What is DeFi (Decentralized Finance)?

Decentralized Finance, more popularly known as DeFi, is an umbrella term for the next-generation financial applications ecosystem currently emerging. What sets the DeFi field apart from traditional finance applications is that it employs public blockchain technology. This is the same technology underpinning cryptocurrencies, and has become hotter than ever in past years.

DeFi, which is sometimes known as “open finance”, encompasses a broad variety of various subjects. To name a few, these include decentralized exchanges, decentralized stablecoins, decentralized money markets, decentralized synthetics and decentralized insurance.

This can all be a lot to take in. No matter what, it is clear that the most important takeaway is that the various applications in the DeFi field are decentralized. You might have heard about decentralization in relation to blockchain technology or cryptocurrencies – but what does it mean?

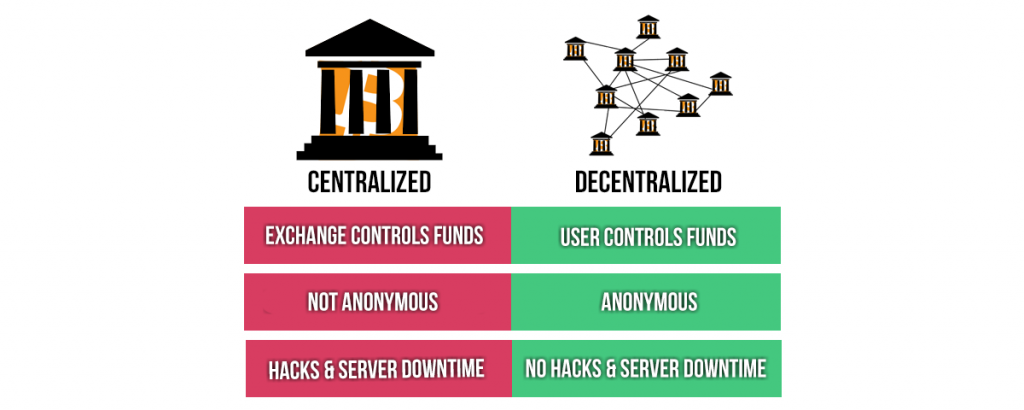

Blockchain technology relies on huge open-source networks. This is the same technology that cryptocurrencies, such as Bitcoin and Ethereum, is built using. However, these networks do not rely on a single central entity. Instead, the compute power and the network itself are spread out across the devices actually making up the network. This constitutions a decentralized network.

As such, the network does not have a single point of failure. The countless devices making up the peer-to-peer network instead share the various records available on the network. This makes it practically impossible to destroy or shut down a blockchain network. Blockchain technology is currently taking the finance world with storm.

For example, the average blockchain developer salary has risen to nearly $150,000 a year. Moreover, a recent report from LinkedIn lists blockchain as the number one hard skill employers are looking for. As such, turning to blockchain coding is one of the best ways to increase your software engineer salary.

Understanding DeFi

Put simply, DeFi can be seen as being the financial ecosystem emerging from blockchain technology. Some liken the advent of DeFi to the introduction of the printing press for sharing information. This means you can think of DeFi as inventing a printing press for financial applications.

Keep in mind that DeFi is a relatively broad term covering many different blockchain-driven applications. Nevertheless, their common denominator is that they are open to anyone, are censorship-resistant, and help to democratize finance.

Furthermore, DeFi is rapidly becoming a big deal. The financial market handles billions of dollars every hour, and is currently using ineffective legacy technologies. Blockchain technology and DeFi has the potential to drastically improve everything from the remittance market to loans and insurance.

Its underlying technology allows blockchain records to be more accurate, tamper-proof, instantly available, shareable and easily verifiable. To properly understand the advent of DeFi, imagine a paradigm shift on the scale of the internet – but in relation to personal finance.

Specifically, DeFi has the potential to make loans, insurance, international payments and much more accessible to anyone with an internet connection. This means people can take control of their own economy, and do not need to rely on a bank or other financial middlemen.

Decentralized applications, commonly known as dApps, are at the core of DeFi. Creating blockchain-driven applications is becoming increasingly common, and can be compared to developing a smartphone application. However, dApps are dramatically more powerful, and can give users access to innovative new financial services.

