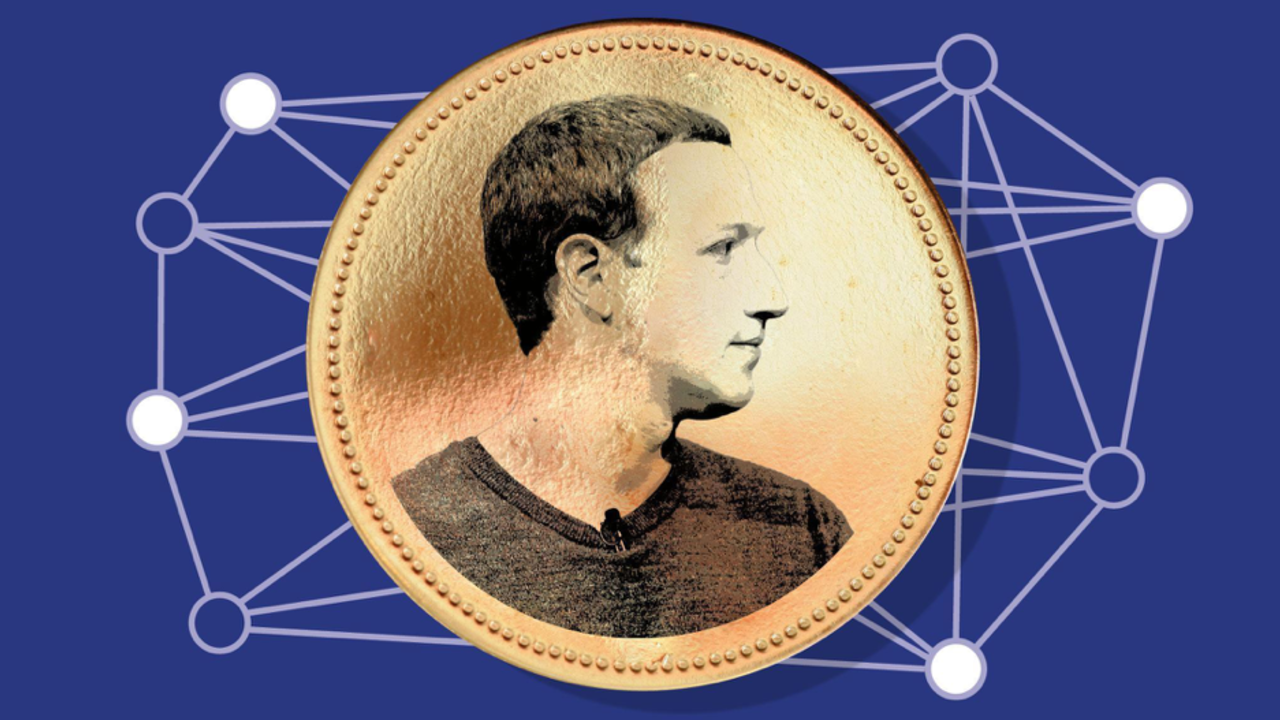

It was on June 18, 2019 that Facebook announced a piece of unprecedented news: the launch of its mysterious cryptocurrency called Libra. This news brought much doubt and surprise around the world, and would subsequently go on to encounter a plethora of obstacles. This meant several of the members of the Libra association would begin to doubt their permanence. This guide breaks down what has happened so far and explains Facebook’s Libra.

Launching Libra

From users of the social network, to the presidents of various countries, many had different reactions to Libra. Specifically, this was the great bet that Mark Zuckerberg had up his sleeve to finish knowing absolutely everything about us: our money.

The natural reaction of the banking sector, politicians and government authorities was total rejection and anguish since Libra officially represented the breakdown of the current economic model, based on the outdated and unsustainable banking system, which would only bring very bad news for them.

On the other hand, for the hundreds of millions of users of Facebook, Instagram and Whatsapp it meant a hope of democratization of the management of our money, which brought a totally renewed and inclusive economic model.

Analyzing Libra

As the days passed, the crypto specialists evaluated Libra giving the following results:

- Libra does not work on a blockchain: According to the White Paper on Libra.org, Libra Blockchain stores each transaction in a single Merkle tree-based data structure (so it would be a single-block blockchain, it wouldn’t be like the blockchains from other cryptocurrencies). For this reason, many specialists simply call it a virtual currency or even a payment method.

- Libra has a built-in central bank: Facebook aims for Libra to become the world’s most widely used virtual currency. To achieve that you need it to be a stable currency and not a speculative cryptocurrency like Bitcoin, which is why Libra Reserve was created to back the Pound with real assets. Users will be able to exchange their currencies at exchange houses for low volatility assets such as bank deposits and government bonds in currencies that are considered stable.

