If you stumbled across Ampleforth’s native token, AMPL, whilst perusing A site such CoinGecko, you might have dismissed it as just another DeFi token. Maybe you thought it was another one of those governance tokens that granted voting rights. Or maybe you’d heard about it and assumed it was some over-hyped accounting trick. However, this article breaks down all there is to know about Ampleforth.

Yes, AMPL is another ERC-20 token that operates on top of the Ethereum. But if you dig a bit deeper, you’ll find it is unique in the DeFi space. Whether it’s worth investing in or not is a different story. But it is certainly a ground-breaking protocol worth looking into.

Ampleforth is different in that it changes its supply of AMPL tokens daily. That’s right, the supply of AMPL tokens automatically adjusts in response to demand. That means your wallet’s supply of AMPL tokens can change each day. This happens because the Ampleforth protocol has an elastic supply that can expand and contract based on market demand.

If projects like Ampleforth excite you, you should be sure to explore Ivan on Tech Academy. Ivan on Tech Academy features numerous blockchain courses that will further your understanding of the blockchain industry.

Is AMPL a Stablecoin?

AMPL utilizes price targeting but that does not make it a stablecoin. Its target price is the U.S. dollar in 2019. So, accounting for inflation in 2020, that target is approximately $1.011. This means that as demand for AMPL tokens increases, the supply also increases. All of this occurs so it can return to its original price target.

Why would anyone want to develop a protocol that does this? Well, the desirable result of such price action is that it has a low correlation to Bitcoin. Your typical stablecoins peg to something like the U.S. dollar to eliminate volatility. Ampleforth’s protocol, on the other hand, only reduces volatility.

How does AMPL Work?

