Consensus Mechanisms

Introduction

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. With the ongoing macroeconomic uncertainty Bitcoin has gotten closer to making new lows. Some crypto native companies are still swooping around and looking for bargain businesses to strengthen their positions going into the next cycle.

The US based FOMC met again this week to announce a 75bps rate rise and presented a continued hawkish outlook with forecasts that interest rates will continue to rise well into 2023. At the moment economists are predicting another 75bps rise in early November and then 50bps in mid-December.

These forecasts can and do change though as new data comes in. The FED are particularly interested in inflation and unemployment figures. For inflation the CPI- Consumer Price Index- often grabs the headlines because it’s a basket of goods for personal consumption and the figure represents the changes in cost of living that an average person would experience.

But then there’s the PPI- Producer Price Index- which is a more volatile figure representing the changes in the costs that producers have to deliver consumer goods and services. Supply side prices fluctuate more and therefore the PPI can be a more sensitive and sometimes more accurate index to base interest rate decisions on. This is because businesses will often absorb input price shocks for a while rather than immediately pass them onto consumers with regular or volatile price changes.

With unemployment data the FED looks at the percentage of people without work. At the moment they actually want this percentage to increase and more people to be unemployed. This would demonstrate business curtailing and an overall decrease in activity and spending in an economy.

During a bear market it’s ripe for acquisitions to take place and the crypto market is no different. There are major players who’ve been better placed to weather the storm and realize that now is an optimum time to acquire less fortunate companies. These could be distressed businesses, like some of the CeFi lenders, or they could just be undervalued businesses which the acquirer seeks to strengthen their core business going into the next cycle.

CNBC reported that FTX, a privately held company, is looking to raise an additional $1B as part of their ongoing acquisition drive. In July they made a deal for the first option to buy CeFi lender BlockFi and were interested in acquiring Bithumb the South Korean CEX. They also made an offer to purchase Voyager but this was so far refused for being too low.

Binance, another CEX behemoth, is also known to be interested in acquiring not only crypto business but also non-crypto business. Earlier in the year CZ announced he was looking at acquiring 1 or 2 businesses in several target sectors with a view to bringing them into the crypto realm. Owning an already established business brings industry expertise and could be a faster route than trying to build one from the ground up.

Let’s see, this is interesting because it could also bring new people to the crypto industry and help advance the next push for mass market adoption!

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

With Great Respect,

Ivan Liljeqvist

Web3 Wallet: Start Guide

Metamask Wallet

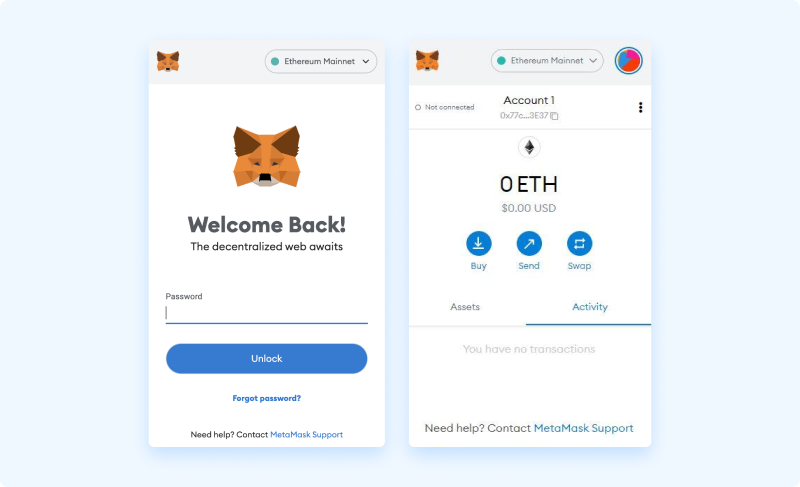

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

Bitcoin dominance remains range bound, as drawn below.

A range can break out in either direction and it’s usually a mistake to try to guess in which direction, before it has actually happened.

At one point it will, and that will be my clue for how to position myself between BTC and alts for the next major move of the markets.

The chart is here shown with 3 day candles.

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Consensus Mechanisms

Introduction

Ever since the first attempt at building a decentralized network, the question of achieving consensus among different network participants has always been a challenge. In 2009, Satoshi Nakamoto launched the Bitcoin network using the Proof-of-Work (PoW) consensus mechanism.

This method allowed nodes all over the world to communicate and run a network in a decentralized manner for the first time ever. PoW has since gained popularity and has been used in many subsequent projects over the years.

However, due to some flaws in the PoW system such as its high energy consumption, other ways of achieving consensus have emerged. In this section, we are going to explore other methods for achieving consensus in distributed systems.

What is a Consensus Mechanism?

Consensus mechanisms are the complete stack of ideas, protocols and incentives that enable a distributed set of nodes to agree on the state of a blockchain.

Consensus mechanisms allow the blockchain’s nodes – the computers that run the blockchain and keep records of all transactions to reach this agreement reliably. As public blockchains are decentralized, they require a framework that allows all participants to agree on the validity of cryptocurrency transactions. The goal of consensus mechanisms is to ensure all participants act ethically and in the interest of the network.

Why Consensus is important?

In crypto, a consensus mechanism prevents bad actors from deliberately cheating. A classic example of crypto cheating is “double-spending.” In this scenario, Anthony, the bad guy, transfers 10 tokens to Bethany and then tries to transfer 10 tokens to Chris at the exact same time.

The challenge is to ensure everyone knows and agrees who owns which tokens. As a result of that agreement, Chris would know that Anthony no longer owns the tokens he is proposing to send. An actor who wishes to “double-spend” would have to convince the nodes to adopt a false history of transactions, in which he/she has not spent the tokens and given them to Bethany.

Double-spending can be prevented by consensus mechanisms that make it expensive and difficult to propose a new block of validated transactions, which discourages bad actors from doing so. Additionally, the mechanisms encourage “good” nodes to propose blocks they genuinely believe will be accepted in order to receive valuable rewards. Anthony will not be able to falsify Bethany’s transaction on the blockchain if there are more good actors than bad actors.