If you are questioning what cryptocurrency is all about and feeling unsure as to what actually makes Bitcoin valuable, you have come to the right place! In this article, we will explore some of the different reasons people attribute value to this piece of code, why we have currencies to begin with, examine the blockchain technology that underpins Bitcoin, and how Bitcoin’s properties compare to gold.

Bitcoin is a digital currency and store of wealth, created by the pseudonymous developer(s) Satoshi Nakomoto as a solution to dwindling fiat currencies following the stock market crash and economic crisis of 2008. Put simply, Bitcoin was born out of the failings of traditional financial markets and fiat currencies.

Bitcoin and Blockchain Technology

Back in 2009, the original Bitcoin blockchain was launched. Along with its launch came the birth of a new technology that would be adopted by thousands of businesses and millions of humans around the globe.

Blockchain, a type of distributed ledger technology (DLT) is a decentralized electronic database, that can not be controlled, censored, or manipulated by any centralized or governing party.

The blockchain or database is run by a network of computers around the globe mathematically verifying transactions by solving a complex math puzzle. Once a transaction is verified it is placed in to a ‘block’ along with all the other verified transactions.

Once this block is full, it gets appended to the blockchain where all the transactions that have ever occurred can be viewed publicly online through a website such as etherscan.io.

It is the blockchain that stores information about the number of unspent transaction outputs (UTXOs) or what most people know as coins (Bitcoin), viewable as a balance in an electronic wallet held by an individual.

When a transaction occurs on the blockchain it is immutable, meaning you can’t go into an account and manually edit the balance (like the banks). Transactions are permanent, like carving into stone.

Each transaction is mathematically hashed or encrypted with the information data of the previous transaction to become verified.

This means, in order to manipulate a transaction on the blockchain, a hacker must also alter transactions that occurred earlier in the chain so that consensus can be achieved across the network.

The information stored on the blockchain is also hashed, using public and private keys. Your public key and your private key can not be linked, meaning you are in complete control over who can view your data and when.

Can the Blockchain be Hacked?

Theoretically speaking, yes a blockchain can be taken over – however, this is extremely difficult to accomplish in practice. If an individual is able to generate enough hash power to take over more than half the network of computers (nodes), this would be what’s known as a 51% attack.

This is something that developers bear in mind when creating new protocols and blockchains. Ethereum Classic has recently been the victim of a 51% attack, with their proof of work network becoming compromised when someone was able to take over the majority of the networks’ computer hashing power. As a result, this allowed millions of dollars worth of double-spending of the Ethereum Classic token to take place.

Most new projects are now moving to proof of stake, which provides a much larger security layer around the network, making 51% attacks astronomically harder to achieve.

The top 10 coins by market cap using proof of work have a much much lower chance of a 51% attack than lower cap coins. This is due to the size of the networks (thousands and thousands of nodes) meaning that even with the worlds’ largest supercomputer it would take longer than a lifetime to potentially hack the network.

One of the many value propositions of Bitcoin is how the network is arguably the largest, most powerful computer network in the world.

Why Do We Have Money?

“Money is gold, nothing else” – JP Morgan 1837 – 1913

Before the time of money, people would barter in exchange for goods from other people, offering whatever goods they themselves could provide in return. For example, I will give you 10 potatoes in exchange for 10 apples.

However, this became difficult as farmers who only owned livestock would struggle to find a good transaction for their goats or cows. They would sometimes have to value their animals in other goods like spices or vegetables or other animals, which often proved difficult when trying to get a fair exchange.

This is how currency was slowly introduced, as a way of valuing goods and a fair medium of exchange between parties. Original currencies were often things like shells – valued for their beauty and scarcity in mainland populations, and fur – for its proof of work of catching an animal, alongside durability and providing warmth. Salt was at one point a highly-valued commodity that funded wars and the building of cities.

Salt is long-lasting, easy to carry, weighable as a unit of account, and used as a preservative and seasoning for food. For hundreds of years, salt was highly valued by farmers and kings alike. This was until technological improvements increased the production of the asset so much, the supply was far out-weighted by demand, reducing the value to be worth pennies in today’s age.

There is one significant factor that determines the difference in definitions between ‘money’ and ‘currency’. It is incredibly important to learn the difference, as most people confuse the two or believe they are the same thing.

