With some of the Yield Farming profits dropping and the most intense DeFi hysteria waning, another digital asset has been gaining traction that may be able to kickstart the blockchain space: namely, non-fungible tokens (NFTs). Non-fungible tokens could be the future of music and art, gaming, and even real estate. But, since the terms “fungible” and “non-fungible” can be somewhat confusing, let’s dig into what it all means.

Fungible Assets

Fungibility is a concept that applies to real-world assets and digital ones as well. Specifically, fungibility is an asset’s ability to hold a standardized value. So, a currency is a fungible asset because its value is equal and standardized. That means, a $10 bill, and a Bitcoin are both fungible assets. That’s because a $10 bill is worth the same as any other $10 bill. And it’s the same with one Bitcoin. There is no specific history in the life of either asset that will change its value with regards to any other denomination of equal value.

There are millions of these assets in circulation but they are all standardized and equal. That’s because fungible assets exist to simplify the trading process between human beings. That’s their superpower. Think about it. If one $10 bill was worth more than another, it would render the US currency system inherently unstable. It’s the same with Bitcoin. So, Bitcoin is a fungible asset just like the USD.

Fungible vs. Non-Fungible

In addition to these traditional fungible assets, there are also some non-fungible tokens, however, and these blockchain assets are designed to be unequal. At first, that seems untenable, and with regards to currencies, it is.

However, with blockchain assets, the possibilities are endless. Tokens can be created to represent other assets besides currency. And some of these non-fungible tokens are commanding hundreds of thousands of dollars which we’ll explore later.

NFTs are largely dependent on blockchain technology. Are you looking to learn more about blockchain technology? In that case, you should enroll in Ivan on Tech Academy. Join over 20,000 students already studying blockchain courses!

Real World Non-Fungible Assets

Non-fungible assets don’t only exist in the digital world. They also exist in the real world. Can you think of any? Consider rare baseball cards. Two cards might seem identical, but the fine details that can easily escape the eye of a non-collector. And the fine details are what make them unique.

And it’s the same with non-fungible tokens. For now, they exist on the Ethereum blockchain and at first glance, they can seem just as fungible as ETH, but let’s consider their properties:

- Non-Fungible Tokens are Unique

These tokens contain metadata that makes them unique. This metadata is an unalterable record and is similar to a certificate of authenticity.

- Non-Fungible Tokens are Rare

Scarcity makes them attractive. Developers can create an infinite amount of digital assets. However, they can also limit the supply which makes the asset rare and hence more desirable.

- Non Fungible Tokens Cannot Be Counterfeited

This comes in handy in lots of cases like works of art and personal identity.

- Non-Fungible Tokens are Indivisible

NFTs cannot be divided into smaller denominations. They are bought and sold as whole units.

- Non-Fungible Tokens Cannot Be Inflated

After all, we’re not talking about fiat currency which can be printed ad infinitum.

Popular Non-Fungible Tokens (NFTs)

From here on out, we’ll just refer to them as NFTs. And one of the most popular NFTs of all time is CryptoKitties. Although thousands of CryptoKitties have been created, they are not created equally. Each has a unique name, eye color, and fur color (to name a few).

Anyone who purchases a CryptoKitty gets an NFT that correlates to that specific kitty. Prices for CryptoKitties vary and you can buy or sell them with fungible tokens like ETH. CryptoKitties is only one example of the collectibles market, but there are others. The truth is, collectibles in blockchain-games are still the main use case for NFTs.

Other Use Cases for NFTs

Art collecting is one promising example. An NFT could be created for an original painting after it was verified by experts. Then, it could be auctioned off by listing the NFT as proof of the painting’s authenticity.

Personal identification is yet another use case. NFTs could play a role in verifying it. A non-traceable NFT could be used as a birth certificate, a driver’s license, or even a passport. Each human being has unique individual attributes and NFTs could digitize these.

Finally, there are virtual assets and real-world assets. Tokenizing real-world assets is still in its infancy, but it is possible. As far as virtual assets go, the Ethereum Name Service offers dot ETH (.ETH) domains that can be converted to NFTs and then be bought and sold.

