In the years following its inception back in 2009, Bitcoin was regarded as somewhat of a – however undeserved – poster-boy for cybercrime and illegal activity. Over the past decade, if you asked anyone in the street what they thought about Bitcoin, the small minority that had even heard of it would likely have told you that it’s either a scam, a Ponzi scheme, or only used for illegal purposes. However, this erroneous view is quickly changing.

Little would those calling Bitcoin a scam know that a decade later, the revolutionary power of the blockchain would immerse across the entire financial landscape, changing how we view money and how we transact forever. Now, Bitcoin and the wider cryptocurrency sector is much more recognized than it was just a few years ago. Moreover, the introduction of CBDCs shows cryptocurrencies are just the latest of a growing number of different types of currencies.

However, seeing how massively the cryptocurrency space has changed over the past ten years, this article looks to the future of cryptocurrency. What could happen over the coming decade – and what effects could increased crypto adoption over the coming decade have?

If you want to get some backstory on Bitcoin or crypto before diving into this article on the future of cryptocurrency, be sure to take a closer look at Ivan on Tech Academy. Ivan on Tech Academy is one of the premier blockchain education platforms out there. Check out the countless blockchain and crypto courses available!

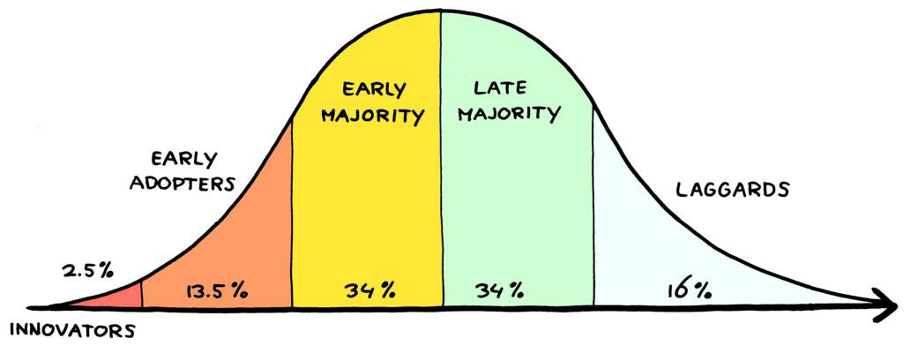

Innovators And Early Adopters

Let’s, however, first take a look at what has come before to understand the possible future of cryptocurrency. Early adopters of cryptocurrency typically came from a computer science or programming background. The first wave of Bitcoin whales were often new college graduates, or mid-term drop-outs that saw an early opportunity and went all-in.

Some of the first Bitcoin wallets were extremely difficult to use, requiring the entire Bitcoin blockchain and software to use. This took a tremendous amount of skill to navigate and many people lost funds from mistakes using early wallets. Oh how far we’ve come!

Crypto wallets are everywhere now, catering to all types of needs. Do you want full custody of your digital assets with no KYC? You got it! Want someone to look after your private keys and do all the technical stuff under-the-hood? No problem!

Early Advancements

Cryptocurrency exchanges have also come a long way in recent years. In their infancy, many prominent crypto exchanges were exposed to hacks, as this type of security was still a very new concept. In the early years, using exchanges could be daunting, to say the least, and even if you were able to navigate them effectively, the concern over losing funds was massive.

Of course, now we have super-secure cold-storage custody, KYC and AML regulations in place on most major exchanges. Coinbase openly admitted that they would be passing user data to regulators and tax officials.

From a technical perspective, one of the earliest advancements in blockchain technology was Segregated Witness, or SegWit. SegWit fixed a fundamental flaw in the structure of transactional data in the Bitcoin code and increased transaction speed by more than double, without the adjustment of block size. SegWit fixed a bug that presented a backdoor for digital signatures to be manipulated. SegWit resolved this issue by removing the digital signature from the middle of the transaction, to the end of the transaction, allowing it to be processed separately from other data.

