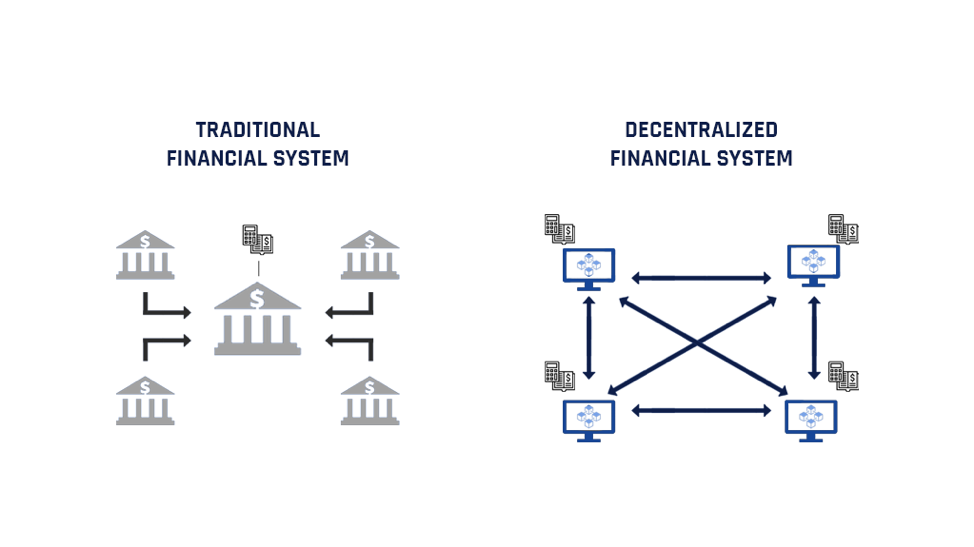

The Etherum ecosystem thrives off of several decentralized solutions to faults in traditional financial systems. Among such solutions, its DeFi (decentralized finance) ecosystem has become a breeding ground for innovation that exceeds the expectations of existing systems.

What is DeFi?

DeFi is the ecosystem of financial applications that operate on blockchain networks. Digital assets may be acquired through DeFi products available on these applications. Examples of DeFi products include:

- Decentralized exchanges

- Tokenization platforms

- Derivatives

- Prediction markets

Digital assets in the DeFi ecosystem may or may not represent assets in the real world. A significant proportion of the assets derive their value from the execution of smart contracts, which can mirror financial instruments in traditional markets.

Photo Source: Stably

Smart contracts provide the infrastructure for many decentralized finance technologies, allowing for the implementation of decentralized governance models and the facilitation of financial transactions, among other vital uses. With smart contracts, business processes are automated, which negates the need to rely on third-party systems for reliable digital business agreements to be executed. As such, this removes layers of complexity. Moreover, this is true for both inexperienced and experienced players in the financial sector who are able to access the benefits of financial products that they previously would have been unauthorized to access.

Traditional Barriers to Financial Markets

Before the onset of the decentralized finance era, several factors presented barriers to entry in the global financial markets. These factors included:

- Legal statuses such as citizenship, documentation, and credentials

- High funding requirements to access financial services

- Geographic location in relation to financial service providers

- Currency risks due to geographic location and source of fiat

- Operational risks due to cross-border payments and money laundering regulations

- Concentration of knowledge among incumbent industry players

The evolution of DeFi over the years means that most people around the world are only limited by their imagination when considering how to gain benefits from the financial ecosystem. However, there are still many complexities that need addressing in order to further expand the full extent of the possibilities of DeFi. The opportunities and challenges related to Ethereum DeFi bonds shed light on the many intricacies of the ecosystem, under the hood. In analyzing the current issues and solutions, much can be revealed about the inner workings of Ethereum, DeFi, and stablecoins.

The Stablecoin Factor and Ethereum DeFi Bonds

Stablecoins have recently become one of the most important determinants of success in the DeFi ecosystem.Significant growth in this sector can be attributed to the diverse range of stablecoins in the space. As an example, Ethereum-based stablecoins experienced greater transactional growth quarter over quarter than that of PayPal’s venmo.

