Fractionalized NFTs, or F-NFTs, are the new crypto sensation making plenty of waves in the rapidly growing NFT sector. Fractional ownership has started a revolution, and some projects have already profited handsomely off it. Take Dogecoin’s Shiba Inu meme, for example. The “DOG” NFT initially sold for $4 million in June of 2021. In only a few months, boosted by the fractionalized NFT version, the price skyrocketed to over $225 million. It was one of fractionalized NFT’s early successes.

However. you’re probably wondering, “what are fractionalized NFTs?”. This article will answer that question and explore some of their benefits and how to create them. But first, you should understand what a regular NFT is.

NFTs vs F-NFTs

NFT stands for “non-fungible token.” An NFT is a digital representation of ownership. So, no two NFTs can be alike. The most popular NFTs are things such as digital art, collectibles, and in-game items. But owners can turn lots of stuff into NFTs, including discount cards, insurance policies, tweets, concert tickets, virtual lands, memes, game cards, etc. Even a person’s identity can become an NFT.

Fractionalized NFTs, on the other hand, present new opportunities for investors by bringing more liquidity and democratization to the marketplace. F-NFTs can also help combat some of the negative factors that have stunted the sector’s growth potential. These include high prices, choked liquidity, and non-interchangeability

What are Fractionalized NFTs?

NFTs are unique, one-of-a-kind assets. However, while making great strides in the crypto realm, many NFTs are priced so high that they’re out of reach for the average investor. Furthermore, until F-NFTs arrived, there could be only one owner. F-NFTs are, therefore, more democratic than regular NFTs.

NFTs are a fascinating sector in the crypto industry. To get a better understanding of them, you’ll need a good foundation. Make sure to check out the Crypto for Beginners course at Moralis Academy.

What are Fractionalized NFTs and How Do They Work?

Using ERC-20 and ERC-721 tokens as examples, let’s look at how F-NFTs work. ERC-721 tokens are the standard for non-fungible token creation on the Ethereum blockchain. ERC-20 tokens, on the other hand, are the standard when creating fungible tokens. ETH, for example, is an ERC-20 token. Fungible in this example means that ETH tokens are as non-unique as the U.S. dollar. If you need more info on fungible vs non-fungible tokens, please read our article covering this topic on the Moralis blog.

So, with fractionalized NFTs, an owner can divvy up one ERC-721 NFT token into multiple ERC-20 tokens. By doing so, they’ve minted an NFT into an F-NFT. A smart contract links the multiple ERC-20 tokens to the ERC-721 NFT. Afterward, a smart contract will connect anyone holding those ERC-20 tokens to the original NFT.

The sequence starts with the NFT locked in a smart contract that resides on the blockchain. Multiple fungible tokens represent ownership of the NFT. Furthermore, the smart contract governs the token supply. So, the smart contract secures the data that differentiates the NFT from the F-NFT and dictates how to divvy up the multiples.

F-NFTs’ Stakeholders

Fractional NFTs have two types of stakeholders:

1. Buyers

These are the users who purchase fractions of the NFT.

2. Curators

Users who fractionalize NFTs and divvy up the asset to sell are called “curators”.

What are Fractionalized NFTs’ Benefits?

While NFTs are great, their prices for high-value assets and luxury items make them impossible for most people to own. These can be popular digital art pieces or tangible goods such as fine wine, yachts, or supercars. Moreover, there are situations where fractionalized NFTs come into play. Average investors can get fractional ownership of a high-priced NFT with smaller sums of money. As such, F-NFTs give smaller investors a chance to own an NFT.

“Smaller” is a relative term, though, depending on the price of the original NFT. In the case of a $10 million piece of digital artwork, a smaller investor might be someone who only has $1 million to invest. A $10 million price tag would put the item out of reach for this investor, no matter how badly he wants it. However, with a fractionalized NFT, the investor could become a partial owner. In this case, $1 million would get him 10% ownership.

Regardless of how much smaller the percentage sizes become, it leads to greater market participation. By enabling greater participation, an NFT owner can generate more interest in their asset. Another advantage of fractionalized NFTs is that they favor owners/creators who want to retain some ownership. Fractionalized NFTs offer these creators a way to sell a portion of their NFT’s value without having to relinquish the whole thing.

Become a blockchain developer and work in the exciting field of NFTs. The best way to learn blockchain development is to start with the 2021 JavaScript Programming for Blockchain Developers class at Moralis Academy.

More Benefits of F-NFTs

1. Monetization

Fractionalized NFTs make it easier for artists and other creators to monetize their assets.

