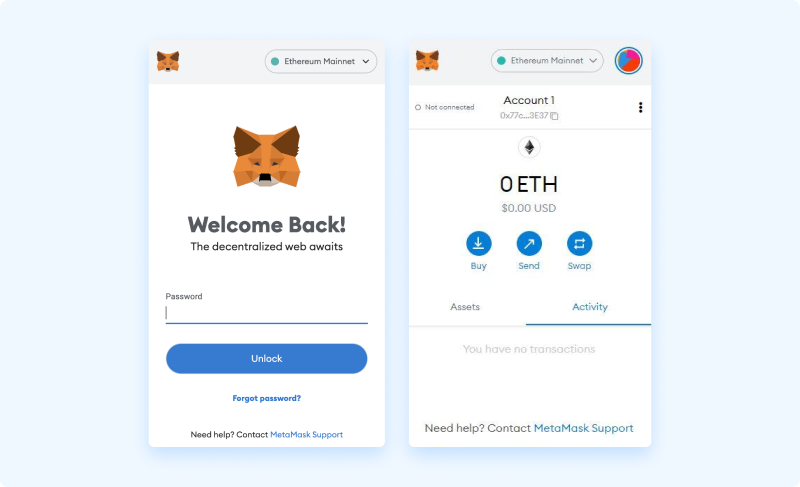

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

Bitcoin dominance remains range bound, as drawn below.

A range can break out in either direction and it’s usually a mistake to try to guess in which direction, before it has actually happened.

At one point it will, and that will be my clue for how to position myself between BTC and alts for the next major move of the markets.

The chart is here shown with 3 day candles.

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Exploring Celo and Shibarium L2

Introduction

The initial goal of bitcoin was to provide a complete peer-to-peer electronic payment system and to serve as an alternative to the current monetary system. Due to the low transaction volume and execution speed of the bitcoin network, it has proven non-practical to be used as money. Projects like the Celo protocol are building a solution to solve the shortfalls of bitcoin as a payment means and enable the mass adoption of cryptocurrencies. The Celo protocol plans to achieve this goal through its address-based encryption scheme and stability mechanism for different currencies.

What is Celo?

Celo is a mobile-first blockchain platform. Powered by the CELO token as the protocol’s native asset, the platform seeks to provide a global payment infrastructure. The open-source platform allows anybody to build borderless, censorship-resistant applications using the DappKit development suite. Celo provides an efficient light client and full node incentives that enable scaling to up to six billion smartphones. Plus, with full EVM (Ethereum Virtual Machine) compatibility, Celo makes it quick and simple for anyone to build decentralized applications (dApps) such as Valora, the native Celo wallet.

The Celo crypto ecosystem comprises a “growing family of native stablecoins”, that are price-pegged to the value of fiat currencies. This includes the Celo Dollar (cUSD), which is price-pegged to $1 per token. Also, the Celo Dollar is used across the Celo ecosystem to pay for transaction fees. With Celo, users can send funds easily to any mobile phone number thanks to Celo’s Plumo protocol. This provides a range of borderless fiat gateways that make cross-border payments and currency conversions frictionless. Moreover, the Celo protocol includes mechanisms to facilitate “lightweight identity and ultralight mobile clients” that make the Celo blockchain the perfect mobile-friendly platform for both developers and users alike. Deutsche Telekom AG, the largest telecommunications company in Europe by revenue, backs Celo. Deutsche Telekom AG has become a validator and major participant in the Celo Proof-of-Stake (PoS) network following partnerships with Chainlink and Flow.

The Celo Foundation

The Celo Foundation aims to create an ecosystem that enables everyone to prosper financially. The Celo Foundation supports the growth and development of the Celo open-source platform regardless of geography or local economic stability. Celo Foundation is a non-profit organization based in the US and guided by the Celo community. Also, the Celo Foundation promotes financial inclusion through education around technology and finance. This includes technical research, environmental health, and community engagement. All of which contribute to a stable, sustainable, and equitable financial ecosystem. Celo Foundation also provides a stable platform and a range of financial products for those in need around the world. To end global poverty, the Celo Foundation uses blockchain technology to address issues such as lack of access to sound money and basic financial services.

The Celo Token Family

The Celo crypto ecosystem uses a multi-token model to enable various blockchain-based services and applications. Each token serves a specific purpose and plays an important role within the Celo ecosystem.

cUSD & cEUR

cUSD & cEUR are stablecoins named after the currencies they follow – the US Dollar and the Euro. Celo Dollars (cUSD) and Celo Euro (cEUR) enable fast, cost-efficient value transfers from any mobile device, anywhere in the world.

The CELO Token

The native Celo token (CELO) is a utility asset primarily used for governance across the Celo ecosystem. This allows CELO token holders to have a say in the project’s future direction. By voting on proposals, CELO token holders can have a say on which new assets are introduced to the Celo Reserve. Furthermore, CELO is used as a unit of account for payments via the Valora wallet and other decentralized applications (dApps) built on the Celo blockchain.

Just like the token price of most cryptocurrencies, CELO price has been shattered during this bear market. CELO has dropped by over 94% from its all-time high of $9.82 and is currently trading around $0.50 at a $240M market cap.

