2020 has been an unprecedented year for the traditional financial markets. Perhaps the most noticeable part of this was when stock indices dropped sharply in March, by roughly 30%, constituting the largest and fastest drop in modern times. Now, following attempts to restart the economy, people are speculating at the imbalance between the stock markets and the U.S. economy on the ground – leading many to wonder ‘is the stock market going to crash again?’

In this article, we will look at both sides of the argument – the bullish and bearish factors about the stock markets. We will cover views of what the experts are saying, and different strategies for how to preserve your wealth during a bear market. Anyone keeping an eye on the cryptocurrency market will know that crypto is often seen as a way to preserve your wealth in times of financial turmoil. This article takes a closer look at what constitutes a stock market crash, and how to preserve your wealth in the case of one.

If you want to learn more about the history of money and crypto basics, be sure to check out the blockchain courses on Ivan on Tech Academy. Ivan on Tech Academy is one of the premier platforms for blockchain education, and right now you can get 20% off with the exclusive promo code BLOG20.

Background Information

Do you find it hard to understand the stock market and traditional financial markets? Governments and financial institutions are sometimes guilty of using long, confusing words, or boring phrases to keep people uninterested in their activities behind the scenes. It is a psychological tactic designed for people to ‘switch off’ to what’s happening with their money and wealth, and society around them.

It has also recently been reported how the media can misrepresent certain statistics, to make situations seem to be worse than they really are, which puts fear into viewers at home. Communication from different news channels doesn’t always necessarily put things into perspective. For example, back in July CNBC reported a 32.9% drop in GDP in the second quarter – this is actually an annualized number.

The Bureau of Economic Analysis reported the “not annualized” figure to be a 9.3% drop in Q2. However, this is still the worst decline since 1947 when quarterly GDP records began.

With a lot of fabrication and exaggeration from media sources, it is important to have a clear understanding of how to view the status of the stock market. To do so you need to be sure of a few economic fundamentals such as understanding the positions of power and history of money.

Who Are The FED and What Do They Do?

The FED is an abbreviated term for the Federal Reserve System, created in December 1913 as the central banking system of America. The FRS is not “owned” by anyone, it was created through the Federal Reserve Act following a series of financial panics, or bank runs, in the early 20th century that spawned a desire for a central monetary system to relieve the financial crises.

The Federal Reserve Act monetary policy had 3 key objectives when established by U.S. congress: “maximizing employment, stabilizing prices, and moderating long-term interest rates”, by managing the nation’s money supply and interest rates.

The Federal Reserve System is broken down in 12 different locations across the states, each one overseeing privately owned commercial banks and managing regulation in their designated region.

The FED was to be seen as “the lender of last resort“, for example, businesses that cannot obtain credit elsewhere, and if the business were to collapse, would result in a severe negative impact on the economy. Originally in 1913, the primary goal of the Federal Reserve System was to prevent bank runs, or rather, reduce the chances of the bank going bankrupt. Here’s a brief overview of how it works:

Fractional-Reserve Banking

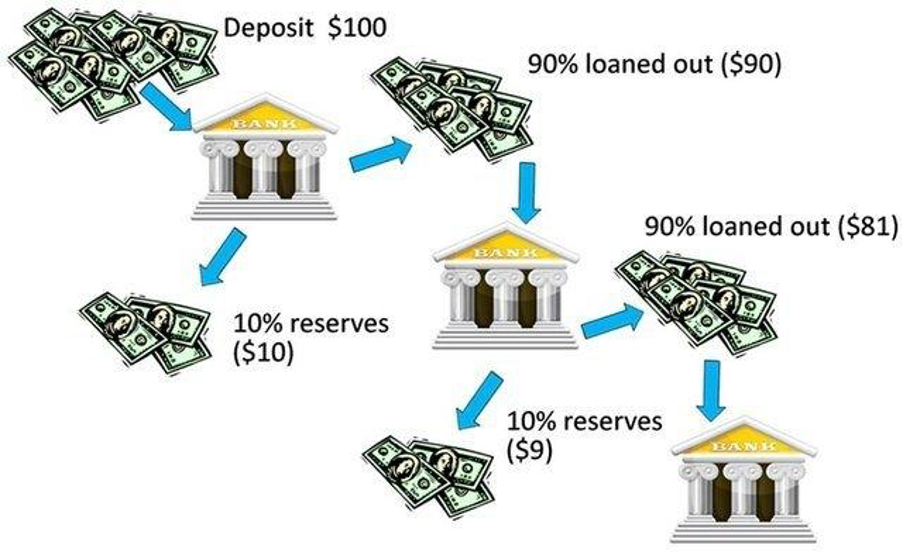

The banks that you and I, and every other average Joe, deposit our hard-earned cash into, are commercial banks that lend out up to 90% of the value of your bank balance. Another way to look at it, your balance is an “IOU” from your bank.

