A crypto exchange is a place where users can buy, sell, and trade cryptocurrencies. To get started, users must first deposit funds into the exchange. Some platforms will take fiat currencies such as U.S. dollars to exchange for cryptocurrency. Others will require you to own cryptocurrency already to exchange it for other cryptos - for example, trading BTC for ETH.

How Crypto Exchanges Operate

A crypto exchange account works similarly to an online stock broker account. It provides you with the tools to buy and sell digital currencies. Furthermore, the best crypto exchanges will offer a good user experience (UX) that simplifies the buying and selling process while providing top security features and low fees.

Are you ready to start trading cryptocurrencies? Before you do, check out the Crypto for Beginners course at Moralis Academy!

Different Types of Cryptocurrency Exchanges

There are two types of cryptocurrency exchanges to consider: centralized and decentralized. Let's take a look at both.

Centralized Exchanges

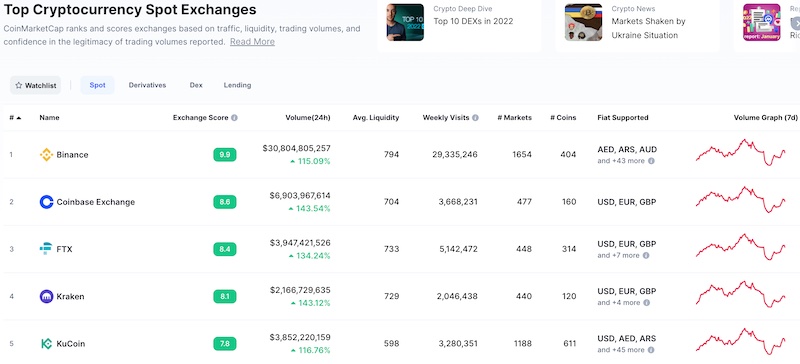

The most common type of exchange is a centralized exchange (CEX). Popular CEXs with large trading volumes such as Binance and Coinbase fall into this category.

CEXs will typically require you to create an online account and register with your personal identification. That's because CEXs have to comply with the know your customer (KYC) and anti-money laundering (AML) government regulations.

Decentralization advocates are not big fans of CEXs. That's because they store user data on central, private servers and take custody of users' funds. So if a hacker breaches their servers, they can help themselves to the available funds and sensitive data. On the other hand, these larger CEXs are the most accessible platforms for new users to onboard Web3 and cryptocurrencies, and many provide varying levels of insurance for system failures.

Decentralized Exchanges

Decentralized exchanges (DEXs) have no central control point and operate in a non-custodial manner. So, there's no single point of failure or one server storing the user's data.

Because of decentralization, government agencies cannot yet regulate these exchanges with invasive KYC or AML requirements. So, users can swap funds as they please without providing identification or worrying about censorship.

In sum, CEXs operate similarly to traditional brokerage accounts and more closely adhere to financial regulations. DEXs, on the other hand, are unregulated and more "free-wheeling" and don't take custody of a user's funds or personal data.

Are you interested in learning how to develop a DEX? Learn how to build a DEX using JavaScript at Moralis Academy!

How to Buy Cryptocurrency

Most CEXs allow you to fund your account with credit cards, debit cards, or bank transfers. Typically, you can press a simple "Buy Now" button to make a transaction.

Once you purchase your crypto from a CEX, the exchange will take custody of it and put it in "cold storage." You'll need to transfer your crypto off the CEXs to your crypto wallet to take possession yourself.

Transactions with a DEX, on the other hand, happen directly through your crypto wallet without you losing custody. To learn more about crypto wallets, be sure to read our "What is a Hardware Wallet?" article.

Top 5 Crypto Exchanges - Coinbase

Coinbase is a popular crypto exchange that simplifies the buying and selling process. It's about as easy as buying stocks on an online brokerage website. Furthermore, you can use the app on your iOS and Android devices.

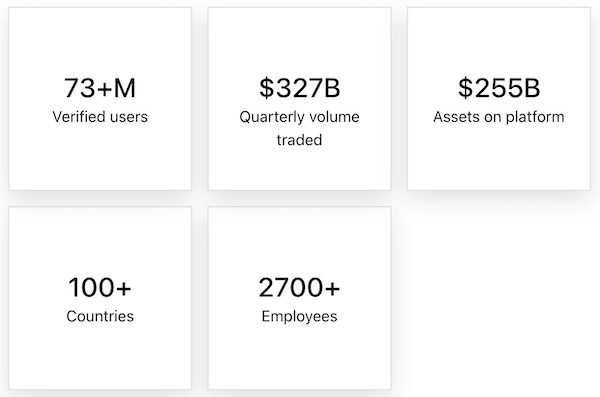

With Coinbase, you can buy, sell, and exchange over 100 cryptocurrencies with new coins added regularly. It's an extensive exchange with approximately 73 million verified users and 10,000 institutions in 100 countries. This demographic contributes about $255 billion in assets, with users trading over $300 billion per quarter.

