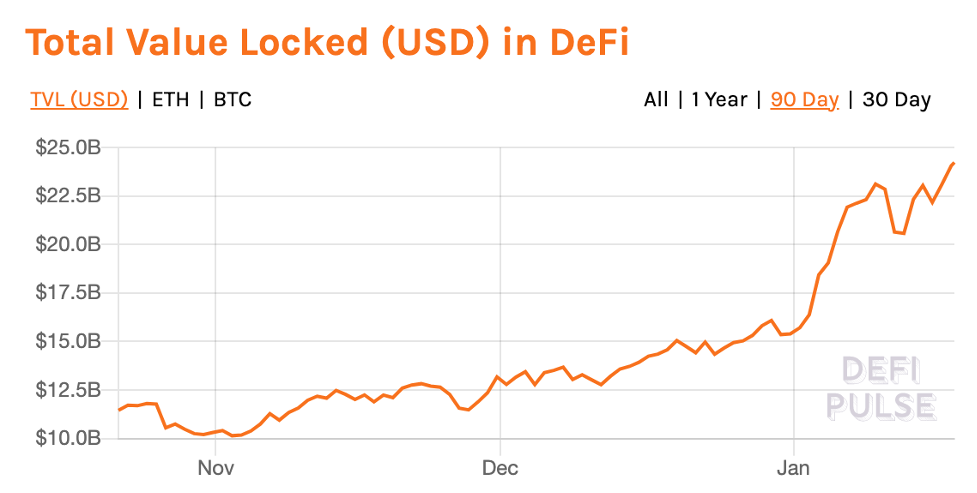

The growth of the decentralized finance (DeFi) field has been fast-paced over the past year, and it has introduced a long list of fascinating projects. What’s more, the Total Value Locked (TVL) in DeFi has risen sharply, as you can see in the chart below. One of these interesting projects is that of Badger DAO and its BADGER token, with which it looks to accelerate the use of Bitcoin in DeFi.

We’ve also seen Yearn.Finance lead the charge against investor-backed projects and instead replace it with their “fair token launch” model. In this kind of model, the community takes ownership of the project from the start. Another leap forward has been the increasing demand for Bitcoin on the Ethereum blockchain.

Many would argue that Bitcoin is the soundest method of exchange or collateral ever invented. Bitcoin usage in DeFi used to be confined to the tiny ecosystem on the Bitcoin network until protocols emerged, allowing Bitcoin holders to wrap their BTC on Ethereum (see Wrapped Bitcoin). Since then, the amount of BTC on the Ethereum blockchain has grown significantly.

However, the problem is that the infrastructure set up to use BTC on Ethereum is still immature. Therefore minting BTC on Ethereum is mostly limited to centralized platforms that require trust, custody, and KYC. While the good news for BTC holders looking to put it into DeFi is that many lending and borrowing protocols use synthetic Bitcoin as collateral, there are presently very few large liquidity pools to trade it.

Thus, with the rise of DeFi and Bitcoin’s potential role in it, an innovative team was motivated to create Badger DAO.

What Is Badger DAO?

As you may know, the term DAO stands for decentralized autonomous organization. What’s more, Badger DAO strives to build the infrastructure and products necessary to accelerate Bitcoin’s use across Ethereum and other blockchains.

The developer team designed it to be a complete ecosystem where projects across the DeFi landscape can collaborate to build products. The DAO allows developers from different projects to align their incentives with decentralized governance. The concept is to bring builders together by encouraging collaboration over competition.

Do you want to build the kind of products Badger DAO is proposing? First, you’ll need to learn to code smart contracts. Start your world-class education today at Ivan on Tech Academy!

Another goal for the team is to make sure that Badger DAO starts as a community-led initiative from the outset. Governance will make decisions regarding new products, and governance will ensure a fair distribution of $BADGER for all participants. Hence, it’s apparent that Badger DAO is committed to a “community first” outlook that is fair and transparent.