As such, it can be interesting to take a deep dive into some of the aspects of the DeFi field. The following topics are especially notable and demonstrate the variety of different DeFi projects:

- Decentralized Exchanges

- Decentralized Stablecoins

- Decentralized Money Markets

- Decentralized Synthetics

- Decentralized Insurance

What are Decentralized Exchanges?

Anyone familiar with cryptocurrencies will likely know that crypto exchanges are an essential part of cryptocurrency trading. These are often so-called “decentralized exchanges”. This is an exchange that operates in a decentralized manner, and lacks a central authority.

For those unfamiliar with the term “exchange”, this is essentially a platform which allows users to trade specific assets. Traditional financial exchanges can more practically be understood as stock exchanges. A decentralized exchange (DEX) is, therefore, a safer and more efficient version of trading platforms such as traditional stock exchanges.

They generally focus on trading cryptocurrencies, but the underlying technology can be useful for trading any asset. Moreover, decentralized exchanges can lower the risk of theft, as users do not have to transfer their assets to the actual exchange. Instead, they can allow users to connect directly to the exchange’s peer-to-peer (P2P) trading network.

Essentially, this means that users are able to trade their assets directly to one another on the exchange. This can take a variety of forms. Some exchanges use proxy tokens representing assets (such as a cryptocurrency), shares (representing ownership), or a multi-signature escrow system. Let’s take a closer look at some decentralized exchanges, or “DEXs”.

Loopring DEX

The Loopring Exchange is a relatively newly launched decentralized exchange from the team behind Loopring. The Loopring DEX is especially notable seeing as it promises to provide mass-validations of transactions using zk-SNARKs through zk-Rollups. Although this may sound somewhat technical, the implications are massive.

Put simply, this means the Loopring Exchange will be able to dramatically boost Ethereum’s current rate of transactions per second (TPS). Loopring states that the Loopring Exchange it is the first “publicly accessible zk-Rollup exchange” on the Ethereum mainnet.

The Loopring Exchange is entirely non-custodial, comes with Ethereum-grade security guarantees, and is able to achieve a 1000x greater throughput, and 600x lower settlement cost, that existing top layer-1 decentralized exchanges.

However, one should note that the Loopring Exchange is still unfinished. Specifically, the first beta of the Loopring Exchange went live on February 27th. The Loopring Exchange utilizes the Loopring protocol, complete with smart contracts and ZK circuits.

In addition to this, the decentralized Loopring protocol also relies on two other “significant components”. These are the Relayer cluster and the React web application. The Relayer cluster is responsible for boosting throughput and lowering cost-per-trade. The decentralized web-app, “loopring.io”, is still a work in progress and will eventually feature smart wallet integration for the decentralized exchange (DEX).

However, the perhaps most notable thing about Loopring is that it provides its Loopring protocol for building decentralized token exchanges. As such, Loopring is providing the foundation for future DEXs. Moreover, the Loopring Exchange can be seen as a proof-of-concept that validates the Loopring protocol and zk-Rollup technology in a DEX setting.

dYdX

The dYdX platform is another decentralized finance (DeFi) platform complete with a decentralized exchange. Specifically, dYdX is a decentralized margin trading exchange, which offers over 4x leverage for traders. It also provides users with options for borrowing and loaning, and does not have any lock-up periods or minimums.

The margin features allow traders to enter into short or long positions, through purchasing tokenized margin positions. Although it should be said that margin trading is combined with high risk, it does occur in traditional markets. As such, providing traders with an alternative to trade both short and long on a DEX is a logical step.

One should also note that dYdX is not some unknown exchange. Rather, it is the sixth decentralized finance app by locked funds. Moreover, dYdX also cooperates with other decentralized exchanges. This allows it to achieve greater liquidity. Funds in the user accounts also accrue interest in accordance with current rates, which are variable.

At the time of writing, the dYdX exchange does not feature any trading fees. Additionally, the exchange does not have any native “dYdX” token. The dYdX firm intends to provide a decentralized protocol for financial derivatives trading built on the Ethereum blockchain and 0x. The dYdX Whitepaper from 2017 outlines how dYdX intends to acheive this, and help create more fair and open decentralized finance markets.

Uniswap

Uniswap is essentially an Ethereum-based protocol and decentralized exchange, described as a ”simple smart contract for swapping ERC-20 tokens” and a decentralized liquidity pool provider. As such, it is clear that Uniswap wears a variety of different hats.

Consequently, Uniswap primarily functions as a DEX. However, it can also act as a lending and borrowing platform for users. What’s more, it is one of the most popular dApps on the market.

