Aave is a decentralized money market protocol that enables users to lend and borrow cryptocurrencies in a trustless manner. There is a wide variety of cryptocurrencies to choose from, and Aave offers both stable and variable interest rates to its users.

We’re looking closer at Aave today because it is quickly establishing itself as a market leader in the lending and borrowing sector of decentralized finance (DeFi). Like other DeFi protocols, there are no lengthy registrations to contend with, nor any KYC (Know Your Customer) or AML (Anti Money Laundering) documents required.

How Aave Works

To transact on Aave, lenders must deposit funds into liquidity pools, and users can then borrow from these pools. Each pool sets assets aside as reserves to hedge against volatility. These reserves also help ensure that lenders can withdraw their funds when they’re ready to exit the protocol.

Aave has close to 20 different cryptocurrencies available for lending and borrowing. Included in this stockpile are some you may have heard of: DAI, ETH, BAT, LINK, MANA, MKR, SNX, USDT, USDC, TUSD, USDT, sUSD, BUSD, KNC, LINK, wBTC, ZRX, and of course, LEND. Not all of the cryptos can be used as collateral, however.

How to Borrow on Aave

One must first lock up collateral to borrow. And the amount locked up must be greater than the amount borrowed. If you’re familiar with DeFi money markets, then you will recognize the concept of overcollateralized loans. With Aave, that amount typically ranges from 50 to 75%. And borrowers must maintain the collateralization ratio. If they don’t, other users can liquidate them. And they will be incentivized to do so by buying out their undercollateralized position for a discount.

Regardless of whether a user deposits collateral for lending or borrowing, they will receive aTokens in exchange. So, 10 DAI deposited will return 10 aTokens. The aTokens accrue interest from lending, and they can be redeemed on a 1:1 basis. Aave also has liquidity pools set up on Balancer and Uniswap to help with any liquidity issues so users can withdraw their funds when ready. Aave also uses Chainlink as an oracle to collect price data.

The Aave Advantage

So far, so good. If you’ve read our other articles on DeFi, many of these features that Aave offers will be familiar to you. After all, DeFi protocols share similar characteristics. However, here is where Aave distinguishes itself from its peers: Flash Loans (uncollateralized loans), rate switching, and unique collateral types.

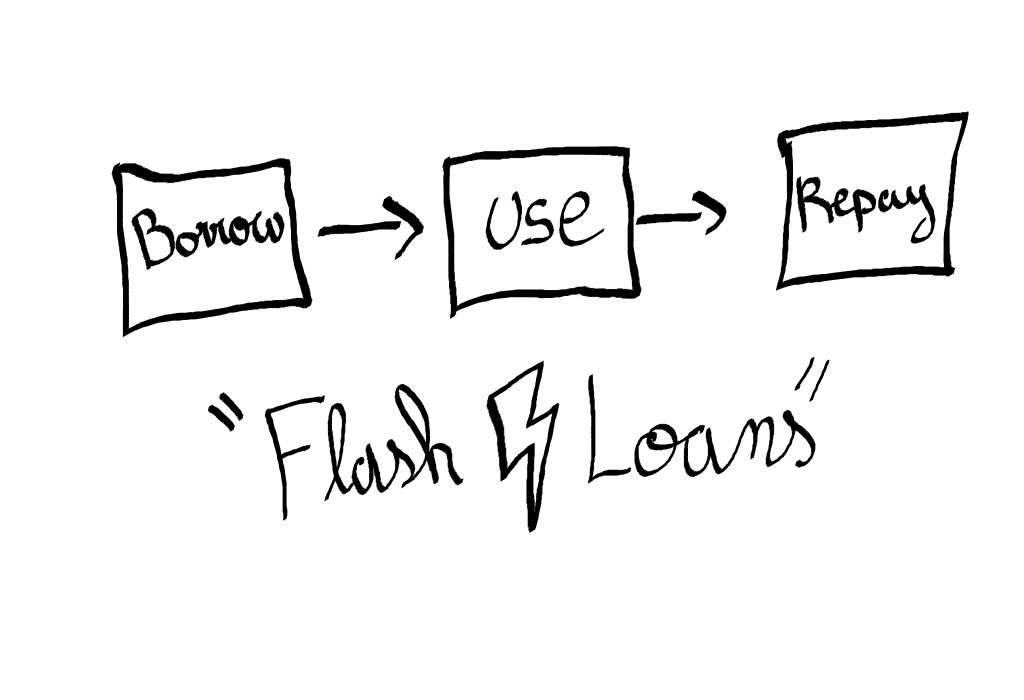

Flash Loans

Flash loans are a huge selling point for Aave, and users don’t need any collateral to access them. That’s right, zero collateral! How can this be?

In lieu of collateral, there are time requirements. In other words, users must pay the loan back within the same transaction. If not, the entire transaction will fail.

