There’s been a lot of buzz regarding so-called “layer-2 solutions” recently. Ethereum’s layer-2 solutions and projects are still in their infancy, but are already showing tremendous growth potential. Specifically, layer-2 solutions are meant to solve issues relating to blockchain scalability challenges. In this article, we’ll take a look at some of the layer-2 solutions you should know about to understand the L2 sector.

For example, this article will dive into layer-2 solutions like Arbitrum. If you’re not familiar with Arbitrum, it’s an optimistic rollup that delivers a user experience (UX) that feels like Ethereum – but with transaction costs that add up to only a fraction of what a layer-1 solution offers. For a deeper dive, please read our article, “What is Arbitrum?“.

If you’re not sure why layer-2 solutions came into existence, it’s because transaction costs and scalability issues plagued Ethereum’s main chain. These problems coincided with Ethereum’s rapidly growing user base, mainly in the DeFi and NFT sectors.

That’s why innovative developers created layer-2 solutions – to help Ethereum scale and reduce gas fees. After all, Ethereum’s success brought more network congestion that needed a solution.

How to Scale with Layer-2 Solutions

Two of the main ways to scale a blockchain are:

1. Main Chain

The first way to scale is to improve transaction capacity on the main chain. That is the direction Ethereum 2.0 is heading.

2. Off-Chain

The other way is to move some of the interactions off-chain.

Layer-1 solutions deal with the main chain, while layer-2 solutions move some of the interactions off-chain. For example, in a layer-2 solution, smart contracts on the main chain could be limited to handling deposits and withdrawals. Everything else could transpire off-chain.

This article will cover some of the critical layer-2 solutions and projects working in the various ecosystems today. If you’re not sure how layer-2 projects and solutions work, please read our introductory article, “Comparing Layer-2 Ethereum Scaling Solutions.”

To get a well-rounded education on how the blockchain works, please visit Ivan on Tech Academy today.

Layer-2 Solutions – Rollups

Users want layer-2 solutions that are as secure as Ethereum but also quick and inexpensive. That’s why rollups are so popular.

As the name suggests, rollups “roll up” multiple transactions into a single block and process them off the main chain. Interactions such as computation and state storage move off-chain while some data remains on-chain. Off-chain interactions help decongest the Ethereum network resulting in faster, cheaper transactions.

Layer-2 Solutions – ZK-Rollups

Not all layer-2 solutions are alike. Even with rollups, there are two different types. One is called the “Zero-Knowledge Proof Rollup” or “ZK-Rollup.” With ZK-Rollups, each batch (a collection of compressed transactions) contains a cryptographic proof called a “SNARK.” The SNARK confirms that the post-state root is correct after executing the batch.

Layer-2 Solutions – Optimistic Rollups

The other kind of rollup is called an “optimistic rollup”. Optimistic rollups are slower than ZK-Rollups, but their setup is less centralized, and they have surpassed some of the limitations that stifled other layer-2 solutions such as sidechains and state channels.

Optimistic rollups offer a better UX, and they’re Turing complete. On the negative side, their throughput is limited compared to ZK-rollups. In addition, ZK-rollups rely on complex mathematics for verification, while optimistic rollups assume everything is okay unless a whistleblower says otherwise.