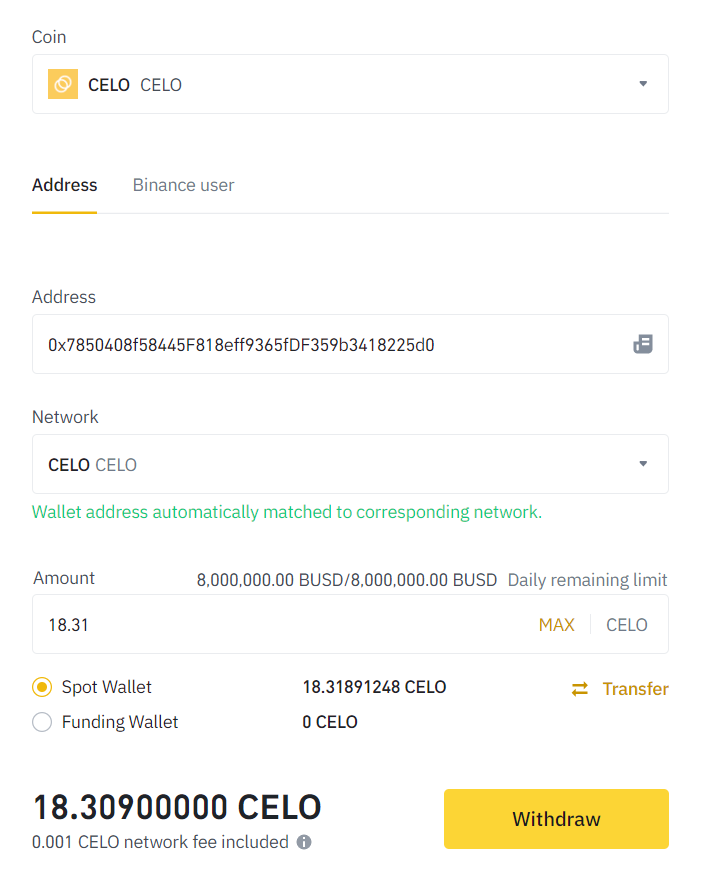

How to Stake Celo and earn Staking Rewards

Following a successful token launch event via CoinList, users can now earn cGLD staking rewards through it. Users can earn a passive income with crypto by locking up funds for a specified period by earning CELO staking rewards. Furthermore, Celo rewards are paid out monthly!

Testing: How to stake CELO in the Celo wallet

Step 1: Create a Celo wallet. The first step is to create a Celo wallet by visiting the website here

Step 2: Fund our Celo Wallet. Once we have created a wallet and backed up our seed phrases, we will deposit some CELO tokens into our wallet. In this case, we withdrew some tokens from our Binance wallet.

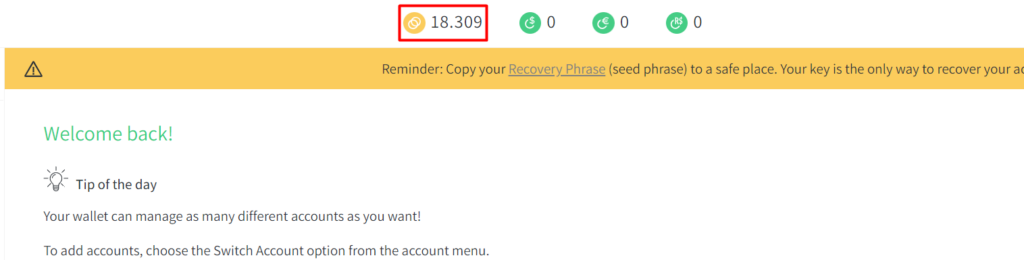

We can now see the CELO tokens in our wallet as below.

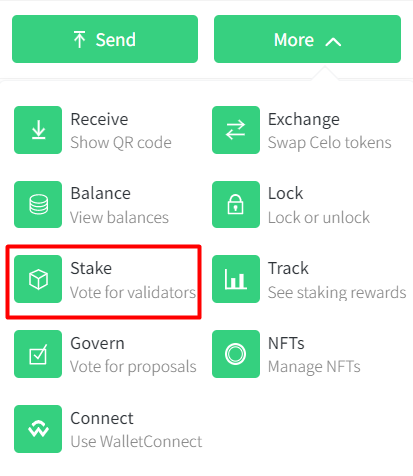

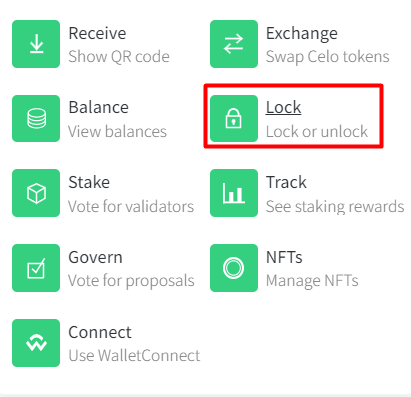

Step 3: Stake CELO tokens. The next step is to stake our CELO tokens. We do this by clicking on the “more” tab at the top left of the screen and then clicking on “Stake”

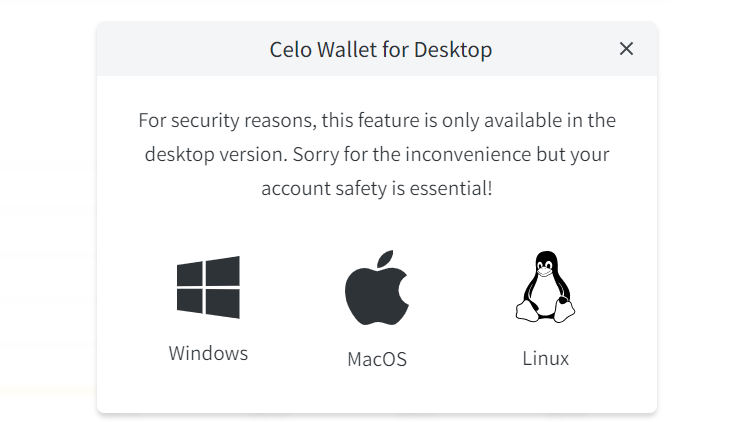

Step 4: Download the Desktop wallet. Once we click on “Stake” we’ll be prompted to download the Celo desktop wallet.

