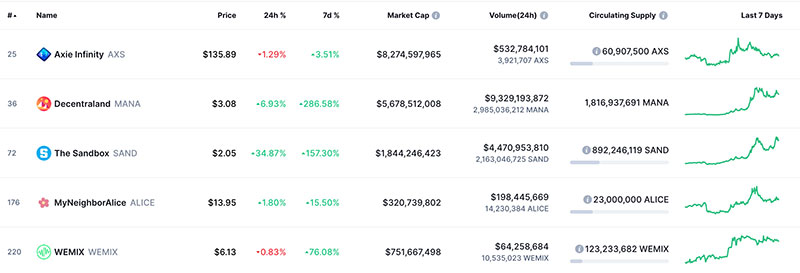

Play-to-earn games, or P2E, have been on a tear lately, significantly impacting the crypto gaming industry. According to NonFungible, the NFT market hit a record $2.5 billion in sales in July 2021. That was quite a leap from $13.7 million in the first half of 2020, and by the end of September 2021, the NFT market cap topped at approximately $14 billion. Moreover, starting in May 2021, the number of game-connected wallets surged. Specifically, the number of unique active wallets (UAW), the metric for tracking crypto wallets connected to blockchain games, jumped to over 750,000. So, what are the reasons for these impressive numbers? One of them is the soaring demand for play-to-earn games.

However, you might be wondering how the play-to-earn crypto gaming model is different than traditional gaming. This article will answer that question and look at some heavy-hitting investors climbing aboard the crypto gaming rocket ship.

Crypto Gaming Takes Off

The blockchain is a disruptive technology par excellence. On the blockchain, individuals can transact securely with each other without a bank, credit card company, or other third party getting involved. The technology could potentially transform any industry, and the gaming sector is no exception.

With such innovations on the blockchain, crypto gaming is enticing game developers and their players to move away from Web2 to the new and improved, decentralized Web3 model. In Web3, players evolve from passive consumers to active owners of the games they play.

Moralis is the ultimate Web3 development platform, allowing users to develop NFT games markedly quicker. So, if you’re ready to become a blockchain developer, then join Moralis Academy and get started today!

What is Play-to-Earn?

Blockchain-based games that give players the chance to monetize their playing time are called play-to-earn, or P2E. In the past, only professional gamers got paid; however, thanks to the burgeoning P2E movement, any gamer can get paid to play.

What Makes P2E Successful?

A few of the reasons for P2E’s success are:

1. The evolution of financial mechanisms in crypto gaming.

2. Users’ interest in getting paid to play.

3. Layer-2 scaling solutions.

Of the three factors that played a role in P2E’s popularity, the adoption of layer-2 solutions stands out. Crypto-gaming platforms that became early adopters of layer-2 spared their players from the exorbitant transaction fees that plagued others on Ethereum.

Most importantly, play-to-earn models offer players a share of the funds. Two of the ways to cash in are:

1. In-Game Currency

One way to get paid is with in-game currency. Since most crypto gaming platforms have a native cryptocurrency, native tokens are good for buying in-game NFTs. Other use cases include governance, staking, or exchanging the tokens for fiat on a centralized exchange.

2. NFT Profits

Blockchain gamers can also earn by trading profitable NFTs on designated marketplaces such as Rarible or OpenSea.

Crypto Gaming and In-Game Items

One of the driving forces behind crypto gaming’s success is “in-game items.” They accounted for $2.3 billion of trading volume in Q3 of 2021 and represented 22% of the total volume, according to DappRadar.

An NFT is a token that represents a digital asset. Moreover, the wallet holding the NFT represents ownership and can transfer it to another wallet. The blockchain not only records ownership. It is also decentralized and immutable. That means no third party can step in and strong-arm an owner’s rights away from the NFT holder.

P2E Crypto Gaming vs Traditional Gaming

What distinguishes crypto gaming from traditional games is that NFTs can include things like in-game items and collectibles. NFTs can also represent virtual land that resides in the game.

Players in traditional gaming can also purchase in-game items. But do they own them? Not exactly. What the gamers own is a license to the digital copy stored on a central server. If the company goes under or the server malfunctions or disappears, the in-game item and proof of ownership disappear along with it.

