Axelar enables cross-chain communication that goes beyond bridging. Explore one of the cutting-edge tools pioneering a chain-agnostic future.

Issue 21

February 17, 2023

The State of Layer 2s: Arbitrum vs. Optimism

Contents

Introduction

By The Moralis Research Team

Welcome back, everybody. It’s been another exciting week in crypto, and we’re pleased to bring you the next edition of Moralis Research. Today, we will be interested in getting your feedback on the content of these reports. Please take a few minutes to give us your feedback here.

This week we saw a good rebound in the market, with bitcoin rising by more than 15%. However, many still fear whether this is the confirmation of a rebound or just a bull trap. A potential Wyckoff accumulation could be playing out. Only time will tell whether the price continues from here or we get a reversal.

Regulators continue to crack down on crypto. The SEC labeled BUSD as an unregistered security and is therefore suing its issuer, Paxos. However, many crypto talking heads wonder whether this ruling makes sense as people buying BUSD have no expectation of receiving a profit in return. As CZ – Binance CEO stated, if BUSD is ruled as a security by the US courts, it will profoundly impact how the crypto industry will develop (or not develop) in the jurisdictions where it is ruled as such. We think it is in the interest of the USA to allow USD-denominated stablecoins in crypto as they enable people to price crypto assets in the world’s reserve currency, the dollar.

In a scenario where the US bans stablecoins completely, the industry would still find a way to price assets on-chain, as was the case before the arrival of stablecoins. Altcoins could be priced in terms of BTC or ETH. Or the emergence of completely decentralized algorithmic stablecoins such as LUSD will be useful.

In traditional markets, the hype around AI is starting to die down as Microsoft’s AI Bing chatbot fumbles answers. Testers of the bot have been subjected to insults and disturbing answers, prompting concerns over its safety. Microsoft replied to this by saying they learned a lot during the testing phase and will use this feedback to improve the service.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report, please remember to fill out the feedback form, your feedback is valued, and we’re always open to suggestions.

Web3 Wallet: Start Guide

Metamask Wallet

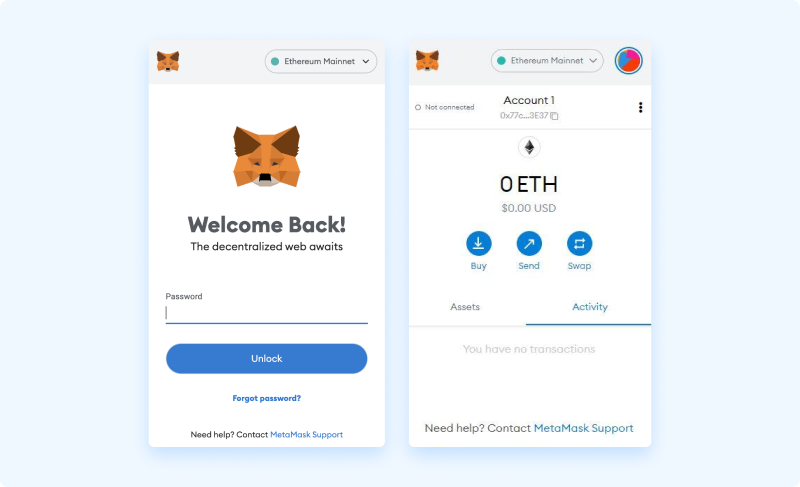

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet or the mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

The State of Layer 2s: Arbitrum vs. Optimism

Introduction

Ethereum Layer 2 (L2) networks have grown to attract most of the activity and value from the underlying Ethereum Layer 1 chain. L2 chains have seen ETH-denominated TVL, user bases, and transaction counts soar over the course of 2022.

Ethereum’s L2s are now consistently processing more transactions than Ethereum’s L1 and are beginning to make their mark as Ethereum’s predominant scaling solution.

People Also Read

We are hitting up at the multi-year ~30k resistance. On lower timeframes, the price has formed a well-defined rectangle.

Ethereum's up coming Shanghai upgrade will enable withdrawals for staked ETH on the Beacon Chain. As a result Liquid Staking