If Bitcoin closes today at current levels, we have a H&S (top) pattern in the chart. The pattern target on

Issue 17

January 27, 2023

Radically Different Defi With Radix?

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. The recent rally in crypto has far outperformed equities, but now macro is back in the spotlight ahead of the first FED interest rate decision of 2023, on Feb 1st next week.

Throughout 2022 crypto markets showed a large correlation with equities markets in the US, so it’s becoming increasingly relevant to have at least a basic understanding of the way traditional finance monitors and controls things. If you can get into a routine of understanding the schedules of data release dates and meetings then you’re already ahead of most people who don’t understand these, let alone the complex economic interdependencies.

There’ll be 8 FED (US central bank) meetings in 2023, the first of which is Tuesday and Wednesday next week, culminating in a decision and announcement on whether they’ll raise, decrease or keep the same interest rate. It will also indicate the amount of quantitative easing/money printing or quantitative tightening/balance sheet reduction that will take place.

The economic data for Q4 of 2022 in the US came in and is showing that GDP, Gross Domestic Product, a crude indicator of an economies growth, grew ~3% for the second quarter in a row. This is holding off recession fears and shows some resilience following the Q1 and Q2 2022 negative growth.

When the interest rate rise decision happens next week the FED will be reacting to the data released since they last met about 6 weeks ago in December. The FED are still laser eyed on bringing inflation down and they will often quote that their main function is controlling inflation.

They do have another unspecified function though and that’s to attempt to calm markets and keep them from overreacting to the decision or becoming too volatile in either direction. After every interest rate decision there is a press conference with the FED chairman, Jerome Powell, who will present a written statement and then answer a few questions. His responses inevitably do still get a reaction from the market and that’s why there’s some increased volatility on the final day of the meeting and press conference.

Currently the markets are gradually pricing in a lower terminal rate than the FED was communicating at the December meeting. This means the expectation of the market is that the FED won’t need to raise as much as originally planned in order to bring inflation down to their target level of 2%. This is based on the data of the past few weeks showing inflation continuing to fall combined with the growth in GDP.

Of course this is a constantly evolving situation. It’s what makes economics such a challenge to predict and why analysts are often off the mark. For example economic data is always backward looking, so by the time it’s released then other forces may already have changed. Black Swan events can and will happen too, such as Covid in 2020 and the Ukraine war in 2022, which really threw predictions out of the window.

Having some understanding of TradFi and central banks such as the FED will only enhance your knowledge of how and why crypto markets react as they do. Even with Bitcoin, DeFi and non-government stablecoins then many of the same economic principles regarding issuance, inflation and available interest rates apply.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

January 27th, 2023 | 13:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds. I don’t give advice to buy or sell specific assets. The education and software tools are timeless and generic for any asset. Rather than relying on subjective market opinions, I apply the principles of technical analysis formulated in 1930s on historical charts. Anyone can apply the same process and get the same result. Technical Analysis does not predict the future. It is a tool to find setups for controlled risk/reward. Larsson Line does not predict the future. It is a mathematical formula for trend expression. My objective with this report is to help you reflect on your own analysis, not to replace it.

Disclosure: I hold Bitcoin and Ethereum exposure through company ownership and in my personal capacity, as ETP price tracker certificates through my bank.

Trend Analysis

Bitcoin (BTC)

Trend is up! Volume gap up to almost 30k.

Ethereum (ETH)

ETH/BTC trend rejected at resistance.

Binance (BNB)

A mixed bag.

Polygon Matic

Hitting up against resistance.

Bitcoin

Trend remains up

Bitcoin has continued trending up since last week.

Now that Larsson Line is gold, I’d love to see a huge price dump with the trend still up, because that means I can buy more. But at the same time it seems most people are still largely sidelined, so I’m not sure the market will give that.

Looking above current levels, the obvious resistance in the chart pattern is the mid-2022 high at about $25k, BUT the volume shows a huge gap all the way up to $28,800. So I would NOT be surprised if this current consolidation is followed by another leg up to around those levels.

For now I’m happy with my positions and I’m not taking any action right now.

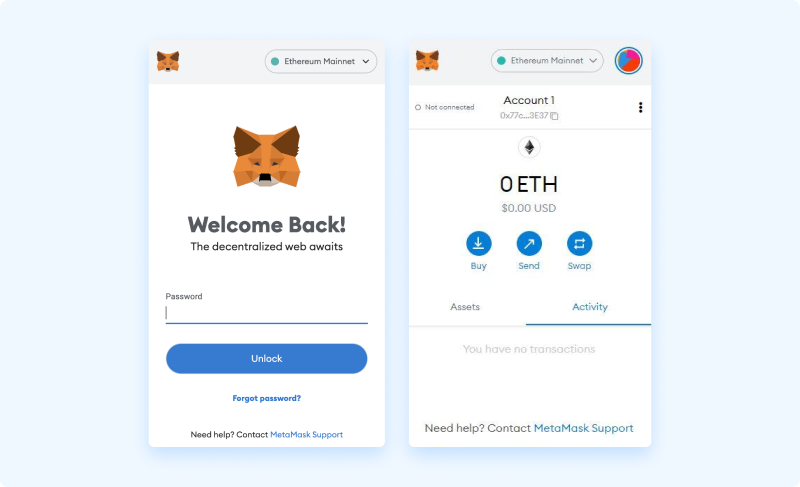

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet or the mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Radically Different Defi with Radix?

Introduction

Last month, the Radix team held their long-awaited #Radfi event, uncovering the many features that the project has been working on for the past 9 years. Radix is focusing on revolutionizing Defi by transforming four pain points in Defi today: the user experience, the programming experience, the execution environment for decentralized applications(dApps), and a better consensus layer.

The Radix team promises to provide a better user experience by creating the Radix wallet, which will be “as safe as traditional finance and as intuitive as the best Web2 apps”. They promise to provide a better programming experience for developers with the Scrypto programming language, potentially having a less complex design and a shorter learning curve. Also, Radix plans to provide a better execution environment for dApps with the Radix engine where “asset behavior is baked in – with assets and asset security being a primary function of the network.” Finally, they plan to provide a better consensus layer with the Cerberus consensus algorithm which will potentially solve the scalability problem of most web3 protocols today.

While most of these features are still promises in the works, the Radix team expects that when all these implementations are shipped per their roadmap, they will reach global adoption of web3.

This section will explore the different features Radix is working on and then give our opinion on whether these implementations will make Defi Radically Different.

People Also Read

As an L2 aggregator, Polygon has a wide variety of decentralized products and services. This reports covers everything Polygon, from

Take a close look at the Moralis X Cronos Hackathon finalists and discover promising new blockchain games on Cronos Network