Are you confused about all the different types of currencies available in 2020? Ever since 2008, there has been an increase in the number of different currency terms and definitions to wrap your head around. As the world is going digital, it makes sense that our finances and financial services will migrate online too. However, there are some critical differences between the traditional currencies and the digital assets that are worth getting educated in, in order to preserve your wealth and prevent it from being controlled or lost.

In this article, we break down the different definitions of the key currencies available today, explaining the history and use cases for each. It is crucial that you truly understand the distinctions between currencies as we head towards the digital financial revolution. The term “decentralized finance”, or DeFi, is often thrown around, and could hold the keys to a paradigm shift for traditional finance.

Before getting into the different types of currencies, it is worth pointing out that cryptocurrencies can seem confusing to some at first glance. Luckily, you can easily enroll in Ivan on Tech Academy, the go-to online blockchain academy and platform, to learn all there is to know about both blockchain and cryptocurrencies.

Different Types of Currencies

Fiat Currency

Fiat currency is what the average Joe would more casually refer to as money or “cash” – the paper money that is issued by the government. It is, however, crucially important to remember that this paper really has no intrinsic value.

Fiat currency is used and often perceived to have value because the government says so and others see value in it too. Technically speaking, after the US dollar abandoning the gold peg in 1971, most fiat currencies no longer have value.

It all started several hundred years ago when rich businessmen traveling internationally would store their wealth in what would become known as banks. Carrying gold around was a risky business with a fair chance of being mugged and losing one’s entire wealth.

When businessmen traveled to England, they were offered the opportunity to store their gold in a secure vault and would receive a paper receipt to redeem their gold when they were leaving the country. Proving a success, if businessmen were in the country for a substantial period, they could allow their gold to be ‘lent’ out, for other men to ‘borrow’. Of course, this was a no-brainer for the businessmen as they would be rewarded in interest for doing so. To them, it was a way of making free money.

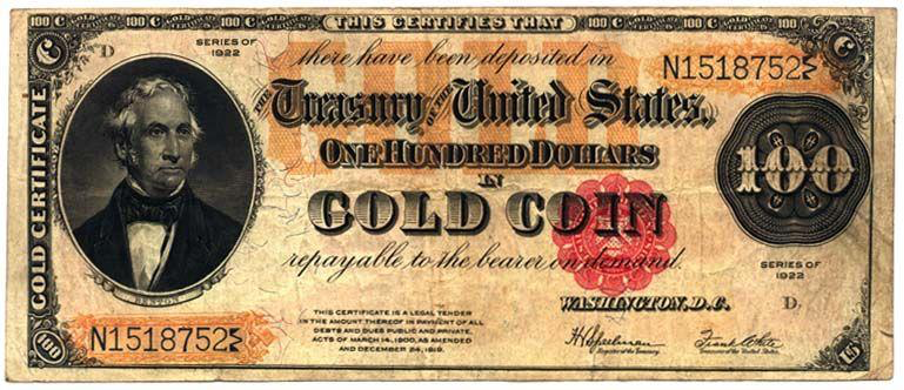

The paper receipts would represent the amount of gold deposited, owed to the recipient of the slip. Over time as this became a more common practice, people would exchange goods and services for the pieces of paper that represented gold, as opposed to gold itself being used as the medium of exchange.

The Gold Standard

As this became the social norm, governments hoarded gold and printed receipts backed to the value of said gold, into the circulation of their economy. However, when a government needs extra money (i.e. to fund a war), it’s difficult to expect the participants in the economy (everyday people) to put forth their hard-earned cash to fund such events, so, this is when the government begins to print more receipts than there is gold to back it.

Printing money out of thin air – in certain communities referred to as “money printer goes brrrr” – devalues the currency because it now takes more of the paper receipts to be worth the same amount of gold. From 1879 to 1933 the US dollar followed ‘the gold standard’ until further funding was needed in the second world war. In 1944 at the Bretton Woods Conference, nations around the world concluded that the US dollar shall be pegged to gold, and all other global currencies shall be pegged to the US dollar.

Over the next 30 years or so, America began printing more paper bills than was representative of their gold reserves, and other countries started catching on. When faith was declining in the US dollar, nations started demanding their gold back. Running low on reserves, President Nixon announced a new financial policy that changed the way the global monetary system would work, forever.

In 1971, it was announced that the US dollar was no longer tied to gold. This originally ‘temporary’ act, meant that it was no longer possible to exchange dollars for gold unless it was in the interest of the United States. The cap on the money printing was lifted, and more and more US paper bills began circulating the global economy.

Did you enjoy this brief recap? If so, you should check out the course on the history of money and Bitcoin. What’s more, Ivan on Tech Academy offers courses on all things related to cryptocurrencies, Bitcoin and blockchain programming. Right now, you can also get 20% off with the exclusive promo code BLOG20. Take a look!

The Future of Fiat Currencies

The debasement of a currency is nothing new, with Roman emperors melting down gold and silver coins, and mixing them with alloy metals to create more coins. History has proved time and again, those in power will always create more wealth than what is practically available, in one way or another, for public spending and warfare.

