The situation is pretty simple for Bitcoin. The trend remains up But there is no top pattern in the chart.

Issue 16

January 13, 2023

The State of Web3 Gaming: Innovations & Expectations

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. 2023 is well underway and it’s time to pay attention to crypto once again. We’re surviving and the fundamentals of Bitcoin are still here. Nothing changed last year and it hasn’t changed this year.

Those of us who are willing to continue learning and increasing our knowledge now will maintain confidence in the fundamentals of blockchain technology and also be better positioned to succeed in the next bull market. We can help to share this knowledge and understanding with anybody who’s lost interest or just stepped back into their comfort zones, because lessons of the past form the wisdom of the future.

I’ve been reading more and taking the time to learn from some of the most respected people in the crypto space. There’s a lot of valuable wisdom in ‘Internet of Money’ by Andreas Antonopolous. For example there’s a criticism that often surfaces, on Bitcoins ability to scale. He describes how throughout the internet era a similar scaling challenge was and still is consistently faced and overcome.

When internet technology was first created it was incredibly slow and the bandwidth incredibly low by today’s standards, but the technology itself was still revolutionary for those with foresight. Yet at the time lots of people refused to see the bigger picture of what it could do or even entertain the idea that the scaling challenges would be overcome.

In the late 1980’s the earliest internet networks were called ‘Usenets’ and operated between Universities and other research centers. They had the purpose of creating a place for people to come together and discuss things. A simple message would take between 30 minutes and 26 hours to deliver, it was useful to a limited set of people, but as demand grew the scaling challenge grew.

Then came emails and the demand for network bandwidth continued to increase and there was only so much which could be achieved with dial up connections through old telephone lines. The more it was successfully used by people the more the networks would become congested due to popularity.

The same thing happened with demand for web pages, then voip, then streaming, and soon it’ll be the AI revolution with demand for things like driverless cars when in theory there’ll be nothing to stop the growth of the use of the internet. With networks you can succeed at one use case then you fail at the next because of the demand. But the key is with the popularity of the network people are adequately incentivized to find a way to overcome the scaling challenge at every stage.

There have been decades of people saying the internet will fail to scale. We’ve had over a decade of people saying Bitcoin won’t scale and less than a decade of people saying Ethereum won’t. When we all keep continuing to use these networks then there are enough incentives for people to keep finding solutions for them to scale!

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

January 13th, 2023 | 08:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds. I don’t give advice to buy or sell specific assets. The education and software tools are timeless and generic for any asset. Rather than relying on subjective market opinions, I apply the principles of technical analysis formulated in 1930s on historical charts. Anyone can apply the same process and get the same result. Technical Analysis does not predict the future. It is a tool to find setups for controlled risk/reward. Larsson Line does not predict the future. It is a mathematical formula for trend expression. My objective with this report is to help you reflect on your own analysis, not to replace it.

Disclosure: I hold Bitcoin and Ethereum exposure through company ownership and in my personal capacity, as ETP price tracker certificates through my bank.

Trend Analysis

Bitcoin (BTC)

WE’RE BACK BABY!

Ethereum (ETH)

ETH/BTC remains in a consolidation range

Binance (BNB)

Binance has faced a lot of FUD lately.

Solana(SOL)

The support has been reclaimed and held.

Polygon (MATIC)

MATIC/BTC needs to break out of this super clear resistance

Cardano (ADA)

Trend down. Rejected at resistance

XRP

Ranging.

Bitcoin (DOMINANCE)

Rejected at resistance.

Bitcoin

WE’RE BACK BABY!

I’ve talked about how the DXY parabola break in early November should serve as pump fuel for speculative assets like Bitcoin.

Then I was fairly optimistic in:

– the Nov 24th edition with headline “Bottoming?” at $16,574

– the Dec 2nd edition with headline “Bottoming?!” at $16,975

– the Dec 9th edition with headline “Bottoming?!!” at $17,243

Then I got spooked by the dump on Dec 15th. With the trend down, I didn’t want to see any surprises or moves in the “wrong” direction and prefer a better safe than sorry approach.

Turns out I might have been right after all, just a little too early.