But Badger DAO must attract and maintain a swathe of coders, content creators, liquidity providers, and users to be successful. Bringing together this kind of diversity of skillsets will ultimately benefit everyone involved. The Badger DAO community members will have a stake in the platform’s success with generated revenues staying in-house. After all, they believe the profits should go to those who contribute to the DAO’s growth.

Badger Builders

Builders are the backbone of the Badger DAO. They are community members dedicated to collaborating with others to bring new products to life. A Builder could be a single developer or a group of them, or even a company.

Also, there are no fixed obligations as to participation requirements - the door is open to anyone who wants to create. A Badger operations team armed with open-source code, a fair amount of governance tokens, and new builders will work together to bring about community-created products.

New Product Pitches

Community members can pitch their new product ideas to the Badger DAO Discord channel to get feedback and collaboration. When the community signals interest, they will develop the proposals further. Next comes an off-chain vote. This vote will decide if the idea should move forward to the greater community. Lastly comes an official vote to get approval.

After a proposal is approved, the dev-ops team will collaborate to help build, fund, and market it. The project will use off-chain voting on Discord and Telegram platforms for any other product and operations-related issues. The hope is that rather than isolated individuals proposing solutions, contributors will join together to create some fantastic products.

Collaboration Is Key

Badger developers are standing by to collaborate with anyone who wants to create something cool and profitable. The team hopes to see not only developers but also DeFi protocols joining in to participate. The platform is open to anyone with an idea, whether it be an individual developer or a blockchain company. Any product the Badger community releases wants to be transparent, fair, and profitable for everyone involved.

The team believes the community can surpass anything built by centrally controlled entities. And the Badger DAO treasury will provide funding while new projects can leverage assets such as $BADGER tokens to incentivize new users during the post-launch phase.

The $BADGER Token Launch

Badger DAO starts off describing their token with a disclaimer that it has no monetary value and strictly governs the DAO. Like Yearn.Finance’s YFI token, $BADGER, will kick off with a fair liquidity mining launch. That means no centralized control of the protocol upon launch, no raising VC funds, and no anonymous team that could incite fears of a potential rug pull.

So, Badger DAO will not follow any bad examples with anonymous founders or risky launches without audits. That’s why the team will be publicly known and involved throughout. And also why the smart contract auditing firm, Zokyo, has already audited all the Badger DAO smart contracts and systems before launch.

Furthermore, the community will decide how to distribute portions of the token supply after 35% of the tokens go to the Badger DAO for maintenance. Funds could be released for things like operations, partnership incentives, additional liquidity mining, and more - but only after the community votes.

Since Badger DAO wants to give control to the community from the outset, you won’t see pre-formatted pie charts littering their website allocating the funds in advance. Instead, they will leave it up to the community to decide how to spend the remaining token supply. Learn all about Ethereum, DAOs, cryptocurrencies, and more at Ivan on Tech Academy!

Time-Locked Founder Rewards

The Badger team believes that incentives lead to success. So, they will allocate 10% of the total supply (2,100,000 $BADGER) to founder rewards and distribute them incrementally to public wallets. The remaining 90% will go to the community. To prevent any rug pulls, founder rewards will have a 1-year time lock on the wallet to release tokens evenly every week across 12 months.

Badger DAO will release a transparency report to confirm these time locks’ authenticity and token distribution schedules.

Badger DAO’s First Product, SETT

Real badgers build their homes out of leaves and grass. These homes, or Setts, are so fortified that they can last for centuries, providing a home for generations of badgers.

Badger DAO wants to do the same for its crypto holders using SETT as its automated DeFi aggregator. Since Badger DAO exists to create Bitcoin focused products, SETT models Yearn.Finance vaults but focused strictly on tokenized BTC assets. SETT will also be the only way for members to earn $BADGER tokens.

Users will deposit assets to earn yield, while smart contracts will execute various strategies to put the assets to work across multiple DeFi protocols. Thus, users can optimize yield without all the hard work and mental effort required for executing the typical yield farmingstrategy.

For a limited time, users who deposit funds to SETTS will receive yield plus $BADGER. The protocol will apply a multiplier effect to rewards for users who stake for more extended periods.

