Zapper.fi is an interesting platform that lets you quickly and easily deploy and manage your DeFi positions within a single interface. With all the complexities involved with multiple yield farming positions, wouldn’t it be nice to manage your portfolio in one dashboard? That’s what Zapper.fi does. It is a DeFi portfolio management dashboard that helps you stay on top of your portfolio, liquidity pools, and liquidity mining positions.

The DeFi sector is arguably hotter than ever, and Zapper Finance (stylized as Zapper.fi, and is the result of a merger between the grassroots projects DeFiZap and DeFiSnap) is another DeFi asset management platform.

Those who really want to get into DeFi, however, should start off by enrolling in Ivan on Tech Academy. Ivan on Tech Academy is the go-to platform for all things blockchain, cryptocurrency and DeFi related. What’s more, right now you can get a special discount by enrolling with the code BLOG20, which will give you 20% off. What’s there to lose?

How Zapper.fi Works

Zapper.fi is built on two actions “Zapping In” and “Zapping Out.” This just means you can enter and exit DeFi positions directly through the Zapper dashboard.

For instance, if you wanted to take a position in Uniswap’s ETH-DAI pool, you would have to swap for 50% ETH and 50% DAI to get into that pool. But, that would exact time costs as well as the gas costs for at least a few transactions. With Zapper.fi, you can do this in one click. So, after you’ve confirmed your trade, you’re considered to be “zapped in” to the Uniswap ETH-DAI pool.

Moreover, like other DeFi protocols, you can use Zapper.fi without sharing any of your KYC data or turning over custody of your funds.

The History of Zapper.fi

DeFiZap

It all started back in 2019 when the project called DeFiZap emerged victorious from the Kyber DeFi Virtual hackathon. DeFiZap provided one-of-a-kind DeFi onramps which softened the blow of things such as impermanent loss. DeFiZap was also one of the top grant recipients of Gitcoin Grants Round 4.

DeFiSnap

DeFiSnap was a dashboard for tracking DeFi positions. It is similar to DeFiZap in that it emerged as one of the top grant recipients of Gitcoin Grants Round 5. DeFiSnap was known for its numerous DeFi integrations. So, while it was great for tracking outstanding positions, DeFiSnap didn’t allow users to deploy capital.

It was only back in May of 2020 that DeFiSnap and DeFiZap merged to create Zapper.fi. This platform combined the best of both protocols to make DeFi as accessible as possible.

Zapper’s Features

Zapper.fi (or Zapper) comes with some interesting features:

- Integration with multiple DeFi platforms.

- Allows portfolio rebalancing via shifting capital to other platforms.

- Multi-pooling features allow diversification of asset distribution across various liquidity pools.

- The best pooling opportunities all in one interface.

- It’s no longer necessary to visit multiple websites to make transactions.

- There are numerous “zappers” using the platform and their numbers are growing.

- You can monitor DeFi positions with a snapshot of your assets and liabilities.

- Zapper can divide your liquidity into whatever proportion the pool requires.

- For example, these proportions would be 50/50 in Uniswap and 80/20 in Balancer.

How to Use Zapper

With Zapper you can invest in hundreds of DeFi strategies, saving time, effort, and gas fees along the way. You can work with the top DeFi protocols such as Balancer, Curve, Uniswap, and yearn.finance without having to visit each website.

- To start with, no account or sign-up forms are necessary.

- Simply connect your Metamask wallet to begin.

- You can connect one or multiple wallets.

- Just click the dropdown menu next to your wallet address at the top left.

- Choose Manage Addresses and paste in your wallet’s ETH address(es).

- First timers will get a questionnaire.

- It will ask about your investing strategies and DeFi experience.

- This will help you understand what kind of investor you are.

- And it will help determine your goals and tolerance for risk.

- After determining your strategy, you will be directed to one of the Zaps.

- Look for the supported protocols under the “Invest” tab.

- Here you can add liquidity, earn incentives and voting rights, and more.

- Zapper does not charge fees

- However, when you Zap In or Zap Out of positions you will need to pay the standard Ethereum gas fees.

- In the true spirit of DeFi, Zapper never takes custody of your assets.