The stablecoins on the network make the DeFi instruments more accessible for people around the world. Additionally, this opens the gates for more demand to be met and resultant increases in the price of digital assets that are demanded by customers.

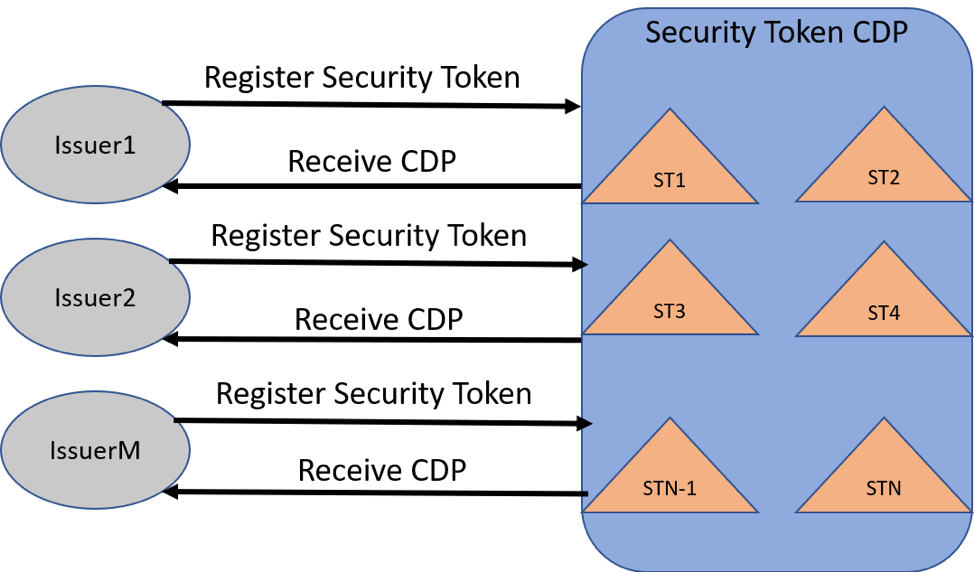

As an example, a DeFi user can convert a stablecoin to Ethereum so that they may use the converted value to fund a collateralized debt position (CDP). Providing investments grow adequately in the future, the long-term benefits may be gained by the DeFi user who, without the stablecoin, may not have been able to engage in the CDP. This is in contrast to traditional payment systems which not only take longer to process transactions but also are almost impossible to use for people in other geographic locations. Just like the internet made the exchange of information cheap and easy, DeFi will make value transfer easy by stripping away layers of complexity that exist in traditional finance systems.

