Polygon Product Updates

Introduction

Welcome back, everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. There were a few different exploits that impacted various elements of different ecosystems this week. So it’s worth pointing out the differences between native and derivative tokens. Particularly those derivatives that live on other networks, and how these compare with Layer 2’s.

Native coins like ETH and BTC only ever live on their original chains. When you see wrapped versions then it’s only as strong as the protocol or entity which is holding the original. For example wBTC is issued by Bitgo and provided they don’t lose the BTC it will be redeemable 1:1.

In the case of centrally issued stablecoin tokens like USDC then the issuer, Circle, must create their own version on other chains and give a promise they’ll be redeemable 1:1 with USD. However, Circle hasn’t issued any stablecoin on Evmos or Moonbeam, two of the newer EVM chains which were proportionally most affected by the Nomad hack. To date Circle has only issued native USDC tokens on Ethereum, Solana, Avalanche, Tron, Algorand, Stellar, Flow and Hedera.

So when earlier this week the Nomad cross-chain bridge suffered an exploit that drained an estimated $190M from the protocol. Anybody who held their ‘mad’ derivative tokens has suffered, even if they weren’t locked in for liquidity or undergoing a bridge via the Nomad protocol. This is because Nomad issued ‘mad’ derivatives of USDC, USDT, ETH and BTC for use across a number of chains.

These derivatives can help to fuel the growth of the newer ecosystems when users want to transfer in the original native tokens but there isn’t any liquidity available. For example, users of Nomad who wanted to bridge in USDC to Evmos had to have a derivative called madUSDC issued. This wasn’t wasn’t a promise by Circle to pay back USDC one-to-one with USD, but rather a derivative of USDC. In effect a promise by the Nomad smart contract to pay back USDC one-to-one with madUSDC from somewhere in it’s cross chain activity.

But when the exploit took place on Nomad these tokens were quickly drained. There was a rush to bridge back to Ethereum and original native assets, which quickly caused large disparity in the value of derivatives compared to the originals. Effectively there was a depeg between mad and natives with the key point being that anybody holding ‘mad’ derivatives across any chain, even if they weren’t using Nomad during the hack, were affected.

This is one of the inherent weaknesses of a cross chain world and leaves people vulnerable to hacks or exploits of bridges even long after they’ve used or interacted with them so it’s a point that Vitalik has raised on many occasions. In comparison Layer 2’s share security with Layer 1 so you have the option not to use one of the cross chain bridges, and fail safes are built in to withdraw back to the original Layer 1 Ethereum.

From a UX perspective there may not be much apparent difference to a user when bridging assets from Ethereum to other networks but it’s good to be aware of the differences. Metamask or any of the wallets may eventually consider differentiating between chains. E.g. Labeling Layer 2 networks as different to other EVM networks.

When bootstrapping an ecosystem derivatives can play an important part in the growth of the chain, but users should pay attention and be aware of the actual tokens which they receive. If derivative tokens lose it’s peg to the native then there’ll be nothing to redeem it back, or in the case of centrally-issued stablecoins no promise to redeem it back to USD.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

With Great Respect,

Ivan Liljeqvist

Cryptocurrency Market Overview and Analysis

August 5th, 2022 09:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intradaymovements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods

of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information,

I will adjust my opinion accordingly.

Disclosure: I hold Bitcoin, Ethereum, Luna and Solana ETP price tracker certificates in ISK through my bank. Through company ownership I also hold small exposure to misc. additional tokens.

Trend Analysis

Bitcoin (BTC)

Wait, what?

Ethereum (ETH)

ETH/USD just below key resistance

Binance (BNB)

Broke out!! 🤩

Cardano (ADA)

Hesitating.

Solana(SOL)

Trend neutral. Bouncing on key support. A breakdown would be bad.

Bitcoin (DOMINANCE)

Range bound between 40-48%.

