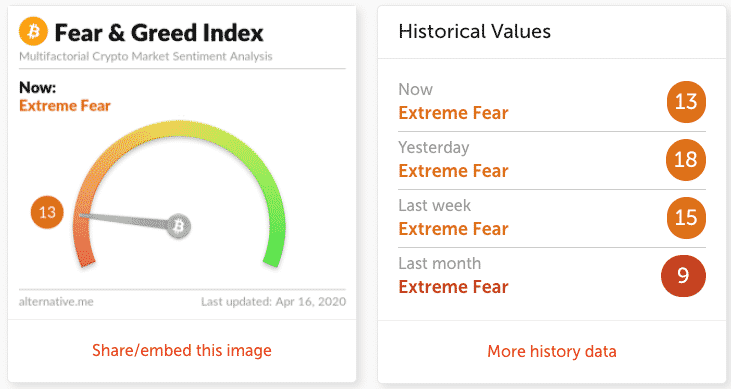

The crypto market has become known for its somewhat volatile performance. Although this is one of the contributing factors to why the cryptocurrency market attracts investors looking for a mix of high-risks and high-rewards, it is hard to gauge the overall trajectory of the market. One of the most popular methods for gauging the cryptocurrency market’s status is the “crypto fear and greed index”.

Introduction to the Crypto Fear and Greed Index

Put as simply as possible, the “Crypto Fear and Greed Index” is a tool for measuring the market’s status. This index is by no means exclusive to crypto markets. It was famously used by CNN Money in order to measure two primary emotions on various timescales. During this time, a general “fear and greed index” formula was helpful in determining investors’ appetite for stocks.

The theory is that a fear and greed index can help determine whether a stock market holds a fair valuation during a given time. Moreover, it is a “contrarian index”, which assumes that great investor fear drives down prices. At the same time, it implies that excessive greed increases prices.

Moreover, the index suggests that the group mentality of investors causes a mass-hysteria of sorts. Large-scale sell-offs can cause panic, and mass rallies (“to the moon”) can entice investors to jump into a market they otherwise wouldn’t.

True, a case could be made that the entire stock market is being driven purely on speculation. In this scenario, no stocks hold an “intrinsic value”, rather they are merely the products of discounting future revenue. This viewpoint somewhat contradicts the basic assumptions of a fear and greed index and should be taken into account.

For example, massive price gains for any asset can often raise its ranking to being “greed”. However, it can be misleading. Bitcoin’s rally to $220 in 2013 would likely have given the $220 price a “greedy” ranking. However, any investor would, in hindsight, know not to divest back then.

Furthermore, fear and greed indices can be created for any assets, not just crypto. Specifically, it judges whether the market is overbought or whether it is oversold. These terms can be somewhat confusing, so let’s get into the weeds.

- When the Crypto Fear and Greed Index is oversold

First and foremost, let’s take a look at when the crypto fear and greed index, or the Bitcoin fear and greed index, is oversold. Essentially, this is seen as the market being “fearful”, in that the market is oversold. This is generally the result of widespread market worry or some other type of fear.

As such, an investor can learn to benefit from when the market is in “fear” mode. After all, mass-liquidations that are driven by fear are irrational, and not the result of conscious investment strategies. Consequently, this presents an excellent opportunity for daring investors.

Specifically, buying when everyone else is selling – essentially “going against the stream” – can be immensely lucrative if done right. Knowing that the market is oversold, or fearful, means that bold investors can make good long-term investment deals.

- When the Crypto Fear and Greed Index is overbought

On the flip side of the “oversold” side of the fear and greed index is the overbought side. As the name suggests, an “overbought” ranking means that the market is predominantly buying the underlying asset. As the Bitcoin fear and greed index tracks the performance of Bitcoin, this means that investors are buying large quantities of Bitcoin.

In extension, this means that the market could be prone to large corrections or a sell-off. The index dubs this as the market being “greedy”, which can be seen as being in a bubble. This is not to say that Bitcoin is a bubble, as some skeptics still try to claim.

However, investors will know quick price increases often give way to price consolidations – or dips. As such, seeing that the Bitcoin Fear and Greed Index is overbought can be a good time to sell, when other investors are rushing into the asset class.

How does the Crypto Fear and Greed Index work?

A crypto fear and greed index works by weighing different factors. First of all, let’s take a look at the composition of the arguably most well-known crypto index, the Bitcoin Fear and Greed Index. This is an apt comparison, seeing as Bitcoin is the premier cryptocurrency asset.

According to the official page of the Bitcoin fear and greed index, it currently weighs data from five sources. However, it is worth noting that the original mix of components was six various data sources. Consequently, the percentages can seem somewhat off.

One of the major components of the Bitcoin fear and greed index is volatility. The volatility of the index accounts for 25% of the total Bitcoin fear and greed ranking. In determining this value, the index measures the current volatility of Bitcoin to the average values in the past one month and three month periods. An odd rise in volatility is usually a sign of a fearful market.