The original Coinbase platform is best for beginners, while more advanced users prefer "Coinbase Pro." It may sound like an exclusive club, but any Coinbase user can access the pro version. It offers more types of trading, such as stop and limit orders, and its users can benefit from lower fees.

Coinbase started in 2012 to create a more fair and accessible financial system powered by crypto. Above all, its ethos is to boost economic freedom around the world.

Learn about corporate training for the blockchain if you want to get your team blockchain certified.

Coinbase Pros & Cons

Like anything else, Coinbase has its list of pros and cons:

Pros:

1. Wide variety of cryptos.

2. Simple UX that lowers the barrier to entry.

3. Very high liquidity.

4. Good exchange for beginners.

5. The pro version offers lower fees and extra features.

6. Solid user reviews and security ratings.

7. Strong security measures keep 98% of user assets offline in cold storage.

Cons:

1. Fees.

The biggest complaint about Coinbase is the high fees. The exchange is not transparent about this and removed the fee schedule from its help section. However, the "trade screen" displays any fees before entering a trade. So you'll know the price before confirming a transaction. Further, lower trading prices are only available to pro users.

2. Customer service.

Coinbase also gets lower marks for customer service. However, some of this is due to our present automated world. Talking to a human being who will walk you through problem resolution for lost funds or locked accounts is virtually nonexistent. Consequently, Coinbase is more of a self-service platform with a help page, chatbots, and an automated phone system.

Top 5 Crypto Exchanges - Gemini

Gemini is a privately owned crypto exchange started in 2015 by the Winklevoss twins. The name Gemini in astrology symbolizes twins and duality. Thus, the "Gemini" moniker is an obvious choice for a company started by the twin brothers Cameron and Tyler.

Gemini has a tiered service with different fee structures and interfaces for different kinds of crypto traders. There is also a mobile app, a payment app, a savings account that pays interest, and a credit card soon to be available to waitlist members. Like other exchanges, Gemini is a platform for buying, selling, spending, or storing cryptocurrencies via its website or mobile app. Further, Gemini's selling points are security and simplicity, and over 40 cryptocurrencies with 20 combinations are available for trading.

Gemini - Emphasis on Safety and Security

With the cowboy image of early "Bitcoiners," the Winklevoss twins always played the "white hat" role. This role bodes well for those who want to enter the crypto game but are afraid of shady exchanges thieving their crypto.

In addition, institutional investors will be impressed that the New York State Department of Financial Services licenses and regulates Gemini. It complies with conventional banking requirements and maintains a relationship with State Street, a New York State-chartered bank. Thus, Gemini can offer custodian and insurance services to its clients.

Layer-2 scaling solutions are the hottest thing in crypto! Follow the link to learn more.

Gemini's Founders

Cameron and Tyler Winklevoss are still the majority owners of Gemini. With all their accomplishments in crypto (as documented in "Bitcoin Billionaires"), the twins are still best known for winning the $65 million lawsuit against Mark Zuckerberg for allegedly stealing their idea for Facebook. The film "The Social Network" depicted the drama as it played out.

The twins used their millions to get started in Bitcoin, and some of that capital went to starting Gemini Trust Co., LLC. in 2015. Further, by 2016, Gemini launched the first daily Bitcoin auction.

Initially, the company positioned itself as the "go-to" exchange for institutional traders, not individual investors. It was also primarily a Bitcoin marketplace. But, a lot has changed since then. According to Bloomberg, Gemini has over 60 cryptos with a valuation of over $7 billion.

Gemini and Coinbase are two of the dominant crypto exchanges and are comparable in many ways. The pros for Gemini are its emphasis on security and regulatory compliance (for those who like that sort of thing). However, its cons are that it has fewer crypto options than Coinbase and fewer trading pairs. Critics also complain about high fees.

Top 5 Crypto Exchanges - Binance.US

Binance is a global powerhouse amongst crypto exchanges. However, U.S. residents can't use it. So, Binance.US is the solution to that problem. Furthermore, its positives are low fees and simplicity.

Other trading order types for more advanced users include market, limit, and stop-limit. There are also powerful dashboards full of trading data such as 24-hour highs, lows, trading volume, and spot price.