Arguably the most groundbreaking development in blockchain technology was the introduction of smart contracts. Smart contracts allow funds to be moved from one wallet address to another when a specific set of events occur. Smart contracts are immutable and cannot be altered, and helped lay the pipework for the DeFi revolution

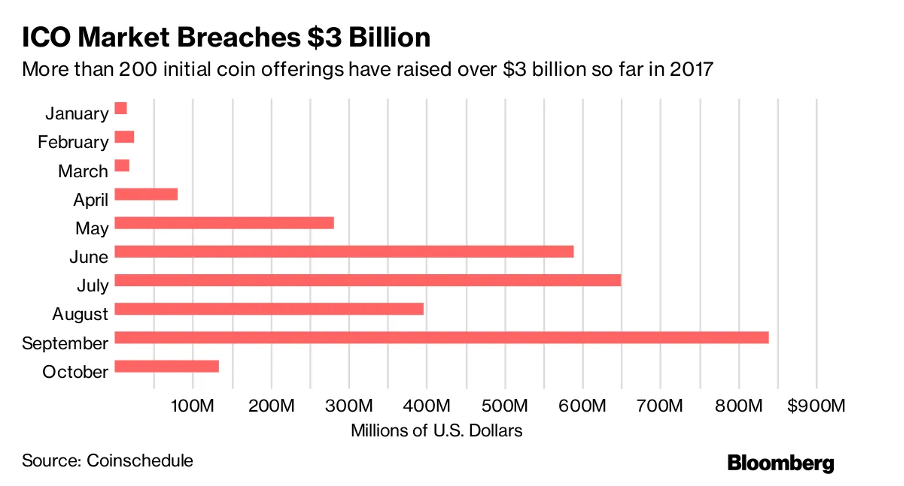

ICO Boom

The ICO boom of 2017 was crazy, really putting crypto on the map for mainstream adoption. The aftermath, though, revealed a bearish sentiment among unsuccessful and bitter traders that bought at the top and sold at the bottom.

The term ‘Bitcoin Maxi’ really came to prominence when the majority of the ICO projects that were making huge gains in 2017, fizzled away into obscurity throughout the following year or so. This brought about the notion that “all altcoins are scams”, despite many resilient projects holding tight through the bearish winter.

With such distrust around altcoins in previous years, the picture is beginning to look much different now. In 2017, many ICOs were a mere promise, with no working product. Now though, with the surge of DeFi and an ever-growing landscape for opportunity and innovation, people are building real, working products on the blockchain, and there is a demand for these products as they serve an important function across the world and are key to the future of cryptocurrency.

Scams

There have been some terrible hacks and scams in crypto throughout the years, with some of the most notable being Mt. Gox and Binance. This wreaked havoc throughout the crypto community, placing a lot of fear and distrust among users, pushing many people out of the market.

Despite this, a lot of these people seem to have returned to the scene in recent months, with crypto exchange volumes reaching record levels. Exchange hacks are still around, but the exchanges are becoming better equipped to deal with attacks, and many exchanges are preparing contingency funds in case of an attack. As such, one could hope that scams will keep becoming more rare in the coming decade.

Bear Markets

In the early days, a lot of people could lose a lot of money during bear markets. With cryptocurrency in its infancy and so many newcomers to the market, extreme volatility meant that a lot of people got rekt due to inexperience and greed.

With the increase in blockchain education and market experience, people are now viewing bear markets as a good time to accumulate. Huge market dumps were once a cause for panic, with the media going crazy every time there was a correction. Now though, people look forward to timing the market and buying the dip. People are no longer afraid of bear markets, they embrace them.

