With recent uncertainty in the media about the stock market and gold prices, rumors of an upcoming crash, the worst since The Great Depression, and money being printed in the trillions, more and more, people are looking at options to retire with Bitcoin.

In this article, we breakdown the basics of how and why people would choose to retire with Bitcoin and the safest ways of doing so.

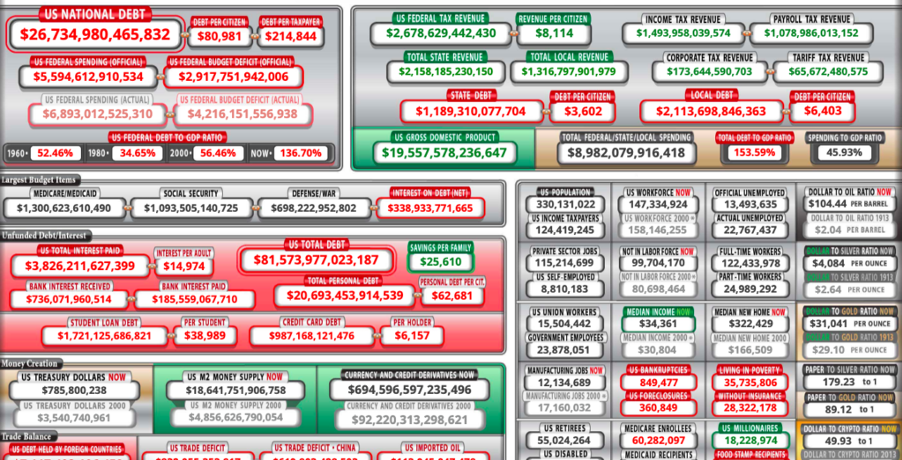

U.S. Debt Clock

The U.S. Debt Clock is a website that displays a breakdown of real-time debt and liabilities of the United States of America, different departments, and averages of the amount of debt per citizen and per taxpayer.

The debt is split between ‘government’ debt, approximately $7 trillion, and ‘public’ debt, which is around $19 trillion.

At the time of writing, the total debt amounts to more than $26.5 trillion, increasing by $1 million approximately every 20 seconds.

To put this into perspective, 1 million seconds ago was 11 days, 13 hours 46 minutes, and 40 seconds. 1 billion seconds ago is just over 31 and one-half years.

1 trillion seconds hasn’t even been recorded yet since the time of civilization.

1 trillion seconds ago would be back more than 31,688 years, around 29,679 B.C., roughly 24,000 years before the earliest civilizations began to take shape.

This website is an incredible insight into the amount of debt in a lot of different countries, but only shows the detailed breakdown of where debt lies, in the U.S.

Why Pensions Are In Danger

Pension funds, that have been paid into by employees and tax-payers throughout their working lives, fall within the ‘unfunded national securities’ debt. This is a debt the government owes to its citizens.

At the time of writing, the unfunded national securities debt stands at $154 trillion, increasing by $1 million in less than every 5 seconds.

Although governments market pension contributions as a savings pot to be accessed later in life, this is simply not the case. Your pension contributions are spent by the government.

Current pensions are paid for by working generations’ taxes, and with record unemployment and thousands of businesses being forced to close due to the global pandemic, this puts an additional strain on the national pension schemes.

What is Bitcoin

Bitcoin is the first cryptocurrency created using blockchain technology, and can sometimes be referred to as a digital or virtual currency.

Instead of having a native currency that can only be used in certain places, Bitcoin is a global, borderless currency, that can be used by anyone regardless of location, race, color, or creed, as long as there is an internet connection.

As opposed to a centralized bank or governing party, the Bitcoin network is run by a system of thousands of computers (called nodes) distributed across the globe, with transactions being verified using mathematical equations.

Bitcoin was ‘given’ to us by an anonymous developer or group of developers by the name of Satoshi Nakomoto in 2009, following a proposal in 2008 after the financial crash. To this day the identity of the developer(s) remains unknown.

Bitcoin, although famous for its volatility, remains the most secure type of currency due to the size of the network and being one of the main asset choices as a store of wealth and value by many individuals and recently, large corporations.

Why Blockchain Technology Is Revolutionary

Blockchain technology can be thought of as a database, storing every single transaction history, on a public, distributed ledger that anyone can access.

