If you’ve ever asked the “what is Kava crypto?” question, then we’ve got you covered. This article will cover the Kava network, the KAVA token, and the Kava Lend protocol to give you a more comprehensive view of what’s happening in this unique ecosystem.

Kava crypto claims to be the first layer-1 blockchain to combine the speed and scalability of Cosmos with Ethereum. That’s why the Kava network refers to Ethereum and Cosmos as co-chains in their ecosystem. Further, Kava crypto seeks to enable developers to build dapps on its co-chain architecture. If you’re unfamiliar with Web3 apps and unsure about dapps (decentralized applications), check out the Moralis Academy Web3 Dapp Programming course. Or, if you already have some coding experience, learn the fastest way to build a Web3 app on the Moralis.io blog.

Scott Stuart, Brian Kerr, and Ruaridh O’Donnell co-founded Kava in 2018 by establishing a “for-profit” company called Kava Labs. Next, the team conducted a token sale on Binance in 2019, where they raised $3 million.

Furthermore, this capital helped them to take Kava live in June 2020. By August 2020, Kava crypto had already garnished $24 million worth of BNB locked into contracts with a total of 8 million USDX borrowed. BNB is Binance’s native token, and USDX is a stablecoin with its price pegged to the US dollar. We’ll go back to USDX again later in the article. So, let’s initiate this article by answering the “what is Kava crypto?” and “how does it work?” questions.

What is Kava Crypto?

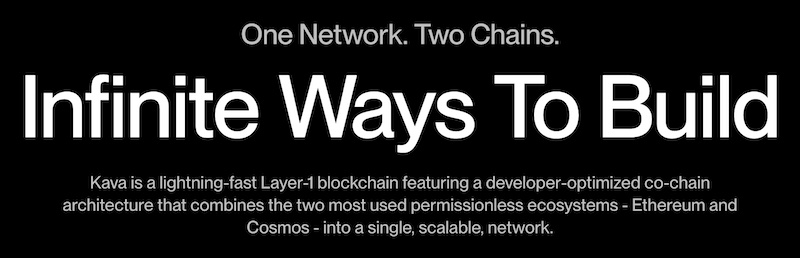

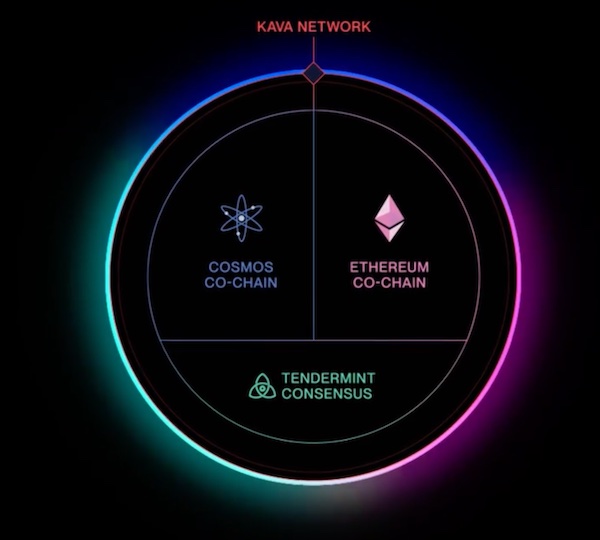

As touched on briefly, Kava crypto is a layer-1 blockchain. More specifically, it blends the Cosmos and Ethereum blockchains and the Tendermint Core consensus engine. This dynamic trio makes the Kava network lightning-fast. Moreover, its co-chain architecture combines two of the most potent permissionless ecosystems – Cosmos and Ethereum – into a single network.

Furthermore, Cosmos developers will naturally gravitate toward the Cosmos co-chain side of things. Ethereum devs, on the other hand, will find the Ethereum co-chain optimized for their needs.

So what Kava has done is package two powerful execution environments into a single network and optimize it for developers. While we’re on the subject of multiple blockchains, check out our list of blockchain guides and tutorials.

Kava Crypto’s Features

The Kava network enables projects to connect to the world’s most popular blockchains and access all its ecosystem’s other assets, users, and projects. By empowering the Ethereum and Cosmos co-chains to operate seamlessly, developers can combine the power of both chains without sacrificing users and assets on the opposing chain. So, what is Kava crypto exactly, and what are some of its features? Let’s take a closer look.