In being a liquidity provider, Uniswap replaces the traditional order book of a central exchange with a liquidity pool. This means that Uniswap creates a bridge between the relevant ERC-20 and Ethereum pair.

Furthermore, the Uniswap exchange provides a smart contract template that enables anyone to create a liquidity pool. As such, Uniswap can be seen to democratize the access to ETH and ERC-20 pairs through a liquidity pool. Moreover, the Uniswap DEX does not feature any listing fees – rather, it only require the Ethereum for gas.

Put simply, this means that Uniswap is a great one-stop-shop for anyone looking to exchange an ERC-20 token. Since May of 2020, Uniswap has also seen an upgrade to Uniswap V2. This brought ERC-20 to ERC-20 token pools to the exchange, providing even more liquidity.

Kyber Network

The Kyber Network is a tool for swapping tokens without requiring any specific exchange. Kyber Network aims to play a central role in the growing DeFi field, through cutting out the middleman, i.e. exchanges. Instead of needing users to visit an exchange, the Kyber Network allows users to exchange their Ethereum and various ERC-20 tokens instantly.

Much like Uniswap, the Kyber Network accomplishes this by providing users with liquidity pools. Projects can connect to these pools, or reserves, in order to integrate this functionality. Moreover, any swapping between different tokens happens on the Ethereum blockchain, making them entirely transparent.

According to Kyber, the Kyber Network can be seen as connecting the currently fragmented tokenized world with instant token swaps. Furthermore, Kyber is open to exchanges, wallets, websites and various other applications, so virtually anyone can integrate the functionality into their own platforms.

As such, the Kyber Network does not only provide a decentralized exchange. Instead, it also connects countless token ecosystems. As such, the Kyber Network is an important step towards a full-fledged DeFi tomorrow.

What are Decentralized Stablecoins?

Regular cryptocurrencies are still relatively volatile. Although this will likely subside in time, some investors desire crypto assets with all the advantages of blockchain technology, but with lower volatility. This is where decentralized stablecoins come into the picture. Put simply, stablecoins are a particular category of cryptocurrencies with low volatility.

Stablecoins achieve their low volatility through pegging their value to other assets. The perhaps clearest example of this is through pegging a stablecoin to the value of a national currency, such as the US dollar. However, this is far from the only solution. Some stablecoins are instead pegged to a basket of goods, or a collection of several currencies.

A Selection of Common Stablecoins

Moreover, decentralized stablecoins are simply stablecoins with a decentralized design frame. As we have previously gone over, this means that there is no central authority issuing them, and no single point of failure. Instead, decentralized stablecoins rely on a resilient network.

This is in stark contrast to some other stablecoins. Although some would argue the ”true” notion of stablecoins consists of decentralized stablecoins, others disagree. Some stablecoin issuers are, in fact, central authorities. In fact, even some central banks are looking into launching stablecoins.

As such, it is more important than ever to differentiate between regular stablecoins and the type of decentralized stablecoins that do not compromise the vision of a decentralized future. This could prove to be an important element in the DeFi world, so it is worth examining some of the best-known decentralized stablecoins.

DAI

The DAI stablecoin comes from the well-known blockchain company MakerDAO. Consequently, the DAI stablecoin uses the Maker Protocol and assets as collateral in order to achieve a soft-peg to the US dollar. Such a peg means that the value of one DAI always stays close to the value of one dollar.

This removes the most notable volatility that usually affects cryptocurrencies. Instead, DAI becomes almost a digital analog of the US dollar, but which is smarter and utilizes blockchain technology.

Seeing as DAI is also a decentralized stablecoin, it is ready available to anyone anywhere and at any time. Nevertheless, it takes advantage of modern techniques in order to decrease long settlement times and expensive transfer fees.

Moreover, DAI allows users to generate, or produce, their own DAI. This is done through opening a smart contract known as a CDP, to create their own DAI with 150% of the backing in collateral. Due to its peg to the US dollar, DAI allows traders to avoid the uncertainty of high volatility.

Tether (USDT)

Tether, also known by its ticker USDT, is arguably one of the most well-known stablecoins on the market. Tether was designed in order to serve as a bridge between the cutting edge blockchain-driven technology of cryptocurrencies and the stability of fiat currencies.