Information on the blockchain is immutable – meaning it can not be removed or altered. Here’s why:

If someone wishes to make a transaction and send some bitcoin BTC to a friend, the transaction is broadcast out to the network of nodes to be verified.

A node will choose a transaction and mathematically verify the validity of the transaction, for example, ensuring the wallet has sufficient funds, by solving enormously complex mathematical equations.

This transaction is updated on the network database to ensure every single node achieves consensus on the state of the transaction, and once confirmed as valid, is placed into a block.

When a block becomes full of verified transactions, it is placed on to the blockchain, with all previously confirmed transactions.

When a node verifies a transaction, it requires data from the previously confirmed transaction in the block, to complete the mathematical equation.

This is how every transaction in every block, and in turn, every transaction in history on the blockchain, is cryptographically hashed (or linked together).

Why People Are Looking To Retire With Bitcoin

In the past, when citizens have turned away from fiat currency to store their wealth, they have turned to gold. Bitcoin is sometimes be referred to as ‘digital gold’, for the similar properties they both hold.

However, as exemplified several times over history, gold can have its drawbacks, namely the limitations around the possession of the precious metal. In 1933 the U.S. announced citizens must surrender their gold or face a hefty fine or imprisonment. In 1959 Australia put a law in place that allowed gold seizures from private citizens if “expedient to do so” to protect the currency of the Australian Commonwealth.

In 1966, the U.K. passed a law making it illegal for anyone to own more than 4 gold coins and closed off private gold imports. This was only temporary before the ban was lifted in 1979.

In addition to government intervention, gold also can be difficult in terms of physical practicalities, for example, the purchasing and storing process.

There are a couple of gold brokers online where you can purchase a chosen amount of weight in gold and have it delivered to your doorstep. It is then your responsibility to securely store this precious metal in your own safe or other means available.

Oftentimes, this isn’t the case. A lot of people feel vulnerable holding gold and therefore turn to services from others to store their wealth for them. More often than not, people who ‘purchase’ gold, never physically see it, but will hold a certificate of authentication which can be exchanged for gold at any time should they wish.

Gold Alternative

One of the main reasons people feel comfortable to retire with Bitcoin is because they have true, full ownership of their digital assets, that cannot be seized by governments.

There have been a few countries around the world, such as India and Russia, that have banned the use of Bitcoin and cryptocurrency within their borders. However, citizens are still able to purchase and access their Bitcoin funds online using a VPN (virtual private network and, although they may be unable to spend crypto in their country, citizens still have a borderless store of wealth that can be used in millions of other places around the world.

Bitcoin is the easiest store-of-value asset to cross borders and travel the world with, as it is simply code that can be accessed anywhere with an internet connection.

Another reason people are looking to retire with Bitcoin may be due to the rumors of Bitcoin becoming the new world reserve currency.

The Most Scarce Asset In The Universe

The U.S. dollar as we know it today was first printed in 1914 and became the world reserve currency in 1971 when President Richard Nixon abandoned the gold standard. Every reserve currency in history has had a lifespan of around 100 years, and with QE infinity (known in the meme community as money printer goes brrr) introduced following the pandemic, many believe the U.S. dollar is in decline.

It has been said by several crypto influencers how ownership of 1 BTC will be of a high-status position when crypto has reached mass global adoption. The beauty of Bitcoin is its scarcity.

Only 21 million Bitcoin can ever be mined, as set by the rules in the protocol. With rumors of Elon Musk planning to operate gold mining rigs on asteroids in the not-too-distant future, it means Bitcoin is the most scarce asset in the universe.

Bitcoin is designed as a deflationary asset, meaning that its purchasing power increases over time. Since its inception is 2009, the value of 1 Bitcoin has increased by more than 10 million% in 10 years, and we are still in the very early stages of adoption.

Where To Buy Bitcoin

If you are new to cryptocurrency, the easiest place to first buy Bitcoin would be on a centralized exchange such as Coinbase or Binance.

These are the 2 largest crypto exchanges in the world, in terms of the number of users and trading volume.

Coinbase provides a service to those who want to purchase Bitcoin, and other large established cryptocurrencies, and hold (or hodl) on to them for a sustained period.

Binance is a great platform for beginners who want to purchase Bitcoin alongside other small-cap coins, and start trading their crypto assets. If you’d like to learn more about how to trade, click here!

