While this week was dramatic, nothing has changed: We are still in the same range and Larsson Line is still

Issue 9

November 25, 2022

Moralis Powered Dapps Part 3

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. There are still questions on whether the contagion has finished or whether there are still some dominoes left to fall. This week it’s Genesis, Grayscale and their parent company Digital Currency Group in the spotlight with a complicated web of financial management/mismanagement.

The instability and losses can again be traced back to the downfall of 3AC following the collapse of Luna and the algorithmic stablecoin UST. Genesis had lent money to the now bankrupt 3AC.

There are also intercompany loans between Genesis and DCG. Then it appears when 3AC collapsed DCG took on Genesis’ other liabilities to shore it up. Then to top it off the FTX group collapsed and it emerged Genesis had lent them $175M.

Genesis is now seeking $1B of external capital to be able to continue its operations. DCG isn’t willing or able to bail out Genesis again and they appear ready to sacrifice the subsidiary. The web of subsidiary companies isn’t as complex as seen in the FTX Group and the surface concern is whether Genesis will be able to continue. But naturally everything else in the group is now also being questioned.

For example Grayscale has so far publicly refused to disclose their on-chain holdings and prove the GBTC trust is fully backed. Ergo, another blockchain project, have attempted their own on-chain analysis though and think they can confirm the rough 633k BTC is held at Coinbase Custody which appears to be good news.

Last year the Grayscale GBTC trust had been trading at a premium to the spot price of BTC and 3AC were known to be arbitraging the differential. They’d been borrowing against their holdings and then repeating the cycle meaning the demand was somewhat artificial.

This year the GBTC price has collapsed, likely because capital has dried up and there are no large entities arbitraging the differential anymore. ‘Equivalent’ shares of the trust can now be bought for a 40% discount to the spot price of BTC. Recently DCG has more than doubled its GBTC holdings but speculation arises whether they used the money they borrowed from Genesis to do so.

If the SEC ever approves the Grayscale Trust as an Exchange Traded Fund, then shareholders will be able to convert their trust shares into ETF Bitcoin. But there still aren’t any spot BTC ETF’s approved in the US and they’re getting refused on the basis of a potentially manipulated market. Unfortunately the revelations of the last few months aren’t going to make the approval of an ETF any more likely. So whilst Grayscale is still a very profitable business with 2% fees collected each year, if DCG has liabilities way more than their assets or an inability to raise further capital they may be forced to consider selling or unwinding Grayscale.

The unwinding of Grayscale would be the doomsday scenario and mean selling billions of dollars of BTC and ETH thus impacting the market even further. It’s not happening yet, but as the last few months have shown things can change quickly.

Keep an eye on what’s unfolding and the tremendous amount of lessons on financial management/mismanagement which can be learnt. Whoever sticks around through all of this (FUD hopefully), will be putting themselves in a better position to be winners of the next cycle.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

Nov 24th, 2022 16:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds.

Disclosure: I hold Bitcoin and Ethereum exposure, both through company ownership and in my personal capacity, as ETP price tracker certificates in ISK through my bank.

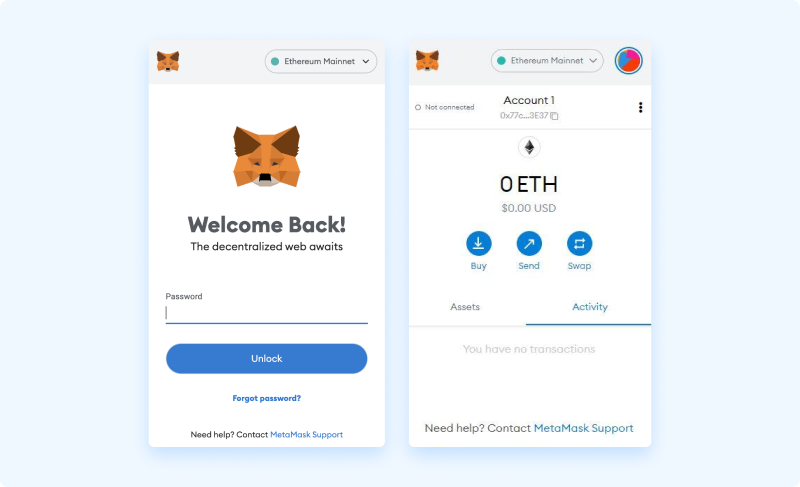

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet, or mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Now that we have a good understanding of the purpose and security practices surrounding seed phrases. Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed:

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Moralis Powered Dapps Part 3

Introduction

The Moralis x Google Defi Hackathon has come to an end. The hackathon was organized by Moralis and Google Cloud in collaboration with sponsors including Polygon, BNB chain, Fantom, Axelar, Multichain, and Covalent. More than 1500 participants competed for a total prize pool of $165,000 to build the next big Defi application. Each team was required to build an application using Moralis and at least one other sponsor. There were three tracks available to participants;

- Polygon Track

- BNB Tack

- Fantom Track

There were additional requirements specific to each track, such as building and deploying a Dapp on that chain.

Furthermore, participants could win extra bounties by using Axelar, Covalent, or Multichain technologies.

A total of 115 projects were submitted to the hackathon, and we were blown away by the variety of ideas and use cases participants addressed. Following a thorough evaluation and judging process, we and our sponsors, are in the process of selecting the best hackathon projects. We will explore some of the projects that made it to the finals of our judging process in this report.

People Also Read

This Issue provides an overview of the state of Web3 gaming and the industry as a whole. We discuss the

If today’s candle closes like this, Bitcoin once again flips previous resistance into new support! Fantastic! Very positive! Again!