There is a 0.5% withdrawal fee, but users can withdraw their assets at any time. There will be an additional 4.5% fee on any profits. These fees will cover gas and transaction costs.

Badgers are animals that fiercely protect themselves and their loved ones from larger animals. That’s why Badger DAO chose the name to advocate for that same kind of fierce unity and the desire to create.

Badger DAO’s Five SETTs

The five SETTS ready for launch will be four Compounding Strategies: Curve – SBTC, Curve – RENBTC, Curve TBTC, and Badger – WBTC. With one SETT put aside for those wishing to stake $BADGER to earn more $BADGER.

SETT is still in its early stages. However, new strategies and innovative SETTs will be coming to market as the community grows. These will include additional compounding strategies, native BTC deposits, single asset vaults with multiple strategies, and BTC neutral strategies to guard against price fluctuations.

Badger DAO’s Second Product, DIGG

Along with the $BADGER token, the team will also launch its community-owned product called DIGG. This product will add to the list of existing Bitcoin synthetics, but it will be non-custodial.

Think of DIGG as an elastic supply cryptocurrency that’s pegged to Bitcoin’s price. The supply of DIGG will automatically adjust each day across all wallets. And these adjustments will be based on DIGG’s USD value vs. BTC. So, if DIGG’s price rises higher than BTC, the wallet balance increases. Likewise, if DIGG’s price drops, wallet balances decrease. At the same time, each day, the system summons a price oracle to determine whether to increase or decrease the supply of DIGG to drive the buy or sell pressure accordingly.

The goal is to remove centralized control and custody over synthetic BTC and instead deploy elastic parameters to maintain the peg. But the protocol can do more to keep DIGG closer to the peg, like rebasing each block or adding new incentives to drive the buy and sell pressure in the right direction.

Moreover, halfway through the $BADGER distribution, the DIGG token will launch where users can stake in SETTs. The Badger DAO will also control 50% of the DIGG supply it hadn’t distributed during liquidity mining.

With their first product, $BADGER token holders will govern things like the token supply, future smart contract changes, marketing decisions, and protocol parameters for present and future projects built by the DAO.

How DAOs Should Work

DAO formation has accelerated as projects seek to follow the community-led governance trend. Staying hip and trendy while riding the decentralization wave on Ethereum has essentially turned governance tokens into the new utility token.

When it comes to the real world, however, DAO’s attract little community governance participation. There can be many reasons for this, including things like high gas fees for voting on-chain. Other reasons might be a lack of perceived ownership amongst the bystanders who don’t bother voting. Voting and participation are nice in theory but fruitless if the multi-sig setups disregard and disapprove any proposed changes. When the vote doesn’t matter, people can lose interest.

Real Community and Venture DAOs

The team at Badger DAO believes the most active DAOs are Venture DAOs. That’s because they not only are responsible for every part of the business, but they have skin in the game as well. Product focused DAOs should learn from Venture DAOs to ensure that community members stay involved in every stage and share the value created by these products.

Badger DAO didn’t just become another DAO because it’s trendy. Their focus is to build community and create an environment of collaboration with a shared mission to bring BTC to DeFi. Their goal is to become more than just a legally formed company, and more than just the typical DAO that gives the nod to the community without actually building one.

That’s why community members will launch all products and why shared ownership will remain at the forefront. Likewise, any product value created through fees and revenue will go to $BADGER token holders and the product creators.

Issues could arise regarding which community members proposed which ideas, so things won’t necessarily be as clear cut when figuring out who reaps the larger percentage of the rewards. For example, If a DeFi protocol provides its funding and developer talent to create a product, they would need to list the resources they’d be willing to allocate to the other appropriate parties. These could include the operations team and other community members who help make their project happen.

Badger DAO Conclusion

We’ve talked a lot about the builders and the development team, but the advocates of these newly created products will also be essential to Badger DAO’s success. The platform will need people to write and produce other content like art, publications, memes, and videos. So, there are many reasons to be excited about Badger DAO’s potential you’re looking to get involved in this type of project.

Do you want to become a skilled blockchain developer in a red-hot job market? If so, start your education today at Ivan on Tech Academy.

Author: MindFrac