Intro

01

02

03

Introduction

GM.

What have Facebook Meta, Google, Microsoft, Apple, and Tesla all got in common?

They were all early in their industries.

When the World Wide Web bleeped and clicked into existence via dial-up modems back in the ‘90s, it was a blank slate. Many didn’t see the potential. Web1 was written off as a fad, not even expected to survive into the millennium.

“I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse.”

- Robert Metcalfe, in InfoWorld, 1995

Good call Robert… 🤨

Of course, many people did see the potential. When Web1 first arrived, there was massive innovation – millions of ideas and possibilities being tried and tested, growing and evolving.

Imagine being one of the first people in that space. One of the first to build and create the ideas that would shape Web2, where we are today.

With the right skills and knowledge, you could take your startup or idea into the stratosphere while the doubters fought over scraps in meatspace.

Hindsight is a wonderful thing of course. The truth is, monumental global opportunities like the birth of the internet don’t come around all that often.

Are the days of innovation for Web1 and Web2 over then? Arguably yes, but here’s the good news:

Web3 is the next once-in-a-generation opportunity.

This global, remote-first, and high-paying industry is already pulling talent from traditional industries.

But what is Web3?

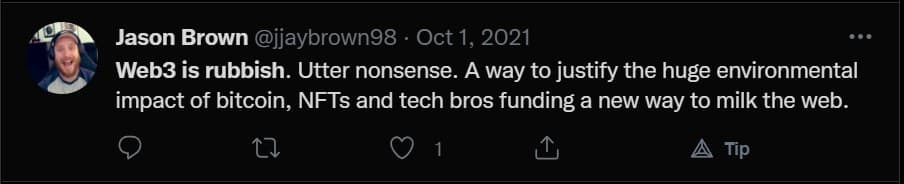

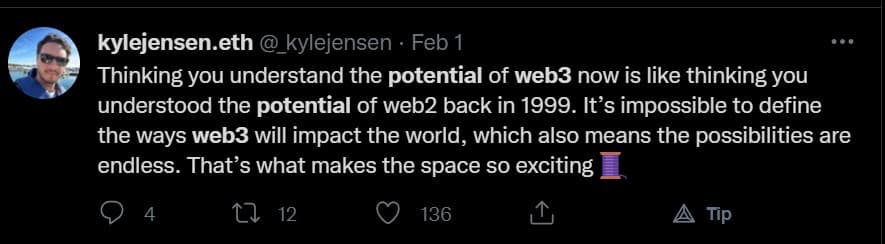

Is it really the future of the internet, or just an idealistic pipedream? Here’s what some people think:

But what is Web3?

Is it really the future of the internet, or just an idealistic pipedream? Here’s

what some people think:

