Altcoins have been stirring up a lot of noise within the crypto community lately. Alts appear to be setting the scene for this coming bull market, with Bitcoin recently pumping back up to its highest price seen since 2017.

In this article, we’re going to explore the different types of altcoins on the market, but more importantly, key factors to help you learn what makes an altcoin valuable, including tips and strategies commonly used to yield high returns on altcoin investments. Firstly, let’s start with the basics:

What Is An Altcoin?

Simply put, an altcoin is an umbrella term for any alternative coin to Bitcoin.

You may see or hear coins being referenced by another category name such as tokens, stablecoins, scamcoins, or shitcoins, but fundamentally they are all different types of altcoins.

Why Do We Have Altcoins?

Bitcoin was the original cryptocurrency created using blockchain technology. Although the protocol is uniquely valuable, some people thought that Bitcoin was too slow to process payments and would not be useful for everyday transactions.

As such, a ‘fork’ of the Bitcoin blockchain was created, introducing changes to the Bitcoin code that could allow payments to be processed up to twice as fast as Bitcoin. This is what we know today as Litecoin.

Litecoin became the first successful altcoin in 2011 after a brief competition with the now unheard-of Namecoin, which fizzled out later that year.

Some people were unhappy with Bitcoin and wanted to change its properties. Unable to do so, they would create their own coin with their preferred properties.

The biggest reason why we have some 5000 different altcoins on the market today, is thanks to a young developer named Vitalik Buterin.

The co-founder and writer for Bitcoin Magazine, Buterin was blown away by blockchain technology and proposed to build a project on top of the Bitcoin blockchain.

Following the rejection of the Bitcoin community, Vitalik took matters into his own hands and began creating the Ethereum network. The Ethereum white paper was proposed in 2013 with the official public launch in early 2015.

Programmable Money

The native Ethereum token ETH is the largest altcoin by market cap and has provided a platform for developers and programmers to build decentralized applications and cryptocurrency tokens. The ETH token powers the Ethereum Network and is required by developers to build on the platform.

The programming language used by the Ethereum Network is called Solidity. Solidity is a ‘Turing complete’ language that allows for the use of smart contracts, for the first time ever allowing money to be programmed. This allowed users to automatically move currency from address A to address B upon specified conditions being met within an immutable smart contract, opening up a world of possibilities for cryptocurrency programmers.

Despite early skepticism towards Ethereum, the sentiment around the second largest cryptocurrency has changed considerably. In the years after its launch, Ethereum would go on to revolutionize the cryptocurrency space with the introduction of ICOs and later, Defi.

Biggest Altcoins Right Now

Anyone can make an altcoin, give it any name and function. What makes an altcoin valuable is if there are clear use cases and demand for it.

Ethereum

Ethereum (ETH) is a perfect example of this. Ethereum is the foundation protocol responsible for the first wave of blockchain-based decentralized finance applications (Dapps), allowing for interoperability between projects built on the Ethereum network. Ethereum created the ERC-20 token standard, which would act as a universally recognized framework for the creation of many new cryptocurrencies. ERC-20 tokens gave rise to a host of new crypto wallets which would allow a multitude of tokens to be transacted and stored from a single Ethereum wallet address.

As of October 2019, there were around 200,000 different ERC-20 tokens coexisting on the Ethereum blockchain. Many within the crypto community argue that ETH is undervalued given the importance of the cryptocurrency, which at the time of writing is valued at a shy $333, down from its all-time high of $1,432.88 in early 2018.

Recently however, Ethereum has been pumping hard, gaining almost 27% in the last week of July. This is likely due to demand for ETH, as it is used to power smart contracts and Defi applications. Defi has become huge in 2020, as the Ethereum 2.0 upgrade approaches it is likely to expand dramatically.

One glance at Defi Pulse shows that Ethereum is the lynchpin of decentralized finance and has been key to its success. The Ethereum community is cheering from the sidelines as many crypto influencers anticipate big moves from the #2 cryptocurrency.

ChainLink

ChainLink is a decentralized oracle solution which is used to connect real-world, off-chain data to the blockchain. ChainLink’s native token LINK has been one of the highest performing altcoins of the year as uses cases for the ERC-20 token continue to increase in Defi and enterprise.

The ChainLink team has announced partnerships almost every week for the majority of 2020, introducing the LINK community to global business partners including Google, Binance, BetProtocol, Swipewallet, Tezos, and many more. You can check out the full list of partnerships here.