There is a list of properties that have historically given value to currencies, with gold being the only currency to withstand the ages. Gold has unique elemental properties that make the metal valuable, with silver, platinum, and palladium holding similar properties, although with slightly less value.

Valuable Properties

There are some intrinsic properties that currencies and money hold.

Currency properties: durable, divisible, portable, fungible, medium of exchange

Money properties: durable, divisible, portable, fungible, medium of exchange, store of wealth over a sustained period of time.

Bitcoin is often referred to as digital gold because of the properties these assets share. Below we have listed the properties of currency and money, alongside explaining why Bitcoin is so valuable when compared to gold.

Portable – Easy to carry around

Gold – Gold is not too heavy, and can be small enough to fit in your pocket.

Bitcoin – Anyone can have access to their Bitcoin wallet at any time, anywhere in the world with internet access.

Divisible – Can be broken down in to smaller pieces

Gold – Goldsmiths have been melting down gold into weighted coins and bars for hundreds, if not thousands of years.

Bitcoin – Similar to 100 pennies to the pound, there are 100 million satoshis in 1 Bitcoin.

Durable – Lasts over time

Gold – This precious metal has been used in transactions for thousands of years. Gold has been passed around from person to person, melted down again before returning to circulation for the process to repeat again. Despite continual movement through society, gold maintains its solid, substantial, and sustainable properties as a form of money and currency.

Bitcoin – Bitcoin is a digital currency with an enormous network of computers around the world verifying transactions. As if the network on earth wasn’t strong enough, there are now several satellites orbiting the earth which serve as blockchain nodes, so should the global network ever be compromised there are copies of the blockchain in the sky.

Fungible – interchangeable

Gold – Wherever you travel to in the world, any gold you find will always be holding the same valuable elemental properties.

Bitcoin – In any geographic location, when you access Bitcoin on a digital wallet, it will always be the same Bitcoin blockchain protocol. One Bitcoin in my pocket is worth the same as one Bitcoin in your pocket.

Scarcity

One of the main properties which makes Bitcoin valuable is its scarcity. Unlike gold, there is a finite amount of Bitcoin that can ever be produced. The protocol is written to mine 21 million coins and no more.

So far, 18 million have been mined – with Satoshi Nakomoto rumored to be holding approximately 980,000 BTC, and over 5 million Bitcoin ‘lost‘ through people losing their private keys and thus their Bitcoin funds.

There is value in scarcity, and Satoshi Nakomoto realized from the 2008 financial crash that quantitative easing (money printer goes brrrr) is only devaluing the dollar.

Unlike the FED printing an unlimited amount of paper – Bitcoin’s supply is halved every 210,000 blocks (approx every 4 years) becoming an increasingly scarce asset. So while fiat currency loses purchasing power with monetary and fiscal stimulus, Bitcoin purchasing power increases and has increased year or year.

Medium of Exchange

Another aspect that makes Bitcoin valuable which is often overlooked, is its use as a ‘medium of exchange’. What this means is how Bitcoin is used as a form of payment in a variety of different ways for goods and services.

The ease of use as a medium of exchange is arguably the most important factor for a currency – as exemplified by the US dollar. The Office of the Comptroller of the Currency (OCC) confirmed in their reports to banks that “fiat money refers to instruments that do not have intrinsic value but that individuals and institutions are willing to use for purposes of purchase and investment because they are issued by a government.”

Bitcoin was used as a currency in its early days, though as the value has increased, Bitcoin has become a much-desired digital asset, in addition to a store of wealth.

In order for Bitcoin and cryptocurrencies to expand and become globally-adopted, they need to be used and spent, so that more people can purchase, gain, and spend, allowing the crypto-economy to keep moving and growing.

Bitcoin is now widely accepted both online and in stores. Thanks to payment giants Mastercard and Visa now getting on board with cryptocurrency (after publicly saying Bitcoin is a scam) people are able to spend a variety of cryptocurrencies online and physically at the point-of-sale with crypto debit cards, at over 200 million merchants worldwide.

Store of Wealth

Historically people have flocked to gold and other commodities to preserve their wealth, but the digital generation is seemingly more inclined to invest in Bitcoin and cryptocurrencies, as they see more value in the technology than they do in a shiny piece of metal or a piece of paper with a promise on it.

In the past, when fiat currencies have gone to zero, new currencies have been reset against the value of gold, which has maintained its value and purchasing power throughout history. This month gold reached it’s all-time-high, becoming more expensive than the last peak in the mid-eighties.