Centralized Exchanges vs Decentralized Exchanges

The key difference between a centralized exchange and a decentralized exchange is that centralized exchanges offer a custodial service meaning they will hold and look after the private keys to your funds for you, often in cold storage hard wallets.

Centralized exchanges operate from a single or central point or entity, whilst decentralized exchanges operate throughout a network of distributed computers.

Centralized exchanges are great for beginners as they offer a seamless user experience through simple interface designs.

Decentralized exchanges are great for more experienced traders or investors, interacting directly with the smart contracts of the cryptocurrencies through a nice graphical user interface.

Bitcoin ATM

The amount of Bitcoin ATMs has been growing exponentially in 2020, with ATMs now at local corner shops and newsagents. With plans to feature Bitcoin ATMs in nearly 20,000 7eleven shops across North America, it has never been easier to convert your cash or digital fiat, to Bitcoin.

There are nearly 300 Bitcoin ATM locations already in the U.K, over 800 in Canada, and soon will become available at Post Offices in Australia,

How To Store Bitcoin Safely

If you are buying Bitcoin on Coinbase, Binance or any other exchange, it is not advisable to be holding large amounts of crypto in a wallet that is connected to the internet. Although there are many security protocols in place, these hot wallets are still vulnerable to online attacks.

The most secure way to store your cryptocurrency is in a hard wallet or cold storage. Only purchase hard wallets direct from the retailer, and it’s advisable to use the big-name more reputable brands such as Ledger or Trezor.

Security Precautions

When you are creating a wallet, either hot or cold, you will be asked to note down a ‘seed phrase’ and create a password, as a security precaution to access your funds. The seed phrase is a random collection of usually either 12 or 24 words.

This seed phrase must not be seen or accessed by anyone else, this seed phrase means you can access your wallet wherever you are in the world, even if you’ve forgotten your password.

Ideally, you will want to have your passwords and seed phrases written down in a notebook – not stored on your computer anywhere. This is the safest place you can see your information.

With cryptocurrency, you are your own bank. You have the sole responsibility of looking after and protecting your funds. If you imagine all of the security protocols in place at a bank, it doesn’t appear that extreme to keep a hard wallet and notebook in a fire-proof safe at home, to preserve your wealth.

When using different wallets, it is recommended to only use hot wallets as though it was your regular wallet, for example, having a little bit of cash to spend or play around with. Like you wouldn’t carry your life savings around with you in your physical wallet, the majority of your wealth ideally should be in cold hard storage.

Bitcoin 401ks

There is an increasing demand for people looking to retire with Bitcoin, with people of all ages looking to purchase Bitcoin now and keep in a pension fund to access at some point later in life.

Bitwage, the cryptocurrency payroll giant, has partnered with the most regulated exchange on the market, Gemini, to offer users in the U.S. a Bitcoin 401k, that allows employees to contribute to a fund from their salary alongside employer contribution.

The U.S. government Payment Protection Program means that businesses receiving financial support loans must spend at least 75% of their funds of employee payrolls, for businesses to receive 100% loan forgiveness as authorized by the federal authority of Small Business Administration (SBA).

Fortunately, the employer retirement contribution is counted towards the 75% payroll expenses. This means that currently, businesses are incentivized by the government to offer healthier contributions to pension funds and 401ks.

Bitwage offers a custodial service through the Gemini wallet for employees to access pre-tax and post-tax Bitcoin contributions to a Bitcoin 401k.

According to the Bitwage website “a traditional 401k allows pre-tax dollar investments with deferrals on income taxes until withdrawal and a Roth 401k allows post-tax dollar investments with no tax obligations on capital gains for qualified withdrawals.” Bitwage can cater to both.

Retire With Bitcoin Conclusion

With the current crisis for pension funds, retirees are completely dependent on the government and the younger working generations in the system to generate enough tax to be re-distributed to dwindling pension funds.

As displayed by the U.S. debt calculator, there is currently no money available for pension funds.

Although the price of the asset may be volatile, Bitcoin has historically proved to be a better store of wealth, and return on investment over a longer period, as opposed to stocks or gold.

Bitcoin is a deflationary asset, easy to hodl over time, and allows full control and ownership over your funds. With the increasing lack of trust in the current governmental system, it only appears natural that people would look to retire with Bitcoin, lt debt var sl kcecreating true2 wealth and financial independence. If you’re looking to learn more about blockchain courses or blockchain education in general, be sure to check out Ivan on Tech Academy, the go-to party.