Learn all about the massive growth of the Web3 sector in this free Moralis eBook!

Issue 24

March 24, 2023

Bitcoin at a critical level. Where do we go Next?

Contents

Introduction

By The Moralis Research Team

Welcome back, everybody. It’s been another exciting week in crypto, and we’re pleased to bring you the next edition of Moralis Research. Today, we will be interested in getting your feedback on the content of these reports. Please take a few minutes to give us your feedback here.

This week we saw a continuation of the crisis in the banking sector with Credit Suisse being acquired by UBS. Additionally, most bank shares plunged by double-digit numbers in the US and Europe.

Moreover, we have seen continuous attacks on the crypto industry from US regulators with the newly termed “operation chokepoint 2.0 continue. Basically, the recent bank run that led to the liquidation and receivership of Silvergate and Signature banks could be the result of the Biden administration’s campaign against the crypto industry, according to a writer for Forbes. The crackdown has included attempts to make it more difficult for banks to deal with crypto clients and a series of regulatory efforts to disrupt the crypto industry.

While some reports suggest the banks failed due to bad bets or their inability to handle depositors such as tech and crypto startups, there is an alternative version of events that the banks were victims of an opportunistic campaign to destroy banks serving the crypto industry. The Biden administration may have even instigated the bank run as part of its campaign against the crypto space, which would represent a significant scandal.

The crackdown against the crypto industry included the SEC’s lawsuit against Paxos for issuing the BUSD stablecoin, crypto exchange Kraken settling with the SEC for offering a staking product, SEC Chair Gensler’s labeling of every crypto asset other than Bitcoin a security, the Senate Committee on Environment and Public Works’ hearing lambasting Bitcoin for its environmental footprint, the Biden administration’s bill proposing onerous tax treatment for crypto miners, the NY Attorney General’s declaration that Ethereum is a security, the SEC’s doubling down on its attempts to block a spot Bitcoin ETF in court, and its attempts to stop Binance US from buying the assets of bankrupt Voyager.

As you know, we’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report, please remember to fill out the feedback form, your feedback is valued, and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

Friday 24th of March, 2023 13:00 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds. I don’t give advice to buy or sell specific assets. The education and software tools are timeless and generic for any asset. Rather than relying on subjective market opinions, I apply the principles of technical analysis formulated in 1930s on historical charts. Anyone can apply the same process and get the same result. Technical Analysis does not predict the future. It is a tool to find setups for controlled risk/reward. Larsson Line does not predict the future. It is a mathematical formula for trend expression. My objective with this report is to help you reflect on your own analysis, not to replace it.

Disclosure: I hold Bitcoin and Ethereum exposure through company ownership and in my personal capacity, as ETP price tracker certificates through my bank.

Trend Analysis

Bitcoin (BTC)

Fantastic. Trend up

DXY

Lost all steam

Bitcoin (DOMINANCE)

At a key point.

Gold

Trend is up

Uranium

Trend is up

Bitcoin

AMAZING SPOT!

First, apologies for the short Friday TA Report today. I’m on the first vacation with my wife without our kids in 6 years. So I’m not going to sit much at the computer :-)

Bitcoin is at a spectacular spot here:

– The trend remains up.

– We’ve cleared the neckline, confirming the IH&S pattern.

– That 25k neckline should offer support and downside protection.

On the upside, it’s hard to say. We have reached the resistance area between 28,600 – 31,700 (the range set in May-June 2022). If we break that too, the target from the IH&S pattern on the log chart is actually around 40k, not 30k, so who knows, this could get exciting.

The market will never make it easy for us. There will be fakes in all directions all the time, but I’m a simple man: The trend is up. We have a confirmed bottom pattern. => Happy life.

That also means I’m very interested in adding in case we get a support retest. It might be too obvious for the market to give it to us, but if we get it, I’ll take it.

If the situation changes, I’ll deal with that then.

Web3 Wallet: Start Guide

Metamask Wallet

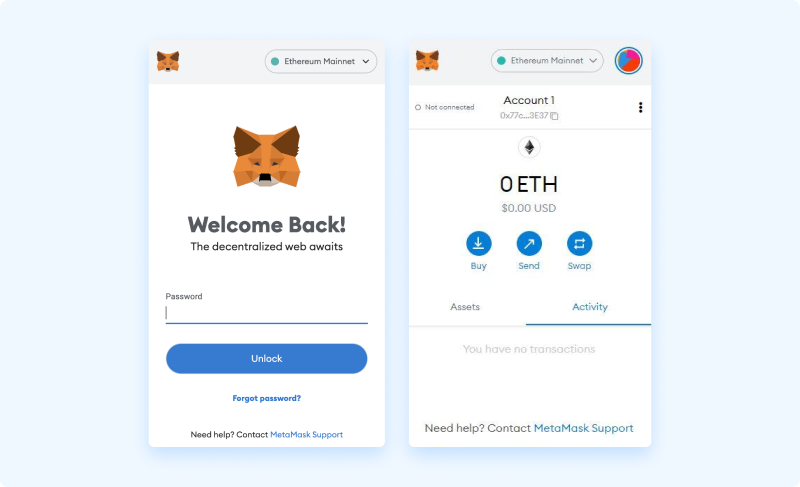

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet or the mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

People Also Read

The picture is clear: Bitcoin got a rejection at the first real resistance 25k. What happens now? Will the price

We are hitting up against the multi-year ~30k+ resistance and have not managed to break out.