NFTs representing in-game items, on the other hand, live on the blockchain forever. The whole blockchain network would have to crash to lose an NFT. Moreover, gamers get complete control over their in-game articles. This result is fortuitous when the time comes to sell them. Owners can transfer their assets on a variety of NFT exchanges. Furthermore, transactions are not limited to the game’s origin marketplace.

Early adopters can look forward to gaming collectibles powering virtual economies. Users want more innovative and creative assets. So, NFT’s ownership component allows for transferability, which turns in-game items into tradeable investments. The whole concept disrupts the traditional gaming infrastructure.

Now that you know the main differences between traditional and crypto gaming, it’s time to dig into the play-to-earn model with some examples.

Play-to-Earn and Axie Infinity

Proponents of play-to-earn believe that it positively impacts society. That’s because people who spend time in P2E crypto gaming enjoy a democratized revenue stream. The best example of this P2E movement is Axie Infinity. Sky Mavis, headquartered in Vietnam, developed Axie, which spearheaded the P2E revolution.

Southeast Asia has always been a gaming hotspot, and in Vietnam, Axie Infinity is one of the most popular play-to-earn projects. Their daily active users hit a stunning number of one million in August, which is impressive for just three years in the business. “Axies” are the game’s main characters which are NFTs that players can buy or sell.

Axie Infinity’s Success with P2E

A well-timed combination of factors caused this play-to-earn game to blossom. One of the factors was the “play games at home” impact of Covid-19 on the marketplace. Another was “Ronin”, which is an Ethereum side chain. If you’re not familiar with sidechains, please read our article on layer-2 solutions.

The Sky Mavis team created Ronin in time to save users from the high transaction fees that plagued similar protocols on Ethereum. Ronin helped Axie Infinity rocket to stratospheric levels, becoming the most traded NFT collection in history. The trading volume for Axie NFTs is close to $3 billion.

Axie’s Play-to-Earn Requirements

On Axie, players can earn up to 75 SLP tokens each day. To do so, they must complete daily tasks such as “player vs player” (PvP) battles and play mini-games. Using ten cents as an average price for SLP, a person playing Axie Infinity full-time could earn around $2,700 in a year. It may not seem like much, but the cash infusion ripple effect can impact economies for people in countries with emerging economies (such as the Philippines or Vietnam).

Therefore, democratizing playing time and revenues works for players, the game industry, and emerging economies alike. The play-to-earn revolution has gone beyond Axie Infinity, however, with new offerings in the pipeline.

If you want to join the P2E movement and create your version of Axie Infinity, you’ll need to learn how to code Ethereum smart contracts. If you already have some programming experience, start with the Ethereum Smart Contract Programming 101 course at Moralis Academy.

Play-to-Earn Games on the Blockchain

Just behind Axie is the well-hyped CryptoPunks collection. It has generated over $2 billion since its inception.

Splinterlands is a P2E trading card game on Hive‘s blockchain. Players compete by strategizing their NFT cards in PvP battles. Players also earn in-game currency called “Dark Energy Crystals” (DEC) by completing quests.

In September, Splinterlands grew to 245,000 daily UAW. That’s a whopping 3,260% increase when compared to June’s totals. The growth spike brought over 58 million transactions which pushed the game’s market cap to over $200 million.

P2E crypto-gaming newcomers Alien Worlds and Upland have also grown their player bases in 2021. Upland lets players own virtual lands that mimic real cities such as New York and San Francisco. It has been one of the most played blockchain games so far in 2021.

Alien Worlds, a space mining and battle game, averages over 500,000 monthly active wallets. In only one week, Splinterlands and Alien Worlds cumulatively attracted over a million UAW’s.

Binance Chain has joined as well. It used to be completely reliant on its version of DeFi protocols. But now, it hosts multiple thriving crypto-gaming protocols such as MOBOX and CryptoBlades.

The Metaverse and Play-to-Earn

While the rush to play-to-earn is disrupting the gaming paradigm, something bigger is looming on the horizon – the metaverse.