The Advantages of Zapper

With Zapper, you can track your positions across the top DeFi protocols, such as:

Zapper allows you to see your assets broken down by platforms and enables you to move funds into supported protocols. Furthermore, one of the biggest advantages of Zapper is how it simplifies the financial process.

Manual liquidity mining takes a lot of time, but with Zapper you don’t have to visit multiple platforms to provide liquidity. That’s because Zapper combines lending, margin trading, and pooling into Zaps. Also, by using Zapper you can save on Ethereum gas fees by bundling multiple transactions into one.

Other Features of Zapper

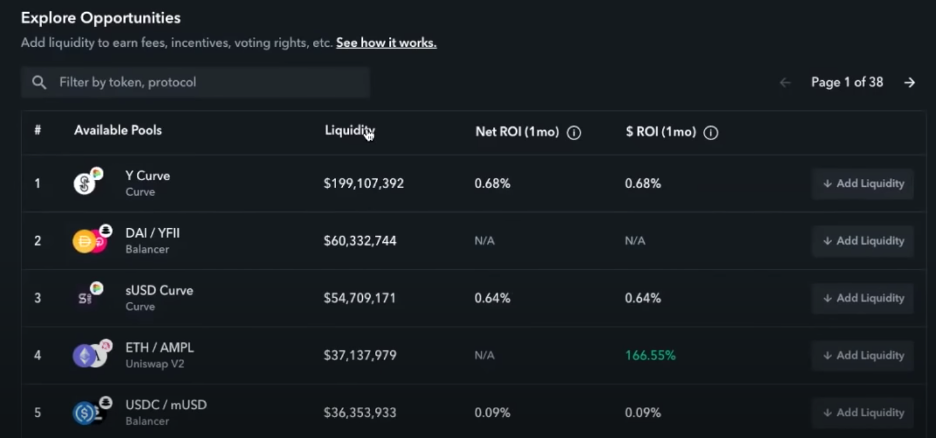

There are hundreds of liquidity providing opportunities that can be accessed from the dashboard. As a result, you can choose from the various pools based on their requirements to provide liquidity and start earning fees and other incentives. Remember, you won’t be able to see the reams of information on the dashboard until you connect your wallet.

And again, if you have multiple wallets, you can type in the 0x address and navigate between the addresses by clicking on them. This way you can see your account breakdown based on what’s in your wallet vs. what is sitting in a liquidity pool. You will see a breakdown of your asset allocation across the different categories depending on which protocol they’re on.

With only a flip of a switch, you can catch a glimpse of all your assets. It’s always useful to keep track of multiple protocols especially if you’re using multiple Ethereum wallet addresses.

The Portfolio Tracking Utility

A cool feature in the portfolio tracking utility is the ability to navigate transactions. With it, you can perform a search based on a protocol or token. This is a much easier way to find something like an SNX token than having to dig through Etherscan.

Yes, Etherscan is powerful, but it has different use cases. To put it simply, it would be harder to navigate to find tokens in your wallet on Etherscan than it would on Zapper. Zapper is easier on the eyes when it comes to knowing where your money is being put to work in the DeFi ecosystem.

If you are looking to learn more about the wonderful world of decentralized finance, you should definitely join the over 20,000 people already enrolled in Ivan on Tech Academy. Take a look at the countless blockchain courses, many of which are about decentralized finance, and supercharge your blockchain skills and knowledge!

Providing Liquidity on Zapper

Zapper provides you with pooling opportunities from their single interface. If you’re interested in becoming a liquidity provider, you can scroll through the different pools with Zapper and rank them based on their liquidity. More liquid pools might mean fewer profits, but they’ll be safer than the less liquid pools.

The magic of Zapper is it allows you to start with the tokens in your wallet that might not be in the pool. So, if you wanted to be an LP in the yCurve pool, you would need one of the listed stablecoins or you couldn’t provide liquidity to that pool. Whereas with Zapper you can just start with what’s already in your wallet.

Let’s say a stablecoin like USDC is required before you can provide liquidity, but you only have ETH in your wallet. Zapper can save you the time it would take to navigate over to a DEX like Uniswap to swap your ETH. Instead, you can stay inside Zapper and they will get the swap done for you. It won’t be entirely free as there will be some gas costs, but you can quickly provide liquidity in a single transaction without possessing the exact stablecoin required in the pool.

