Tokenomics study how cryptocurrencies work in the broader context of crypto ecosystems and the related policies. Specifically, understanding tokenomics if you want to understand the crypto market better, to one day be able to become a top-notch crypto investor, it's better to do your own research. But what does that mean exactly? We always hear influencers qualifying their coin picks with, "this is not financial advice, do your own research." However, it does little good if you don't know where to start researching.

That's why today we're going through the topic of “tokenomics”. Analyzing a project's tokenomics is the very least you should do before you decide to invest in it. With cryptocurrencies, you'll also want to blend some traditional technical analysis from the old-school stock trading world as well as some on-chain analysis.

We won't be covering these topics in this article, but you can get up to speed by taking the Algorithmic Trading & Technical Analysis Course at Ivan on Tech Academy. Also, you can check out our article, "On-Chain Analysis and DeFi."

What are Tokenomics? Token Economics

Haven't you ever wondered what makes certain cryptocurrencies more valuable than others? Let's look at two that have been in the news lately—Bitcoin and Dogecoin. They are similar to each other, yet one BTC is worth roughly $48,000 today, and one DOGE is worth roughly 5 cents. Why is that? Tokenomics can give us some answers.

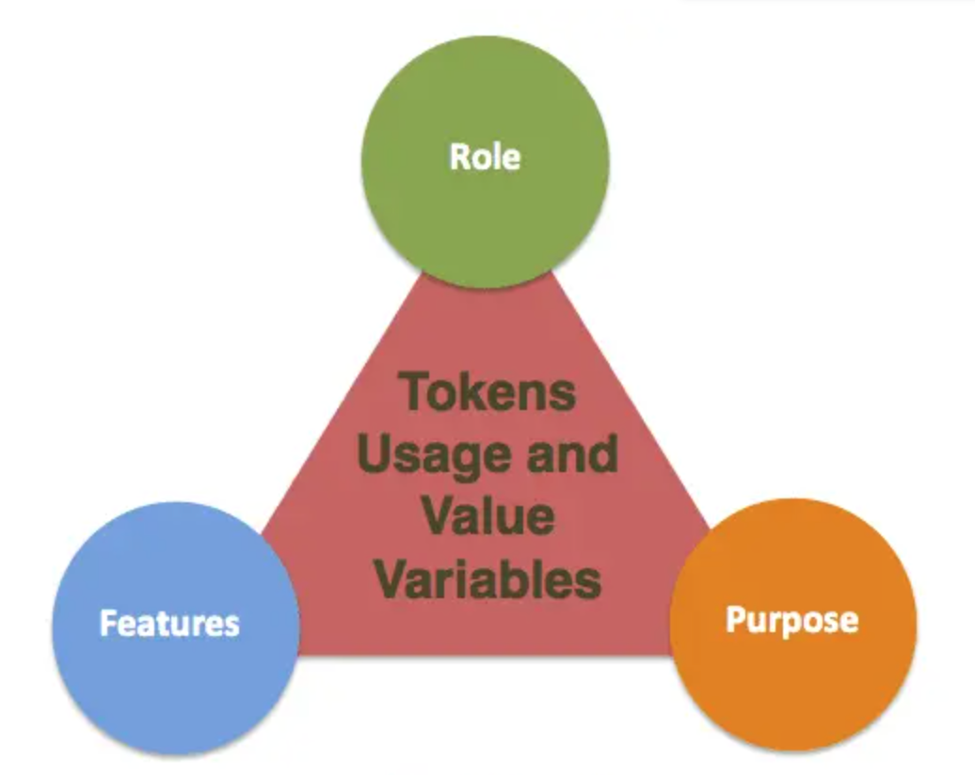

The term tokenomics stands for “Token Economics”. That's a good way to remember it. Tokenomics refers to a token's quality and consists of anything that impacts the token's value. Quality and value are things that will either convince smart investors to buy or avoid a token. This sounds like it can lead one down a myriad of rabbit holes. But not to fear, it will all make sense in the end.

Before we start on our journey, however, let's clarify the terms "coins" vs. "tokens." You'll hear these terms used interchangeably; however, coins and tokens are two different things in the "cryptoverse."

What are Tokenomics? Coins vs. Tokens

First off, coins are native to their blockchain. While they can have other uses, coins are most often used as money. So, coins are cryptocurrencies native to their own blockchains like Bitcoin or Ethereum. According to the Securities and Exchange Commission (SEC), they function like currencies. Hence both BTC and ETH are listed as such.