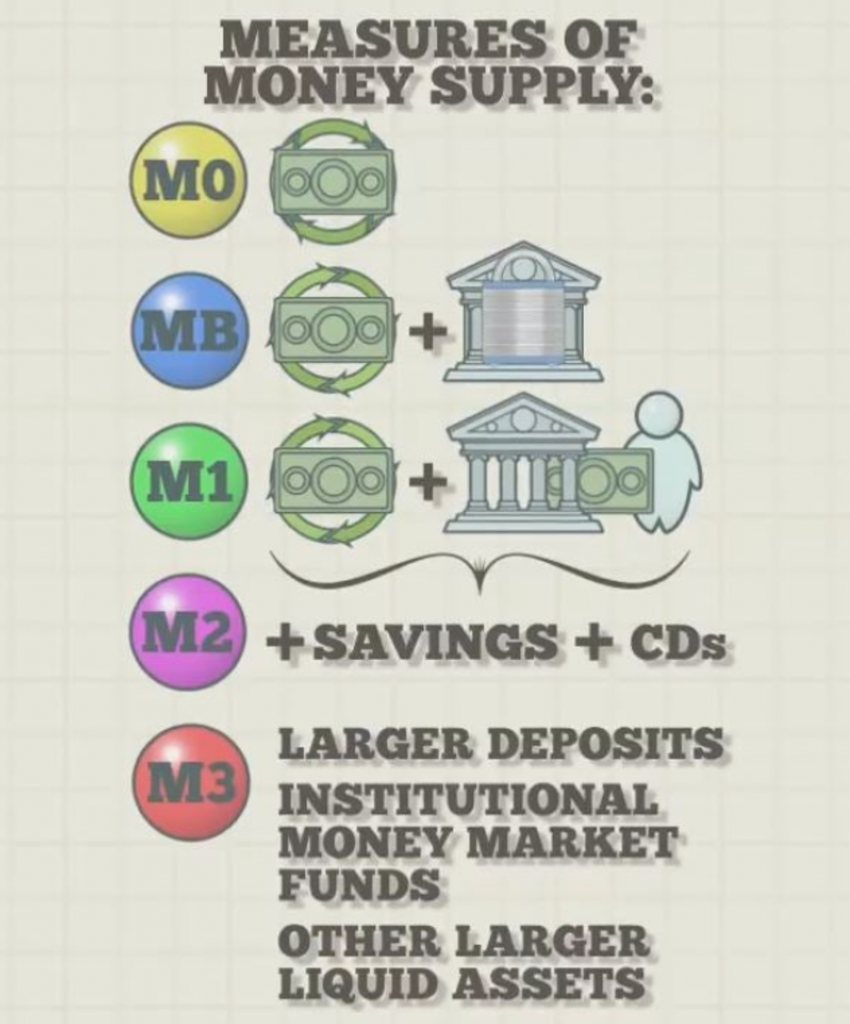

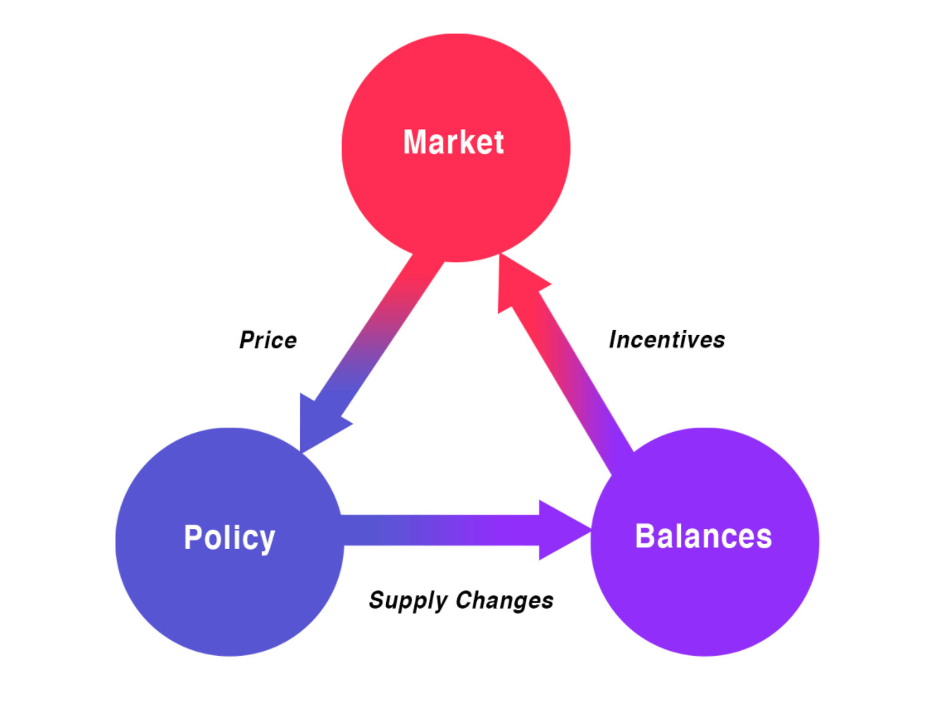

AMPL’s smart contract automatically increases and decreases its money supply. And it accomplishes this without the need for a central bank. Indeed, one of the loftier goals is for Ampleforth to become an alternative to the central bank. So, what happens is wallet balances increase when the price of AMPL is high. And they decrease when the price is low. But that does not mean AMPL is dilutive.

When the central bank floods the market with U.S. dollars, they dilute the money supply with inflation. But as an AMPL holder, you can’t be diluted by supply inflation. That’s because adjustments apply proportionally across every user’s balance. That means your percent ownership always remains fixed.

For example, let’s say you’re a whale and you own 10% of the network. In that case, you will always own 10% until you decide to sell. Supply can expand and contract directly into and out of your wallet. Meaning, the number of AMPL you own can change based on the market conditions. But your network percentage does not change.

This daily supply adjustment is called a “rebase.” We’ll explain this concept further.

AMPL’s Rebase Operation

AMPL is a “supply-elastic” cryptocurrency. So, the total supply of AMPL tokens changes in response to the price per unit. This happens every night at 7 pm Pacific time. That’s when Ampleforth expands or contracts its supply. And this nightly adjustment is called a rebase. The rebase is applied across each user’s wallet balance. But again, its rebases are non-dilutive.