Layer-2 Solutions – Arbitrum and Optimism

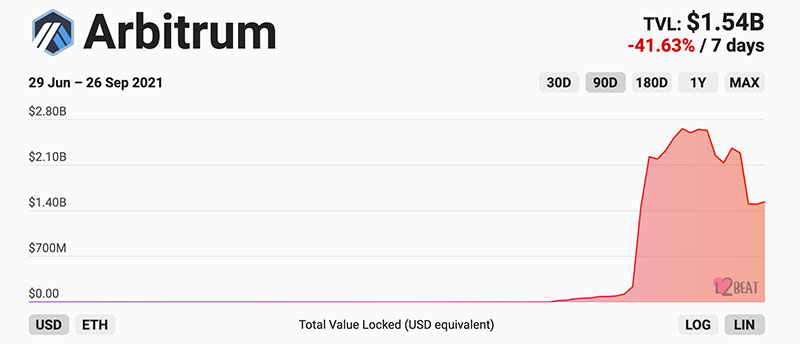

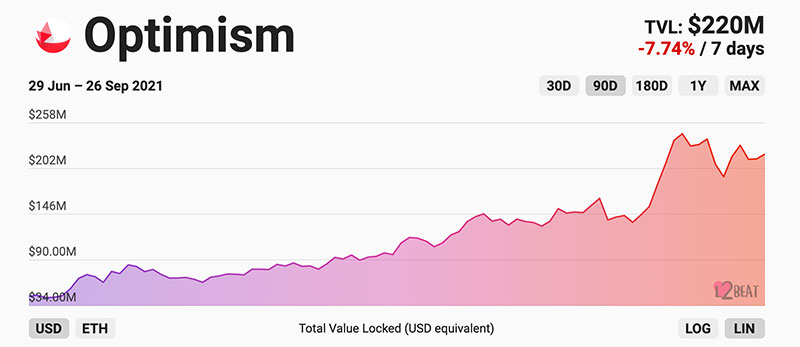

Two significant layer-2 solutions are Arbitrum and Optimism. These networks already generate millions of dollars in fees (none of which goes to their users), having gone live just a few months ago. But even though these are giants of the optimistic rollup world, neither Arbitrum nor Optimism offers a token for investors. Also, it’s still uncertain whether or not they will ever provide one. If they do, they could provide tokens in the form of a retroactive airdrop for early adopters.

Since users’ favorite protocols don’t always offer tokens, those looking for ways to get exposure to layer-2 projects may need to look beyond the protocols themselves and try to untangle the interconnections in the DeFi ecosystem.

To learn more about decentralized applications (dApps) operating on layer-1 and layer-2 solutions, make sure to take the “Ethereum dApp Programming“ course at Ivan on Tech Academy.

Layer-2 Projects

While solving some of Ethereum’s shortcomings with rapid-fire confirmations and reduced gas fees, layer-2 solutions also inherit the excellent parts of Ethereum, like its security features. These are some of the reasons projects deploy to layer-2. One positive thing for Ethereum holders is that layer-2 projects such as Arbitrum, dYdX, and Optimism burn ETH with each transaction. Burning ETH is always good for the price of ETH.

Users looking to gain exposure to layer-2 solutions typically look at native tokens on the network of interest. However, although layer-2 tokens are in a rapidly emerging market phase, not all projects offer them. For those interested, protocols that offer tokens will play a similar role to those offering tokens on layer-1.

Layer-2 Projects – Applications

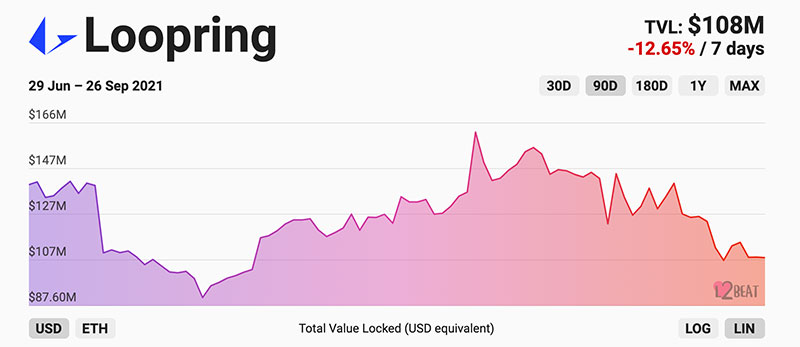

Layer-2 Applications – Loopring

Loopring is a well-known, application-specific rollup with a suite of products built on their ZK-rollup. This suite includes an automated market maker (AMM) and an order-book exchange. Over the past year, it has generated over $2.7 million in revenue with its LRC token. LRC acts as Loopring’s governance token but also serves as collateral. Users can buy LRC directly or earn the tokens indirectly by providing liquidity to specific incentivized token pairs.