Intro

01

02

03

Step One

Understanding Web3

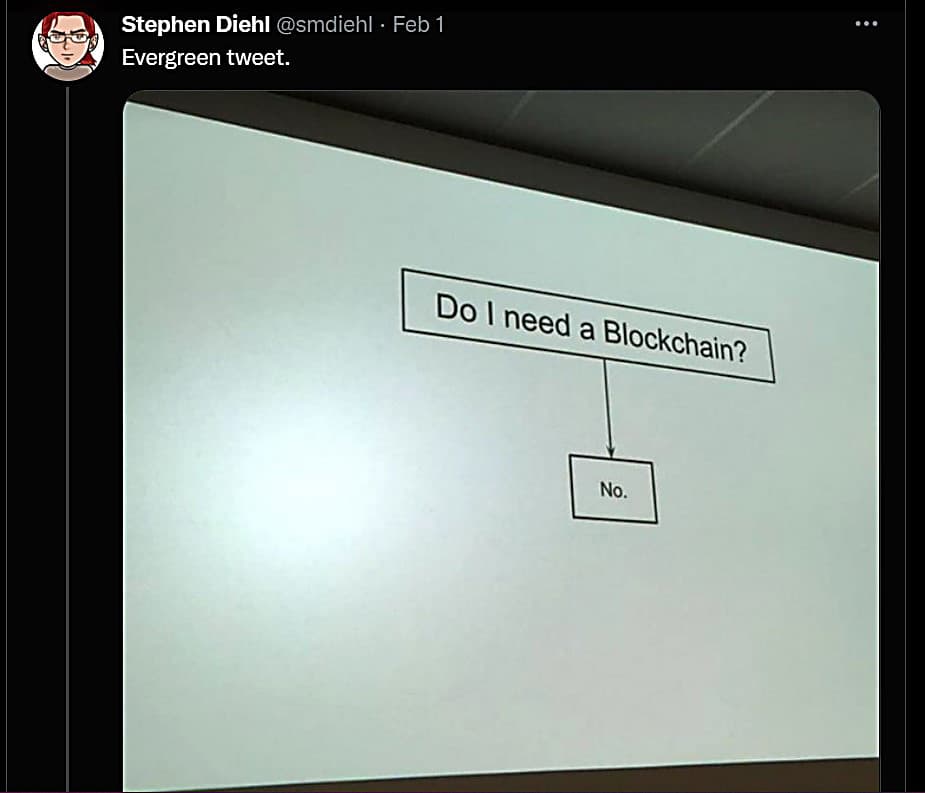

The first thing to understand about Web3, and the cause of the division we’ve seen above, is that it’s a very new thing. What does and does not define Web3 is still up for debate.

However, there are certain principles underlining Web3. It’s DNA. These principles are unlikely to change. This is important, because the current confusion and debates are often centered on how and if Web3 will achieve these core goals.

The fundamental ideology of Web3 is essentially quite simple: A web that empowers the individual by being:

Decentralized:

Public blockchains cannot be controlled by a single individual or entity, like how Big Tech dominates Web2

Permissionless:

No one can restrict your access to a public blockchain, and therefore Web3

What are the benefits of this right now?

- Censorship resistance – content cannot be removed by any central authority

- No gatekeepers – anyone with an internet connection and $10 can interact with Decentralized Finance (DeFi)

- Programmable money – anyone can program their own money, and create their own financial products

- No need for logins or personal information when interacting with Web3

- No personal data can be collected unless you allow it

- All transactions are public

What are the potential benefits in the future?

- Metaverses where buying and selling digital assets and goods is permissionless

- GameFi, or play and earn Web3 gaming that enables ownership of metaverse assets

- Provable, immutable ownership of both digital and real-world assets or information

- A decentralized web owned and operated by individuals, DAOs (Decentralized Autonomous Organizations), and creators, rather than Nation States or Big Tech

Are there challenges?

Of course. That’s also why Web3 needs and attracts the best talent to solve them. Understanding these problems is a more complicated issue. For now, let’s start with the basics. We can break Web3 down into four key components:

- Blockchains (the foundations of the decentralized web)

- Wallets (your ‘ID’ and way of interacting with the decentralized web)

- Cryptocurrencies (the currencies that power blockchain networks and metaverses)

- Smart contracts and dApps (decentralized applications)

LET'S TAKE A CLOSER LOOK AT EACH ONE IN TURN

What is a Blockchain?

A blockchain is simply a database, with one key difference. The data is distributed across a network of computers, rather than kept on one central server.

And here’s the important part – anyone with the required hardware can in principle run a ‘node’ and contribute to the security of the network.

This is how the Bitcoin network operates. It is not controlled by any single authority or organization, but by tens of thousands of individual nodes.

Now, combine this with the fact that for any new data to be written to the blockchain, all nodes must be in agreement that the new data is valid. It must be verified against the rest of the network.

Once new data is verified and added to the blockchain, it is timestamped. This means all historical transactions/data are publicly viewable, permanently recorded, and irreversible.

Example

- You want to send 1BTC to a friend (lucky you for owning 1 BTC!)

- When you send that transaction, it is checked by the nodes against the blockchain to make sure you have enough BTC to make the transaction

- If you do, the transaction will be processed and recorded to the blockchain

- If you don’t (let’s be honest, most of us don’t have 1BTC…), it will be rejected

There’s far more to it of course, and there are many different ways blockchains can operate. Learning in detail how the Bitcoin network works, however, gives you a solid foundation for understanding other blockchains.

What is a Wallet?

Simply put, a crypto or Web3 wallet is both your gateway to the world of Web3, and the place where all your cryptocurrencies and other digital assets, like NFTs, are tracked.

Think of it as one digital identity when interacting with a blockchain (you can have as many ‘identities’ as you have wallets). Your wallet has a unique address, which can both send and receive cryptocurrencies and digital assets, as well as interact with smart contracts.

This means you can interact with any Web3 dApp with one click once you’ve signed in to your wallet.

There are two huge advantages to this.

- Once you’re logged into your wallet, you can connect to and access any dApp on the same network in one click, with no additional security or verification required.

- Your personal details/social accounts are not needed. All any Web3 sites or dApps will see is your wallet address. In the future, you’ll likely be able to control what additional data to send, if you choose to.