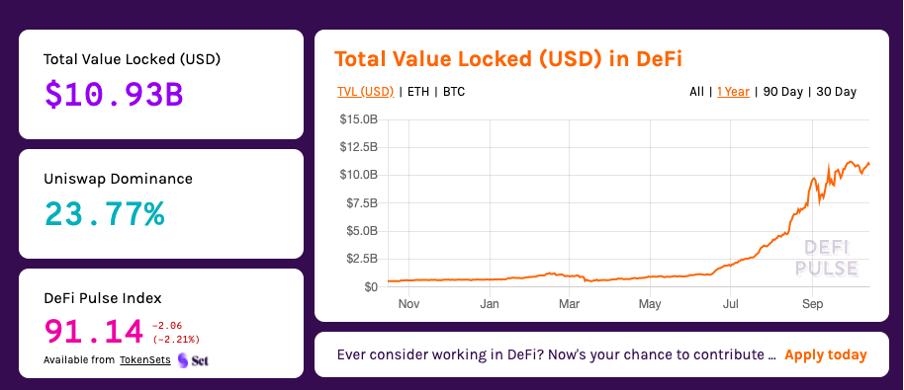

DeFi

Decentralized finance (DeFi) didn’t really exist during the last bull market, it’s only within the past 12 months we have seen the rise of hundreds of DeFi applications across various blockchains. The Ethereum blockchain is the backbone of the ecosystem hosting more than 200 DeFi projects. The Bitcoin blockchain comes in second supporting 26 DeFi services, whilst the EOS blockchain currently hosts 22.

A collective of protocols offering crypto borrowing and lending services, interest-bearing accounts, staking, and under and over-collateralized loans, together form the Decentralized Finance umbrella that is set to disrupt the legacy financial system.

These financial instruments are made possible through decentralized platforms and smart contracts that are programmed to benefit the user of the application, maintain ownership of their wealth, and put back into the project community, to maintain complete self-sustainability.

In a world where millions of people are denied banking services for a list of discriminatory reasons, access to DeFi tools are paramount to the equality and growth of struggling economies.

DeFi is hotter than it has ever been, and Ivan on Tech Academy has a large number of articles pertaining to DeFi. What’s more, the many blockchain courses available provide a world-class education regarding blockchain technology and cryptocurrencies. Best of all, right now you can get 20% off when using the promo code BLOG20!

CeDeFi

Bitcoin was made famous, in part, due to its decentralized properties. Transactions on the Bitcoin blockchain are immutable and with thousands of Bitcoin nodes across the globe, it is the most secure blockchain and the largest network of computers in the world.

Bitcoin is completely decentralized and has no single point of failure. There is a hard-cap on supply and it is practically impossible to hack the Bitcoin blockchain.

Fast forward a few years, and the DeFi boom has brought about a wave of financial services that appeal to the traditional financial sector. That being said, there’s little wonder that some crypto firms are looking to become hybrid cryptocurrency banks.

Crypto exchange Kraken recently received the go-ahead for a US banking license, with plans to go global. Kraken will offer a variety of crypto services in tandem with traditional banking tools and services.

Meanwhile, as crypto custodian Gemini expands throughout Europe, the firm has been approved for the Electronic Money Institution (EMI) license from the Financial Conduct Authority (FCA).

This type of interoperability between the centralized finance world and major crypto firms can only point towards increased awareness and adoption of cryptocurrency, normalizing digital assets for future generations.

There are also a variety of crypto-debit cards available that allow you to spend your crypto anywhere on goods and services. Find out more about crypto-debit cards here!

Integrating the usability and convenience with the innovation and potential that blockchain has to offer, the merging of centralized finance and decentralized finance (CeDeFi) is becoming increasingly popular, serving as a catalyst for the mass adoption of cryptocurrency in a huge untapped market.

Institutional Investment

At the time of writing there is almost $7 billion worth of BTC held by 13 publicly traded companies, and this list is growing every day. The exponential rise of institutional investment into Bitcoin shows that the future of cryptocurrency is deemed a safe hedge against economic uncertainty, hence why Bitcoin is often referred to as “digital gold”.