World reserve currencies have historically lasted around 100 years, in the macroeconomic boom and bust cycles. The US dollar is due to come to an end, having been instated as the world reserve currency in 1914. Every single fiat currency that has ever entered circulation in an economy, has been debased or effectively devalued.

Digital Currency

The term ‘digital currency’ is an umbrella term for representing different types of currencies that only exist in electronic form, from virtual currencies to cryptocurrencies. Digital currencies themselves do not hold value (with the one exception of cryptocurrencies explained below).

Digital currencies are an electronic record or balance representing the value of your local fiat currency (e.g. USD, GBP, EUR, etc.) and can sometimes be referred to as electronic cash, e-cash, or electronic money. They are completely intangible.

You can find digital currencies displayed in your mobile fiat banking app, in-game currencies, or at a crypto exchange.

History

David Lee Chaum is an American computer scientist and cryptographer and introduced the first concept of a digital currency back in 1983. Six years later he founded DigiCash, a secure, peer-to-peer electronic cash transfer company, with cryptographically encrypted transactions that meant each transfer was anonymous. Sadly, Chaum filed for bankruptcy in 1998 as the company failed to meet demand and could not scale efficiently.

Since then, many different types of digital currencies and forms of electronic money have emerged, notably PayPal launching in 1998. A couple of years prior, in 1996, e-gold was established and proved success after success, peaking at a $2 billion transaction volume in 2006. However, due to suspicious transactions, the corporation was shut down by the federal government in 2008.

The next form of digital currency to emerge was cryptocurrency with the introduction of blockchain technology in early 2009. Blockchain technology has allowed secure, immutable, global transactions in various types of crypto, and other new currencies. To learn more about how blockchain technology works, click here!

Virtual Currency

Virtual currency is a type of digital currency – a currency that is intangible and only exists in digital form. Virtual currencies technically speaking hold no intrinsic value, and are often used within gaming. Virtual currencies are more often than not restricted to a particular game or event or time.

100 gold coins may buy you an extra life in Super Mario Bros, but you can’t use them to purchase a sandwich for lunch from your local shop!

Virtual currencies are not regulated and are often controlled by the developer or group of developers behind an application. Virtual coins have also been referred to as ‘closed’ or ‘fictional currency’ for their lack of connection to the real-world economy.

History

The use of the term ‘virtual currencies’ began around 2009, and the definitions of such have varied over the past decade. The correct legal classification falls under ‘digital currency’, however, the US government has adopted the term ‘virtual currency’ as confirmed by FinCEN, the FBI in 2012, and the General Accounting Office in 2013.

In 2018, the Directive EU of the European Parliament publicly released the latest definition of ‘virtual currencies’:

“a digital representation of value that is not issued or guaranteed by a central bank or a public authority, is not necessarily attached to a legally established currency and does not possess a legal status of currency or money, but is accepted by natural or legal persons as a means of exchange and which can be transferred, stored and traded electronically“

Virtual currencies are a great medium of exchange with many, but not all, being created on the blockchain, meaning they are secure, transparent, and fairly fast. The price of some virtual currencies may fluctuate drastically, as there is no central organization controlling the price. The value of the currencies is purely determined by consumer sentiment.

Cryptocurrency

Created in 2008, Bitcoin is the world’s first cryptocurrency, created by an unknown developer(s) Satoshi Nakamoto.

The open-source Bitcoin software went live in 2009, and this is when people first began mining Bitcoin. The process of mining Bitcoin involves using huge amounts of computing power to solve extremely difficult mathematical equations. This process, known as cryptographic hashing, is part of how the distributed network of Bitcoin nodes reaches consensus on any transaction for it to be confirmed.

For a Bitcoin transaction to be validated, each node or miner must agree that there are enough funds available for the transaction and that no foul play takes place. Miners are incentivized to keep the network secure with block rewards, which are paid in the form of BTC.

As a decentralized digital currency, Bitcoin requires no intermediaries and operates outside of the control of central banks. Bitcoin transactions are immutable and cannot be changed or altered. As a public blockchain, all Bitcoin transactions are viewable to anyone.

Bitcoin has been often referred to as ‘digital gold’ as they both share similar qualities. It’s durable, so will last over time. It’s fungible, 1 BTC is of equivalent value to another 1 BTC, similar to one ounce of gold mined in Australia is valued the same as one ounce of gold mined in China. They are both divisible – gold in bars and coins, and Bitcoin divisible to 100 million satoshis. They are both scarce – however Bitcoin has a cap of 21 million coins to ever be mined. Gold however doesn’t have a fixed scarcity, as there is talks of mining gold on asteroids.

Bitcoin is a distributed ledger of transactions held on the blockchain and is the largest, most secure network of computers in the world. If you’d like to learn more about Bitcoin then click here.