We choose the version for our operating system and download it. Once the download is complete, we need to install the wallet on our computer and stake our CELO tokens.

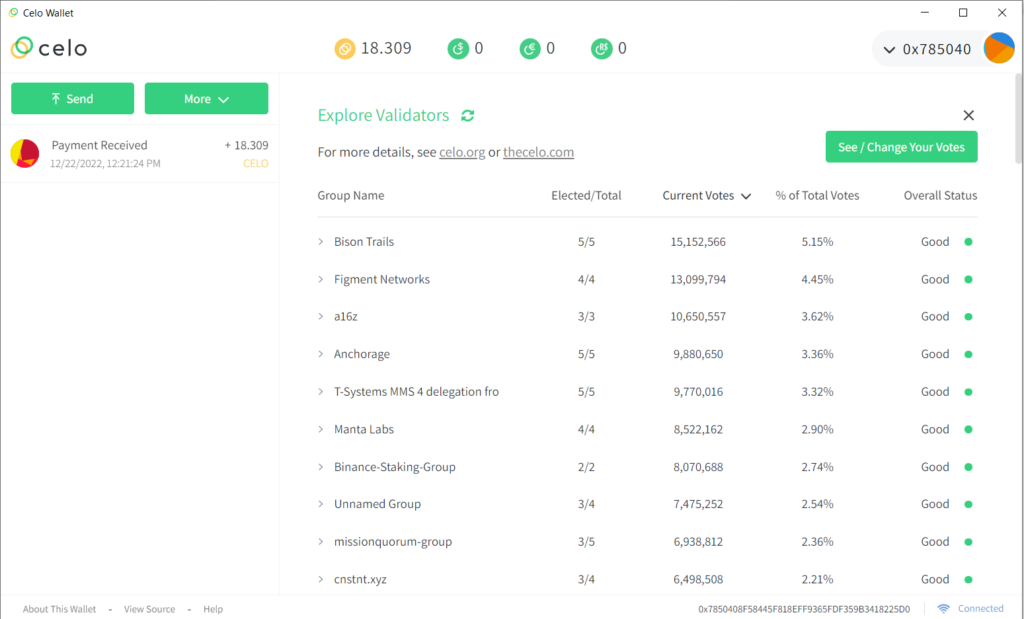

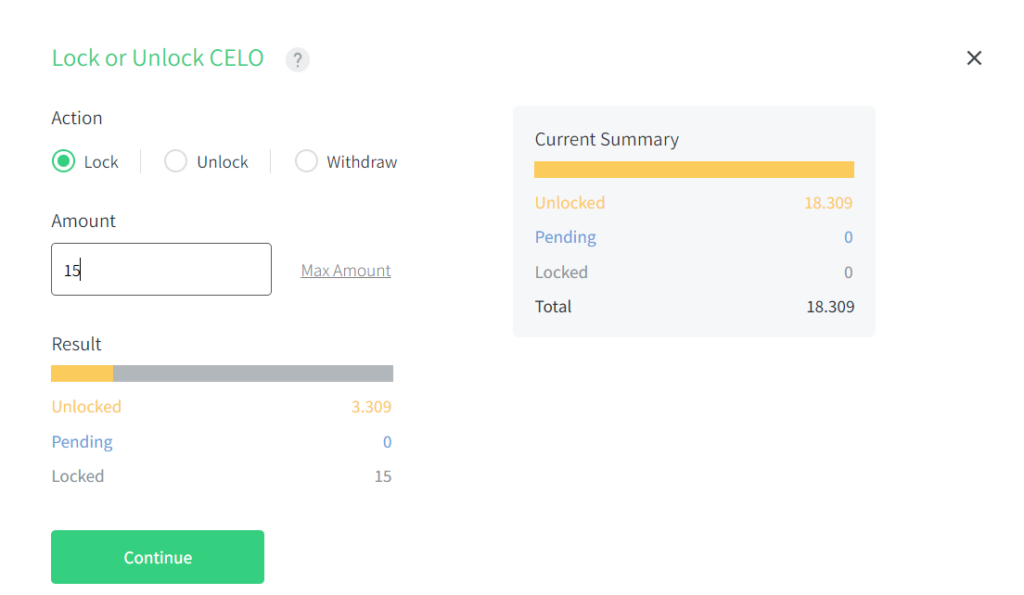

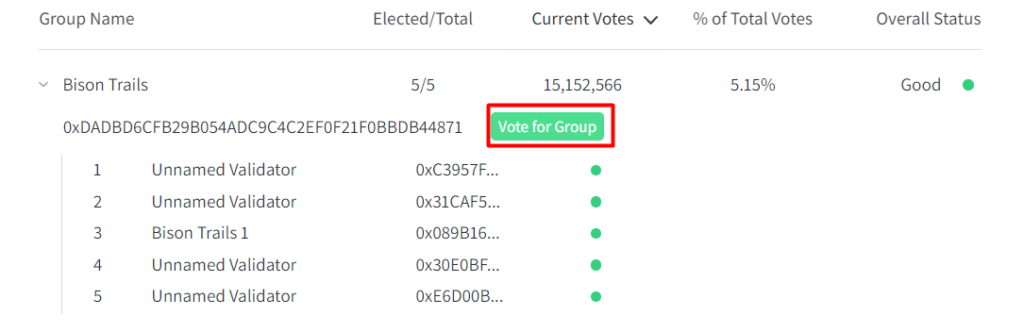

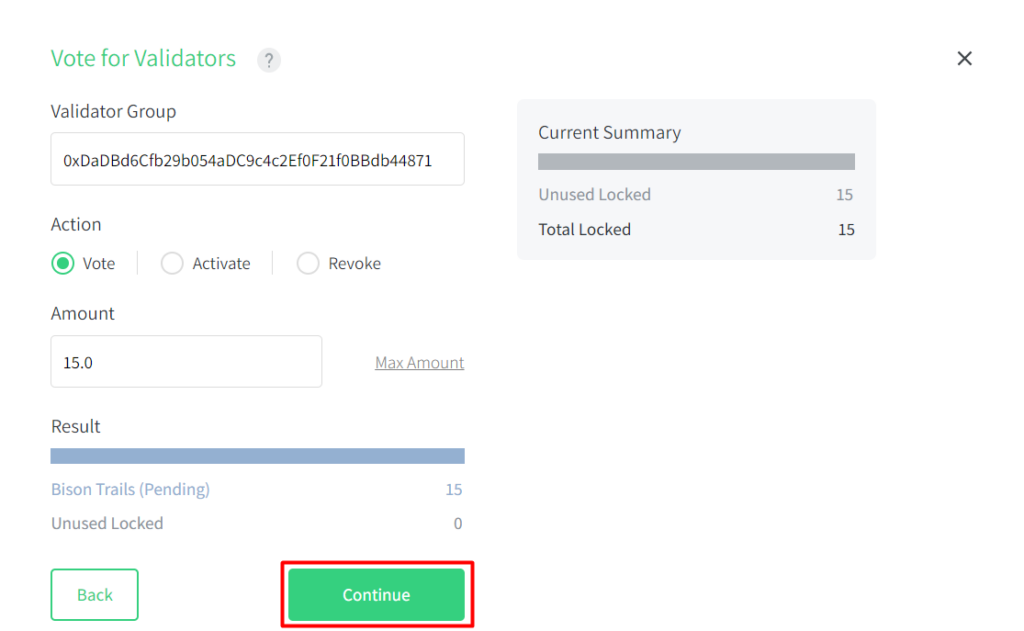

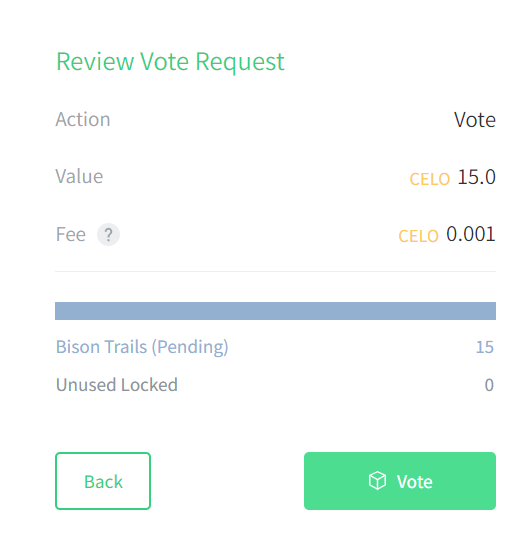

Step 5: Choose and Vote for a Validator. We must choose a validator to whom we will delegate our CELO tokens.

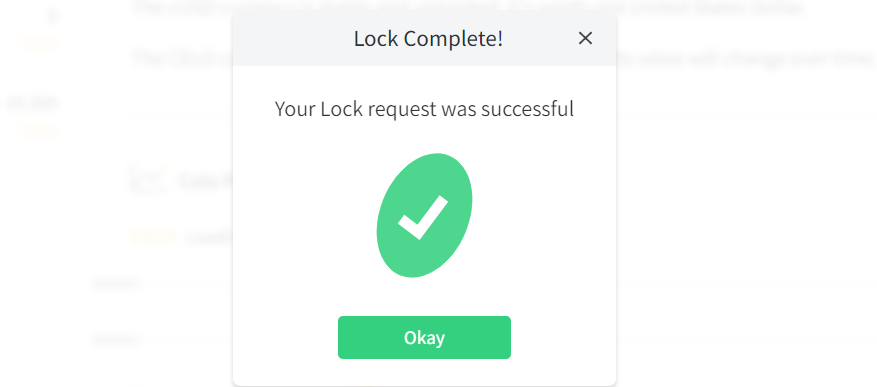

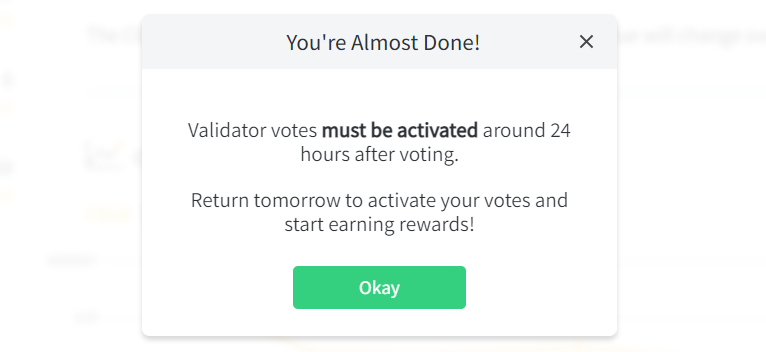

Before we delegate our tokens, we need to Lock them and vote for our choice’s validator, and then come back after 24 hours to start earning rewards.

We then need to vote for a validator group among the list. In this case, we chose “Bison Trails” to vote for.

Step 6: Activate after 24 hours. After voting on our validator, we need to return after 24 hours to activate our stake and earn CELO rewards.

The Celo Mento Reserve

The Mento protocol provides a platform upon which the community can create stabilized value digital assets. These digital assets aim to track the value of an existing real-world asset (for example, the first one, cUSD, is designed to track the US Dollar).