As this lending compounds at scale across millions of citizens, it creates a very unstable framework where, if someone is no longer able to pay a loan, this has a chain reaction down the line resulting in other lenders or suppliers being unable to pay their loans.

A bank run is when the public loses faith in the system and wants to withdraw from the banks and hold their cash, for fear of the bank being unable to pay out their money. In the recent 2008 crash, UK-based Northern Rock saw the first bank-run in 150 years of British banking.

The Northern Rock bank collapsed that year with thousands of people losing their pensions and savings, with a government “bailout” that barely made a difference to the people who needed it. The bank executives were bailed-out, still receiving seven-figure bonuses and ensuring their six-figure pensions were secure; Northern Rock customers were sold on to hedge funds, private equity funds, or had their mortgage sold back onto the global financial markets for a profit.

The Difference Between The Government and The Federal Reserve Service

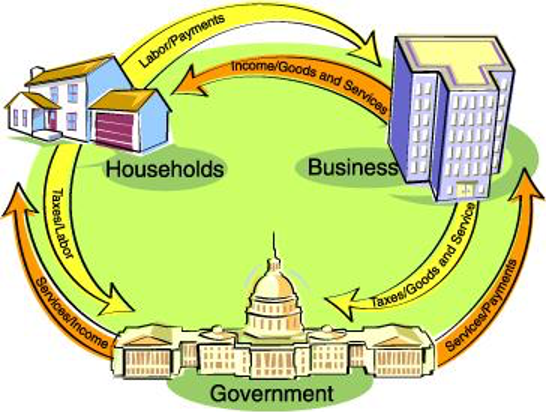

The FED effectively acts as the central bank for the United States. A central bank is a banker’s bank.

Central banks normally are in communication with the government of a country as it manages the country’s financial and monetary policies, however, they are designed to be completely separate and independent from any government party.

A commercial bank offers banking services to businesses, local institutions, and most individuals.

There are different layers to the governmental infrastructure, and it tends to be different for every country.

Federal Powers vs State Powers

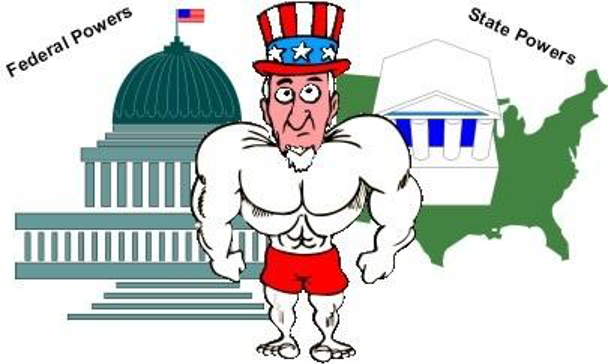

According to share.america.gov, “only the federal government can regulate interstate and foreign commerce, declare war and set taxing, spending, and other national policies.“

In the U.S., there is a 3-tier governing system starting with a 435-member House of Representatives including the 100-member U.S. Senate (each of the 50 states receives 2 senators regardless of its population size).

The second level is the executive branch that is made up of the President and his/her advisers, as well as multiple departments and agencies, each one led by a secretary. The President decides how military weapons will be used, where to deploy troops, and where ships are sent. The military’s generals and admirals take their orders from the President.

At the top is the Supreme Court – the highest federal court in the United States that ensures Americans have equal justice under laws and regulations. The court has 9 justices (1 chief and 8 associates) who interpret disagreements fairly and impartially.

Government vs Parliament

In the U.K., the political party that wins the most seats at a general election takes regulative control of the government and responsibility for running the country for 5 years. However, the government cannot make new laws or raise new taxes before passing through Parliament first.

The Houses of Parliament question ministers, request information about new proposals, monitor how public money is being spent, and track how new laws have been working out in practice. Parliament tries to ensure that Government decisions are open, transparent, non-discriminatory, and efficient.

WTF Happened in 1971 – Mike Maloney

Mike Maloney is the founder of goldsilver.com. Following the 2000 stock crash, Mike has written several books and created a YouTube video series called The Hidden Secrets Of Money, which breaks down and reveals all the governments and central banks’ movements of money, in a simple, easy-to-understand, captivating way. If you’re not familiar with the 10-video series, it’s worth checking out – it may just blow your mind!

