Exploring some of the projects which made it to the finals of the Moralis x Google Defining Defi Hackathon sponsored

Issue 9

December 2, 2022

Deep Dive: Dune Analytics & Projects Spotlights

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. Whilst Bitcoin and the rest of the crypto market show signs of settling, the focus returns to regulators and governments on their next moves.

It’s clear existing regulators have so far failed to either protect or prevent the majority of any users’ losses and as a nascent innovative industry focused on financial self-responsibility we’ve rarely wanted them to do so. However in the public eye there may come an inflection point where in order to reach mass adoption the perception needs to be that assets are better protected.

We often look to the US to lead with their policies but there are of course hundreds of different jurisdictions. Many blockchain projects already choose to register offshore in places that are easier to operate, so the door will always be open to less than genuine projects that operate somewhere with lack of oversight or ability to enforce regulations. Even with strict government regulations the collapse of projects won’t necessarily be prevented.

What is needed is more self-regulation of the industry where genuine players are better placed to know what and how to avoid disasters. This, combined with a universal effort on educating users on the different levels of risk and assessment of grades of projects they are choosing to interact with, will still allow innovation to flourish.

The result could be something similar to what is seen in Traditional Finance but without having to necessarily report to any government. FINRA-FInancial Industry Regulatory Authority in the US and FCA-Financial Conduct Authority in the UK are examples. These are funded by membership fees and/or fines levied on members.

The benefit for members to join is they can then say to the public they are part of these schemes and to become well established players in global finance, they need to join. The public perception is also that anything not part of them isn’t to be trusted.

In crypto we don’t yet have any agreed benchmarks for users to base their decisions on. But we also don’t want to create a monopolistic situation where only the large players thrive. If established crypto projects begin to voluntarily gather together to form a similar self-regulatory group then it will be a good start.

Binance is taking steps to lead with a recovery fund, but proactive self-regulation where best practices are established is also needed. However the caveat in nascent industries is fierce competition and teams wanting to remain agile. They don’t want to reveal their operations and future plans to competitors too early, nor be policed by a larger player.

So the answer may be somewhere in the middle. Bluechip projects being able and positioned to join, but startups wanting to go to market quickly and without oversight are able to still do so without hindrance on their innovative potential. Maybe a monetary benchmark could then be set, for example a certain amount of trading volume, say $100M or a certain TVL, say $20M before the rest of the members want them to apply to join and commit to the best practices.

If the whole industry can rally to educate the public on the different types of project, different levels of regulation and different levels of risk exposure before they choose to participate it will benefit everybody who is genuinely in this for the improvement of humanity and not just monetary opportunism.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

Dec 2nd, 2022 09:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds.

Disclosure: I hold Bitcoin and Ethereum exposure, both through company ownership and in my personal capacity, as ETP price tracker certificates in ISK through my bank.

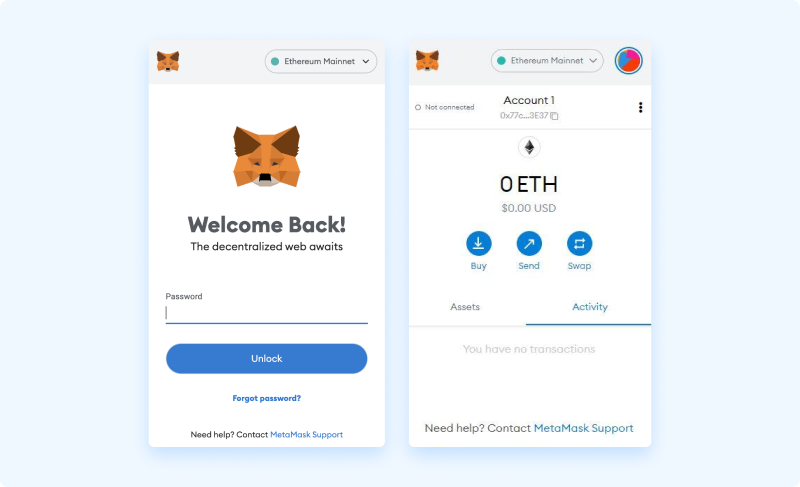

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet, or mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Now that we have a good understanding of the purpose and security practices surrounding seed phrases. Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed:

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Dune Analytics Deep-Dive & Project Spotlights

Introduction

While public blockchain data is free and available to everyone, getting, structuring, and making sense of this data proves very challenging. Previously Dune Analytics, now known as just Dune allows anyone to access blockchain databases for free. With Dune, anyone can create and access crypto dashboards, which can assist in spotting trends and making informed decisions.

Founded in 2018, Dune Analytics was launched in 2019 in Oslo, Norway, by Fredrik Haga and Mats Olsen. Since then, Dune has grown exponentially, with users from around the world joining in to leverage the on-chain analytics it provides. Dune is a community-driven platform made up of analysts, traders, and enthusiastic data nerds who create and openly share their queries which can then be forked and remixed in many ways by others. This community is what makes Dune different from other blockchain data analytics platforms. The platform currently supports data from Ethereum — including layer-2 solutions such as Polygon, Optimism — Binance Smart Chain, and Gnosis Chain.

This report will dive deeper into on-chain analysis using Dune and demonstrate how to query blockchain data and create accessible dashboards on the platform.

People Also Read

We are hitting up at the multi-year ~30k resistance. On very short timeframes price has formed a very well-defined rectangle,

Despite price action drama yesterday, when taking a step back, the situation remains the same as last week, and it’s