In this report, we explore PoS, PoW, and more in-depth, detailing the historical evolution of consensus mechanisms and protocol security.

Issue 13

January 6, 2023

2023: The year of Liquid Staking Derivative Protocols?

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. Happy New Year and I hope you’ve all had a great festive celebration whatever you’ve done. Now we can look forward to the year ahead and get back to the work that needs to be done for the crypto industry to continue making progress.

This time last year everything was bullish, it felt like everybody was on top of the world with excitement. Well that was the time to take profits. At the beginning of last year risk management and taking profits was a key part of a successful cycle.

2022 was then filled with a flurry of calamities and lots of bearishness following the collapse of flagship projects, services or exchanges. Diversification was therefore also a key part of surviving the contagion and collapse.

Sadly many of the newcomers who came during the bullishness have now disappeared because they failed to take profits and depending on when they joined through the bull market could even be underwater. Or there are those who got caught in the collapse of a CeFi or CEX who are writing off the rest of crypto as a scam.

At this point in the cycle it’s the opposite to one year ago. With the negative feeling and amount of people who’ve lost interest then it’s similar to previous bear markets when people lost in the Mt Gox collapse or failed ICO projects. The mainstream media and herd mentality went through a period of thinking it was all over.

People who were new or weren’t deeply involved in the space don’t necessarily understand the technology and sometimes just give up in all the emotion. But now’s the time for them to zoom out and realize what’s happening. Anybody who thinks the bear market will continue forever isn’t seeing the bigger picture.

Those who fail to see the bigger picture because they’re too caught in any losses of the previous cycle will then inevitably miss the point of maximum opportunity in the upcoming cycle!

The genie is out of the bottle with the decentralized revolution. More people crave freedom and independence, more people work online and have the ability to manage themselves. Financial independence and financial autonomy is a big part of the revolution and cryptocurrency is a key cog in the machine of making all this possible. But it’s not the only part.

There’s a trend in decentralization across lots of different industries that aren’t directly related to currency and Web 3.0 is enhancing lots of these trends. Before individuals could sell their digital art through social media. Now there’s decentralized and provable NFT art. Before there was independent journalism. Now there’s uncensorable independent journalism. Before there was p2p gaming. Now there’s the open and ownable metaverse.

Web3 is so much more than just yams, yield, or yolo pumps. It’s a growing part of society.

We’ve got to do our best to get the people who lost interest back once they understand the true potential of decentralization and Web3. Those lessons of the past will then form their wisdom of their future!

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

January 6th, 2023 | 09:00 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds.

Disclosure: I hold Bitcoin and Ethereum exposure, both through company ownership and in my personal capacity, as ETP price tracker certificates in ISK through my bank.

Trend Analysis

Bitcoin (BTC)

I have a feeling we might get a major pump.

Bitcoin (DOMINANCE)

Bitcoin dominance excluding stablecoins rejected at the major support

Solana (SOL)

SOL has had a recovery this week.

Bitcoin

(BTC) Bitcoin remains in downtrend

Happy New Year!

The Bitcoin trend was down for the entire year 2022. What will 2023 look like?

I have a feeling we might get a major pump. But I’m not buying back yet.

Ideally I would love to see another flush down to an identifiable support level, to give a controlled entry with a controlled invalidation level. Of course the market doesn’t care about what I want, but if that happens, I want to have my thought process clear so I’m ready to pull the trigger, if it happens.

For now, it’s hard for me to see a controlled entry here. Price just got rejected at the support/resistance line we’ve had drawn since early December and the trend remains down.

If we get another catastrophic event causing another sell-off, what could be logical points of support? The two obvious ones are the 13.8k level, from the 2019 top, and the 11.8k level from the volumes during 2019-2020 (VRVP on right).

If we get a touchdown and reversal on one of those, I might gamble an entry against the trend.

If that doesn’t happen and we instead get a trend reversal (Larsson Line flipping gold) I will also probably buy that event and be ready to scale in heavily if we still get retracements to support with the trend still up.

I’ll need to keep this report a little short due to travel, but there is also nothing much to say about the altcoins since last week. Perhaps with one exception and I will cover that.

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet, or mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next, we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Now that we have a good understanding of the purpose and security practices surrounding seed phrases. Selecting the [Next] button prompts the generation of a new seed phrase, and a related warning is displayed:

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Liquid Staking Derivative Protocols

Introduction

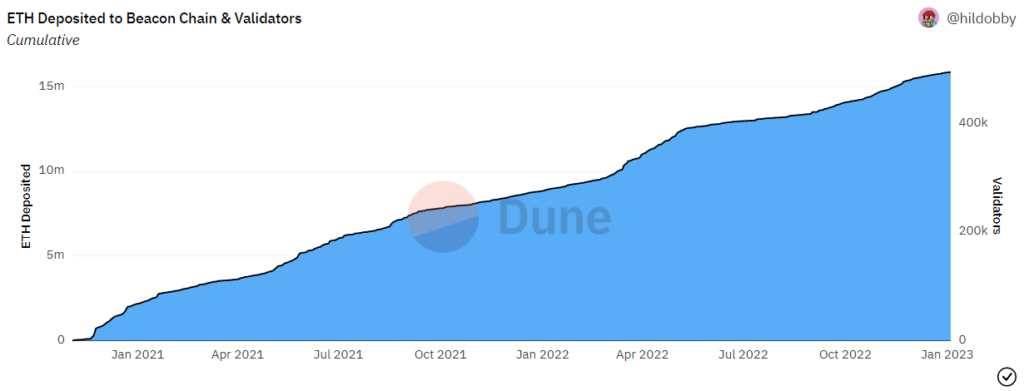

During this market cooldown, one of the sectors experiencing massive growth in the Ethereum Defi ecosystem is the Liquid Staking sector. The amount of ETH staked has soared 79% in 2022, including 14.8% since the merge.

People Also Read

Join us to explore the Aptos blockchain, a new layer-1 PoS (proof-of-stake) blockchain which offers unique and promising features that

Exploring the impact of Account Abstraction by uncovering key innovations, protocols, and Ethereum Improvement Proposals (EIPs), bringing AA to production.