Given the huge value of personal data in Web2, and the often unscrupulous methods many of the big players will use to access, exploit, and sell your data, we can start to see the massive power and potential of Web3.

Wallets come in two varieties - software and hardware.

Software wallets:

Are often referred to as ‘hot wallets’ as they are directly connected to the internet and blockchain networks. Metamask is an example of a software wallet, and one of the most popular in the world today.

Hardware wallets:

Also known as ‘cold wallets’ come in the form of hardware that must be connected to a device before interacting with the blockchain.

There are advantages and disadvantages to both software and hardware wallets. You can read more about wallets in Step Three.

What is a Cryptocurrency?

Cryptocurrencies, or tokens, are digital currencies secured by cryptography and digital signatures. This makes creating counterfeit tokens or double-spending basically impossible.

Because cryptocurrencies are built on blockchains, they are not owned or controlled by any single entity, putting them out of reach of central banks, governments, and other bodies. As long as the blockchain is running, cryptocurrency transactions will continue.

This means that anyone with a wallet and some crypto, even a small amount, can access a $240 billion (and growing) network of decentralized financial applications.

You can send and receive currency without permission, to anyone with a wallet, anywhere. You don’t need to be approved by a bank, and you don’t need an arbitrary credit rating to participate.

This fact alone has driven massive adoption and interest from those traditionally locked out of similar financial products.

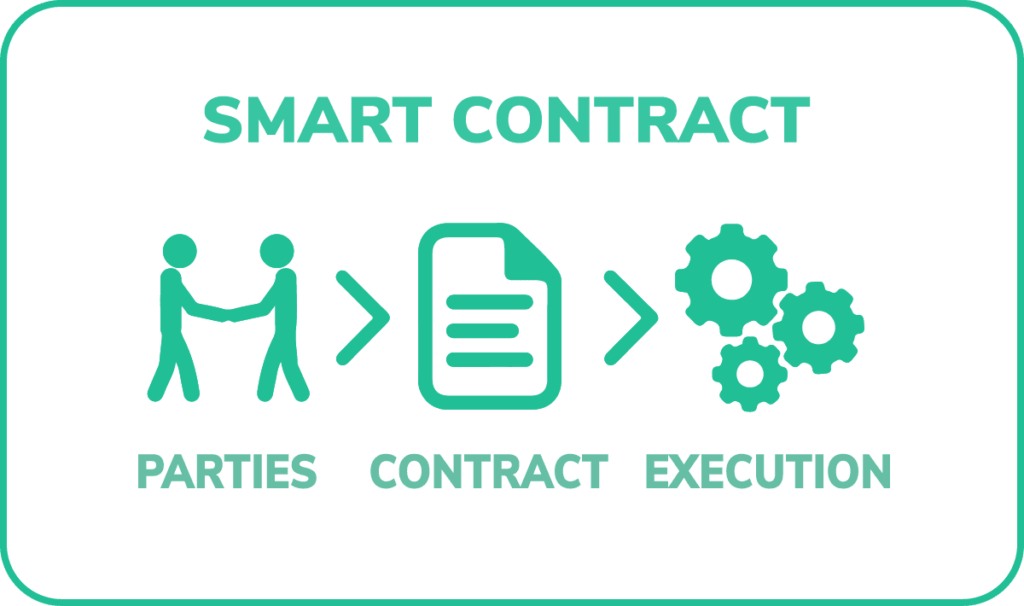

What are Smart Contracts and dApps?

Smart Contracts act as the fundamental link between blockchains, wallets, and cryptocurrencies. Ethereum is currently the most popular and active smart contract platform in the world, with almost 2 million smart contracts live on the network.

Let’s suppose you want to buy a car. You can go to a car dealership where a salesman will act as a third party to the car manufacturer and set up a contract for you. Or, you can buy a car online, again using a third-party website to set up and execute the contract.

Buying a car on the blockchain would simply be a case of signing the transaction via a smart contract, using your wallet.

So, smart contracts simplify the process. They can be programmed by anyone with the right knowledge.

Buying a car on the blockchain would simply be a case of signing the transaction via a smart contract, using your wallet.

So, smart contracts simplify the process. They can be programmed by anyone with the right knowledge.

Buying a car on the blockchain would simply be a case of signing the transaction via a smart contract, using your wallet.

Smart contracts aren’t actually a new concept. In fact, you can think of a vending machine as a type of ‘smart contract’. There is no need to trust or interact with a human third party to buy your snacks. You pay the money, you receive your snacks. The rest is automated.