2. Democratized Ownership

As mentioned, high-profile NFT auctions exclude small and medium investors from taking part. So, fractionalized NFTs make democratized ownership possible. Even as bidding prices increase, small fractional values can still be affordable. The benefit is that even if the overall value of the NFT skyrockets, investors other than whales will still be able to participate.

3. Better Liquidity

The NFT market is still hot, but since each item is unique, there is a limited supply. Marketplace liquidity could, therefore, feel the squeeze from scarcity. However, F-NFTs can help by adding liquidity. Deep-pocketed whales sitting on the sidelines can make for an illiquid market on a given asset. More negligible investor participation, however, can fill the purchasing gaps that would otherwise not exist. Furthermore, the excess of fungible ERC-20 tokens can trade on secondary markets. This kind of trading adds even more liquidity.

4. Price Discovery

Fractionalized NFTs enable price discovery. Lower prices mean more significant numbers of participants. By opening the market for broader participation, traders can discover a fair price. “Price discovery” is a term used to describe the process that markets cycle through to establish an asset’s correct price. For example, a collectible NFT could be fractionalized and sold in pieces of 10% to gauge its total price in the marketplace.

5. Curator Fees

Owners who mint their NFTs into F-NFTs can earn an annual curator fee. The NFT owner has the authority to set and update the curator fee. However, the maximum is set and capped by governance to prevent the curator from gouging the other owners with high fees.

What are Fractionalized NFTs and Which Markets Could They Disrupt?

The following industries/markets are the ones that F-NFTs could disrupt.

Art:

Artists can easily split up their NFTs into multiple F-NFTs to sell to collectors. It’s a good way for emerging artists to start.

In-Game Items:

The in-game items market is hot. These can be things such as armor, skins, and weapons used in crypto gaming. Each can be fractionalized and sold to multiple people.

Domain Names:

Sales for domain names such as “.eth” and “.crypto” have also seen spikes. By fractionalizing domain names as NFTs, they can also be sold to multiple investors.

Collectibles:

The collectibles market is enormous. The fractionalized 50 CryptoPunks collection offered small investors the opportunity to invest. Average investors would have been locked out from this collection otherwise.

Real Estate:

High-priced real estate can be split into multiple fractionalized NFTs, thus opening up this luxury market to average investors. F-NFTs could also eliminate mortgages. Instead of one person paying off a house in 30 years, a group of investors or tenants could hold a percentage of the property together.

Music:

The music industry is also buzzing over the potential of NFTs and F-NFTs. In the current revenue model, record labels still control the lion’s share of the profits. However, artists could fractionalize ownership of their songs and albums to sell directly to their fan base. Such a scenario could remove the need for a record label or reduce their role in profit-taking. Therefore, fractionalized NFTs are poised to expand the artist-to-fan relationship in music.

What are Fractionalized NFTs and Where to Create Them?

If you have basic coding skills and are familiar with the blockchain, you can mint NFTs with Moralis. Or, for fractionalized NFTs, there are platforms that specialize in these assets.

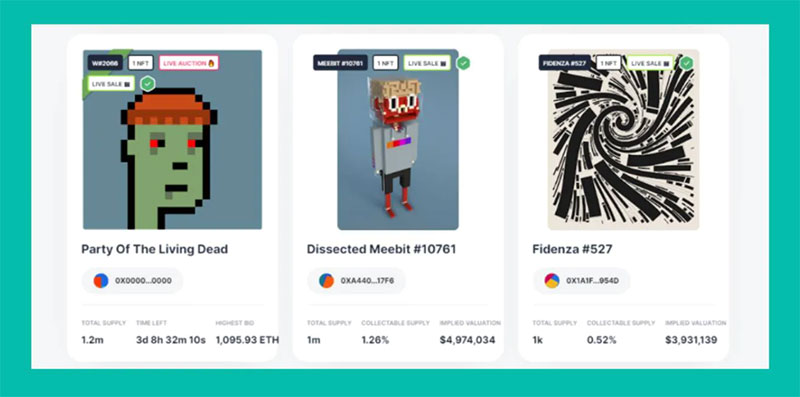

With DeFi and NFTs crossing paths, NFT fractionalization protocols are in demand. These include Unic.ly, DAOfi, Niftyx, and the fractional.art protocol. Each of these protocols offers variations on creating and trading F-NFTs.