Gold can be difficult to store safely. Many people give permission for others to hold their gold securely in a vault. Some order online and hold a certificate of authentication, redeemable for ‘x’ amount of gold. Most people who buy gold, do so without ever seeing the asset they’ve purchased.

Bitcoin can be stored safely off-line in hard wallets that can not be hacked, which are marginally larger than the size of an average USB stick. This gives you complete ownership of your digital assets.

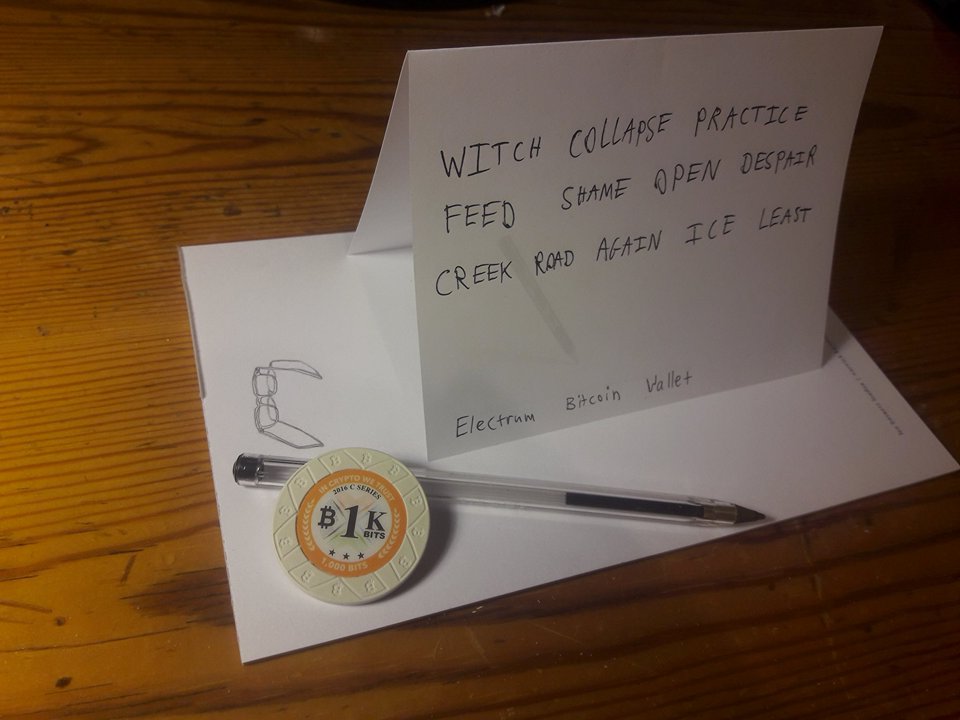

One of the most troublesome aspects of storing Bitcoins is remembering the seed phrase to access a wallet or account. Thousands of people have lost their funds due to being unable to remember key phrases and passwords.

Seed phrases

Write down your seed phrases and passwords in a book and store that book in a safe or somewhere else away and secure. If you lose this, you could lose your funds forever. On the other hand, however, this seed phrase can be memorized, meaning that your funds can be stored safely across borders without fear of repercussion.

What Makes Bitcoin Valuable?

Conclusion

Bitcoin has opened up a brand new free-market, allowing the value of assets to be purely determined by supply and demand and market sentiment.

Before government manipulation and overly inflated valuations of companies, this was how the stock market was designed to operate. Due to human errors of greed and indulgence, the value of the stock markets no longer reflects the real economic situation happening for everyday people.

Bitcoin solved this issue by replacing the monetary policy with a deflationary protocol which is incredibly difficult to manipulate. The network of nodes/miners powering the Bitcoin

blockchain are financially incentivized to follow the rules, meaning that any attempt to manipulate transactions on the blockchain by a miner, would result in a loss of Bitcoin block rewards.

Bitcoin is often referred to as ‘digital gold’ – and rightly so, as it holds many of the same properties as gold and serves as a globally recognized store of wealth much like the precious metal. However, Bitcoin is even more portable, more divisible, more scarce and more fungible than gold.

All of these fundamentals and properties are what makes Bitcoin valuable and could, therefore, be a recipe for a new world-reserve currency. If you want to learn more about cryptocurrencies, be sure to check out Ivan on Tech Academy. The Academy is the go-to place for learning blockchain, the technology that underpins cryptocurrencies.