The introduction of blockchain technology has created an opportunity for thousands of different types of cryptocurrencies, some of which we’ve explained below:

Ethereum

Ethereum was created by Vitalik Buterin, launched in 2015, and was a game-changer to the blockchain industry. Prior to Ethereum, the Bitcoin blockchain meant transactions could only be programmed to go from A to B.

The Ethereum blockchain is written using a Turing-complete language, which means that it can solve any mathematical equation and additionally, created a platform for developers to build decentralized applications with the use of smart contracts.

Smart contracts are essentially programmable money that can move a specified amount of funds from A to B, upon meeting certain criteria defined by the user. For example, to motivate your child at school, you could program a smart contract to transfer $100 to their account for every ‘A’ they get, $50 for every ‘B’, and so on. Check out our blog post on Smart Contracts Explained if you’d like to read further into the subject.

Ethereum is the second-largest cryptocurrency by market cap and hosts hundreds of decentralized finance applications, gaming applications, and decentralized marketplaces.

Although many other blockchains are emerging in the DeFi space, Ethereum is without doubt leading the way in terms of adoption, use cases, and development. To build and use DeFi platforms, you’re more than likely going to need some ETH.

Altcoins

Strictly speaking, altcoins are essentially any other cryptocurrency that is not Bitcoin. In the view of Bitcoin Maximalists, Ethereum is considered an altcoin. However, to most in the crypto community, Ethereum is Ethereum. It’s a stand-alone crypto that is unique in its properties and network size.

There are further categories to altcoins, which namely describe their role and function in the crypto ecosystem. For example, shitcoins, are generally coins created as a joke, have no value nor functional properties.

An altcoin is valued when the coin itself brings value to its community of users. If you’re interested in learning what makes an altcoin valuable – definitely bookmark this tab for later!

Tokens

A broad definition of tokens is a type of coin that is derived from another protocol or blockchain. For example BAT, the Basic Attention Token is created on the Ethereum blockchain, therefore, BAT is an Ethereum token.

If you dive a little deeper into the definitions, tokens are split into several different categories such as:

- Utility Tokens

- Reward Tokens

- Asset Tokens

- Security Tokens

- Non-fungible Tokens

However, we will go over the specific definitions of these tokens in another article.

Stablecoins

Stablecoins are a type of cryptocurrency that is price-pegged to a currency such as the US dollar. Tether or USDT is the most popular stablecoin and remains as close as possible to $1 at all times. Stablecoins are good for buying dips and can also be used to access financial services that are only available on the blockchain, without the risk of holding a volatile asset.

CBDCs

CBDCs – Central Bank Digital Currencies – is the government’s response to the cryptocurrencies that threaten the legacy financial ecosystem. CBDCs are essentially the same as your regular digital fiat currency. They are government-issued, under centralized control, and vulnerable to the same hyperinflationary effects of regular printed fiat currency.

CBDCs are still in the cards for a lot of nations, with China recently making a pioneering move introducing their CBDC digital yuan (e-CNY) in recent days. On October 9th, 2020, in the Chinese city of Shenzhen, 50,000 residents who participated in a lottery received an airdrop of 10 million digital yuan (worth approximately $1.5 million) The residents have 6 days between October 12th to October 18th to spend their winnings, with unspent winnings reportedly being taken back from winners after the deadline.

A survey by the UK-based journal Central Banking was sent out in February this year to 46 countries to gauge their opinions and future actions around CBDCs. 65% of respondents had already actively researched into the use of digital currencies. However, it was also noted that the majority of the countries that had formerly researched digital currencies, had no current intention of pursuing the creation of a CBDC.

The survey also found that 71% of respondents would consider introducing a CBDC – interestingly, only one central bank out of this percentage would consider the use of blockchain technology. Others would consider different forms of distributed ledger technology, however, research suggests banks are not yet convinced of the security of blockchain, with user privacy concerns high among financial institutions.

CBDCs: Points To Consider

The key thing to remember with CBDCs is that the balance is worth as much as your local fiat currency. Introducing central bank digital currencies, and removing cash from society entirely, would give governments and central banks the ultimate control of your wealth. They are, by name, centralized, and people don’t have any true rights or ownership.

As evidenced by the digital yuan lottery giveaway, the government is exercising its authority by removing any unspent funds after 6 days, with the click of a button. It could be as extreme as going to a protest for an opposing political party, then having your entire funds frozen or removed for doing so if caught.

CBDCs are a much more cost and time-efficient way for governments to introduce quantitative easing or, devaluing the fiat currency further, by removal of the printing press and just typing in a new balance.

Conclusion

In times of economic uncertainty, a lack of knowledge about money, the stock market, and the economic landscape can lead to substantial loss of wealth for many people, whereas those who know how to manage risk can use this as an opportunity for financial gains.

An increase in education around money, the different types of currencies, and what they do, could reduce economic disparity and reduce global poverty.

“The quality of a society is directly proportional to the quality of its money” – Mike Maloney.

Do you find learning about cryptocurrencies interesting? If so, you should be sure to check out all the courses readily available on Ivan on Tech Academy. Join over 20,000 students taking part of some of the best crypto and blockchain courses in the world!