As I shared in the discord this Tuesday Jan 10th, I took a gamble entry that day at $17,400 as we had just cleared both the $16,871 resistance and the $17,260 resistance levels that I’ve drawn in this report since many editions back.

This shows again that even though I was shaken out by the mid-Dec dump, it was possible to get in again at almost the same levels without risking holding on the way down in case that dump had gotten much deeper, down to the 13.8k level or even 11.8k.

Now price is at a healthy distance above the entry, but we’re not completely out of the woods yet. Just like the previous time, I’m not interested in HODL-ing anything on the way down, especially before the trend has turned up. It’s a gamble entry, not a high confidence entry.

There are two things to watch for now:

- The 18,600 level (set from the horizontal part of the descending triangle). That we just cleared. Let’s see if we hold it and turn it into support.

- If you look on the volume profile on the right side of the chart above, you can see that we just touched the price levels where a high volume of coins have historically changed hands. This volume area here from 19,000 – 19,300 can provide real resistance. If we clear that and hold, yeah baby, it’s go time!

- The daily trend. It will turn neutral today if price holds here. But neutral isn’t a trigger for me. I want to see it up. If we can consolidate and hold these levels, it will turn up. But it hasn’t happened yet.

If I didn’t have an entry in already, I wouldn’t buy here, just below a key volume resistance area, because it’s hard to put an invalidation level.

Now I have an entry and I’ll hold that and I’ll probably add a 2nd position if we either

a) successfully retest support

b) breakout through the volume area (and then probably use the 18,600 as stop loss level)

c) trend turns up

If all 3 happen, I’ll go big.

Not a recommendation. Just what I’m doing. My situation is probably different from yours.

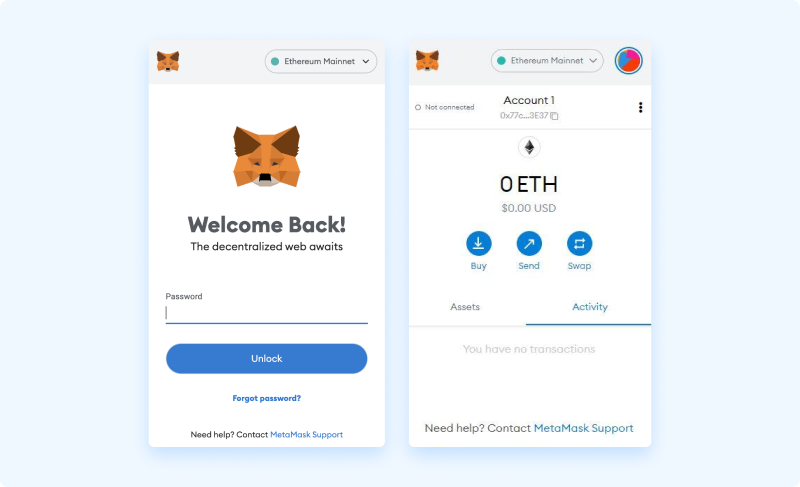

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet, or mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started]:

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next, we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Now that we have a good understanding of the purpose and security practices surrounding seed phrases. Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed:

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, we are brought to a final confirmation page, indicated that our wallet setup is now complete. Here we select [All Done] and our wallet is ready to use:

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

The State of Web3 Gaming: Innovations & Expectations for 2023

Introduction

The Web3/NFT gaming ecosystem saw a huge hype in the summer of 2021 when games like Axie infinity, The Sandbox, Decentraland, and many others saw a huge upside of up to 100x in their token prices. Most of these gains were mainly driven by FOMO and speculation without much real usage of the games. The limited number of users playing these games was mainly due to poor User Experience(UX), low-quality gameplay, and many others.

There has been a lot of discussion by famous talking heads in the industry about the potential for Web3 gaming to have a big year in 2023. In this section, we dive deeper into the state of Web3 gaming and the things we expect to see in a great Web3 game going forward.

People Also Read

The Bitcoin trend remains up. We've cleared the neckline, confirming the IH&S pattern. What will the market do next?

If Bitcoin closes today at current levels, we have a H&S (top) pattern in the chart. The pattern target on