Furthermore, Tether is pegged to the US dollar with a 1-to-1 ratio. This is done through a combination of fiat currency backing, such as actual US dollars, and various loans to affiliate companies. This makes Tether essentially similar to a digital dollar, much like DAI.

However, unlike DAI, Tether does not allow users to create their own stablecoins tokens merely through making a deposit. Instead, the only way to get your hands on Tether tokens is purchasing or trading them.

Additionally, Tether has been issued on several different blockchains. Specifically, there is Tether on the Omni, Tron, EOS, Liquid, Algorand and Ethereum blockchains. Nevertheless, the vast majority of these exist on the Ethereum blockchain, with roughly 70% of Tether being on the Ethereum blockchain.

USDC

USDC, or USD Coin, is yet another stablecoin. This stablecoins comes from the open-source technology project Centre, which is a partnership between the cryptocurrency exchange Coinbase and the money transmitter firm Circle.

USDC was launched in 2018, and is one of the main competitors to other leading stablecoin offerings such as Tether and DAI. Specifically, USDC draws some inspiration from DAI when it comes to pegging its price to (you guessed it) the US dollar. This is done through a process known as tokenization.

There are three main steps to tokenization. First and foremost, a users sends US dollars to the token issuer’s bank account. Then, the issuer uses a USDC smart contract to create an equivalent amount of USDC to the payment. Following this, the newly created USD Coins are delivered to its owner. The collateral USD are held as a reserve.

USDC is an ERC-20 token, and as such, it can be used with any application with support for ERC-20 tokens. It is a 1-to-1 digital representation of the US dollar, making it relatively stable in volatile markets.

Decentralized Money Markets

This term may sound confusing for those unfamiliar with regular money markets. Put simply, money markets are the markets for borrowing and lending assets. As such, decentralized money markets mainly allow users to borrow or lend various crypto assets.

Decentralized money markets can be seen as an alternative to the traditional banking system for lending or borrowing. Moreover, they mainly manage themselves, through the use of smart contracts that set up the rules for how the decentralized money markets function.

The big difference between decentralized money markets and regular money markets, however, is that decentralized money markets are open to anyone. As such, they can cater to the needs of those without access to financial infrastructure.

Additionally, they also allow basically anyone to earn interest on their crypto assets through e.g. lending or borrowing. This is essentially giving normal people access to the mechanisms banks have been using to make money for centuries.

Compound

Compound is the blockchain firm behind the Compound Protocol. Put simply, Compound Protocol is a decentralized money market protocol that relates to interest rates. Specifically, it is an algorithm-based autonomous interest rate protocol for building DeFi applications.

The decentralized finance field is clearly leaning heavily on various protocols. This is due to how they function much like building tools. Protocols such as Compound allow developers to build more competent and powerful DeFi applications or dApps.

Compound states that their mission is to build the future of finance using its interest rate protocol. Currently, the majority of cryptocurrencies are stuck on crypto exchanges and do not yield any interest. Compound looks to change this through a lending and borrowing project.

The project consists of accessible Ethereum smart contracts. Lenders can lock their crypto assets using the Compound Protocol, and borrowers can take out loans. The interest rates are, more specifically, set using the supply and the demand of each crypto asset.

