In this report, we explore PoS, PoW, and more in-depth, detailing the historical evolution of consensus mechanisms and protocol security.

Issue 9

November 18, 2022

The State Of Web3 Development

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. The downfall of FTX and Alameda sent shockwaves through the industry and they’ve now entered Chapter 11 bankruptcy proceedings in the US, in a filing of over 100 different companies under the same umbrella. The ripples from the collapse are being felt by other Cexes, CeFi, Institutional lenders and protocols in the Solana ecosystem which were closely tied.

FTX have a new CEO in charge after Sam Bankman-Fried stepped down. John Ray is a restructuring expert and has been brought in to guide the company through bankruptcy. Some of his comments made in the first filings are quite telling, saying he’s never seen anything as bad as FTX in over 40 years of restructuring. That there’s been a total absence of any lasting records of decision-making, who was working for the FTX Group or what their terms of employment were and even a list of major creditors.

Without records or paper-trails it’s going to make the job of unraveling this mess even harder so anybody who’s lost out should prepare for a long wait before finding out if there’ll be anything left to salvage with any certainty. One current optimistic theory is that FTX lent Alameda several billion dollars of depositors funds and much of that has been put into early stage projects which will eventually be recoverable. During the last bull market that may well have been possible, however there are now several important considerations.

Some projects may have had their funds on FTX as part of their agreement with Alameda or FTX Ventures. Some may never get to launch now that reputations and plans are damaged.

As well let’s not forget that if FTX lent exchange customer funds out then it was against the terms of their agreement and the court is bound to want to examine this.

John Ray revealed that Alameda had a ‘secret exemption’ from liquidations on FTX which would suggest they held an advantage when trading or launching their new venture tokens. For example, the rise of the Solana ecosystem was intricately woven with FTX and Alameda, and many projects were relying on this symbiotic relationship. Considering the state of the market, vesting periods and damaged reputations then it’s likely to take a long time to recoup this proportion of depositors funds.

Users are rightfully concerned and this has led to a flurry of panic to withdraw from other exchanges with the threat of contagion we’ve unfortunately become used to in 2022. Genesis, an institutional lender, has been forced to halt withdrawals this week and Crypto.com has been under fire for the consistency of their declared holdings.

If there’s anything positive that can come from this it’ll be industry wide adoption of Proof of Reserves solutions. These are designed to prove at regular snapshots how many assets entities hold in comparison to their liabilities. Making this the norm would give users greater confidence in the platform they are using and any that refused to do so would be less likely to succeed. After every exchange like Mt.Gox, Quadriga or FTX collapse it’s said that Cexes are one of the major weaknesses in the industry.

One of the best things we can do through the ongoing bear market is to continue to help others understand how to self-custody their assets and use hardware wallets. This option isn’t without its own set of risks either, so best practices must be adequately understood to enable it to be an extra segment of a fully diversified portfolio.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

Nov 18th, 2022 09:00 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday

movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods

of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information,

I will adjust my opinion accordingly.

Disclosure: I hold Bitcoin, Ethereum, Luna and Solana ETP price tracker certificates in ISK through my bank. Through company ownership I also hold small exposure to misc. additional tokens.

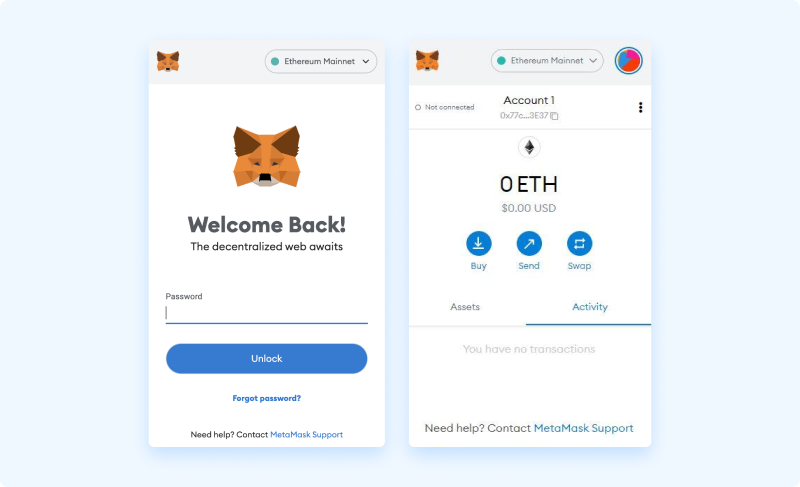

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet, or mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Now that we have a good understanding of the purpose and security practices surrounding seed phrases. Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed:

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

The State of web3 Development

Introduction

With the crypto contagion caused by the fall of FTX and other associated companies, the web3 ecosystem has seen one of its worst weeks ever. Bitcoin’s price dropped by over 21% within the week, making this situation particularly challenging for cryptocurrency holders and investors. More than 28% – $250B of value was wiped out from the total market capitalization of crypto assets. Despite these adverse events, we observed that developers are still more active than ever in building web3 projects.

In this report, we explored the state of web3 Development based on two metrics. Firstly, based on the engagement of developers in the GitHub repositories of open source web3 projects. Secondly, based on internal metrics from the number of API requests we get on each chain for projects building using Moralis.

Most of the data for the first part is based on results published by Electric Capital in their 2021 web3 developers report and the most recent report published by Telstra ventures. Furthermore, we used data from Dappraddar for the number of existing Dapps.

People Also Read

If today’s candle closes like this, Bitcoin once again flips previous resistance into new support! Fantastic! Very positive! Again!

Exploring Web3 data analytics tool, Dune Analytics and giving a spotlight on a few crypto projects we find interesting.