One of the reasons blockchain technology has become such a well-known technology and keeps growing rapidly is the rise of cryptocurrencies. Bitcoin is often what pops up in people’s minds when they hear the word cryptocurrency. This might not be strange since it was Bitcoin that was the spark for the whole cryptocurrency spectacle. But Bitcoin is just one of the currencies out there, and there is a lot more to this phenomenon.

Few people around the world have never heard about cryptocurrencies. But what are cryptocurrencies, and how do they work? In this post, we will go through the basics and give you an idea of what cryptocurrencies are.

How does crypto work?

The mysterious “Satoshi Nakamoto” is the creator of Bitcoin, but this premier cryptocurrency is actually a byproduct of another invention. The invention that first was intended as a” Peer-to-peer cash system”. This was a revolutionary invention that many people had tried to realize, but they had not been successful.

The most important part of the digital cash system is Bitcoin because no centralized authority has control over it. The system is fully decentralized and not under anyone’s control.

Before Bitcoin, there was no digital currency, but in the nineties, many people had made reasonable efforts without being successful. Since none of the other attempts to create a cryptocurrency before had failed, many people gave up on the concept.

The previous attempts were often a centralized currency, which might have been the reason that they failed. This made Satoshi Nakamoto employ a decentralized system for digital currency – Bitcoin – instead, which has proven to be more successful.

Double Spending

The basics of a cash system are transactions, balance, and accounts. As such, these traits are given for any type of currency. However, a critical aspect of any cash system is double-spending. This is a big problem, and it means that people are spending the same money. Traditional currencies and cash systems do this through a centralized authority that keeps records in balance on a server.

Since Bitcoin and other cryptocurrencies are decentralized, they do not have a central server that can track how the balance is at the current moment. This is a significant issue since it would allow for double-spending. This means that everyone part of the network will need information on all the transactions made. If they fail to do this, it might become the case that two people spend the same cash.

This problem does not sound so significant if all the people in the system agree on every transaction. But if not everyone agrees, this becomes a huge problem. Only one faulty transaction can screw up the whole balance in the system.

This is precisely the problem that Nakamoto solved when inventing Bitcoin. A system that would allow everyone involved to be in consensus with one another without having a central authority to keep the record straight. This was what made any cryptocurrency possible and is the reason that virtual currencies have exploded and taken over the world.

What are cryptocurrencies?

The definition of a cryptocurrency is not far from the definition of any regular currency out there. Firstly, there needs to be a set amount of entities – money – and no single person can change the record of the balance without special circumstances. And this definition is basically the same for both regular currency and cryptocurrencies. But it is actually not just as simple as this, and the two are different in many other aspects.

For example, physical currencies such as notes and coins are in correlation with the definition above. It is impossible to change the number of coins that you have in your pocket without fulfilling particular circumstances or conditions.

One condition might be that you make a sale, for example, this would increase the number of coins that you possess, but it would also lower the amount that the customer has in his/her pocket. There is also often a record of who made the transaction and why it was made. This information is then stored in a database with information on the transaction, balance, and the accounts that were involved.

Blockchain

The technology that makes this possible on a practical level is blockchain. Blockchain utilizes a crypto-graphical function to make sure that the information on transactions can’t be falsified and changed by anyone. This validation means that a majority of the network needs to confirm a transaction for it to become legitimate.

The record is kept in blocks that show the current state of the currency when the block was formed. When a transaction is then made, another block forms and so on. This is also the reason that technology is called a blockchain. The formation of a new block occurs when a majority of the network confirm a transaction.

The new block contains a cryptographic signature from the previous block, and this signature is known as a hash. This means that a clear record of every transaction exists, and the hash verifies everything.

The verification process

To understand Bitcoin and cryptocurrencies, we will need to know how someone can verify a transaction and how to create new coins. Bitcoin, for example, employs a lot of peers. All of the people that are peers have access to the records of every transaction ever. This also means that everyone in the network has access to all the records regarding the balance of the currency.

Everyone in the network receives a key; this key allows for transactions between people trading Bitcoin. This key is used to sign a transaction, which is then confirmed by the rest of the network. After signing a transaction, the information makes its way from one peer to another which is how the verification of the block works. People call this technology” Peer-to-Peer” technology, which is a big part of cryptocurrencies such as Bitcoin.

Miners

The verification process is one of the most important aspects of Bitcoin. Once a transaction is made, it immediately can be seen by the whole network, but it has to be validated by several people before the transaction is made.

When the transaction is pending, the transaction is changeable. This means that before the transaction is confirmed by the validators, it can still be edited and changed. When the validators are done confirming a transaction, a change can never occur. Confirmation of a block, therefore, means that no one can change the information of that block. This is part of the security that blockchain provides. It also gives everyone a record that can not be meddled with, which means it harder to commit fraud.