Source: Jesus Rodriguez, Hackernoon

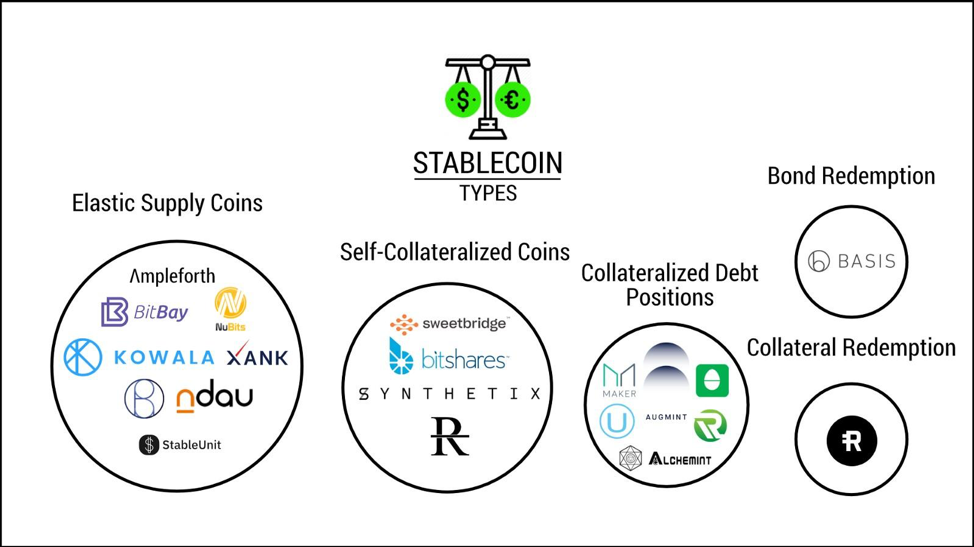

Explaining Stablecoins

Stablecoins stand to significantly reduce the risks of cross-border transactions and the volatility associated with fiat currencies that would usually be used to directly invest in financial systems. For this reason, it should come as no surprise that approximately 50% of stablecoins were reported to run on Ethereum. In addition, reports revealed 2% of ETH in existence as being locked up as DAI stablecoin backing collateral. The effects of stablecoins on the network have been monumental. Provided that an adequate smart contract infrastructure is implemented to support the governance system, stablecoins could drive demand not only for Ethereum but for other DeFi networks. Unfortunately, there are many issues with stablecoins that could delay the sector’s transition to becoming more robust.

Challenges of Stablecoins

Source: Marx Dagger, Hackernoon

Stablecoins can also be considered as pegged coins, which means that, ultimately, their value is closely linked to a specific asset or assets. This could threaten the present model of economic incentives for the collateralized stablecoin projects.

In order to understand the true depth of this threat and its associated risks, it is important to distinguish between the main types of stablecoins:

- Fiat-collateralized

- Crypto-collateralized

- Non-collateralized

Fiat-collateralized stablecoins gained a lot of popularity due to the fact that their value comes from traditional currencies, such as the Euro or US dollar. They are usually redeemable at 1:1 ratio with fiat currencies they are pegged against, making them attractive as less risky stores of value in the cryptocurrency sector. Many users of these types of stablecoins prefer them as active measures are taken to keep the stablecoin at a 1:1 ratio with the fiat currency. Projects that attempt to provide such coins include Gemini Dollars and USDC.

Non-Collateral Stablecoins

Non-collateralized stablecoins operate on the basis of algorithms which make the system supply more tokens as demand increases. As more tokens are supplied, the price of tokens lower (and vice versa) to ensure that a stable peg is achieved.

Crypto-collateralized stablecoins derive value from cryptocurrency assets which are used as collateral. Different methods are used to maintain their 1:1 peg against assets. Such methods include the over-collateralization and incentives. Maker’s DAI is a major crypto-collateralized stablecoin. The DAI has a pegging to the US dollar and backed by ETH.

For every DAI, a certain amount of ETH is locked into a MakerDAO smart contract as collateral. The smart contract releases the collateral once the debt is cleared. It can also sell the collateral if its value drops below a certain value. The volatility of ETH presents risks to the present system as stablecoin liquidation can be enabled. The nature of stablecoins like this can limit the innovation that could be possible within the economic incentives system of the DeFi sector.

The unprecedented Black Thursday event saw the price of DAI rise to over 10% above the intended 1 USD peg. Holders of the governance token (MKR) reacted to this occurrence by lowering the stability fee and savings rate close to zero. This event brought to light points of improvement in the system. With negative interest rates, more downward pressure could have been exerted on market prices. Despite initial designs of the system, which would have allowed for negative interest rates in this situation, the current system lacks the mechanism for such rates.

The Original Design With Reflex Bonds

Originally, DAI had negative rates. In the design for DAI the market price was meant to float instead of going back to the same redemption price of one US dollar. Its value was to be determined by the market, not by governance systems. If the original design was adopted, the digital asset would have experienced lower volatility than is currently experienced.

DAI was not pegged to 1 USD or any other asset. Instead, it was called the “external reference asset” through which the target price was denominated. The stablecoin would behave more like a dampened index. A fixed target-price would be used as a stopgap until the portfolio was ready (through diversification) for the floating target price to become stable.