Another critical factor in determining the status of the Bitcoin fear and greed index is volume or market momentum. This also accounts for roughly 25% of the total Bitcoin index ranking. The measurements are done comparing the current “market momentum”, or trading volume, in comparison with the 30-day and 90-day averages, much like the volatility benchmark.

The index also uses a lot of text processing from social media in its index. This gives a broad measurement of how many people are talking about a certain asset – in this case, Bitcoin. According to the team behind the index, this accounts for 15% of the total ranking.

Additionally, the social media factor works by having a Twitter analysis keeping tabs on what hashtags people use. A sharp increase in interaction rate is taken to indicate public interest.

Bitcoin Greed and Fear Index components

Furthermore, the sixth Bitcoin fear and greed index component – which is no longer in use – is that of surveys. According to the index’s website, this component is currently on pause. However, this does not stop it from being an interesting component to consider, if it returns. Back when it was a thing, surveys were responsible for 15% of the Bitcoin greed and fear index score.

The survey-side of things can see people actually vote on specific questions. This means it is possible to directly gauge the sentiment of various crypto or Bitcoin investors. Nevertheless, surveys are – by their very nature – prone to manipulation, which may be why they are on pause.

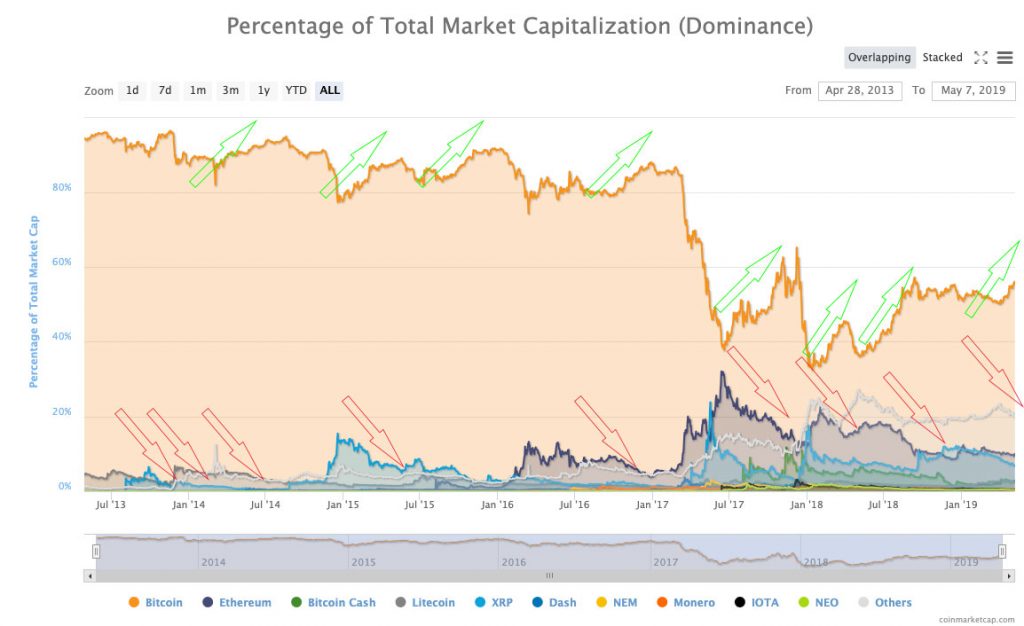

Moreover, the dominance of Bitcoin also accounts for 10% of the Bitcoin greed and fear index ranking. Those in a crypto academy or keeping an eye on the crypto market will know that Bitcoin is the premier cryptocurrency by a significant margin. At the same time, however, it is interesting seeing to what extent Bitcoin is the premier cryptocurrency.

Bitcoin Dominance

A rise in Bitcoin dominance usually comes as a broader rise in the popularity of Bitcoin. Merely being the “number one crypto” is not enough to make well-informed decisions, but seeing the extent of Bitcoin’s dominance can be helpful.

For example, shrinking Bitcoin dominance can signify that people are becoming increasingly greedy and investing in risky altcoins. As such, it is important to keep Bitcoin’s relative dominance in mind when deciding the index score.

Additionally, trends also account for roughly 10% of the index score. Trends simply means compiling Google Trends search results and knowing how to understand these. If there is a sharp uptick in the number of Bitcoin searches, this likely means a trend is growing. Specific search terms can also indicate things such as fear.