For example, let’s say the total supply of AMPL is 100,000. And let’s say you own 3,000 tokens. Instead of thinking “I own 3,000 AMPL tokens.” You would think, “I own 3% of the network.” That’s because if the demand spiked and the price doubled from $1 to $2, supply would have to double to 200,000 tokens. Supply would double to maintain the $1 target price. If you were holding 3,000 AMPL, your supply would double as well to 6,000.

Your wallet would not experience nightly airdrops of tokens, however. The rebase function takes place in the AMPL token smart contract.

Again, let’s say AMPLs price rises 5% or more above the target price. If that happens, the rebase will expand the supply. If AMPLs price drops 5% or more below the target, the rebase will slash the number of units in those wallets.

Ampleforth and Equilibrium

Equilibrium in economics can be described as a state where supply and demand find balance. Ampleforth attains equilibrium when a change in demand triggers an equal change in supply.

And this daily rebase operation applies across every wallet’s balance. If there is a 2x increase in price, then it will be met with a 2x increase in supply. This is how the rebase achieves equilibrium. But Ampleforth removes the power to inflate the money supply away from a central authority. And it puts demand into the hands of the free market.

Cryptocurrencies Role in Economics

Economic changes like booms and bust affect what kinds of assets people want to hold. And fixed-supply assets like gold and Bitcoin become more appealing during times of economic uncertainty. Sudden shocks in demand volatility, however, can disrupt fixed-supply ecosystems. An ecosystem composed of fixed supply assets has a greater risk of cascading failure. This is due to all the built-in correlation.

The most important economic function of today’s denationalized cryptocurrencies is to provide a check against inflation and boom-bust cycles. Bitcoin is independent in the sense that traditional assets are not connected to it. Nor do central bankers control its supply. Bitcoin adds diversity to an otherwise overly interdependent global economy. And it gives people the choice of opting out of traditional assets.

However, even with the addition of thousands of cryptocurrencies, nothing has been added in the way of diversity. Too many cryptocurrencies are tied to Bitcoin’s price. When Bitcoin’s price rises their price rises. And when it falls, theirs falls. Their price movements essentially mirror Bitcoin’s. From the standpoint of diversity, it could be argued that only one cryptocurrency has been created. And that is Bitcoin. Everything else is connected to its price movements.

AMPL on the other hand has created a new price movement pattern. It’s unlike any other cryptocurrency in that regard. AMPL can automatically adjust its supply in response to changes in demand. Its design solves the supply inelasticity problem that hampers fixed-supply assets.

Those looking for further information regarding boom and bust cycles, as well as other financial terms, should absolutely enroll in Ivan on Tech Academy’s Technical Analysis course. This course gives you all the technical know-how you need before you embark on crypto trading. Moreover, right now you’ll get 20% off when using the exclusive promo code BLOG20.

Solving the Diversification Problem and Other Use Cases

Cryptocurrencies are all correlated to an extent. And that has led some analysts to categorize the crypto markets as being fraught with systemic risk. Some even call them dangerous. To combat this, AMPL offers unique incentives to wrest it from Bitcoin’s price-pattern dominance. And by doing so, it adds diversity to the present, homogenous ecosystem. The mere presence of AMPL provides diversification. ´

Near to Long-Term Goals

Ampleforth’s goals are to provide change by offering unique incentives. It is suited for the following use cases:

- Near term

In the near term, AMPL can diversify cryptocurrency portfolios.

- Medium Term

AMPL’s unique volatility pattern and token dynamics make it a valuable building block and a promising form of DeFi collateral.

- Long term

The ultimate long-term goal of Ampleforth is quite ambitious. The team believes that AMPL can be a better Bitcoin. Better in the way it’s adaptable to shocks.

AMPL as the New DeFi Building Block

Systemic risk is prevalent in today’s crypto markets. That’s because of the high correlations between cryptocurrencies. In the DeFi ecosystem, simply bundling different assets together does not reduce aggregate volatility. And that’s because they’re all correlated.

AMPL, however, can bring diversity to decentralized assets. So, it can be argued that it is a new primitive building block in the DeFi ecosystem. Other DeFi tokens are limited, however, because of this correlation.