The Cosmos Co-Chain

Cosmos SDK is an open-source framework for building proof-of-stake (PoS) blockchains. It’s highly scalable and secure and uses the IBC protocol to connect Kava to many chains in the Cosmos ecosystem. Furthermore, IBC is an open-source protocol that relays messages between independent blockchains linking them to each other. Hence, it acts as a relayer between blockchains for transmitting data.

Ethereum Co-Chain

Solidity developers need an execution environment compatible with Ethereum Virtual Machine to succeed. Kava and the Kava network’s scalability provides developers with that and, thus, benefits their dapp’s capabilities. Ready to learn more about one of Kava’s co-chains? Take the Ethereum Fundamentals course at Moralis Academy!

Flexibility and Interoperability

When asking the question, “what is Kava crypto and what are some of its top features?” flexibility and interoperability are two of them. Since devs have a choice to build and deploy on either of Kava’s two co-chains, they have the flexibility to work on the chain they’re most comfortable with inside the Kava network. For instance, developers can deploy Solidity smart contracts and have peace of mind knowing they will interoperate seamlessly with Cosmos SDK protocols. Further, their projects can connect with millions of users and every major asset in the ecosystem.

The Tendermint Consensus Engine

We’ve already mentioned that Tendermint Core is a lightning-fast consensus mechanism. Additionally, Kava relies on Tendermint to support its PoS system. The engine that powers Kava’s unique co-chain architecture gives Kava the energy it needs to handle thousands of protocol transactions from its multitude of users. Moreover, it helps enable the free flow of users and assets between Kava and other relevant ecosystems at scale.

Kava Modules

As new open-source modules get developed on Cosmos, the Kava network can implement the ones it deems desirable. We already mentioned the IBC module, which Kava integrated in January of 2022 to help Cosmos SDK blockchains communicate.

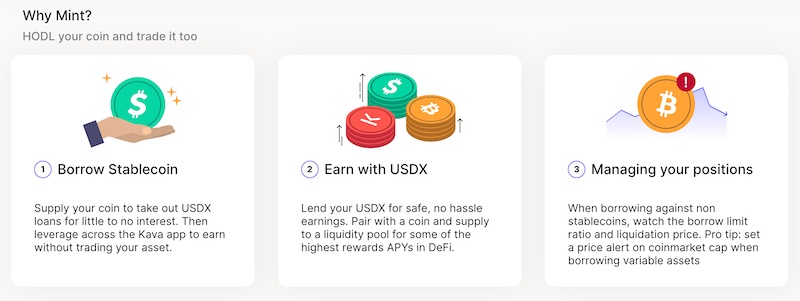

Kava crypto also employs a collateralized debt position (CDP) module, where users lock their crypto into Cosmos smart contracts. Further, after supplying their assets, they can take out loans in the USDX stablecoin. Moreover, users get weekly KAVA rewards by collateralizing cryptocurrencies to mint USDX. We’ll explore CDPs a bit later. For now, let’s look at KAVA.

The KAVA Token

At this point, you might be wondering, is there a difference between Kava crypto and KAVA? First, KAVA is Kava’s native cryptocurrency and plays a critical role in the project’s security and governance. You can distinguish the token from the protocol because it’s all capital letters. “KAVA” is the reward users receive for participating in the Kava Lend app (below). Furthermore, the amount of KAVA a user receive depends on the type of collateral they put up and how much USDX they mint.

Because it’s also the governance token, anyone who holds and stakes KAVA can vote on the protocol’s rules, policies, and changes to its key parameters. These include borrower fees, incentive rewards, collateralization ratio, and which assets Kava will accept as collateral.

Blockchain Security

Regarding the network’s security, Kava crypto employs the top 100 nodes to validate blocks. Furthermore, they do so by participating in a weighted stake of KAVA tokens. Validators receive KAVA incentives as block rewards and a percentage of the network’s transaction fees. More importantly, if a validator fails to ensure double signing transactions and high uptime, they can get their stake slashed.

Incentives

Kava points out that its on-chain incentive model is not only decentralized but also revolutionary. Further, it ensures that the best projects in each Web3 (DeFi, GameFi, and NFTs) get rewarded accordingly.