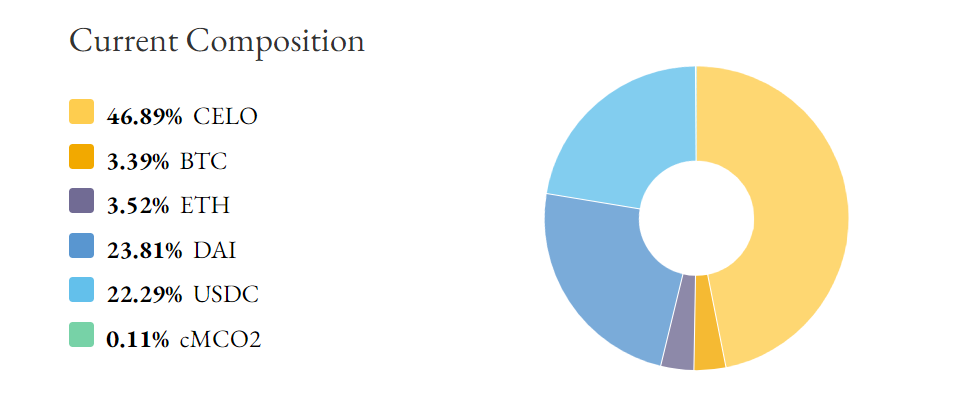

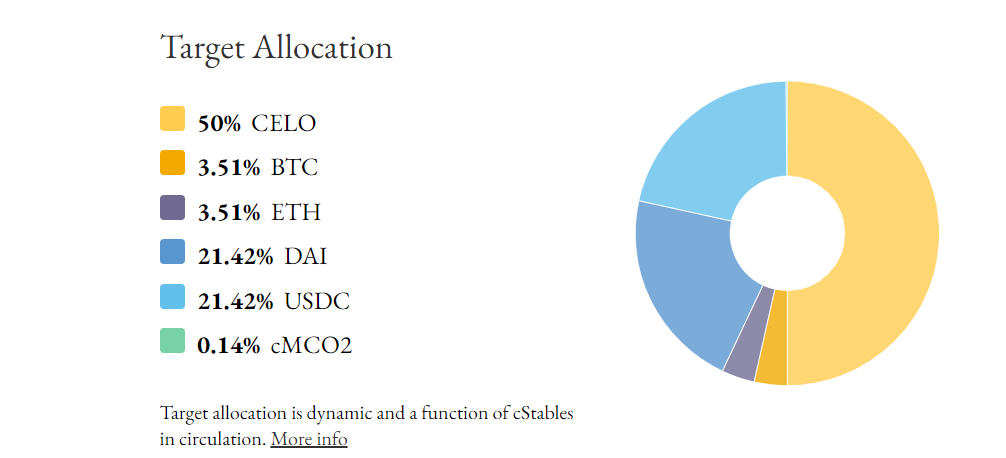

The selection process for reserve assets is achieved through protocol governance. CELO token holders can vote on assets they deem suitable to be included in the reserve. Newly added assets must be freely traded on open markets and be based on an open-source protocol. Assets native to the Celo blockchain are preferable for the Celo reserve. This means that rebalancing to governable target weights can be achieved transparently on-chain in a decentralized manner. At the time of writing, Celo has a total reserve of $141M. The composition of the Celo Stability Mechanism is:

- 46.89% CELO

- 3.39% BTC

- 3.52% ETH

- 23.81% DAI

- 22.29% USDC

- 0.11% cMCO2

With the use of high-quality tokenized voluntary carbon credit assets, the Celo Reserve can diversify several risk factors to encourage stability. This also helps by promoting awareness of the broader Celo ecosystem. Furthermore, on-chain rebalancing is highly cost-efficient and lends itself to high levels of decentralization and transparency.

The Mento Stability Mechanism

Mento allows for multiple stable-value assets where each asset tracks a measurable value, such as the Dollar, Euro, basket of goods in Greece, the price of a barrel of oil, and more. The protocol is designed to maintain a stable value for each of these assets by adjusting its supply to match demand. The reserve is a mechanism by which the protocol can contract supply. The Mechanism is made according to the initial reserve target.

Initial Reserve Target

The initial reserve target follows reserved allocations over time, based on the governance of the Celo protocol. The amount of CELO initially allocated to the reserve can be diversified into other crypto assets. Because of market fluctuations and volatility, this target is not expected to be met immediately. Rather, reserve rebalances occur every two weeks and are fully transparent and auditable on-chain. Also, some of the assets used in reserve are subject to a multi-year lock-up.

Celo Custodians

CELO is held in the Reserve smart contract. The Mento Reserve ensures that non-CELO reserve assets are held safely through the use of approved, qualified and licensed custodians in a country that is not blacklisted by the Financial Action Task Force or subject to sanctions prohibitions. Any assets Celo Reserve custodians hold must be made publicly available to ensure full transparency throughout the ecosystem.

Celo’s Plumo Protocol

One of the many obstacles to the mass adoption of crypto is the shortage of simple public key infrastructures. Users must know the recipient’s public key to make payments using existing infrastructures outside of centralized exchanges. Likewise, to receive a payment, users must first establish a private/public key-pair that can be broadcast to the network. Celo aims to solve this problem by enabling crypto payments that can be sent directly via an email address or mobile telephone number. This enables users to send and receive crypto payments without needing a wallet. Using identity-based encryption through the Plumo protocol, Celo has created a payment solution that is incredibly easy to use. Indeed, even those without previous experience can send and receive crypto payments simply, and securely. Furthermore, by removing the need for a private/public key-notpair, Celo enables a seamless user experience that doesn’t require a third-party private key generator. This is particularly useful in permissionless systems.