On the other hand, tokens serve a different purpose. They have unique use cases and represent "things" in their ecosystem. But they are not necessarily limited to one specific role. Tokens can represent things like a stake or voting rights, and they can exist on multiple blockchains. Decentraland, for example, burns its MANA token when purchasing digital assets on its marketplace.

Now that you know the difference, you can be a tremendous bore at parties and correct people who use the terms "token" or "coin" out of context.

But there is another reason for recognizing the difference, and that is government regulations. Regulators treat coins and tokens differently, and this matters to you as an investor. Some tokens have characteristics that make them eerily similar to company stocks, and the last thing you want is for the SEC to come along and slap your project with a hefty fine or, worse yet, shut it down.

Crypto Ratings Council

Therefore, before investing in a token long-term, you'll want to know if the proper paperwork has been filed with regulators and if your project has a competent legal team running interference in case of potential flare-ups.

If your token runs the risk of being labeled as a security, you may want to avoid investing or at least be prepared to dump quickly. The Crypto Ratings Council evaluates many of the major cryptocurrencies and rates them based on regulatory action risk. You can also read about a real-life example of this in our article, "Exploring the SEC Ripple (XRP) Lawsuit."

In this article, we will use either the term "tokens" or "coins" in our examples for brevity's sake. But understand that the aspects of tokenomics we're discussing will typically apply to both coins and tokens.

To sum up, we’ve already covered coins vs. tokens and we'll be covering the remaining aspects of tokenomics in this order: supply, allocation, use-case.

What are Tokenomics? Supply

Token supply is the first thing you'll want to check. Let's go back to Dogecoin. DOGE is one of the biggest cryptocurrencies based on market capitalization (market cap), standing at about $6 billion. Its coin has a massive supply but a low dollar value.

Yearn.finance's YFI token has a smaller market cap (approximately $1 billion), yet its token's price has rivaled Bitcoin's in the past. Presently it's about $33k.

So, knowing this, can you hypothesize why YFI has more potential for doubling its value than DOGE? Well, it's easier for a cryptocurrency to double in value when it has a market cap of 1 billion instead of one that's already amassed 6 billion. CoinGecko is a good resource for checking your coin’s price and market cap. It calculates the market cap by multiplying the coins in circulation by the current price.

So, when considering an investment, take a look at a cryptocurrency's market cap and not just its price per coin. If you want to take it to a higher level, remember that most cryptocurrencies have coins that are locked or have not yet been mined. That means they're not in circulation.

CoinGecko represents this with what's called a "fully diluted valuation figure." Essentially, this is a theoretical market cap based on every coin being in circulation. You can also find this figure on block explorers like Etherscan or Binance's BSCscan.

Inflationary vs. Deflationary

So, what is tokenomics? Well, if you've been investing in the crypto markets for a while, then you know that another factor to consider is whether a token is inflationary or deflationary. Proof of Stake (POS) cryptos use inflation to incentivize validators and delegators on their network. DeFi tokens use inflation to reward liquidity providers and yield farmers.

To keep their annual percentage yield (APY) high, some DeFi tokens maintain aggressive inflation schedules. This kind of activity has prompted Yearn Finance founder Andre Cronje to advise traders to earn DeFi tokens by using them (as a liquidity provider or yield farmer) rather than merely buying them on an exchange.

Too much inflation can reduce a coin's value based on supply and demand. A reduction in supply over time, however, can increase the value of that cryptocurrency. If you want to become a rock star DeFi developer like Andre Cronje, get started with the DeFi 101 course at Ivan on Tech Academy today!

Deflationary Tactics

While deflationary tactics may not have a huge impact in the short term, they are part of the reason why cryptos like Bitcoin keep climbing in value. Yes, miners create new BTC every ten minutes. However, with a maximum supply of 21 million coins and the fact that the number of new coins created per block is slashed in half every four years (the halving), not to mention accidental loss, all add up to make Bitcoin deflationary. One whale alone was reported to have lost his password that will forever separate him from his beloved 7,000 BTC. At today's price, that adds up to a $350 million loss. Ouch!

Moreover, each time this kind of human error occurs, the total supply of BTC in circulation drops.

Technically, Ethereum is inflationary, but it becomes deflationary when the network gets overloaded and fees burning ETH more than compensate for the inflation rate. Also, those staking on ETH 2.0 will have their coins locked for a period, and even if the price rockets skyward during this time, they will have to sit on their hands and watch. This means a percentage of ETH will be locked, restricting the circulating supply, which brings us to "staking."