- Libra is controlled by a group of companies: An association based in Switzerland, the Libra Association, which includes 28 large companies such as Visa, MasterCard, Vodafone, Spotify, PayPal or Uber, in addition to some important venture capital funds. Very different from cryptocurrencies like bitcoin, which is only controlled by algorithms and by nodes (people with a pc) around the world.

- Libra is not an open source cryptocurrency: Libra is fully controlled by the Libra association, which are the only ones authorized to “mine” or generate said “cryptocurrency”.

This caused a wave of criticism which highlights the uniquely commercial interest that Facebook had behind the creation of Libra, being not very transparent and much less secure.

Does everyone hate Libra?

After the reactions that many private and public authorities had, which felt directly attacked and challenged by this Facebook initiative, the restrictions and prohibitions by different countries and economic / financial authorities began, here are some examples:

Bruno Le Maire

- France wants to ban Libra in Europe. Bruno Le Maire, France’s finance minister, warns of the obvious dangers that Facebook’s dominance brought to the financial market would bring.

- The European Union will not authorize Libra. The European Union will not authorize Libra, the cryptocurrency that Facebook wants to launch, because it questions the monetary sovereignty of the states and involves numerous risks.

- The US Congress asks to curb Libra. They demand a moratorium to be able to examine the “risks and benefits” of this cryptocurrency.

When the FED and the US government realized the dire consequences of the Pound for the Dollar, they immediately told Facebook to withdraw the project since they wanted Libra to pass the same strict evaluations as any currency before its issue, with the intention of the global financial establishment that Libra be ensnared in innumerable financial regulations.

Libra’s delay

All this resulted in Facebook having to admit that the official launch of Libra has a delay, since overcoming the restrictions according to law will take longer than expected.

Why did Mastercard, Visa, PayPal and Stripe leaved Libra? Facebook initially set the launch of its Libra cryptocurrency for June 2020. However, the tense delay in overcoming regulations made four companies hesitate to continue belonging to the Libra association.

The companies are: Visa, Mastercard, PayPal and Stripe. But what has had to happen to make them think about leaving this project. According to a report, the reason is because these four companies want to maintain a good relationship with regulators at all costs, who are not enthusiastic about the idea that Facebook wants to enter the global financial market.

On the other hand, the managers of these companies are increasingly concerned about how Facebook manages the private data of its users, since in the event of a scandal of this type with Libra, the image of these four companies would be seriously damaged.

It is important to say that if these four companies make the decision to leave the Libra project, it would be very difficult for Libra to have the success it promises, since these companies represent the financial arm of the association, with their products ultimately carrying out the Libra transactions.

Rethinking Libra

After about six months of uncertainty about the future of Libra thanks to resounding rejection of global financial and banking authorities around the world, the Libra digital currency had to be rethought to try to see the light at the end of the road.

The strategy? Libra’s digital wallet is now expected to launch this autumn but with a different name and additional characteristics , several months later than initially planned, according to the reports

The company even founded a new subsidiary – Novi Financial, which runs the development of Libra’s digital wallet, Calibra which is now being rebranded with a new name and logo for the digital storage – Novi.

On the other hand, The Libra Association published a second version of its white paper, announcing that it would not launch a single stablecoin backed by a basket of assets. Instead, it will now look to issue a series of stablecoins backed by a single asset each.

Since such important members as Stripe, Visa and Mastercard withdrew from the project, Libra urgently needed to have “spare” members to satisfy this specific need. That’s why Checkout.com, a payments processor focused on cross-border transactions, joins the Libra Association.

We cannot deny that Facebook has learned from its mistakes when the HSBC Chief Legal Officer and former U.S. Treasury Under Secretary Stuart Levey as its new CEO with the evident interest in giving Libra a renewed image that is led by a close person and recognized in the financial regulatory sector in order to improve its chances of overcoming the current obstacles of its long-awaited launch.

Libra explained and conclusions

Analyzing the new measures that Facebook has taken since its stagnation caused by global financial regulators, basically the social network has done what circumstance obliged it:

- Replace its ex-former members (Paypal, Visa, Mastercard and Stripe) with other new members (Shopify, Tagomi, Heifer international, checkout.com, Temasek, Paradigm and Slow Ventures).

- Change the organization chart of Libra with professionals who give it a more strategic vision in the face of its threats and strengths in the market.

(More info about the Libra’s timeline here).

Will these measures that Facebook has taken be enough to once and for all launch Pound in style? On the other hand, the social network has launched a tool called “Facebook Pay” which will allow all its companies (Instagram, Facebook and Whastapp) to have a common payment gateway which will be the necessary infrastructure for Libra to really open their wings. If you find this interesting, you can learn more about Libra, ETH 2.0, Staking, and everything about crypto with blockchain classes on the blockchain course platform Ivan on Tech Academy.