Changes to the worth of the asset (termed “reflex bond” by Nikolai Mushegian) are dependent on its unique features:

- Collateralized and not pegged, with low volatility compared to its own collateral

- Different redemption price from existing DAI; variable redemption prices

- Different market price from existing DAI

- Per-second redemption rate used to incentivize CDP creators to create more bonds or pay back bond debt

- Redemption rate changes the redemption price overtime in a similar way to an interest rate

- Borrowing power is calculated by dividing the value of the feed data divided by the redemption price which is divided by the liquidation ratio.

Traditional Bonds

An adequate understanding of traditional bonds can shed light on some of the capabilities of the reflex bonds. A bond (in the traditional finance context) can be issued by banks, governments, and corporations to raise capital for ongoing projects. The bond issued usually includes the terms of the loan, the date the loan must be paid back, and the amount of interest payments to be made.

People that buy the bonds are considered as lenders who receive a fixed interest payment in return for providing capital. Bonds are considered by many traditional investors as a great way to lower portfolio risk through diversification. Bonds are usually used along with stocks and cash equivalents for this purpose. Corporate and government bonds are usually publicly traded while others may be traded privately between borrower and lender.

Bridging the Gap

There are a lot of various gaps that need to be filled in order to make fully robust reflex bond solutions. Smart contracts must be designed and supported in ways that ensure a high level of truthfulness is achieved.

The requirements to consider in the creation of a reflex-bond include:

- Provision of price feeds for the bond and collateral through an oracle

- Changes to redemption rate via a rate setter

- A lending and liquidation mechanism

From Theory to Application

Efforts are being made to make reflex bonds possible. After the system is launched, it will be possible to automatically deposit ETH to create the bonds. The deposits could then be used in another protocol to borrow or create other digital assets. With less volatility, it becomes easier to use the bonds as collateral to acquire digital assets such as synthetic gold.

MetaCartel Ventures

MetaCartel Ventures recently invested in a project by Reflexer Labs and its project RAI, a trust minimized collateral for DeFi.

The system offers several key benefits including:

- A system that issues its own reflex bonds, most of which will be used to collateralize synthetic assets

- USD, Euro, and other stablecoins built on a protocol without having to engage with multiple asset risk

- Less systemic risks in the DeFi ecosystem as less assets would need to be held in Ethereum

The Reflex Bond

The Reflex Bond made by Reflexer Labs, “$RAI” will only be collateralized by Etheruem, allowing dampened exposure to its market. It will offer dampened exposure to Ethereum, lower risk of loss, and lower volatility. This could make cryptocurrency assets more attractive for more traditional financial institutions such as wealth funds and banks. Many traditional financial institutions complain of the volatility of the sector, which they consider to be too high to even consider for their “high-risk” portfolios.

Image Source: DeFi Rate

Its solution to address existing issues in the DeFi involves the minimization of governance. With governance minimized, risks can be substantially reduced and transparency in the DeFi model could be improved significantly.

Reflexer offers the following changes to governance:

- Decreased governance in the long-term

- Fully frozen protocol where governance/votes will only be on the oracle

- Functions of the reflex bond system are known and agreed on by all participants in the space.

Conclusion

The topics of Ethereum DeFi bonds and stablecoins reveals a lot about the evolution of the blockchain network which has been responsible for a growing variety of decentralized applications used by corporations, startups, and investors.

Ethereum has had its fair share of volatility and the attendant consequences which have caused investors to lose and make millions. Irrespective of the amounts made and lost, the fact remains that the future of the global financial system depends on the developments that take place in the DeFi sector.

In order for more corporations and people to trust in DeFi and engage with it with greater confidence, deeper understanding of protocols, oracles, governance, and collateralization systems is required.

Reflexer Labs has taken a big step to introduce $RAI, which could set the precedent for a new era of reflexer bonds that allow for low-risk collateralization of synthetic assets and less systemic risks in the DeFi sector. In order to make this possible, robust systems may need to be in place to enable the provision of price feeds for the bond and collaterals through oracles, more effective lending and liquidation mechanisms, and changes to the redemption rate.