To combat this, DeFi protocols have been practicing over-collateralization. It’s there to compensate for the inherent volatility of the space. But users still face risks of liquidation. Diversification is therefore necessary. Without it, many DeFi applications will be forced to use centralized assets as collateral. Because when collateralized assets all move in the same price direction, liquidation risks run high. Essentially, systemic risk results when there are no counterbalancing assets.

AMPL can reduce this risk of auto-liquidation when combined with other DeFi assets as collateral.

Profit Seeking Traders

The way AMPL plans to be “tomorrow’s better Bitcoin” is by automatically translating price-volatility into supply-volatility. This however depends on profit-seeking traders. They must act on incentives to restore equilibrium. They work on the demand side after the change in supply has occurred. In other words, AMPL has a built-in financial incentive to help reestablish equilibrium.

With its present small market cap, wallet balances are volatile. As its market cap grows, however, periods of equilibrium will last longer. During these static periods, AMPL will remain stable in price.

Bitcoin will become less volatile as its supply stabilizes. But it will not ever be stable in price. Like any fixed supply asset it will still be vulnerable to sudden demand shocks. The economies that can be built on top of it therefore will be limited.

A Short History of Money – From 1944 to Ampleforth

At the Bretton Woods conference in 1944, forty-four allied nations came together. There they abolished the gold standard and made the U.S. dollar the world’s reserve currency. With economic security being paramount, the dollar was pegged to a certain amount of gold. The remaining currencies were pegged to the dollar. But by 1971, gold’s role in the global economy was reduced to that of just another commodity.

Bretton Woods Conference

Gold has limited supply. Thus it was deemed to be a poor global reserve currency. That’s because supply couldn’t scale to meet the pace of growth. The downside of abolishing the gold standard, however, was that it empowered central bankers. Ever since they have been endlessly tinkering with the money supply. They, rather than market forces, have been able to expand and contract it at will.

Bitcoin presented the world with an asset whose supply central bankers couldn’t inflate. However being a fixed supply asset like gold, Bitcoin can suffer from sudden demand shocks. These can destabilize ecosystems that rely on it for support.

Ampleforth fixes the supply inelasticity problem. It takes the idea of a flexible supply from fiat. But at the same time, it is free from the totalitarian control of the state and central bankers. Ampleforth can be described as gold morphing into a digital commodity with a flexible supply. And it’s all based on market forces.

A fixed supply asset like gold would have limited global economic growth. But if gold’s supply could expand and contract based on market demand, you’d have a glimpse of Ampleforth in action.

The Future of Ampleforth

The three drivers of demand for AMPL would are similar to many DeFi tokens:

- Incentives

- Short-Term Speculation (Yield Farming)

- Economic Utility

Many DeFi protocols hand out incentives like candy. The risk of doing this is it might only attract short-term users with no community loyalty. So, it’s safe to say that neither short-term incentives nor speculation schemes like Yield Farming are sustainable. However, if Ampleforth can provide utility on the economic front then it can experience long-term sustainability.

With its elastic supply movements, it could make for a nice form of DeFi collateral. Its countercyclical nature can also make it a sought after crypto portfolio addition. In the long-run, AMPL can become a simple, bankless asset, like Bitcoin. Except it can better adapt to economic shocks.

Ampleforth is still an experiment and the possibility for failure is always high. Time will tell if its a good market fit, how resilient it is, and whether it provides real value to the ecosystem. With a market cap of $110M, it’s still small enough to provide a top-notch payoff. That is if it lives up to the lofty goals its founders have for it.

AMPL aims to be the simplest solution to supply inelasticity. It can be held as a diversifying asset to balance out a portfolio or used as collateral in DeFi. Right now, it’s hard to imagine all the alien forms of money waiting in the wings with everything moving so fast. But AMPL has already proven to be a leader in this great experimentation.

To learn more about DeFi and receive the best blockchain education possible, visit Ivan on Tech Academy today and join over 20,000 students already learning about blockchain. We’re looking forward to your enrollment!

Author MindFrac