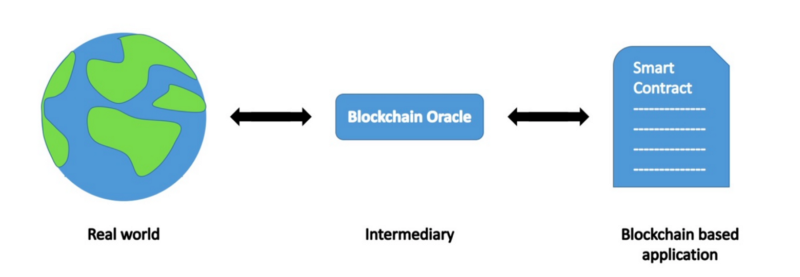

Oracles can sometimes be seen as the less glamorous side of blockchain technology, and are often taken for granted with some of the foundational support oracles provide in projects. What makes oracles so special? And why do we need oracles?

In this article we shall explain what oracles are and their role in the blockchain ecosystem, how oracles and smart contracts work together, and examples of the popular types of oracles in the cryptocurrency market today. Read on for a full breakdown of blockchain oracles!

What is a Smart Contract?

The first smart contract idea was proposed by Nick Szabo in 1994, however, it wasn’t until 2015 when Vitalik Buterin launched the Ethereum Network, that smart contracts became deployable and used by developers.

Ultimately smart contracts are pieces of code that can move money from one account address to another, upon specified conditions being met.

Smart contracts can be for personal or enterprise use. You could create a smart contract to bet between a friend – team A wins, you get the money, team B wins, your friend gets the money.

A supply-chain business can create a smart contract to automatically pay their suppliers upon receipt of a delivery using sensor and locational data to trigger the smart contract.

The Bitcoin blockchain, back in 2009, introduced blockchain technology through a decentralized network of computers mining and verifying a virtual digital currency (BTC), that could only allow transactions to be sent from A to B.

When Vitalik Buterin introduced the Ethereum Network, it opened up a Pandora’s box of decentralized Lego blocks that developers can use to build decentralized applications (dApps) and cryptocurrencies, and interoperate with other projects, on top of the Ethereum Network.

There have since been numerous blockchains and platforms created that support smart contracts, including NEO, Hyperledger, and Waves.

None of these applications could be possible without smart contracts, and the majority of smart contracts are powered by oracles.

What are Oracles?

In short, oracles are a way of verifying and communicating real-world data to blockchains. Smart contracts create the paths for money to move from one address to another, oracles provide the data to confirm whether or not a condition has been met, for smart contracts to be deployed for said money to move from A to B.

Interoperability

Interoperability is a major player for the growth of cryptocurrency adoption, and a prominent feature at the beginning this year’s bull run. Interoperability can be categorized into two forms:

On-chain

On-chain communication is information passed between two blockchains, with 3 main approaches to doing so:

– Bridges: a purpose-built blockchain to carry information between two blockchains

– Hub and Spoke: a central blockchain that is used as a ‘hub’ for connecting all other blockchains (the spokes)

– Decentralized Exchange: creating an exchange platform the bridge the gap between two separate projects

Off-chain

Off-chain communication is transmission from real-world data that is not already stored on the blockchain, such as price predictions, temperature of goods in transit, stock inventory levels.

Off-chain communication is also referred to with decentralized communication that is off the blockchain using layer-2 implementations like ‘state channels’, for example atomic swaps, where you are able to exchange 2 digital assets without the need for a centralized exchange.

Cross-chain communication and atomic swaps can also occur on a ‘blockchain operating system’, that are run on top of participating blockchains.

Oracles provide off-chain data for both blockchain and enterprise use, and can often be referred to as a bridge between the outside world and blockchains.

Oracles are blockchain agnostic – meaning that they are compatible across a vast array of blockchains.

Co-founder of Chainlink, Sergey Nazarov, told First Mover in a phone interview. “We don’t make contracts. We don’t secure blocks. We don’t secure transactions. We just feed data into various systems.”

Different Types of Oracles

Oracles generally fall into one of two categories:

Software

Information retrieved from the blockchain or other smart contracts, or from various online data sources is relayed by a software oracle.