Some KAVA rewards go to the protocols that drive user growth on the Kava network by incentivizing usage and providing scalability. Its incentive module also distributes KAVA emissions between the Ethereum and Cosmos co-chains. The top 100 protocols share incentives based on usage metrics and TVL (total value locked).

Attracting the Top Projects

How does Kava crypto attract the best projects and developers? After all, one way to judge a network’s quality is to evaluate the projects built on it. Furthermore, Kava seeks to provide the best environment to attract top Web3 developers. They offer on-chain incentives for projects on their network as one way to accomplish this goal.

Don’t miss our list of Web3 ebooks at Moralis Academy! In addition, once you have a solid foundation in Web3 and obtain some coding knowledge, you can learn how to make a Web3 website at Moralis Academy!

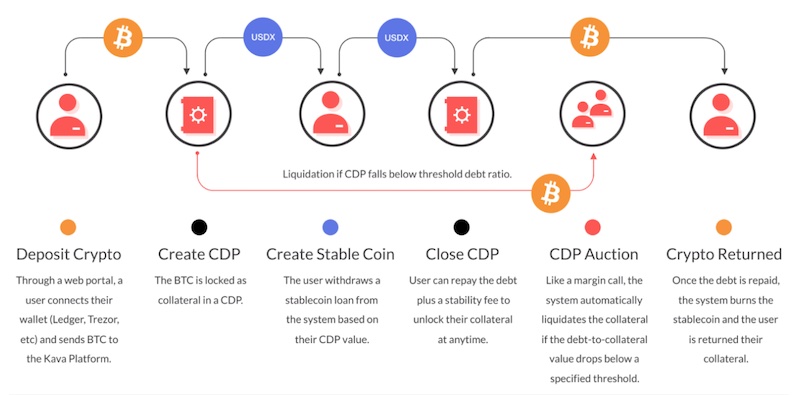

The CDP Process

Kava creates a collateralized debt position (CDP) with the assets locked. Moreover, the CDP is a contract that keeps the USDX value pegged to the US dollar. Here’s how it works:

1. User deposits crypto.

2. Kava creates a CDP by locking the user’s crypto in a smart contract.

3. The borrower receives a USDX loan dependent upon the CDP’s value.

4. Borrower repays the debt and Kava’s fee to unlock the collateral.

5. Kava returns the user’s crypto and burns the USDX.

To the newcomer, Web3 people can sound like they’re speaking a foreign language. Check out our list of popular crypto terminology in one of our recent blog articles. Additionally, if you’re interested in non-fungible tokens (NFTs), we also have many NFT coding tutorials available.

Collateralization Ratio and Kava

The collateralization ratio refers to the percentage of debt to collateral, and it calculates the liquidation price. Furthermore, this ratio is the mechanism that protects Kava from the volatility that can reduce the collateral’s value. Kava typically over-collateralizes USDX. What this means for borrowers is they must deposit an amount of cryptocurrency that is worth more than the value of USDX that Kava mints.

For example, a collateralization ratio of 300% means borrowers get liquidated when their cryptocurrency locked in Kava drops below 3x of the USDX they borrowed. The short version is that if a user’s collateralization drops below a certain threshold, the collateral automatically gets liquidated.

Now that you know more about how Kava crypto works, let’s look at Kava Lend.

What is Kava Lend?

Kava Lend is a decentralized money market where users can lend their assets to others who want to borrow and vice versa. Also, users who supply assets will earn interest as borrowers pay on it.

Additionally, liquidity providers can receive rewards in KAVA and HARD tokens. Further, HARD is Kava Lend’s governance token. The advantage for Kava Lend users is they only have to supply a single asset, whereas the typical decentralized exchange (DEX) requires a pair of tokens.

Suppliers and Borrowers

Users supplying USDX and ATOM tokens will receive KAVA rewards and a portion of the interest the protocol collects from borrowers. Potential borrowers on Kava Lend must first put up assets as collateral. The loan-to-value ratio is 50% for all collateral except USDX, in which the loan-to-value ratio is 25%.

So, if a user supplies $1,000 in value, they can borrow up to $500 worth of Kava Lend-supported assets. If they provide $1,000 of USDX, they can borrow $250 (remember USDX’s ratio is 25%).