Tech giants such as Microstrategy and Square have added substantial amounts of BTC to their balance sheets, indicating a positive sentiment from investors and shareholders. Grayscale, currently the largest publicly traded crypto hedge fund, recently launched a national TV ad campaign for Bitcoin, showing that confidence in crypto is growing!

World Reserve Currency

When the idea of Bitcoin becoming the world reserve currency first came about, it was scoffed at. No way could the US dollar be knocked off the top spot, and if it were, surely the euro or the yuan could step up?

Well as it happens, the entire global economy is in trouble. All fiat currencies have historically gone towards zero. We’re now in the most uncertain economic time in an entire generation, and many countries cannot rely on their local currency as a way to preserve wealth. Countries such as Argentina, Venezuela, and Zimbabwe have all experienced extreme hyperinflation, leading many citizens to Bitcoin to preserve their purchasing power.

There is a huge rise in merchants in developing countries that are beginning to accept payment for goods and services as local currencies dwindle. When the network effect truly takes place, the adoption of cryptocurrency will be exponential.

The idea of Bitcoin as the world reserve currency no longer seems so far-fetched, as it is used daily by millions every day. With cryptographically-provable scarcity, the supply of Bitcoin cannot be manipulated. The value of Bitcoin is determined by supply and demand, not by how much debt a central bank dumps on a nation.

Socio-Economic Parity

Some are even suggesting that cryptocurrency could help to end world poverty and shrink the wealth divide. Citizens living in countries that have strict capital controls are looking to crypto as a safe way to preserve wealth and make cross-border payments. Historically, avoiding capital controls has been extremely challenging and dangerous. Now though, thanks to a landscape of decentralized financial applications that can be accessed by anyone, there are more ways than ever to secure your wealth using cryptocurrency.

There are currently 1.7 billion people globally without access to basic financial services. Two-thirds of these people, however, have access to mobile phones by which they can access the internet. This completely levels the playing field, as someone living in a rural or underdeveloped area, a place of war, or someone without proper documentation can utilize the many decentralized financial applications available on the blockchain, free from capital control or financial exclusion.

The Future of Cryptocurrency: Conclusion

When Bitcoin first came about, many people dismissed it as a joke or a gimmick. When the price of Bitcoin gained the attention of the broader public, the reputation of cryptocurrency was tarnished by naive investors losing large sums of money and scammers draining funds from an under-developed infrastructure. The ICO boom created a divide as Bitcoin maximalists looked with uncertainty at what was being created on Ethereum.

After many bearish months, a lot of education, and an array of highly functional blockchain products now being highly utilized, the future of cryptocurrency has never looked so exciting.

Cryptocurrency no longer relies on the downfall of the traditional financial system for it to thrive, rather, blockchain technology is changing how we transact and think about money, currency, and finance, informing policymakers and those in positions of power. With so many user-friendly dApps and fiat on-ramps, the future of cryptocurrency is outpacing traditional finance.

The legacy financial system tried for years to create a negative sentiment around cryptocurrency, but alas, governments, banks, hedge funds, and enterprises are all embracing the power of the blockchain.

As the banks and traditional financial institutions continue to adopt blockchain technology, the use of cryptocurrency will be commonplace and wide-spread. Just like Apple Pay and PayPal have become the norm, so too could cryptocurrency.

Cryptocurrency is revolutionizing the gaming industry, and it is now possible to travel the world with crypto, and soon we will see mortgages, insurance, and all other kinds of services incorporating blockchain technology! Cryptocurrency is no longer a threat to the traditional financial system, rather, it is leading the way, showing the outdated institutions how to adapt to a new paradigm of digital and technological innovation, while showing users a path toward financial freedom.

Ivan on Tech Academy lets you keep up to date with the most important developments in the cryptocurrency sector. Moreover, the many courses available lets you choose what you want to learn about, and go from zero previous experience to blockchain hero in just a few short weeks!