The true scale of NFT use cases, however, first become apparent when one learns about the capabilities of blockchain technology. If you enroll in Ivan on Tech Academy, one of the premier blockchain education platforms, you can get 20% off using the promo code BLOG20.

The Advantages of NFTs

Here are three ways NFTs can improve our lives in the digital space:

- Ownership Rights

Big-tech tyrants can take down your YouTube channel on a whim. Or they can snatch your Twitter handle for any perceived infraction. NFTs, on the other hand, can’t be taken away. The blockchain is like a blockade to help protect your rights to ownership.

- Transferable Property

Back to the big tech analogy. Twitter won’t allow you to sell your handle. NFTs, however, can be freely traded. Imagine what it would be like if you could digitize your personal Twitter handle.

- Authenticity

Blockchain-powered NFTs provide an excellent way of combatting fraud and counterfeiting that will help embolden buyer confidence.

Some Famous NFT Projects

The best ways to judge an NFT platform are by the number of users on it and the value of the assets being exchanged. Here are some of the top projects.

- CryptoKitties

We mentioned them earlier.

Here users can create artwork, challenges, scenes, and more.

- Gods Unchained

This is a card game where the cards can be bought and sold as NFTs.

- My Crypto Heroes

This is a Japanese battling game built on Ethereum. Its NFT offering includes competing heroes.

Similar to the Ethereum Name Service mentioned earlier except their extensions end in dot crypto (.crypto).

NFT Standards

Different standards exist for NFTs. The first and most popular NFT type is ERC-721. ERC-721 tokens took off with the explosive interest in digital collectibles and game-based assets. The smart contract code embeds the unique details that make them rare.

ERC-1155 tokens take the utility of NFTs further as they can develop both fungible and non-fungible tokens. And then there is ERC-998. These tokens can bundle ERC-721 tokens. That means unique assets that need to stay together can be bundled and sold in bulk. Think of the ability to transfer a game hero collectible along with his weapons in a single transaction.

NFTs aren’t only on Ethereum, however. Other blockchains supporting NFTs include EOS, NEO, and TRON. But since each token is unique, exchanges don’t trade them. If you’re interested in NFTs, there are special marketplaces that connect buyers and sellers.

However, there are no utopias. Like anything else, NFTs have their challenges.

NFT Pros and Cons

On the positive side, NFTs could open up new revenue streams in areas like the arts, gaming, and sports. They could introduce millions of newcomers to cryptocurrencies. And they can elevate attitudes towards ownership of not only digital assets but real-world ones as well.

On the negative side of things, NFTs are a bit complex. They need greater simplification to gain mass appeal. Even for devs, building dApps for NFTs can be tricky. Also, it seems NFT projects have a poor retention rate, not to mention the liquidity issues.

NFTs and DeFi

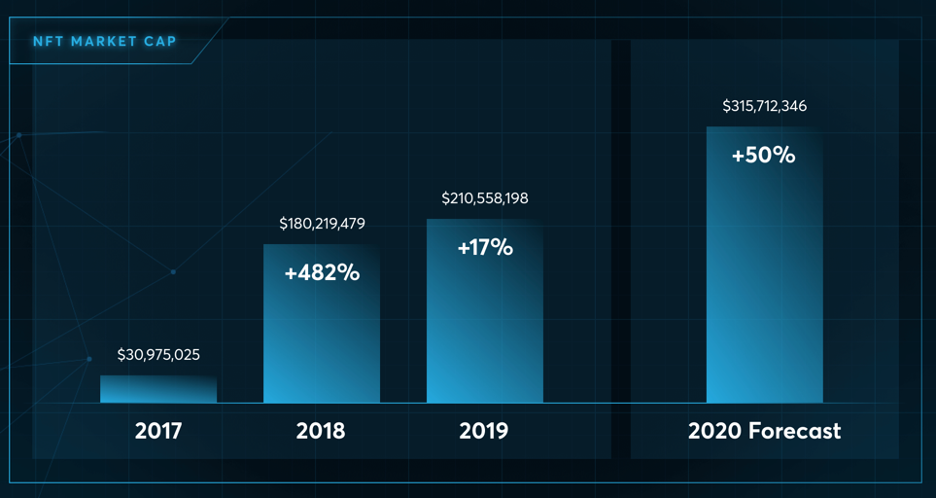

In terms of market cap, NFTs are forecast to grow 50% by the year’s end to a total of $315 million. That’s great, but DeFi still dwarfs it. DeFi started the year 2020 with TVL around $665 million and has now surged to over $11 billion (according to DeFi Pulse). Billions of dollars have been absorbed into the DeFi ecosystem this year. And this has been accomplished by providing a few basic functions like over-collateralized loans, interest-earning capabilities, and decentralized trading and derivatives.