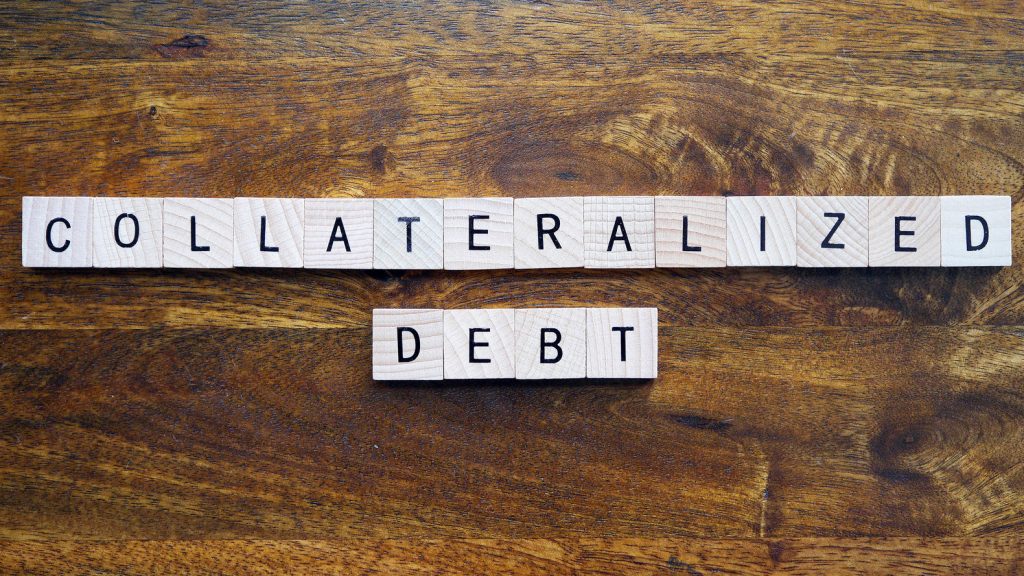

CDPs

Collateralized Debt Positions, or more commonly referred to as CDPs, are another interesting DeFi occurrence. Essentially, a CDP is a system of smart contracts which uses collateral (mainly Ethereum) in order to generate stablecoins.

The most popular CDP system is that from MakerDAO, but the technology behind it works in theory for many types of crypto assets. The reasoning behind MakerDAO’s CDPs is that its DAI stablecoin can only be created when users lock up collateral.

Furthermore, MakerDAO’s CDPs does not have a 1-to-1 peg either. Instead, the collateral that backs up the DAI needs to be worth 150% the amount of DAI. This means that the collateral value of the (current ETH price times the locked ETH) Collateralized Debt Position needs to be at least 150% of the DAI, but it’s recommended to have around 350% because of Ethereum volatility.

If market volatility means that the collateral ETH held is suddenly not worth enough, your DAI can be sold back to the market. This is done in order cover your generated DAI (that you can no longer support), along with stability fees and a liquidation penalty.

MakerDAO

However, there is more to MakerDAO than merely its CDPs. MakerDAO is the company behind the DAI stablecoin, as mentioned before, which becomes a stable asset in the relatively volatile cryptocurrency market. The CDP from MakerDAO can be seen as the smart contract, or programming, that makes DAI loans possible.

It may sound counterintuitive that MakerDAO’s DAI loans can be a good investment opportunity, seeing as it requires 150% of the value in escrow. However, if the price of Ethereum (Ether) would increase, the value would increase without increasing the collateral.

However, the perhaps most obvious usage case of MakerDAO’s isn’t as an investment vehicle. Instead, the DAI stablecoin allows companies to offset the volatility risk inherent to the cryptocurrency sector, while still giving access to the benefits of crypto assets.

As such, MakerDAO, the DAI stablecoin, the MKR token and CDPs are sure to stay an important part of the emerging DeFi field.

Oasis

Oasis is another DeFi platform, or dApp, which acts as a liquidity pool. The platform, sometimes known as ”oasis.app”, is built on a secure Ethereum protocol, and takes significant inspiration from MakerDAO and the DAI stablecoin.

Moreover, Oasis wears a variety of different hats. For example, this offers everything from the ability to earn savings, trade tokens and borrow the DAI stablecoin against collateral using the CDPs mechanisms.

For example, the OasisDEX Protocol is a non-custodial, decentralized protocol allowing users to trade in a decentralized manner. Oasis’ OasisDEX Protocol employs a matching engine and an on-chain order book to link up transactions.

As such, Oasis functions both as an exchange and has crypto wallet-like functionality. Put simply, this means that Oasis is an important DeFi hub for those serious about getting into decentralized finance.

Decentralized Synthetics

Yet another central aspect of DeFi is that of decentralized synthetics. As you will likely understand by now, the ”decentralized” part of this means that it is built using resilient, distributed blockchain technology. What then is synthetics?

Synthetics are sometimes instead knows as derivatives. Traders will know that derivatives, or synthetics, track the value of something. This allows traders to gain exposure to an asset they want to invest in, even if it is hard to physically invest in it.

This can be things such as gold, traditional stocks, crypto assets or even commodities. However, decentralized finance and decentralized synthetics is especially important for those without access to traditional finance systems.

However, one should also keep in mind that a synthetic, or derivative, does not represent ownership over the asset itself – only a representation of a value that is derived from it.

UMA

UMA is short for Universal Market Access. Besides just representing the ultimate – and ambitious – end goal of DeFi, in giving universal access to financial markets, UMA is also a protocol.