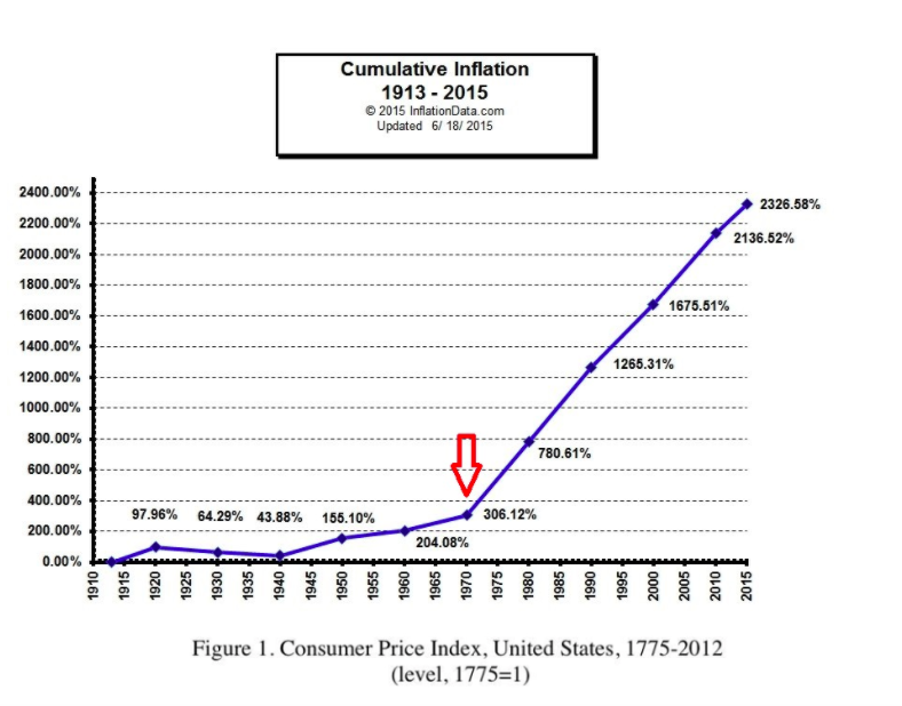

wtfhappenedin1971.com is also one of Mike’s websites and a great source for statistical data and graphs displaying the economic disparity following President Nixon “temporarily” un-pegging the value of the U.S. dollar from gold.

Although it was initially advised as temporary. we have never gone back. The ceiling for printing money was lifted, and the U.S. government didn’t have to pay countries their gold back within their requested short time-frames.

Why is this an issue?

The history of fiat currency shows every single tried and tested fiat currency, has gone to zero.

In the beginning stages, the fiat paper currency value is pegged to gold. However, when citizens of a country don’t want to fund things such as war, the government needs to find – or create – money from elsewhere. This is how debasement happens. More currency is printed than the amount of value the country is worth (in gold).

Bretton Woods Conference

In 1944, at The Bretton Woods Conference, the world’s wealthiest nations came together to regulate the international monetary and financial orders after World War II. It was decided that the U.S. dollar was to be the world reserve currency – pegged to the price of gold (At this point America held approximately two-thirds of the world’s gold supply). All other currencies would then be pegged to the U.S. dollar.

When President Nixon cut the gold peg in 1971, it was the first major crack in the foundations of the global economy, the effects of which can still be felt now.

Boom and Bust Cycles

Ups and downs, bullishness and bearishness, ‘boom and bust’ cycles, are a natural part of a free market.

In a market where there is no government inflation or manipulation of stocks and assets, underperforming businesses that are making a loss and can not afford to keep going must be cleared out to make way for new businesses, technology, and innovations.

Some argue this is a bad thing because it potentially means temporary mass unemployment. However, economies work in cycles and perform best when businesses consistently make a loss, close down, and reallocate the capital to newer, more profitable businesses.

Previous ‘bust’ cycles have occurred in the early 1980s when the FED raised interest rates to 20% to end inflation. We went through a bust cycle in the early 2000s after the ‘dot com’ bubble. The 2008 bust, subprime mortgage crisis, however, didn’t properly reset the economic cycle as the FED gave most banks a bailout.

Historically, periods of economic downturn and recession could be overcome by austerity and a healthy reversal of the economy could be naturally achieved if the necessary cutbacks were made.

Unfortunately though, with the increase in stimulus, the chances of an actual recovery in this regard look slim, as the damage done to the economy by recent unprecedented measures will take generations to undo.

The majority of stimulus money goes to businesses and corporations, only a fraction of the trillions printed this year has made it into the hands of regular citizens. By propping up businesses that are ‘too big to fail’, the stock market is artificially inflated and the value of stocks no longer represents the actual value of the company being propped up.

Is The Stock Market Going To Crash – What Experts Are Saying

The S&P 500 is an index of the 505 largest businesses in America. Over recent months there has been an increasing imbalance within the stock market, which is essentially being held up by 5 companies: Alphabet (Google), Amazon, Facebook, Microsoft, and Tesla, with the common denominator being technology.

Mike Maloney

Mike Maloney hosts the popular GoldSilver (w/ Mike Maloney) channel with 560K subscribers. In one of Mike’s recent YouTube videos “Is This The Beginning Of The End?”, he explains the lack of sustainability and fear for the future of the stock market following the stimulus cheques produced as a result of the pandemic.