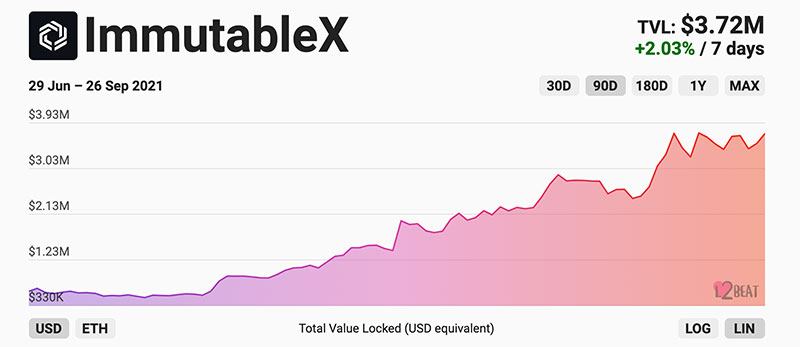

Layer-2 Applications – Immutable X

Immutable X is a ZK-rollup deployed on StarkWare that functions as an NFT exchange in the gaming sector. The protocol incentivizes users to engage with its platform via a play-to-earn rewards system using the IMX token. The IMX token plays several roles within the network. For one thing, users must pay 20% of their transaction fees in IMX. Immutable X also uses IMX as its governance token. Furthermore, IMX holders can stake their tokens and earn a share of the network fees paid in IMX.

Layer-2 Projects – Infrastructure

Layer-2’s infrastructure hosts a vast web of interconnected projects. So rather than trying to single out individual applications such as Loopring or Immutable X, those looking to get involved with layer-2 can also look at the infrastructure layer. That’s where tools that power the applications reside.

Another question to ask is, which assets stand to gain from the growth of layer-2? Particularly as it pertains to network effects and the barriers to entry for up and coming competing services. Many protocols in the layer-2 infrastructure operate as quasi-monopolies with limited competition.

Here are some projects already integrating into layer-2:

Layer-2 Projects – Chainlink

DeFi protocols need secure and trust minimized oracles to aid in pricing and timely liquidation activities. For instance, significant projects on layer-2 such as Aave, Curve, Dopex, SushiSwap, and Synthetix are already integrating oracles for their price feeds. While Chainlink offers users exposure to DeFi as a whole, one day, it may become more deeply integrated with Arbitrum.

Layer-2 Projects – The Graph

This protocol also plays a crucial role in the infrastructure stack. DeFi projects not only need off-chain data but access to on-chain data as well. The Graph indexes on-chain data for other applications to query it in a decentralized and trustless manner. This protocol supports additional layer-2 networks such as Arbitrum and Optimism. Several applications with layer-2 deployments, such as Futureswap, Synthetix, and Uniswap, also utilize it.

Like Chainlink, The Graph provides a more broad-based level of exposure to layer-2 networks and applications.

Layer-2 Projects – Hop and Connext

As mentioned, layer-2 offers vast improvements to UX compared to layer-1 in terms of speed and lower gas fees. However, the gains come with some drawbacks. For one thing, Optimistic Rollups have lengthy withdrawal times up to an excruciating seven days. They also have problems moving liquidity between differing layer-2 networks.

Connext and Hop Protocol are layer-2 projects working to solve this issue so that users can quickly transfer assets across different networks while expediting the withdrawal process. These projects don’t offer tokens. However, for users who like to act as early adopters, projects like these sometimes offer retroactive airdrops to their early users if they later decide to offer tokens.

Layer-2 Early Adopters and Native Applications

Layer-2’s offer new and emerging markets where protocols can grow their user base and revenues. But no one wants to use a network if no practical applications are running on top of it. So layer-2 solutions can only excel when quality applications are deploying on them. Two common types of applications to look for are:

1) Early Adopters

Uniswap, SushiSwap, and Curve are examples of projects that migrated to layer-2, but already had a successful presence on layer-1.

2) Natives

Dopex and Synthetix are examples of applications exclusive to layer-2.

The difference between the two is that early adopters aren’t entirely dependent on the success of the underlying layer-2 network. That’s why these protocols tend to be less risky than layer-2 natives, that put all their eggs in one basket.