This concept is the same for smart contracts on the blockchain. Today, smart contracts are most commonly used to create the functionality for decentralized exchanges on the blockchain – DeFi. The potential, however, is huge when we start to think about how smart contracts could be applied to real-world and additional digital assets.

Intro

01

02

03

Step Two

Finding Your Niche

So, now you have an idea of the workings and potential of Web3. Exciting right?

It might seem, however, that the only way to actively engage in the industry is to be a developer or programmer.

It’s true that there are massive opportunities for developers in the space right now, especially if you have existing knowledge of Web2 development.

BUT.

There are many, many other opportunities too, and there’s a very good chance that no matter your existing skillset, you can apply it to Web3.

Below are some of the most in-demand roles and skills in Web3 right now, as well as other areas to consider opportunities.

The fact is, if you’ve got the drive and mindset, Web3 communities and companies will welcome you with open arms. You just need the right knowledge to complement your existing skills.

Web3 Development Opportunities

Web3 is an attractive space if you’re a developer. Why? The sheer scope of possibilities.

Having the power to program your own financial products and digital currencies has already opened the flood gates of innovation, and we’re still at the start of what’s achievable.

The best part is, you can take all your existing dev skills and apply them to Web3 easily. Working with front-end languages like React, Node.js, or JavaScript? You’re already one step ahead.

Here are some key Web3 roles in demand for developers with Web2 dev skills and accompanying salaries (correct at the time of writing March 2022):

If you want to focus on front-end and development, you can see for yourself how easy it is to get started using powerful tools like Moralis. Also, keep in mind there are high-paying opportunities across the whole Web3 tech stack, not just front-end development (although this is in very high demand at the time of writing).

Web3 is always open to those who can showcase their skill too. If you’ve been considering learning coding, now’s a great time to do so! Programming languages like Solidity and Rust are fairly easy to learn once you have a good understanding of JavaScript, even if you don’t come from a programming background.

Web3 Front End Developer:

$100K starting salary on average. The highest paying senior roles can reach $500K

Solidity Developer:

(the programming language of the Ethereum blockchain network) -$150k on average

Full-stack Blockchain Developer:

$120k on average

Non-Technical Business and Professional Opportunities

Not a developer? Not to worry. As Web3 is growing, so is the demand for business professionals from all backgrounds.

HR, Sales, Marketing, and especially Community Management are increasingly fundamental roles that all Web3 projects need, whether they’re the established big hitters, mooning unicorns, or scrappy startups.

Some in-demand non-technical roles, and their average salaries, include:

Product Managers:

100k to 160k

Sales Professionals

70k to $140k

Marketing Professionals

$80k to $140k

Designers

$80k to $150k

Community Management

$50k -$100k

Once again, if you already have some experience or expertise in these fields, you can make the transition into Web3 quite smoothly. All you need is a good understanding of the fundamental tech (blockchain, cryptocurrencies, and smart contracts).

Some roles might require more laser-focused knowledge of specific blockchains or protocols, but there are fast and effective ways to learn what you need.

We’ll cover how in the final chapter.

Entrepreneurial Opportunities

Web3 is exciting because it’s new and innovative. That innovation is already attracting huge interest from venture capital and big investors (over $3.8 billion as of early March 2022, in fact).

Let’s suppose you have an idea for a mobile app. There are currently almost 3 billion apps on the Play Store alone.

The harsh reality is, no matter how good your app idea might be, chances are someone has already done it. You’re walking straight into an oversaturated, highly competitive market.

Web3, on the other hand, is still ripe with opportunities. While the rate of adoption is increasing, there’s still space for entrepreneurs looking to create dApps or Web3 applications.

What’s more, investors are actively hunting out new projects and talent. They want to catch the next Web3 unicorn. What if it’s your idea?

To spot those entrepreneurial opportunities, a good understanding of the Web3 space and the tech behind it is of course important.

Additionally, a crucial step for any entrepreneur is being able to prototype and showcase their product. Even if you have no experience developing software, the important part is knowing the right knowledge – just enough to build a prototype to secure investment.

We’ll cover how to get that knowledge next.

Intro

01

02

03

Step Three

Building Your Knowledge

Now the important part. How to learn what you need to succeed in Web3. Given the space is still so new, the vast majority of Web3 employers won’t be too interested in your official qualifications.

That’s not to say that a degree in Computer Science, Marketing, or Business won’t be useful as a supporting factor on your CV, but let’s be honest – getting a degree in Solidity programming, Blockchain, or Web3 technologies from traditional educational institutions is still a long way off.

So where does that leave you?

Google, YouTube, or online learning.