ChainLink recently launched ChainLink VRF, which utilizes verifiable random functions to generate randomness which is verifiable on-chain, which is critical for storing sensitive information securely within smart contracts. A bit like picking digitally randomized names from an invisible hat, Chainlink can generate provably randomized outcomes of events that can be observed on-chain.

Synonymous with the growth and success of ChainLink are the ‘Link Marines’ who make up the rapidly-expanding LINK community. Active around the clock on Twitter, Discord, and Telegram, ChainLink has one of the most supportive communities of any individual project in the space.

XRP

XRP is another popular altcoin with an incredibly strong community, though can often be referenced in the punch line of a joke due to XRP’s price movements (or there-lack-of) over the past 2 years. The “XRP Army” have their own blog for news and updates – by the XRP Community, for the #XRPCommunity

XRP is the native token of the XRP Ledger – an open-source, borderless, and decentralized blockchain technology that aims to settle transactions within 3-5 seconds.

On 7th December 2017 XRP was valued at $0.22, 30 days later on 7th January 2018 the coin reached its’ all-time high of $3.40. Despite this, XRP has a coin market cap of nearly $12 billion – 3rd largest following Bitcoin ($213B) and Ethereum ($39B). XRP pumped by 30% in the last week of July to $0.26.

Altcoin Factors to Look Out For

Here we have listed key points to consider when looking at what makes an altcoin valuable. Ideally, an altcoin should be performing well in these areas to minimize risks as alts are often extremely volatile in comparison to Bitcoin and it can be difficult to establish whether it is a good investment or not.

Fundamentals

Do you understand exactly what kind of value this altcoin is offering? What does it do? Not just for the hodlers of the coin but also think about what this project is bringing to the broader community, is it something new? Does the asset have intrinsic value? What function does the coin or token serve in the ecosystem of the underlying project?

Use Cases

The use case of an altcoin is something you should always consider before investing in it. DYOR (do your own research) about the function the coin serves. Is it solving a problem? Does the coin offer a more efficient solution to something out there already? Can you see this coin being used by thousands of people every day?

Market Cap

We are still in the early stages of adoption with a lot of potential for Bitcoin’s market cap to grown from billions to trillions. However, to make substantial gains in the short-term, many choose to trek deep into the Altcoin Forest and search for small market cap coins with the potential to go to 10X-100X. A coin with a market cap already in the hundreds of millions is unlikely to achieve such sizeable gains as this would put the market cap above that of Bitcoin, which for most coins is an unlikely scenario.

That being said, the smaller the market cap, the bigger the associated risk. Providing that you only invest what you can afford to lose, however, big rewards in crypto usually require a certain amount of risk. If you can find an altcoin which is new to the scene and has solid fundamentals and use cases, with a market cap of less than $50,000,000 – the odds are that you stand a chance of making a large return.

You can view an altcoin’s market cap by visiting coinmarketcap.com or coingecko.com, both providing clear and up-to-date information about thousands of cryptocurrencies.

Trading Volume

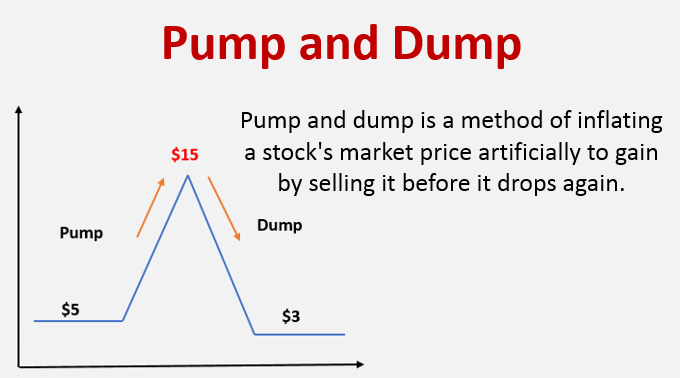

In addition to the market cap of smaller altcoins, it is also very important that you check the recent trading volumes before choosing to get a bag.

With lower market caps come lower trading volumes, which can increase the chance of a ‘whale’ dumping their coins and manipulating the price. The risk of this decreases as the trading volume of the coin grows, and the number of coins required to manipulate the price grows in number and is higher in price.

Available Exchanges

When searching for new altcoins it’s worth checking to see whether or not it is available on reputable exchanges such as Uniswap.

Finding coins that are yet to be listed on major centralized exchanges will generally give you higher returns than coins that already are listed on Coinbase or Binance for example.