Layer-2 Early Adopters – Uniswap

Uniswap is an early adopter of layer-2 via its partnership with Optimism. They deployed to the network in July 2021. Being the largest DEX on Ethereum in terms of volume, Uniswap presently has over $31 million on Optimism. Uniswap also recently launched on Arbitrum and experienced even more significant usage coming in at over $37 million in TVL.

Layer-2 Early Adopters – SushiSwap

SushiSwap is another early adopter. Specifically, it was one of the first DEXs to go live on Arbitrum with over $33 million in liquidity. SushiSwap also deployed on Avalanche, Fantom, and Harmony.

Notably, on certain days, SushiSwap has outperformed its top rival Uniswap in terms of volume. The DEX has not deployed on Optimism yet, but migration to the network seems inevitable due to their multi-chain strategy. SushiSwap will likely deploy on Optimism after its mainnet release.

Layer-2 Early Adopters – Curve

Curve is another DeFi protocol that was quick to embrace layer-2 as it went live on Fantom, Polygon (Matic), and more recently, Arbitrum. The combined liquidity of the deployed Curve pools is over $131 million, with a daily volume close to $6 million.

Layer-2 Natives – Dopex

Dopex is a derivatives project that will benefit from layer-2’s quicker confirmation times and lower fees. It is a decentralized options protocol backed by some big DeFi players, DeFiGod and Tetranode. Dopex’s farms hold more than $75 million in TVL. At the time of writing, Dopex is on testnet but plans to deploy its mainnet on Arbitrum.

This project offers users exposure to the DeFi derivatives sector but also the optimistic rollup ecosystem.

Layer-2 Natives – dYdX

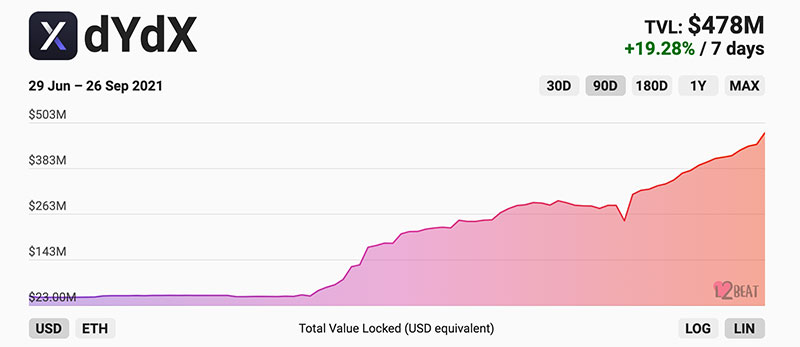

dYdX is a perpetual exchange in the DeFi ecosystem. It got a boost from layer-2 by building its rollup on StarkWare.

The derivatives protocol just launched its liquidity mining program, including a retroactive airdrop of DYDX tokens. Further, it has seen daily volumes rise over 10x recently, climbing upwards of $600 million.

Layer-2 Natives – Synthetix

Synthetix started on layer-1, so it could also be considered an early adopter of layer-2. However, developments on layer-1 stifled Synthetic’s growth with high gas fees. These were exceptionally high because Synthetix transactions are computationally intensive. So, it’s not surprising that it greatly benefited by becoming a layer-2 native.

Synthetix was an early adopter of Optimism. Now, other projects are building on top of its deployment. One of these is Kwenta, which is an exchange that allows users to mint and trade Synths. Another is Lyra, an options protocol with two pools holding more than $12 million in TVL.

Layer-2 Solutions and Projects – Conclusion

Users can benefit from layer-2 projects without having to invest in them directly. By changing from the familiar layer-1 projects to layer-2 projects, users can save time and money. This growth has something to offer all of those willing to do their homework, particularly developers.

To get involved as a blockchain developer working on layer-2 projects and solutions, you’ll need to start with a foundation. Ivan on Tech Academy offers precisely that – a solid foundation for those looking to learn blockchain development. Since many DeFi protocols benefit from deploying to layer-2, an excellent place to start is the “DeFi 101” course. Start learning today!

Author: MindFrac