Building on Celo

The technology behind Celo was created to empower people by giving them access to advanced blockchain-based financial services. With Celo, anybody with a smartphone can easily send money to a phone number or purchase goods. Celo provides developers with access to a platform with Ethereum Virtual Machine (EVM) compatibility, along with native stable value assets and a lightweight protocol. This has enabled developers to build diverse blockchain-based applications using the Celo SDK (software development kit).

Celo SDK

The mobile-first Celo SDK (software development kit) is a suite of tools that enables builders of decentralized applications (dApps) to create innovative and powerful mobile apps, such as the Valora mobile wallet. As an open-source protocol, anyone can contribute to the development of Celo. Developers building with the Celo SDK can use cUSD and ERC-20 tokens to create mobile apps with a low barrier to entry. Furthermore, these apps benefit from the security of the Celo blockchain. Moreover, when building on Celo, gas can be paid in several different currencies!

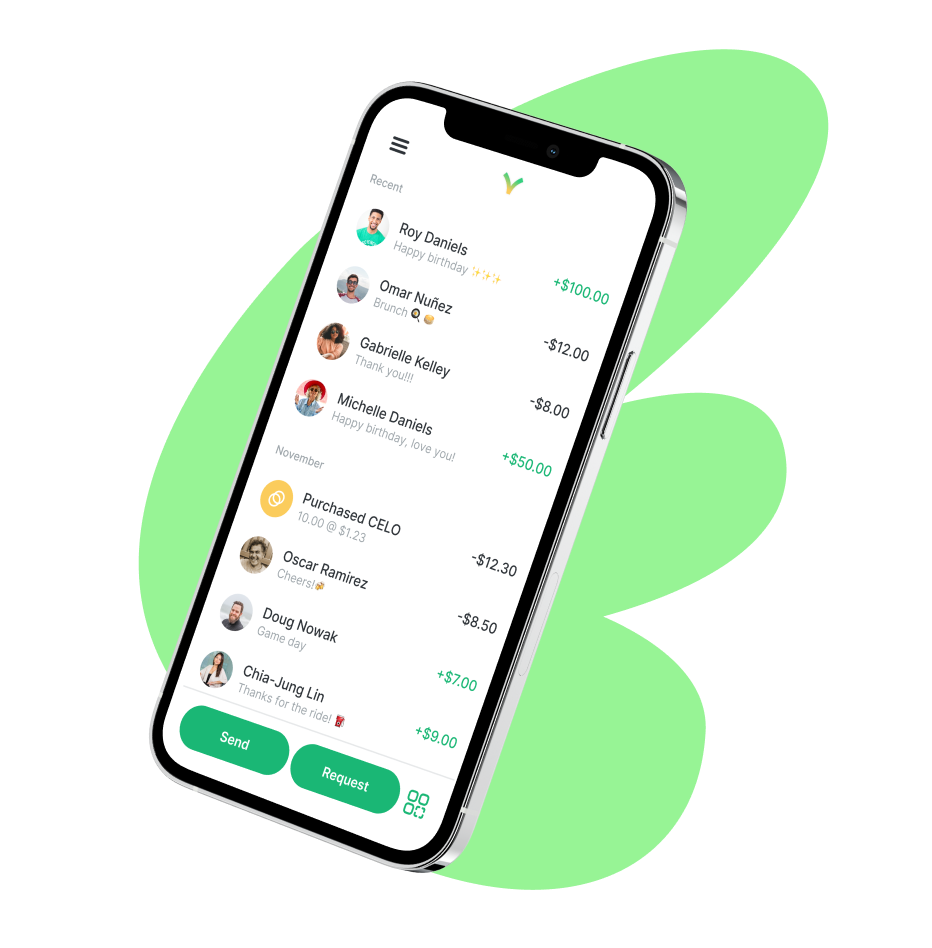

Valora – the Native Celo Wallet

Built using the Celo SDK, Valora is the native Celo wallet that enables users to send funds just like a text message. With the non-custodial Valora wallet, users can transfer assets from anywhere in the world using a mobile phone. Furthermore, transactions made using the Valora app incur a one-time, low-cost fee without intermediaries. The Valora wallet is currently available in over 100 countries.

Fees can be paid using cUSD and ERC-20 tokens. Plus, transactions made using the Valora Celo wallet have no extra service charges. Moreover, because Valora is built on the Celo blockchain, cross-border payments and remittances are cheap and secure.

Watchlist: Exploring Shibarium - Shiba Inu’s L2 Blockchain

After launching successfully and establishing huge and loyal support in the form of ShibArmy, SHIB’s founder, Ryoshi, is focused on stretching its value beyond just a meme token. Often labeled the “Dogecoin killer,” SHIB is the utility token of Shibaswap, a decentralized exchange (DEX) built on the Ethereum network. In 2021, Ryoshi publicized Shiba’s lineup for the Shibarium blockchain, including integrating a new Shiba stablecoin, SHI.

Shibarium is an L2 scaling solution designed to optimize the Ethereum blockchain. Shibarium seeks to offer minimal gas fees, high transaction throughput, metaverse and gaming, dapp accelerator, and token utility for SHIB.

For Shibarium to achieve its objectives, it will involve five utility tokens, SHIB, BONE, LEASH, TREAT, and SHI. Investing in each offers investors different ways to increase their returns. Investors can leverage Shibaswap, the ecosystem’s native DEX, to swap tokens, participate in governance, generate passive income and buy NFTs.