Hardware

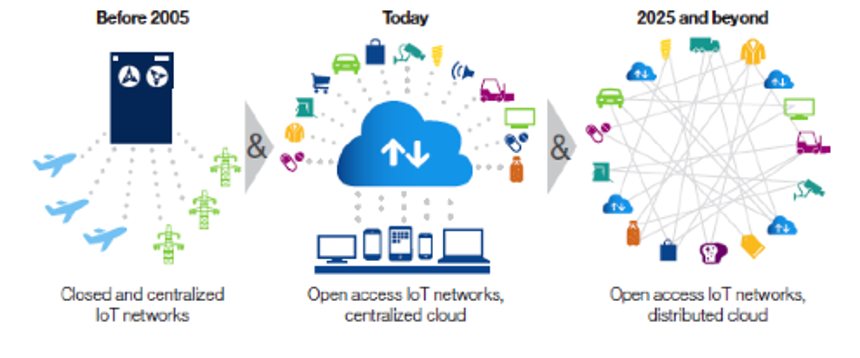

Hardware oracles tend to use IoT (internet of things) devices to track and verify real-world data before relaying it to the smart contract. These are commonly used within the supply chain industry gathering/monitoring data of produce from origin to final sale.

How Do Oracles Work

Data information is collected from one or multiple sources by one or more oracles, and is signed on the blockchain before transmitting the information to the designated project. There are different methods used to ensure data is as accurate as possible from oracles.

Multiple Sources

Oracles can search through multiple APIs, websites and data sources to extract relevant data, decreasing the chance of receiving misinformation. However multiple sources from one oracle increases the risk of a ‘single-point-of-failure’.

Multiple Oracles

Using multiple oracles eliminates the ‘single-point-of-failure’ risk, and also increases the reliability of data. The chance of receiving incorrect information would be due to multiple incorrect data sources.

Incentivise

Many oracle services are incentivised to produce accurate data, receiving rewards in tokens for doing so and a penalty if the information produced is found to be incorrect.

Trusted Execution Environments

A recent protocol allows data queries to be answered in confidence, in a secluded environment. A trusted execution environment requires a trusted hardware system called a ‘secure enclave’ that contains a program that protects oracle-retrieved information from malicious attacks, and allows complete integrity of a project.

In the beginning of 2019, Chainlink acquired a trusted hardware system developed by Ari Juels, a computer science professor called Town Crier. Town Crier keeps the computation confidential when it answers data queries from smart contracts.

Ari Juels

Why Do We Need Oracles

Oracles help close the gap between real-world information and decentralized technology. Oracles are needed across different industries with projects interacting outside blockchain use, providing streams of data information on a daily, hourly, or per transaction basis.

Price Predictions

Expanding on the betting example we used earlier with smart contracts, oracles would be a key function in executing the bet. When writing the smart contract, you could program for an oracle to check the sports results from one or multiple trusted sports websites, to confirm the score of the game. Without an oracle, the smart contract would not be able to execute the function.

Insurance

It may be possible one day to buy a wide array of insurance products over the blockchain through oracles. For example, travel insurance – if your flight is delayed or canceled, an oracle can verify this information from trusted online sources for flight times, for a near-instantaneous payout could be made.

Shipping

Oracles can communicate with IoT devices to give accurate, up-to-date geographical positioning information on international shipments for decentralized applications to track consignments.

Different Types of Oracles

ChainLink

Chainlink is by far the biggest oracle, with partnerships with the largest companies in the world ranging from Microsoft, Google, Coca-cola and many more. Chainlink uses its Ethereum token LINK to request data information both on and off-chain.

LINK has been one of the fastest-growing cryptocurrencies this year, with the token now holding the number 5 position on CoinGecko and CoinMarketCap.

Recently the oracle giant has released Chainlink VRF which uses verifiable random functions to produce randomness that is verifiable on-chain. In brief, a smart contract will request randomness from Chainlink, Chainlink then generates randomness and sends it to the VRF contract. VRF contracts will then verify the randomness, before being sent to the smart contract.