The fractional.art Protocol and F-NFTs

Fractional.art is the latest arrival on the Ethereum mainnet to grab a share of the F-NFT market. It launched in July of 2021 and has already become a popular platform for unlocking NFT liquidity. Owners and creators looking to mint F-NFTs can use fractional.art, and it’s not difficult to learn.

The fact that fractional.art is so new, yet has already raised $8 million in funding, testifies to the interest in the F-NFT sector.

Fractional.art revolves around three principal smart contracts. Since these contracts are permissionless, users can build a frontend or interact directly with fractional.art on a Web3 wallet such as MetaMask.

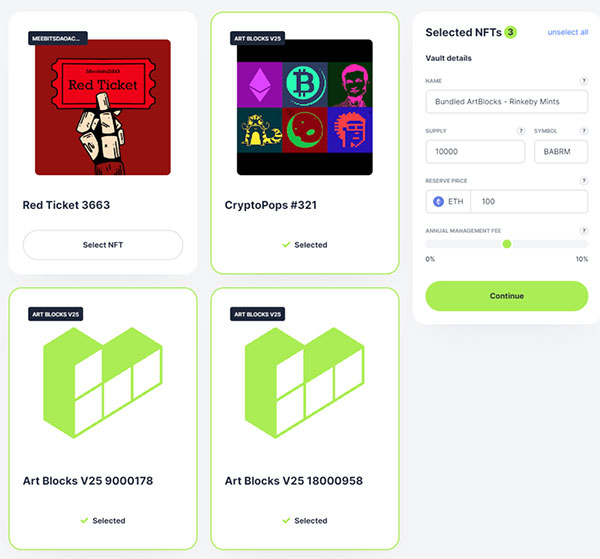

Fractional Smart Contracts and Vaults

1. A smart contract for vaults containing single fractionalized NFTs.

2. Another is for vaults containing multiple F-NFTs.

3. Finally, there is a smart contract that facilitates vault governance.

These vaults work on a price system whereby percentage holders vote on a reserve price. The vote’s weighted average determines the buyout price. For example, if an owner retains 100% of the NFT and sets the reserve price to ten ETH, then that is the reserve price.

On the other hand, if the creator only retains 75% ownership and the other 25% owner votes on a five ETH reserve price, the smart contract will set the reserve price at 8.12 ETH. But if the owner retained 75% ownership and no one else purchased the remaining 25%, then the F-NFT price would stand at ten ETH.

What are Fractionalized NFTs and Buyouts?

When an interested buyer or group of buyers wants to conduct a fractional.art buyout, they need to deposit an amount of ETH that at least meets the vault’s reserve price. An auction follows, and if the buyout is successful, the holders can redeem their ERC-20 fractions for ETH.

So, the steps of owning a fractionalized NFT are:

1. Connect your crypto wallet to fractional.art.

2. Choose the NFT you want.

3. Pay on fractional.art’s exchange with ETH or other approved ERC-20 tokens.

PartyDAO’s PartyBid and F-NFTs

Protocols such as fractional.art have also given rise to other innovations such as PartyDAO’s PartyBid tool. The PartyBid dApp facilitates collective bidding. PartyBid groups of friends or professional collectives can join forces and “raid bid” on their favorite NFTs. It’s another way for regular investors to get together and compete against the whales.

PartyBid not only helps groups obtain NFTs but also allows them to fractionalize their purchases thanks to fractional.art’s open infrastructure. Moreover, investors have already used the PartyBid dApp to purchase some significant NFTs such as CryptoPunks and other popular NFTs.

What are Fractionalized NFTs? – The Future

In the DeFi world, NFT ownership has been wholly singular until now. However, fractionalized NFTs provide investors with other options. Plenty of exchanges are there to provide liquidity to ERC-20 and ERC-721 tokens. But in this new era, the future demands that developers create new exchanges. These exchanges will need to list and authenticate assets and conduct smart contract fractionalization.

You could learn how to create an NFT marketplace or explore NFT game development with Moralis’ NFT API. Moreover, all you need are some basic coding skills. As such, you could create a business out of your NFT exchange. Or, you could use the experience gained for a future employer.

Debates continue as to what the future holds for F-NFTs. While helping to grow participation in the booming NFT sector, those wishing to fractionalize NFTs must watch out for future government regulators that may consider them to be securities. The F-NFT marketplace may have some regulatory challenges to overcome; however, the future still looks bright due to their number of real-world applications.

Artists, creators, virtual builders, gamers, and collectors can all use this tech. If you’re ready to start a career as a blockchain developer in this exciting field, join Moralis Academy today!