One dashboard is named "Simple," and the other is "Advanced." Binance.US does not allow margin trading, however. Even Coinbase Pro has recently stopped margin trading activities in the U.S. for retail investors. So, those wanting to margin trade will have to investigate other exchanges such as Kraken.

One complaint from users is that the 50+ cryptocurrencies available pale compared to the regular Binance. Further, Binance bans U.S. residents from using it. Even the Binance.US option excludes Hawaii, Idaho, Louisiana, New York, Texas, and Vermont residents. Such is the state of the crypto regulatory environment in the U.S.

Binance.US Pros & Cons

Pros:

1. Low costs for spot trading.

2. Decent range of cryptos.

3. High ratings from user reviews.

4. Volume discounts which make low fees almost negligible.

5. High-volume traders get lower transaction fees.

Cons:

1. Fewer cryptocurrencies are available than on the original exchange, Binance.

2. Not available in all U.S. states.

3. Crypto newbies may need more tutorials.

4. No margin trading support.

5. The educational resources of the U.S. version don't match the original Binance Academy or even beginner-friendly Coinbase.

Have you ever wondered how to use the Polygon bridge? Find out by following the link.

Top 5 Crypto Exchanges - KuCoin

Another one of the top five crypto exchanges is KuCoin. This exchange has a wide variety of cryptocurrencies and offers low trading fees. KuCoin's headquarters is in Singapore, which some American traders find attractive because they're not as hyper-vigilant about regulations as U.S.-based exchanges.

Pros:

1. Wide variety of cryptos to trade with low fees.

2. Discounted trading fees up to 20% by paying with KuCoin's KCS stablecoin.

3. Margin trading available.

Cons:

1. Trading is based on USD stablecoins rather than fiat currency.

2. The marketplace may be too complex for beginning traders.

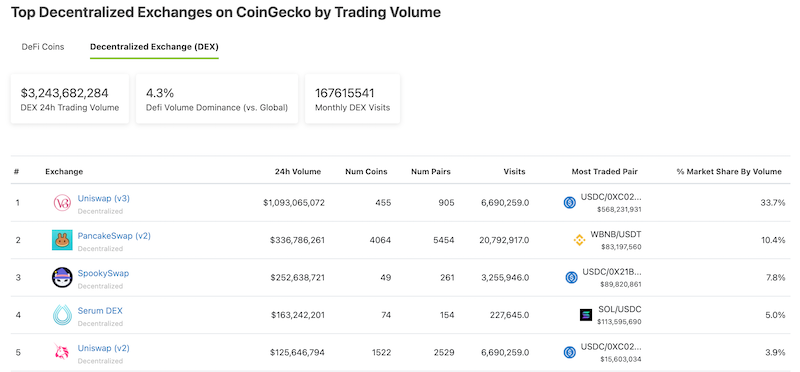

Top 5 Crypto Exchanges - Uniswap

Uniswap is the largest DEX on Ethereum. It allows users all over the world to trade crypto without an intermediary. There are no KYC or AML forms to fill out, and no identification is necessary.

This DEX launched in November 2018. Since then, other DEXs such as SushiSwap have entered the stage. The positives of Uniswap are that its users never give up custody of their funds. A third party never holds users' cryptocurrencies because both parties are trading directly from their wallets. In addition, there are no censorship worries, so anyone with a crypto wallet and an internet connection can participate.

Top 5 Crypto Exchanges - Summary

In sum, whether you prefer to use one of the top five crypto exchanges listed here or you prefer another, you should research a few things. First off, you'll want to make sure it offers the cryptocurrencies you're interested in before you fund your account. Some exchanges have more options than others.

You also want to check out the fees and custodial issues that may apply when you transfer off the exchange to your wallet. There are two types of payments on crypto exchanges: trading fees and withdrawal fees.

So, pay attention because some exchanges will claim to charge zero fees, but it's not entirely true. Instead of charging fees outright, they make money on the "spread." The spread is the difference between their price for buying and selling a cryptocurrency. More importantly, spreads can end up being more expensive than paying a percentage trading fee in some situations.

If you're new to crypto and only want to onboard with Bitcoin, another option is Cash App. This mobile-first interface is easy to navigate and is ideal for the first-time crypto investor. Simply link your bank account, transfer your fiat to the app, and buy Bitcoin. From there, you can store your Bitcoin or transfer it to another exchange to buy other cryptos. It's a quick way to onboard.

Are you ready to learn more? Explore the best courses in crypto at Moralis Academy!