Chainlink was challenged in the past months when Zeus Capital released a report on Twitter stating LINK is a scam, and spreading a lot of FUD around the project. Upon investigating, the LINK community (Link Marines) found suspiciously little information around Zeus Capital, and concluded the information in the report to be false and contrived. Crypto influencers were also approached by Zeus Capital, some of whom were offered 5 BTC for a ‘bad Link’ post.

Chainlink, the team and its marines, remain strong and unfazed as the project continues to grow with new partnerships and integrations daily. CoinTelegraph has just reported Bitcoin sidechain RSK will soon be equipped with Chainlink oracles, allowing developers on the blockchain to gain access into market price feeds and other off-chain data to help build their applications.

Band

The BAND oracle can sometimes be referred to as LINK’s little brother, or the Pepsi to Chainlinks’ Coke, and has seen massive pumps in the fast couple of months.

BAND is a cross-chain, secure, scalable, blockchain-agnostic decentralized oracle for web3 applications. It’s focus is on building a “trusted information bridge between the Web 2.0 and the Web 3.0 of the future.”

The oracle project has gone from strength to strength since its inception in September 2019, being backed by many global investors including Binance, Woodstock, Sequoia Capital to name a few.

The Binance Smart Chain – the blockchain created by the world’s largest crypto exchange – has just integrated BAND protocol’s data oracles.

BAND Protocol has also created an Ecosystem Fund, where users can apply for funding to support the development of decentralized applications (Dapps).

DIA

The Switzerland-based not-for-profit organization DIA stands for Decentralized Information Asset, and uses oracles with tokenomic incentives and community knowledge to source, verify and provide accurate financial data.

DIA is predominantly used within DeFi applications, as a reliable and trustworthy data feed to avoid exploitation and manipulation within financial products. DIA is open-source and transparent, meaning anyone can view the movement and action of the tokens.

The DIA ecosystem employs a governance role for token holders, allowing them to vote on governance issues including decision-making on how the platform will expand in the future. Holding the DIA token also gives users exclusive access to live data feeds; all historic data can be accessed free of charge, whereas access to live data streams and certain APIs is only available when purchased with DIA tokens.

DOS

The DOS oracle has been referred to by many as the ‘Chinese Chainlink’, providing an efficient and secure way to bring real-world data onto blockchains.

DOS can relay near real-time request fulfilment information that is verifiable on-chain across multiple blockchains with cross-chain interactions.

DOS has managed to create a protocol that is scalable at low cost, with data query throughput and computation capacity increasing as more nodes join to grow the network.

Although the project still has a small market cap, it has shown a lot of promise and potential with increase in use cases and a 10X in price in the past couple of months.

NEST

NEST Protocol is the first oracle network to produce price data on chain by using a unique “quote mining” mechanism, whereby miners provide price quotes and pay commissions to receive NEST tokens.

It’s a relatively simple process to join, simply use the Nest mobile dapp to start quote mining, it is available for both iOS and Android.

Similar to other oracles, holders of the NEST token gain governance rights and participate in community decision-making. Miners obtain NEST tokens through paying ETH commissions and taking certain price fluctuation risks.

NEST Protocol also creates an opportunity for developers to create their own single-use ERC20 Token/ETH price oracle through the NEST dapp, but it must be approved, auctioned and certified before being executed.

Conclusion: The Future of Oracles

Why do we need oracles? Hopefully after reading all of the above you understand that as we move to an online decentralized world, the use of oracles is mandatory in giving use to the majority of smart contracts.

Oracles are indifferent, oracles are not centralized or biased. Oracles simply provide a data feed from either information on the blockchain, or real-word instances, to a designated smart contract.

In the future when your printer is low on ink, an oracle could read a sensor, pass this information on to a smart contract that can trigger an order from your nearest stationary store, so you will never run out of printer ink again.

It sounds amazing and very convenient, but it may be setting us up for perhaps a too convenient lifestyle. For example with the introduction of smart home appliances, your fridge would be able to detect when you’re running low on milk and order some for you at your door. Fewer people would find a reason to go out and leave the house.

Unless, of course, these people are wearing smart devices that use oracles to pass on data to the blockchain about how much exercise has been accomplished in exchange for rewards. Nevertheless, the application opportunities are virtually endless.

If you want to learn more about blockchain oracles and all things related to crypto, be sure to check out Ivan on Tech Academy – the go-to blockchain education academy!