Googling and YouTube

Good Google-Fu can be extremely helpful, no doubt. There’s also massive amounts of free Web3 content on YouTube.

Are these a great way to dip your toes into Web3, crypto, and blockchain? Absolutely. If you’re interested in the industry and enjoy building projects in your spare time, or want to test the waters, then you can’t go wrong.

If you’re looking to enter the space professionally, however, then there are some things to keep in mind.

- As a beginner, it can be hard to know if the information you’re reading/watching is accurate and correct.

This can cause big problems down the line. You might realize your fundamental knowledge is off, requiring you to go back, find a better source of info (somehow) and re-learn what you thought you knew. - Self-motivation and developing a learning structure can be difficult because you don’t really know what you should be learning first. Diving into advanced concepts before you know the basics will cause more confusion than learning.

Additionally, you’re probably already studying, working, or have other responsibilities to handle day-to-day. Spending hours searching for the right content in the right order drastically reduces your learning time. It’s demotivating, and can easily ruin your fledgling learning routine. - You won’t get any practical, guided learning.

This is crucial. Many Web3 projects and companies won’t care too much about qualifications (unless they’re industry-specific like Moralis Academy’s), but they will certainly want to see some examples of what you can do.

- As a beginner, it can be hard to know if the information you’re reading/watching is accurate and correct.

That could be writing a blog post on DeFi, showcasing a Web3 app you built, or sharing the UX design you did for a crypto wallet.

Being able to apply your Web3 knowledge in this way will give you the edge when job hunting.

Now, that’s not to say you won’t succeed using the Google and YouTube approach. Some people definitely do. It is, however, a longer, harder journey for most of us. Given Web3 adoption is increasing rapidly, it’s better to learn efficiently, correctly, and more quickly as a result. This way, you minimize the chance of missed opportunities.

TLDR:

YouTube and Google are a great starting place, but to really develop the skills you need to become a Web3 professional in any field, structured learning and tuition will be a much more effective approach for most people.

Online Learning

Given the ease of access, online learning is a great way to level up your Web3 skillset. Some similar problems to self-learning do still persist though – how do you truly know which courses or online academies will be best?

The problem you’ll find when researching potential places to learn is that all the real experts in Web3 aren’t teaching at established universities. They’re active in the industry right now.

These are also the best people to learn from. So how do you access that valuable knowledge?

Moralis Academy is one option. The Academy was created by leading Web3 educators, developers, and Moralis founders Ivan Liljeqvist and Filip Martinson to offer accessible, easy-to-understand courses taught by the leading professionals in the industry right now.

The Academy also has one of the most comprehensive collections of Web3 courses you can find. Tuition covers everything from the basics for complete beginners, to advanced Web3 development practices, and blockchain protocol deep dives.

Some additional advantages of online learning at the Academy in particular are:

Fully flexible learning

There are no set course or seminar times. You can learn at your own pace and work to your own schedule. This makes it easy to build your Web3 knowledge around other commitments like work, family, and so on. Even an hour a day will go a long way.

The right knowledge, the right way

You’ll be learning from some of the biggest brains in Web3. Not only will you get a level of knowledge that isn’t readily available through most free content, you’ll also learn in a structured, logical way.

It won’t break the bank

A traditional Computer Science degree in the US can cost around $40k. A traditional MBA will easily clear $60k. If you want to learn how to program for Web3, or understand the business opportunities that Web3 and blockchain present, chances are you won’t even pick up the knowledge you need on these programs.

In comparison, the highest tier plan at Moralis Academy is under $2000 a year. With that, you get access to 30+ specialist Web3 courses.

Where to Start

It’s important to DYOR and make an informed decision before committing to a career change and any online education of course. You need to make sure it’s the right fit for you!

Check out these free resources for some solid entry-level knowledge, and to get a feel for the Web3 landscape and its opportunities.

Check out the Moralis Academy YouTube and see what students have achieved:

https://www.youtube.com/channel/UCT2E5faQg9DY-HAyKmVEE_Q

Head to the Moralis YouTube channel here for free development tutorials:

https://www.youtube.com/channel/UCgWS9Q3P5AxCWyQLT2kQhBw

Get an overview of Moralis Academy courses, including Crypto for Beginners and Ethereum Fundamentals here: https://academy.moralis.io/all-courses

Join the Moralis discord and learn more about both the Academy and the Moralis software platform: moralis.io/discord

Thanks for reading!

Make sure to check out the glossary below for all your Web3 jargon-busting needs too.

We hope you found this eBook useful. See you in Web3!