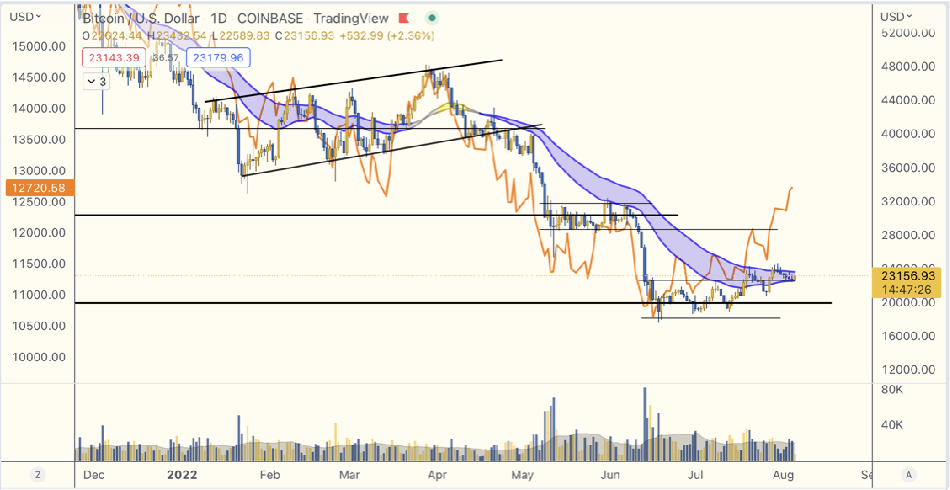

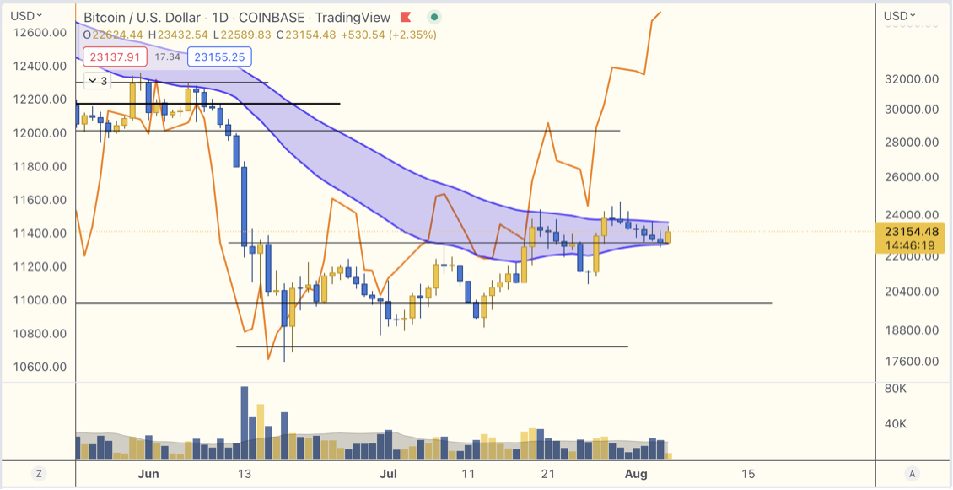

(BTC) No reversal yet

Bitcoin, for the first time in a year+, has stopped following Nasdaq, and not in a good way.

Nasdaq has made a significant recovery and broken through a key resistance, while Bitcoin has been flat and even backed up. Someone is selling!

Zooming in, this becomes even clearer. Nasdaq pulled away during the past week, while Bitcoin didn’t really follow in the recovery. Compare the levels in early June, to mid-June, and then the recovery since then.

We’ll have to see what happens next, but the pattern has changed and unless BTC catches up soon, this is worrying to me.

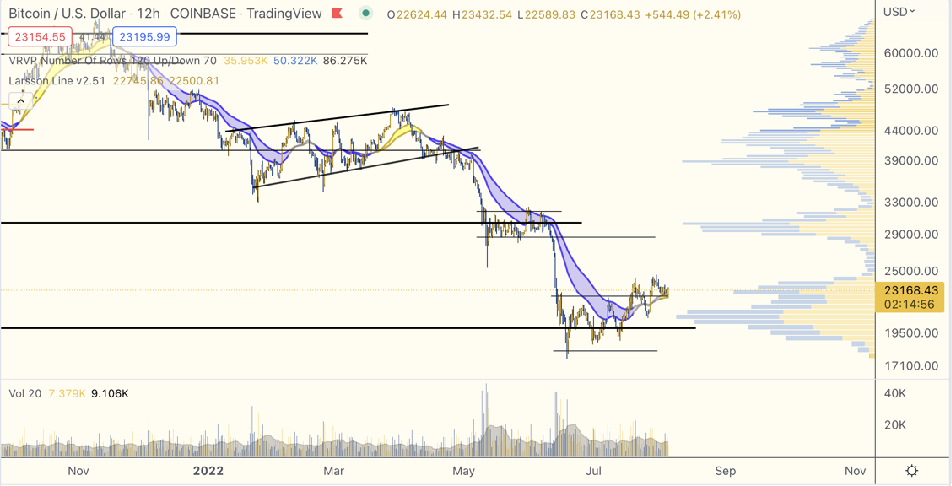

I was planning to say that we could try to switch to a shorter timeframe like 12h for a part of the analysis, to at least test out the theory that the world has accelerated so much that booms and busts happen so much faster in 2022 that we need to adjust the process to adapt. The trend is up (gold) on the 12h timeframe now.

But… now I’m less certain. Signals are in conflict:

- Bitcoin didn’t follow Nasdaq in the recovery

- Trend down on 1D candles

- Trend up on 12h candles

You don’t have to take every good trade.

You just have to take a few and avoid losing money on too many bad ones.

If in doubt, I’d rather wait for more clarity.

Web3 Wallet: Start Guide

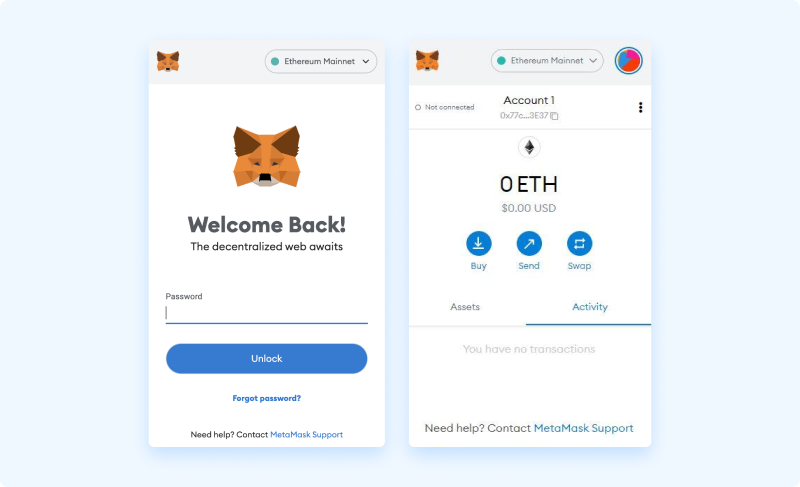

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

Bitcoin dominance remains range bound, as drawn below.

A range can break out in either direction and it’s usually a mistake to try to guess in which direction, before it has actually happened.

At one point it will, and that will be my clue for how to position myself between BTC and alts for the next major move of the markets.

The chart is here shown with 3 day candles.

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.