Collateral and Kava Lend

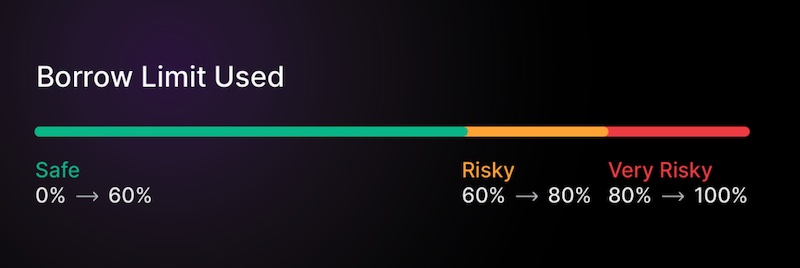

Users can supply multiple assets to stabilize their leverage against funds borrowed on Kava Lend. Various assets can help maintain a borrower’s collateral value should one asset price drop. After supplying collateral, users can borrow supported assets up to their limit. Further, borrowers must pay interest on their loans which accumulates over time.

Based on the collateral amount a user puts up, the borrow limit ratio will determine the max amount they can borrow compared to what they are currently borrowing. So, if a user puts up $1,000 worth of Bitcoin (BTC), the most they can borrow is $500 worth of another asset. But, if BTC’s price drops and the borrower’s collateral sinks to $800, the new borrowing amount also gets reduced to $400.

If the borrowed amount exceeds that new limit of $400, the borrower’s collateral faces the risk of liquidation. So, when borrowing assets on Kava Lend, it’s best to over-collateralize the loan to minimize liquidation risk.

Supply Side Risk

The risk for suppliers is low. Lenders retain full ownership of their assets and are not subject to impermanent loss. Moreover, they can earn HARD token rewards based on borrowers’ interest fees. ATOM and USDX suppliers also make extra KAVA incentives. More importantly, they can stake extra KAVA and instantly start earning a 30% APY.

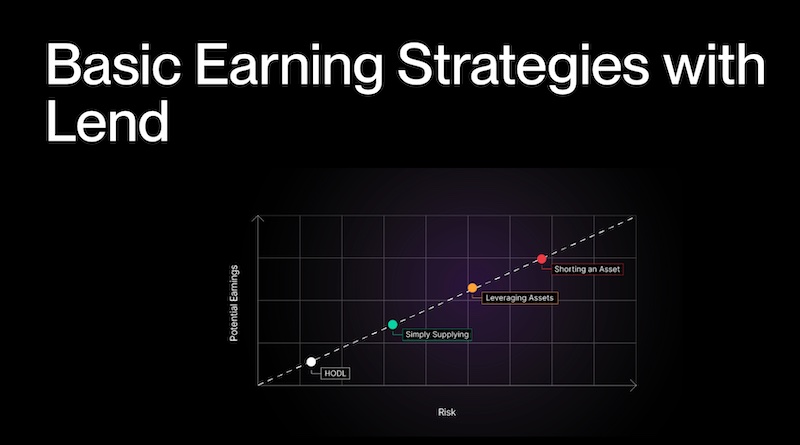

Kava Lend Strategies – Leverage and Short Selling

Kava Lend users can also leverage assets by supplying tokens such as BNB, ATOM, and BTCB to borrow the USDX stablecoin. Next, they can provide their USDX as collateral to earn extra Kava rewards. As with any leverage strategy, there are risks to consider.

In addition, users can also short assets on Kava Lend when they believe an asset’s value will decline – that is, if they’re willing to stomach the high risks involved.

On the topic of dropping prices, the bear market continues. So, while learning about lending and borrowing on Kava, check out how to invest during a crypto bear market.

What is Kava Crypto – Summary

As you can tell by now, Kava crypto offers a unique co-chain architecture that benefits both users and developers. The fact that Kava’s lending protocol also gives suppliers the option to supply a single cryptocurrency rather than a pair is a plus. Moreover, they can do so without fearing impermanent loss penalties.

One question remains, however. How necessary will it be to blend Ethereum with the Cosmos SDK after Ethereum’s The Merge event? With features such as sharding and popular layer-2 solutions like StarkNet and Optimism already starting to solve Ethereum’s scalability and transaction speed issues, only time will tell if co-chain architecture offerings are as necessary.