Neal Stephenson’s sci-fi novel “Snow Crash” originally conceived the metaverse, while Ernest Cline’s “Ready Player One” popularized it. Moreover, the metaverse is a place in virtual reality where individuals can play, trade, socialize, and create things. It could one day potentially change the way we build communities.

Blockchain-based virtual worlds collected over $56M in trading volumes in Q3, with The Sandbox leading the way. The Sandbox is similar to Minecraft, in which players can build experiences monetized with the in-game currency, “SAND”. The Sandbox has also formed key partnerships with big players such as Atari and Snoop Dogg.

Some other popular metaverse games on the blockchain include Somnium Space, CryptoVoxels, Treeverse, and Ember Sword. Interestingly enough, the decentralized metaverse is transforming into a virtual reality ecosystem based on P2E games.

Players are finally beginning to understand the unlocked potential of gaming on the blockchain. Especially now with all the media attention on the metaverse. While so much of what is to come is still in development, venture capitalists (VCs) are already taking notice.

VC Interest in Play-to-Earn

Some projections for the video game industry look for it to surpass $200 billion by 2023. Furthermore, World of Warcraft generated over $10 billion in revenue during the last ten years, and blockchain-based virtual worlds are not that far behind when you consider their novelty.

The P2E movement is gaining steam along with it and has already attracted some big investors. The VC firm Andreessen Horowitz (a16z) recently invested $150 million in Sky Mavis, creators of Axie Infinity.

Another is Sorare, a startup P2E fantasy football game that secured $680 million in a “Series B” round from SoftBank’s “Vision Fund 2”.

Dapper Labs, the firm behind NBA Top Shot, and CryptoKitties collected over $600 million in investment rounds from VCs that, again, includes a16z.

Animoca Brands quietly dropped an undisclosed amount on Star Atlas. It’s an upcoming P2E game that will run on Solana. Due to its tokenomics, and multiple game NFTs, Star Atlas seeks to build a galactic economy that includes politics, mining plots, and, more importantly, battles. Along with Star Atlas, Animoca’s portfolio includes Arc8, Revv Racing, and The Sandbox.

Huobi joins the party armed with a $10 million fund to unload on crypto gaming. Having already invested in several early-stage projects, including Immutable X, Supernova, and Rangers Protocol, Huobi has high hopes for the play-to-earn sector.

More Play-to-Earn Games

Even though they lack AAA status, Solana has other upcoming play-to-earn games worth checking out. These include Aurory, Cryowar, Ninja Game, and Project Seed.

Illuvium is another P2E game that will run on the Immutable X blockchain. Immutable X is a layer-2 solution that uses zero-knowledge Rollups (zk-Rollups) for its consensus mechanism. Layer-2 is essential because it gives gamers a gas-free playing experience.

On Illuvium, players can capture and breed called “Illuvials,” which are game creatures. It is similar to Pokemon in that regard. Its tokenomics, mechanics, and graphics have earned it a AAA game rating.

Gala Games is a startup looking to create a decentralized ecosystem based on play-to-earn games. It has other projects in the works.

Thus far, though, it has only launched “Town Star”. It is a play-to-earn farming game that rewards its players with its network’s native token, GALA.

The Future of Play-to-Earn in Crypto Gaming

Play-to-earn empowers gamers by granting them capital based on their playing time. With approximately 2.5 billion gamers around the globe coupled with innovative blockchain technology and the disruptive nature of P2E games, something exciting could be afoot.

VCs are throwing millions of dollars at the space, and the influx of capital will help pave the way for a new generation of P2E games. The future certainly looks bright, and a bevy of new micro-economies will undoubtedly spring up in the process.

Retail investors will have to tread lightly, however. There is also lots of “vaporware” out there. These fake protocols exist to make their founders rich before they cut and run, so buyers beware!

You can invest in P2E games, or you could build your own. To become a blockchain developer and start creating your crypto-gaming empire, you’ll need to learn how to code. Join Moralis Academy and take the 2021 JavaScript Programming for Blockchain Developers course if you’re new to programming. What’s more, Moralis features a comprehensive NFT API if you want to look into NFT game development. Why not start today?