This is because you’ll have the opportunity to invest before the coin gets the price exposure to the broader crypto community. Major exchange listings often result in a short-term pump, so being ahead of the curve can be profitable.

Development Team

DYOR (do your own research) about the development team of the project and altcoin you’re looking at. Are they experienced with blockchain? Have they been in the space for a while and are they active on their Github repository?

It’s essential when choosing a coin to invest in, that you do a bit of digging on the developers to confirm who they are and to gain an understanding of the vision for the project.

Pumpamentals

Pumpamentals are contributing factors to a project’s success that are not specific to fundamentals, rather the community and hype supporting the project and the narrative behind it. The hype is often a major factor in the performance of exotic cryptocurrencies.

Marketing Team

You could have the best coin in the world, but without a decent marketing team, nobody would see it or hear about it. Some projects prefer a ‘soft’ launch with no marketing, quietly entering the space hoping that the project is so good it will go viral without any marketing material behind it.

Other projects have announcements of announcements of announcements and have active marketing teams across all online platforms.

HEX’s recent marketing campaign included pitch-side advertising boards at a professional football match and taxi-wrapping in London. One thing to bear in mind though: promoting “11,500% gains” will probably get people talking, but could come across to the average Joe as if it’s a scam.

Still, the increased offline exposure is good for the overall cryptocurrency movement, signaling broader awareness and adoption of cryptocurrency.

Social Media + Github

Have a look round the altcoin’s social platforms and see if you can gauge an idea of how active they are and how responsive the community is.

A project may have scheduled posts to be published 2-3 times a day with lots of fresh content, but if the audience and the community show little interaction, it’s not particularly a good sign.

The crypto community is at large on Twitter and Discord, but depending on the project’s audience demographic, it may also have an active profile on Facebook and Instagram.

Coca Cola vs Pepsi

What does this project offer that has previously worked well? Has it introduced a new twist to an existing successful use case? There is opportunity and space for unlimited options in crypto, however, human psychology will generally favor a frontrunner, or the next best thing – i.e Coca-Cola or Pepsi.

In this example, ChainLink is Coca-Cola and Band Protocol is Pepsi. ChainLink is the original decentralized oracle provider, while Band has recently joined the scene as Link’s little brother, offering similar data integration solutions while striving to prevent on-chain congestion on the Ethereum network by building on the COSMOS blockchain.

Bull Run Narrative

Does this coin fit with the narrative of this coming bull market?

In 2013 we had Bitcoin but ‘X’, i.e. “it’s like Bitcoin but faster“.

In 2017 we saw Ethereum taking off and the introduction of ICOs.

In 2020 people are talking about decentralized finance, DeFi derivatives, oracles, enterprise, and interoperability.

Is the altcoin you’re researching in line with the current narrative? Will the team’s vision for the project be realized in time for the next bull market?

When Is The Best Time To Buy Altcoins?

Pre-pump or Post-dump

If you see an altcoin that has pumped 30%-40% or more in the past 24 hours, the chances are that investing at this stage could result in a major price correction. Chasing a rally usually results in losing money. The odds are stacked against you when the price is going up.

Many prefer to keep a close eye on the coin and wait for it to drop. If a coin is pumping wildly, it can’t last forever and in most cases, there will be some sort of correction.

At this stage, it could be an ideal time to grab yourself a bag – post-dump. Or, if you’re able to do your research well, pre-pump, when the price correction of the coin has consolidated and the technical indicators look bullish again.

What Makes An Altcoin Valuable: Conclusion

It’s an exciting time for the crypto community as we’re sat the edge of our seats waiting for the coming bull run to take momentum.

With over 5000 cryptocurrencies on the market, many traders and investors are looking beyond Bitcoin for speculative gains after the “Grandfather of Crypto” traded sideways for much of 2020. Although some altcoins tend to pose a higher risk than Bitcoin, many could also offer substantially higher returns if you’re able to time the market correctly.

With this is in mind it is very, very important that you only invest with what you can afford to lose – don’t bet the farm and keep your emotions out of the way!

Doing your own research by learning about the development of future projects and innovations in the space is part of the excitement. We strongly encourage you to do your investigations across several different platforms and draw your own conclusions about the projects you invest in.

With an understanding of what makes an altcoin valuable and an idea of what to look for in an altcoin, trekking through the Altcoin Forest is considerably more rewarding. Remember, the forest is right next door to Rekt City, so be careful out there!