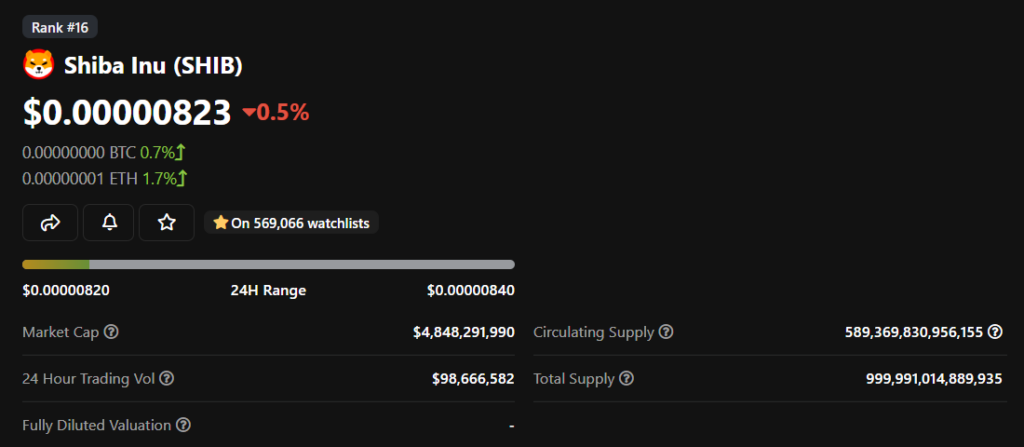

SHIB

While BONE is Shibarium’s preferred utility token, SHIB stands tall as the native token of the Shiba Inu ecosystem. Unlike most other digital currencies, SHIB’s high supply enables investors to own trillions of tokens. It has a total supply of 1 quadrillion and a circulating supply of 589 trillion.

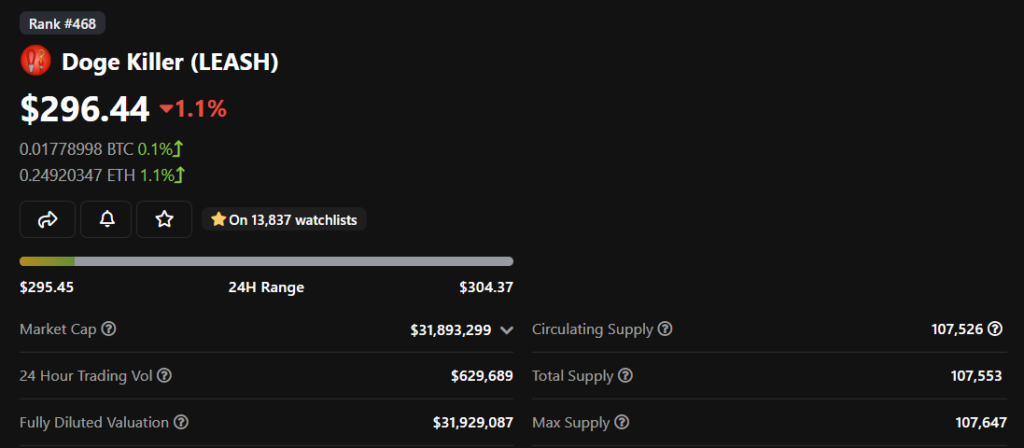

Doge Killer (LEASH)

Ryoshi, the anonymous SHIB creator, is the creator of LEASH. He introduced it as a rebase token – a crypto with a flexible supply, which could regulate its price through demand. Rebase token holders sometimes experience changes in the number of coins in their wallets, but their total value remains constant.

LEASH has a maximum supply of 107,647 tokens, which is relatively low compared to SHIB’s supply, which runs to quadrillions. These low numbers, coupled with the increase in interest, are likely why LEASH has a high price of about $296 as of December 22, 2022.

When you stake or bury the LEASH tokens, you are rewarded with xLEASH tokens. By holding xLEASH, you qualify to join the xLEASH liquidity pool, where you receive 0.5% of all BONE per block. Besides, when digging or offering liquidity with LEASH tokens, you receive a portion of the LEASH-ETH SSLP.

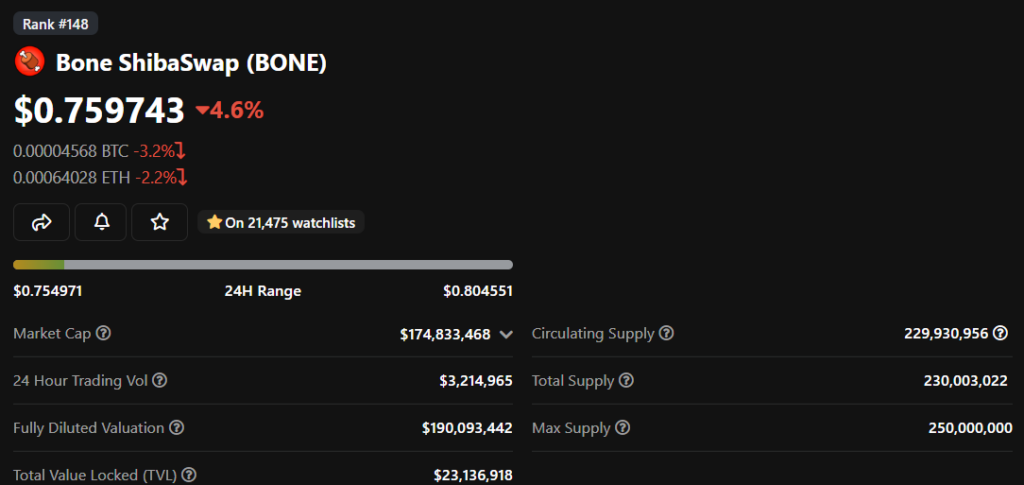

BONE

BONE acts as ShibaSwap’s governance token, implying holders can participate in shaping the future of the Shiba Inu ecosystem. Besides, developers are paid in BONE tokens. It has a maximum supply of 250 million and a circulating supply of almost 230 million. When you bury BONE tokens, you get tBONE, which gives you access to a liquidity pool that offers 1% rewards of all the BONE per block. Besides, when you dig into providing liquidity with BONE tokens, you receive a portion of BONE-ETH SSLP.