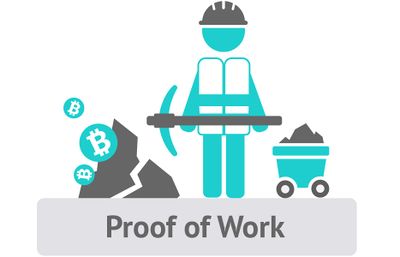

The validators of a transaction are actually known as Miners. It is their duty and function within a cryptocurrency to confirm the transactions. Whenever a miner validates a transaction, the information is added to every node in the network. Therefore, it is the miner’s job to make sure a transaction is fair and then distribute this information to everyone in the network.

This is basically a work position where the miner receives some sort of compensation. The miners in Bitcoin, for example, receive bitcoin if they confirm transactions. But what is cryptocurrency mining really?

Mining cryptocurrency

To explain what a cryptocurrency is, we need to talk about the mining process. Since the system is fully decentralized, no one can control it. This also means that no one can give someone the task of becoming a miner. But this does also mean that no one can prevent anyone from becoming a miner.

For this system to actually function, there needs to be a system that prevents anyone from abusing this. If someone were able to create an infinite number of peers, the system would break since it would mean that one person could verify a transaction through all their peers. This would instantly mean that transactions would be able to be falsified.

To solve this issue, Nakamoto utilizes what is known as SHA 256 algorithm, which means that the miners can confirm their work, something that is known as “Proof-of-Work”. To be able to mine someone also need a computer that meets som requirement. The miner needs a powerful computer since it is required to find a hash. The verification that connects one block to another in the blockchain.

To build a block within the blockchain, a miner essentially needs to solve a puzzle. People are calling this puzzle a cryptologic puzzle. A block forms whenever a miner solves the puzzle. As a reward for this work, the miner receives payment in the form of, for example, Bitcoin.

The difficulty of this puzzle increases as more are solved, which means that more computer power is needed. Since the puzzles increase in difficulty, this also means that the puzzles will become unsolvable in the future. If the puzzles then are unsolvable, no more of the currency can be created.

The properties of cryptocurrencies

Take a look at the funds in your regular account in your bank. These funds are under the control of your bank, which poses a problem. The amount of the funds can instantly change if someone decides to change it. Meddling with the database is a possibility that causes can cause a problem.

Cryptocurrencies, on the other hand, can not be meddled within the same way as regular currency can be a victim of. The thing that makes cryptocurrencies secure and unchangeable by people is cryptography. This is great since it is not controlled by trust in other people, but by actual math. Since it actually is math that secures the currency, it is super hard to compromise the network. It is also noteworthy that all cryptocurrencies can have different properties.

Five properties of cryptocurrencies

- The first property that we are listing is the fact that transactions are irreversible. This means that no-one, not even the creator of a cryptocurrency, can change a purchase once it has undergone the confirmation process. This is good in several ways, but it also means that anyone dealing in this currency needs to be extra careful. If someone sends money to a scammer, for example, no one can reverse this process.

- It is always possible to look at the flow of every transaction on a crypto network, but it is impossible to know which people are involved. This is possible since everyone receives an account with 30 different letters, numbers, and other characters, which means that everyone is unidentifiable.

- Since the currency is entirely virtual, transactions can be done in a matter of seconds. A confirmation can be done in just a few minutes, and the currency can also be sent all over the globe.

- A cryptocurrency is also extremely secure since only the owner of a private key can send cryptocurrencies.

- There are no limitations to a cryptocurrency. No one can decide if it is okay to send currency to another person. There is no issuing authority that can prevent you from conducting a transaction.