Specifically, UMA is a decentralized protocol that creates financial Ethereum markets accessible to people all over the world. Moreover, this protocol essentially creates a framework for others to create synthetic Ethereum assets.

This is a bigger deal than it sounds. Providing the tools for creating new financial offerings is essential to seeing the dream of DeFi and universal market access come to fruition. Additionally, this protocol uses self-enforcing smart financial contracts, which means that there is no need for a bank or other middleman.

Furthermore, UMA also uses “secure oracles with economic guarantees” supplying stable data-feeds and resilience. This is fairly technical, but the UMA Whitepaper goes into greater detail on it. Safe to say, anyone looking to learn more about decentralized synthetics on Ethereum and UMA should make sure to check it out.

Synthetix

Synthetix is another protocol specializing in decentralized synthetic assets on Ethereum. What’s more, the project provides on-chain exposure to “any asset” using its Synths tokens, which provide exposure to gold, US dollars, Bitcoin and more upcoming assets.

Synthetix first came about as a stablecoin project known as Havven, and it today supports more than 30 different Synths. Synths are tokens with a peg to another asset class, essentially decentralized synthethics, that relate to various commodities, cryptocurrency assets or fiat currencies.

Synthetix also has a non-custodial decentralized exchange, or DEX, known as “Synthetix.Exchange”. All of this means that Synthetix is leaning into DeFi Jared. Moreover, the Synthetix Protocol is one step closer to tokenizing real-world markets using DeFi.

Decentralized Insurance

The insurance industry can sound dull to those looking to learn more about the wonderful world of DeFi and the blockchain revolution. However, the industry is particularly well-suited to utilizing blockchain technology and decentralized insurance is becoming especially hot right now.

In addition to this, the insurance industry is also a trillion dollar industry. The fundamentals of insurance are extremely compatible with blockchain technology and digital ledger technology.

Everything from assessing different rates of risk, setting premiums, paying out claims and so on is close to a perfect use-case for blockchain technology and smart contracts. As such, many observers are already suggesting that decentralized insurance can be one of the next big fields for DeFi.

Decentralized insurance can make away with middlemen, financial institutions that charge exorbitant fees, and other ineffective aspects of the legacy insurance sector. Moreover, decentralized insurance is a great choice to reduce smart contract risk.

Nexus Mutual

Nexus Mutual brands itself as “a decentralized alternative to insurance”. Nexus Mutual is also a form of hedge against traditional insurance failures. Instead than relying on a bank with its own interests, Nexus Mutual uses smart contracts and an Ethereum-driven risk-sharing insurance system.

Nexus Mutual is therefore decidedly not an insurance company. Instead, it prides itself on being run by its own members, and all member decisions are kept on-the-record with smart contracts and the Ethereum public blockchain.

The DeFi insurer Nexus Mutual is, therefore, shaking up things that have been in place since the traditional insurance model first came about in the 17th century.

Opyn

Opyn, or Opyn Insurance, is a DeFi-based insurance layer for decentralized insurance. Moreover, the platform is permissionless and specializes in protecting users DeFi deposits from various types of risks.

Opyn began as a leverage platform but recently become an insurance layer for decentralized finance. This is a sign of the growing interest in the DeFi field, but also provides specific functionality.

The Opyn platform allows users to insure their Compound Deposits. This is done through connecting to the Convexity Protocol, which is a set of Ethereum-based smart contracts. Additionally, the insurance platform can also allow holders of Ethereum to earn premiums through being part of providing insurance.

The Ultimate DeFi Summary

All of this shows the versatility of the emerging DeFi field. Although the blockchain industry and the cryptocurrency revolution are interesting aspects all on their own, decentralized finance could well be the ”next big thing” in the blockchain field.

As thing DeFi summary shows, the DeFi field covers a wide variety of different subjects. Everything from decentralized stablecoins to decentralized exchanges and all the way onto decentralized insurance and decentralized synthetics play a part in the DeFi industry.

Although this DeFi summary and ultimate DeFi guide is a great start to understanding this interesting field, there is so much more to learn.

The Ivan on Tech Academy Introduction to DeFi blog post is the go-to start for learning about DeFi, this articles goes through all the fundamentals, but those really interested in decentralized finance should take a blockchain education course on DeFi.

Ivan on Tech Academy offers courses on both DeFi 101 and DeFi 201, making sure there is something for anyone. What are you waiting for? Take a look at the courses and kickstart your DeFi career today!