Staking

When you stake on a network as a validator or delegator, your coins are locked up for a period. For POS cryptos like Polkadot, over 60% of DOT is being staked, and these tokens are locked in for 28 days. That means if the price explodes during this time, only those who aren't staked will be able to cash in.

Other POS cryptos like Cardano don't have lock-up periods for those looking to stake. So, positive price fluctuations could be more rapidly squashed as everyone moves to cash in. Therefore, staking with lock-in requirements can have a restrictive effect on supply.

What are Tokenomics? Allocation

To figure out a project's token allocation and distribution, check out their whitepaper. Make sure to figure out the lock-up period for the team and advisors. Projects with long lock-up periods will have better potential in the long run. The last thing you want to do is invest in a new coin and immediately see the insiders dumping their tokens on the market. That will quickly deflate the price.

Fair Launch vs. Pre-Mine

Cryptocurrencies are either created by fair launch or by pre-mine. A fair launch happens when a community of people collectively mine a coin, so there are no token allocations. This was the case with Bitcoin, Dogecoin, and Litecoin.

Allocation is present with pre-mined cryptocurrencies, however. A pre-mine happens when a project mints some or even all the tokens before openly selling to the public. Pre-mines are used to raise funds by selling tokens before public launch.

It's not unusual to see most of the pre-mined tokens allocated to venture capital firms along with the project's team members, with only a small percentage available to regular investors in an ICO. This can result in small circulating supplies. It can also be detrimental to growth when these insiders start to unload their tokens for quick profits in a bull run.

Researching Allocation

To determine how a project has allocated its tokens, you can research the details for ERC-20 tokens on Etherscan. BSCscan is used for Binance tokens. You'll have to use native Blockchain Explorers for other tokens, which can be a little trickier. Regardless if a token was a fair launch or a pre-mine, this is a good way to double-check the stated allocations vs. the actual allocations.

One thing to be aware of is that some tokens are held in smart contracts rather than wallets. If you don't correctly make this distinction, the data may look like a few whales are hoarding the lion's share of coins in their wallet, when in fact, the actual distribution might be quite equitable.

Take a look at DOGE, for example, and you'll see that one wallet holds a sizable percentage. This is never good from a tokenomics perspective. If a few whales hold a large portion of coins, it means they can unload their holdings at any time.

Pre-Mined Vesting and Inflation

Vesting applies to pre-mined tokens. It refers to how the project will allocate its tokens in the future. It's common practice for pre-mine projects to lock up a portion of their tokens for gradual release. This reassures investors that the private investors and the team won't be flooding the market with tokens by cashing in quickly. Vesting schedules typically play out over multiple years.

Be careful if you see a vesting schedule that unlocks too many tokens at once, which as already stated, can sink the price action over the short term.

What are Tokenomics? Use Case (Utility)

When discussing tokenomics, a use-case can include anything that drives demand for a coin. Let's look at the top two coins:

Bitcoin has been called "digital gold" because its primary use case is a store of value. That's important in today's market, seeing how poorly fiat currencies are performing in that regard.

Ethereum's primary use case is to pay fees to use the decentralized applications (dApps) built on it. With all the dApps and ERC-20 tokens moving around, there is a great demand for ETH to pay gas fees.

Utility vs. Security

If a token can beat the Howey test, it can be classified as a utility token and not as a security. Utility tokens provide users with a service or product and can also grant their holders rights to use a network or participate in governance with their vote.

However, if a token is deemed a security, the project is subject to federal securities and regulations.

What is Tokenomics? Conclusion

Tokenomics is too vast a subject to cover in one article. However, this will provide you with a good start in your research. For some of you, it may have been too much information. If that is the case, here is a shortlist:

- Fair launch is preferable to a pre-mine.

- Deflationary is preferable to Inflationary.

If inflation is necessary, check for minimal inflation schedules and coin burning to pay network fees.

- Good use cases are preferable to non-existent or, worse yet, nonsensical use cases.

- Combine Technical Analysis with On-Chain Analysis.

Having said that, there are always exceptions to the rules, but these are some of the favorable factors to watch out for when evaluating medium or long-term opportunities.

Now, if you’re ready to up your game and become an expert in all things crypto, sign up with Ivan on Tech Academy and start your education today. A good place to start is the Crypto Basics Course!

Author: MindFrac