Zapping Into Liquidity Pools on Uniswap

There are three types of pools when choosing Uniswap:

Pegged Pools

These pools are low risk / low reward. These are for tokens pegged to ETH. So, you will maintain full exposure to ETH while collecting trading fees and rewards when you stake.

Stable Pools

Stable pools are high risk / high reward. The ETH-DAI pool would be an example. Traders love these pools because they can generate some fat fees. The downside of this pool is you can miss out on ETH gains with any significant price breaks. However, when the fees are high enough, they can more than cover this opportunity cost.

Token Pools

These pools work well for hodlers. An example would be the ETH-MKR pool. If you are already an existing token holder, why not use some of them to supply liquidity to an established pool? This is not investment advice. Always do your research, but it might be worth looking into if you want to earn some extra yield.

So, if you’re just starting as a liquidity provider, you might want to stick with deep liquidity pools that are well established. Look for signs of high trading volume and lots of involvement from liquidity providers rather than some obscure, illiquid pool promising big returns.

Also, you probably want to steer clear of pools with highly specialized, exotic tokens. If you’ve never heard of the token, there could be a good reason to avoid it until you’ve fully researched it.

But, before you even decide to become a liquidity provider, there are a few questions to ask yourself. What assets do you want to put to work? Do you have some extra DAI hanging around? Or do you want exposure to a token you don’t already own?

There are so many things that Zapper can do it’s hard to cover in one article. But utilizing any DeFi protocol comes with some potential risks that we’ll cover next.

Risks of Using Zapper

First off, always practice common sense using any DeFi protocol. That means bookmark the Zapper website in your browser and only use the bookmark. You don’t want to click on any unsolicited email link, no matter how official it looks. It could be a phishing scam.

Users often wonder whether every liquidity pool listed on Zapper is safe to Zap into. The risks involved with using the functions in the Invest tab are the same as any other liquidity risks. Whenever you zap into a liquidity provider opportunity on any DeFi platform you are exposing yourself to potential smart contract bugs. If you’re moving large sums of money, you can protect yourself by buying cover on places like Nexus Mutual.

So, while the team does their best to vet smart contracts to make sure they are developed by reputable DeFi teams and fully audited, users should beware that there is always risk involved when zapping into yield farming opportunities. There could also be smart contract risks with Zapper itself when transporting your tokens to and from the various platforms and liquidity pools.

Slippage and Other Risks

But one of the biggest risks of using Zapper is slippage. To counter this, click the little icon at the top right. There you can choose your slippage tolerance along with the maximum percentage you are willing to lose. You can choose 3% or 2% or even go lower down to 1%. Once you set your max tolerance for slippage you are protected up to that amount. So when you hit “Confirm” to execute a Zap, you will get an error telling you to reload the page or to increase your slippage tolerance if you exceed your slippage tolerance.

This is a great feature that prevents you from entering a trade you might regret later when you find out how much slippage costs you just ate. It doesn’t taste nice, so choose your slippage tolerance carefully.

Other risks include the standard kinds common to the DeFi ecosystem. These include hacks or the potential for impermanent loss on platforms like Uniswap. There can also be stablecoin de-pegging, wrapped Bitcoin de-pegging, and the systemic risk that exists because of the elaborate correlation that exists between the wide range of DeFi apps and protocols.

Conclusion

Zapper is rapidly evolving into a top asset management protocol. It is entirely self-funded and backed by strong community support so they can pivot quickly to meet the needs of the yield farmers and liquidity providers of the future.

Zapper does a good job of keeping up with the latest and greatest DeFi applications and platforms. Generally, if someone releases a new dApp, it will show up in the Zapper dashboard within a few days.

At present, only the Ethereum network is supported. But that’s because the team’s view is that since the lion’s share of DeFi activity takes place on the Ethereum, that is where their focus will stay. However, other blockchains may come under future consideration depending on whether they can attract large enough numbers of users and liquidity.

Also, the team appears to be exploring different governance options. You can join their Discord to follow the progress if you’re interested.

Want to learn more about the exciting world of DeFi? Join Ivan on Tech Academy today and start your journey towards getting a world-class blockchain education!

Author: MindFrac