Alternatives to the Crypto Fear and Greed Index

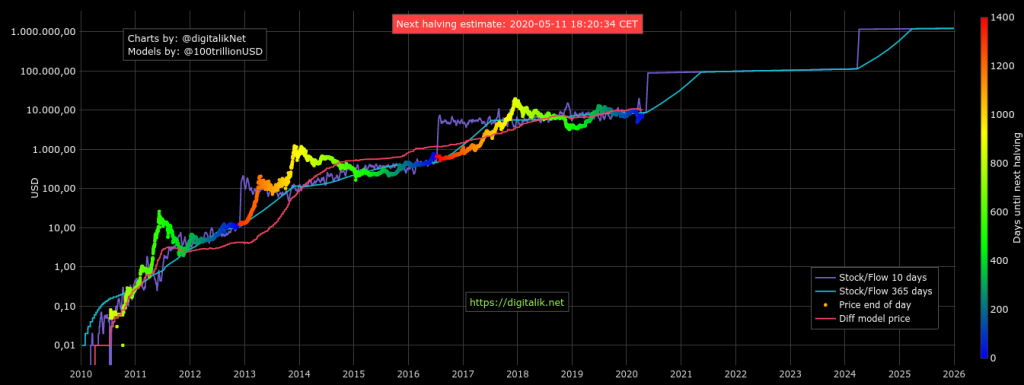

Of course, the crypto fear and greed index is not the only method analysts rely on to track the performance of the cryptocurrency market. The Bitcoin stock to flow model, or S2F method, recently made a splash. This especially came to light during the 2020 Bitcoin halving event, and rightly so.

The Bitcoin stock-to-flow model comes from the original S2F model, which was primarily used to value precious metals. Due to their innate scarcity, the stock to flow model measures the “stock”, i.e. the total available amount of the assets, to the continuous “flow”, i.e. the mining of new precious metals.

Bitcoin Stock to Flow Model

The vast majority of cryptocurrencies are finite and have an inherent mechanism for decreasing their continuous “flow”. Perhaps the most well-known example of this is Bitcoin, which goes through a “halving event” roughly every fourth year.

This halving event effectively cuts the block mining reward in half. As such, it encourages early adopters, and makes Bitcoin an appreciating asset class as the “flow” decreases. Although the Bitcoin stock-to-flow method differs from the Bitcoin fear and greed index in execution, they both help to gauge the price trajectory of crypto assets such as Bitcoin.

Naturally, there are many different methods for estimating the future price of crypto assets. However, the Bitcoin Fear and Greed Index, along with the Bitcoin Stock-to-Flow Model, are arguably some of the most well-known.

Advantages of the Crypto Fear and Greed Index

Although the name of the crypto fear and greed index may initially sound odd or off-putting, it is actually quite logical. After all, most investments happen mainly due to greed or fear, and most sell-offs similarly happen mainly due to either greed or fear.

One of the main advantages of a crypto fear and greed index or, indeed, any fear and greed index, is that it makes some sense of a complicated market. In fact, the index provides a glimpse into something that would otherwise be nearly immeasurable.

Knowing the status of the crypto market, such as whether this is oversold or overbought, can be essential to crypto traders. It is also worth keeping in mind that this is not a new occurrence. Instead, fear and greed indices are often just as useful in other asset markets.

Gold, silver, oil and other commodities also use similar contrarian indices. As such, it is possible to make some correlations between the crypto market and the market for these finite resources. This is a valuable advantage, primarily due to the fact that the crypto market often lacks an analog when it comes to understanding its performance.

Disadvantages of the Crypto Fear and Greed Index

The perhaps main drawback of the index is that it does not present a single “truth”. Instead, it tries compiling the available data into a metric that makes sense at one specific point in time. This means that hindsight can reveal that fear, for example, did not correspond to a great time to buy.

In the same way, a greedy ranking does not automatically mean that investors should sell. In the end, the Bitcoin fear and greed index, or any crypto fear and greed index, simply tries to compile available information into a sensible metric.

Nevertheless, it is also worth mentioning that this type of index can be hard to understand for some. At the same time, it does not capture all the available types of fear or greed. For example, there are many types of fear. Fear Of Missing Out, more commonly known as FOMO, can be a powerful type of fear and incentivize action

This fear, then, is quite comparable to greed. This can make it hard for laymen to make sense of a fear and greed index. A good piece of advice is to not simply stare at the labels, but to instead understand the index as signifying two ends of a spectrum, ranging from oversold to overbought.

Crypto Fear and Greed Index Summary

To summarize, the crypto fear and greed index is a helpful tool for understanding the state of the cryptocurrency market. Primarily, it reveals whether the market is oversold or overbought. However, traders can use it in conjunction with other tools or analyses to reach a deeper understanding.

For those looking to truly understand the cryptocurrency market, however, a deeper dive is vital. This is why the online blockchain education platform Ivan on Tech Academy is offering countless in-depth blockchain courses.

These blockchain courses allow you to understand the intricacies of the blockchain and crypto market in your own pace. You can do their courses from anywhere, and at any time. Join over 20,000 existing alumni and enroll in a world-class blockchain academy!