Mike explains to viewers the articles published claiming the U.S. Treasury will put in $450 billion, for it to be fractionally distributed out to create $2.3 trillion to support the economy.

Mike Maloney has previously accurately predicted stock market crashes and is encouraging his viewers to look at alternative assets to stocks to preserve their wealth.

Robert Kiyosaki

Robert Kiyosaki is a successful entrepreneur and investor, and author of one of the top-selling books Rich Dad, Poor Dad. Robert frequently posts videos on YouTube to his 1.5 million subscribers on his Rich Dad Channel.

This year the Rich Dad Channel has featured numerous videos warning of the dollar decline, how to prepare for the upcoming market crash, and educating viewers on the current flaws in the banking system and stock market.

Anthony Pompliano

Also known as ‘Pomp’, Anthony Pompliano has been in the crypto space for a couple of years investing in Bitcoin and is the co-founder of Morgan Creek Digital. Pomp has a successful YouTube channel with different video playlists organizing the Monday-to-Friday ‘Lunch Money’ series, Pomp Podcasts, interviews, and ‘Pomp Explains’ episodes, with his channel often featuring multiple daily uploads.

In ‘Pomp Explains’, Pompliano answers common questions around the current financial market and best moves on how to preserve your wealth in a financial crisis alongside updates on moves by the FED and government around national public debt and unemployment.

What Are They Saying?

The overall message from these 3 successful investors, entrepreneurs, and other wealth/crypto influencers suggests that there is a growing difference between the success of the stock market and the unemployment in societies. Is the stock market going to crash? It appears this is a clear calling for some kind of correction or crash.

Alongside this, many influencers are advising their viewers to look at investing in the crypto market, specifically Bitcoin, as a way of protecting their wealth during an economic crash.

Why People Are Choosing Bitcoin

Instead of a central bank or governing party controlling a nation’s currency, Bitcoin is a global, borderless cryptocurrency that is powered by a network of thousands of distributed computers across the globe, known as blockchain technology.

Blockchain technology can be thought of as a database that stores all transaction data which is immutable, meaning it can not be removed or adjusted.

Bitcoin and other cryptocurrencies have brought back the free market, for digital assets to be purely valued on supply and demand. There can only ever be 21 million Bitcoin mined as is written into the protocol, making Bitcoin the most scarce asset in the universe.

Since its inception in 2008, more and more people have discovered the value and potential of Bitcoin, with the price of 1 Bitcoin (BTC) increasing over 10 million percent in just over a decade, and we are still in the very early stages of adoption.

Preserving one’s wealth through Bitcoin and cryptocurrency investments has never been more popular. Enroll in crypto courses on Ivan on Tech Academy today in order to learn more about blockchain and cryptocurrencies!

How To Preserve Your Wealth

More and more people are choosing to invest a percentage of their portfolio or savings into cryptocurrencies, with an increasing number of projects and start-ups making it easier than ever to learn how to preserve your wealth.

If you are new to crypto, it’s often easier for beginners to register with a reputable centralized exchange such as Coinbase or Binance. Alternatively, you can use decentralized exchanges to purchase Bitcoin or other cryptocurrencies.

In order to purchase any crypto, you will need to have a wallet. Wallets can be soft/online or hard/offline, desktop, or paper wallets (click here to learn more).

If you are wanting to invest in cryptocurrencies and hold (or hodl) them over some time, it would be advisable to purchase a hard wallet where your coins are stored offline, safe from online malware, and hackers. We have covered extensively how these wallets work and the best hard wallets on the market in an article here.

If you are thinking about perhaps looking for an alternative investment for your retirement, there are now Bitcoin 401ks in the U.S. where employers are paying a pension contribution for their employees in Bitcoin. You can learn more about how to retire with Bitcoin here.

Conclusion

It has been suggested by economists that we were to anticipate a financial crash in 2019, yet the numbers surpassed most economists’ predictions positively. With recent market success, some are asking what the difference is this time. Is the stock market going to crash again?

We are living in an unprecedented situation, printing unimaginable amounts of money on large scale to keep businesses afloat whilst our economies shut down. There are several key factors to consider such as the looming ‘second round’ of the virus that could send stocks plummeting once more, plus an upcoming presidential election.

There were also rumors about the effect of the stock market after labor day, with some influencers predicting a crash. The general feeling across the crypto YouTube space is that the stock market could continue to rise until election day. After that is anyone’s guess, the FED has a lot of power and many ways to prop up the market in an attempt to prevent a crash due to unfavorable election results.

If you want to learn more about the history of money, blockchain technology, or cryptocurrencies and how these can help you preserve your wealth, be sure to take a close look at Ivan on Tech Academy!