DeFi has been growing at a phenomenal rate but the current crypto ecosystem still contains and limits it. So, how does DeFi get to the next level? The natural progression will likely involve adding real-world assets to the mix. That would not only be a way to bring real-world assets into DeFi, but it would also open it up to businesses outside of crypto.

NFTs could on-board a completely new audience into DeFi bringing with them new investment capital to fuel even more growth. This all may sound a bit futuristic, but there is already a platform doing it.

The Tinlake Protocol

Tinlake is a dApp on Ethereum that allows investors to finance their asset pools. That sounds very DeFi just like other liquidity pools available on protocols like Uniswap or Balancer. But when companies or individuals offer up assets, Tinlake can tokenize and bring them on-chain as NFTs. Investors can then lend against the tokenized assets and get crypto plus yield for doing so. This is DeFi’s evolution and it’s not happening sometime in the future, it’s happening right now.

So, Tinlake can already do on-chain borrowing against real-world collateral. And smart contracts manage the process. It enables borrowers to access DeFi’s liquidity when they put up assets like mortgages or auto loans.

Amazingly, these real-world assets can be tokenized by issuing NFTs. Investors can loan against these tokenized real-world assets by supplying stablecoins and earn yield income. This enables stablecoin providers to use these NFTs to back their stablecoins with collateralized asset pools.

So, Tinlake’s smart contracts can pool NFTs and use them as collateral to raise funds in the form of stablecoins. This is accomplished by issuing fungible tokens that represent a fractional claim on the proceeds of the pool. The fungible tokens can then be locked into other protocols. Also, Tinlake’s asset pools can be individually configured with different interest rates.

This isn’t a sales pitch for Tinlake. It is still a new project with only three active pools at the time of this writing. A deep dive into Tinlake may be forthcoming. But for now, it is interesting to see how it helps demonstrate what is possible and how DeFi can be further extended by using real-world assets. And that could be huge.

The Future of NFTs

New developments and exciting use cases for NFTs are happening all the time that are shaping the future. NFTs can help consumers get control over their DNA data. Top sports clubs are launching tokenized player cards. NFTs can even help combat fake news.

NFTs open the possibility of digitizing assets and data. New markets could open up for both real-world and digital assets that can morph into the backbone of a new digital economy. Once it gets rolling there isn’t a limit to the things NFTs could digitize. And unlike the ICO craze, NFTs have staying power.

Even major companies are showing interest in the NFT market. The Winklevoss twins have recently revamped a CEX called Nifty. This will allow users to sell NFTs and withdraw their profits in fiat. There is also talk of hooking up with celebrities to start issuing collectibles.

Conclusion

Interactive platforms offer devs a place to experiment with NFTs and will hopefully help them come up with even more use cases. With all this experimentation, winners will emerge from the pool of losers that crashed and burned. Successful experiments emerge from failed ones and that’s how progress works.

We’ve already talked about crypto-collectibles, art, domain names, and Twitter handles. But real-world assets are the new frontier. After purchasing an NFT, owners can hodl it, display it like a trophy, sell it, or shared it. A person could conduct business instantaneously with others around the world.

A less techy user interface will be key to growing mainstream adoption. And as the market heats up, the temptation will be for buyers to snap up NFTs willy nilly. They just need to take care not to end up as the greater fool holding the bag if the market tanks in the extreme cycles of boom and bust. And these are likely to be more extreme in the early phases.

The most exciting use case for those of us in the DeFi space is the role NFTs can play in onboarding more people. NFTs can be a big win for DeFi.

To learn more about NFTs and receive a world-class blockchain education, be sure to join Ivan on Tech Academy!

Author: MindFrac