On December 30, 2021, Shiba Inu developers confirmed that Shibarium users would pay gas in BONE tokens. So, what makes BONE the best choice? Well, there are several reasons. First, BONE’s maximum cap is high enough to let Shibarium users buy adequate amounts while supporting liquidity but low enough to prevent it from requiring intense price management.

SHI

SHI is an upcoming stablecoin that will run on Ethereum and Shibarium. It aims to become a universal store of value, unit of account, and exchange medium. Almost all stablecoins are pegged to $1. However, SHI will be pegged to $0.01 to ensure it is easily accessible to all classes of people worldwide, with the plan to enable goods and services payments globally.

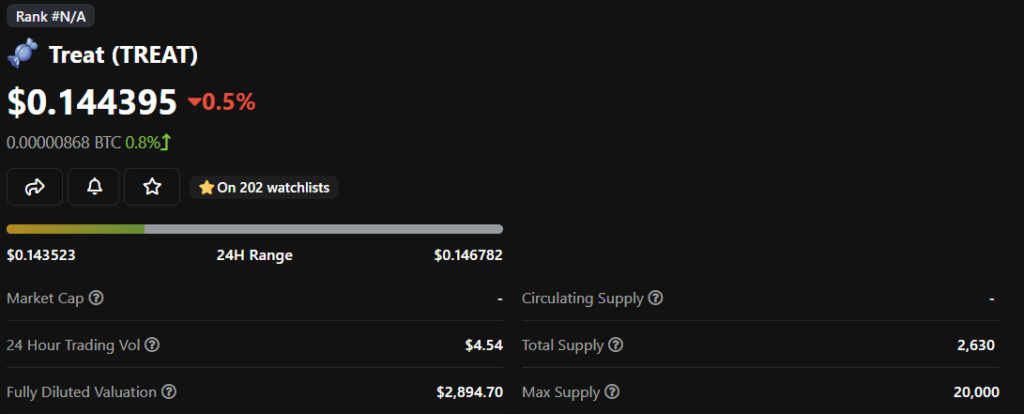

THREAT

As the term suggests, TREAT is a reward asset for Shiba Inu investors. The token obtains the rewards from the Shiba Inu metaverse and Collectible Card Game. Additionally, TREAT is meant to bring balance to the SHI stablecoin. A number of TREAT tokens are allocated to the most loyal ecosystem supporters – individuals who help cultivate the ecosystem’s confidence. It has a maximum supply of 20,000 and a total supply of 2,630 tokens.

Shiba Eternity

Shiba Eternity is a play-to-earn (P2E) mobile card game with a Shiba Inu theme. It was created in partnership with PlaySide Studios. Its mechanics requires two participants to play against each other. Each participant aims to defeat their opponents by taking all points from them. You can utilize spells, cards, and other tools to defeat your opponent and earn rewards.

It’s also important to note that the game is free to download and play. All new participants receive starter decks. In the first phase, you will meet Ryoshi, a Shiboshi who will help you maneuver through the game. Thanks to tutorial-based guides, newbies can quickly learn the game’s mechanics.

Shibaswap DEX

Shibaswap is a native DEX for the Shiba Inu ecosystem. It brings a Uniswap-like experience to the ecosystem – facilitating non-custodial crypto swaps and liquidity provision. Besides, it offers extra features like staking, governance, and a Shiboshi social club – a community for Shiboshi NFT owners. To use Shibaswap, you connect your web3 wallet and start using your favorite feature.

There are currently four ways of generating passive income in ShibaSwap DEX:

Dig: Users who deposit SHIB tokens in the Dig poll earn free BONE tokens. The amount you earn is based on the number of tokens you have deposited in the pool.

Woof: This yield farm pool lets you swap your BONE rewards with SSLP tokens. 33% of the rewards are immediately available for use, but the rest are locked for six months.

Bury: To generate interest, you can stake your SHIB, LEASH, or BONE tokens in the Bury tool. The interest is paid in the form of xSHIB, xLEASH, or tBONE, based on the asset you stake. You can withdraw 33% of the returns weekly and the rest after six months.

Burn Portal: This Shibaswap feature rewards users for burning SHIB tokens. The feature lets you deposit SHIB tokens to a dead wallet and rewards you with Ryoshi tokens.

Appendix

Helpful Beginner Resources

Where is there more information about included projects?

Finding a more specific project, token, or coin is straightforward. Relevant source material for all data is cited. Follow the links to investigate on your own!

Finding a more specific project, token, or coin is straightforward. Relevant source material for all data is cited. Follow the links to investigate on your own!

What makes something decentralized?

Decentralization is an ideal more than a state of being. It contains characteristics including self custodianship, trust minimization, public accessibility, permission minimization, and auditability. Decentralization acts on a spectrum of the highest level of decentralization to the absence of some.

How do smart contracts work in practice?

Smart contracts are automated processes on a decentralized network. Also, any user can interact with these contracts. When submitting a transaction to the contract, it is final. That means every Uniswap swap, NFT purchase, token transfer, and collateral deposit can not be reversed. Tread with caution; this is a powerful technology.

People Also Read

The facts behind FTX case, on and off-chain. Join us on this historical account of SBF and the latest black

Exploring the impact of Account Abstraction by uncovering key innovations, protocols, and Ethereum Improvement Proposals (EIPs), bringing AA to production.