Cryptocurrencies also have a unique monetary value

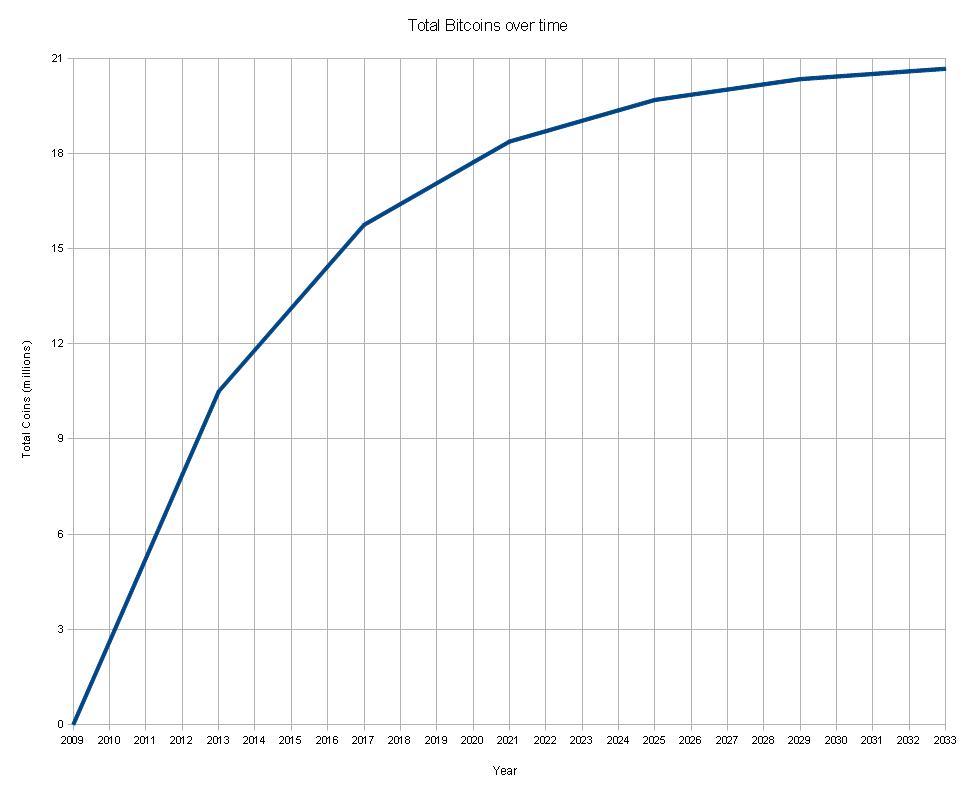

Firstly, cryptocurrencies such as Bitcoin will reach a maximum limit. Experts have calculated the creation of new Bitcoins will reach its end in 120 years. This is due to the total number of Bitcoins being finite. This is unlike regular currencies, fiat currencies, which can be created by a government or a bank if needed.

It is also possible to establish the exact number of Bitcoins that will one day exist. Nothing will be able to change that fact.

Total amount of Bitcoin

Secondly, the tokens in cryptocurrencies only represent what they really are. For example, in a regular fiat-money system, the numbers that are on display is only debt. This is also one of the reasons why cryptocurrencies might have a superior monetary value than regular currencies.

A combination of the properties and monetary properties of cryptocurrencies is what is making them so interesting. No single entity such as a government can control the currency, they can not know who made a transaction and they can not stop anyone from making a transaction.

For example, the monetary properties off, such as Bitcoin, also means that the currency is not under the control of a central bank. This means that the banks lose their control over inflation and deflation since they can not print more money when they want to.

Revolutionary aspects of cryptocurrency

Prior to the launch of Bitcoin, no-one knew the impact that cryptocurrencies would come to have on the world. Cryptocurrencies are out of anyone’s control, and people call it digital gold. The reason behind this is because it shares a lot of properties with regular gold. For example, no one can create an infinite number of Bitcoins since it has to be mined, just like Bitcoin.

The fact that everyone is completely anonymous also means that cryptocurrencies can have a negative impact. It allows for black market trades, which can become a problem in the world since it allows for illegal transactions.

But the fact that it is a form of payment is just a small part of the impact that cryptocurrencies have in the world. Another important part of these virtual currencies is the fact that they can store value, just like gold can. But one has to be careful since cryptocurrencies are extremely volatile. They can increase rapidly just to decrease even more rapidly in a matter of hours.

A list of different cryptocurrencies

In this article, we talk a lot about bitcoin, but there are several other virtual currencies out there. Here is a list of popular cryptocurrencies:

- Bitcoin

Bitcoin is by far the most popular cryptocurrency. People do also often associate Bitcoin with the word cryptocurrency. The currency was first introduced in 2008 and is probably here to stay even longer into the future.

- Ethereum

Vitalik Buterin is behind the cryptocurrency Ethereum and is also one of the more popular currencies out there. Ethereum actually can not only validate the balance of the currency but is also able to perform programs and contracts.

- Ripple

It is impossible to mine Ripple which is one thing that separates this currency from Bitcoin. The coins were already pre-made which means that no new coins can be issued.

- Litecoin

Litecoin can be seen as a little brother of Bitcoin and was one of the first currencies to follow the giant Bitcoin. Once aspect, where Litecoin beat Bitcoin, is the fact that it is faster and one difference from Bitcoin is that it runs on another mining algorithm.

- Monero

Monero is running on a different algorithm known as CryptoNight. This algorithm allows for more privacy than for example Bitcoin. All the transactions in the bitcoin network are public so there is always a trail of the money. Monero on the other hand, with a ring-signature, made the information of each transaction private.

If you want to learn more about cryptocurrencies and blockchain, tune in to the number one blockchain education platform Ivan on Tech Academy for several unique blockchain courses.