Flash Loans are futuristic and next-generation DeFi. They are Aave’s most significant contribution, and they hold incredible potential. Since the code is open-source, other developers will be able to offer them on their platforms. And Flash Loans are native to the crypto space. In other words, they aren’t something that Aave borrowed from the traditional financial world and recreated in DeFi. They are entirely new.

This article won’t delve into the complicated ways traders profit off Flash Loans as they are technically complex. But the simple explanation is, the user must repay the loan amount by the time the next block is mined. If not, every transaction that has occurred with the borrowed funds will be canceled.

Yield farming

It seems impossible to make money with a Flash Loan given the short amount of time a trader has to work his magic. They are often used for Yield Farming, but the potential these loans possess is far from realized at this point. At present, there are three use cases for Flash Loans:

- Arbitrage

- Refinance loans

- Swap the current deposit of collateral

We will be exploring them further in the future, so stay tuned. In the meantime, just know that Flash Loans provide arbitrage opportunities for little cost to the user, and they are a revenue stream for Aave. Fees collected are 0.3% of the loan amount.

Interest Rate Switching

Interest rates are subject to supply and demand forces. For lending protocols like Aave, the relationship between the pool’s liquidity and the demand to borrow will determine the interest rates. So, when the demand for borrowing increases, it reduces available liquidity, interest rates rise, and depositors generate more income.

Lending platforms typically lock users into either a fixed or variable interest rate. With Aave, however, users can switch between stable or variable interest rates. This ensures they can get the best rate for the loan.

The variable interest behaves as mentioned above. Algorithms determine the rate based on demand for an asset pool. With heavier demand loads, both lenders and borrowers will see an increase in interest rates.

The stable rate, on the other hand, is different. It is determined by averaging the last 30 days of interest rates for the particular asset. Stable rates give borrowers peace of mind knowing their interest rate will not radically deviate over the course of the loan’s duration.

Don’t think of stable rates as fixed interest rates, though. “Stable” in this case just means it is a more stable type of variable interest rate. These rates are less susceptible to market volatility.

What makes them unique is that users on Aave can switch between stable and variable rates at any time. And the team appears to be getting more aggressive with their interest rate model to ensure their users get the number they are looking to hit.

Unique Collateral

If you’re looking for diversity when it comes to choices of collateral types, look no further. Aave has the most diverse range of DeFi collateral in the space. We already mentioned a few at the beginning of the article. But besides the more popular tokens like ETH, DAI, and USDC, borrowers will soon be able to take out positions on Uniswap LP tokens and TokenSets.

How to Use Aave

To get started, you’ll need a Web 3.0 wallet like Metamask. Then head over to https://app.aave.com/ and connect to deposit your funds. From there, you can pick an asset, the amount you want to lend, and deposit your tokens to the lending pool. You can always monitor your accrued interest in the Aave dashboard.

As mentioned earlier, you will receive aTokens when you deposit your funds. Aave’s aTokens are similar to Compound’s cTokens as you will have an interest-earning asset. They are different, however, in that each aToken will always equal its underlying asset. An aETH token will have the same value as ETH.

Also, cTokens appreciate in value with interest earned, whereas aTokens will just increase in number with interest earned. So, as your interest grows, your number of aTokens will grow. While we’re on the topic of Compound Finance, let’s see how it compares to Aave.

Aave vs. Compound

Both Aave and Compound overcollateralize their lending protocols. They both utilize lending pools from which users can borrow funds. And both have a governance token (see below).

As far as differences go, Aave is more complex than Compound. This can be both good and bad. It is preferable for Compound in that its user interface (UI) is easier to navigate. At the same time, however, it is good for Aave in that it offers more features than its simpler rival.

Also, Compound does not offer stable interest rates, much less interest-rate switching between stable and variable rates. Nor does Compound offer Flash Loans. And at the time of this writing, it only has nine assets available whilst Aave is closing in on 20.

All in all, it appears that Aave wins the day as a lending protocol, but Compound is easier to use since it has fewer features. It also incentivizes lenders and borrowers to participate by giving them fractions of COMP tokens at frequent intervals like little dopamine hits to keep them hooked.

Aave offers a wider range of asset support, while Compound is just starting to expand its product offerings via governance delegates.

Surely, the competition between Compound and Aave will be heating up. Each will be shooting for expanded product offerings, better interest rates, and improving their user experience. But Aave is just getting off the ground when it comes to community governance whilst Compound is close to becoming a fully operational Decentralized Autonomous Organization (DAO). Both have their advantages, so it will be interesting to see how it unfolds.

The LEND Token

LEND is Aave’s native token. At first glance, one would think it would be “AAV” or something more akin to its name. However, when the founders launched back in 2017, they raised $600,000 worth of ETH for 1 billion LEND tokens in their ICO. Originally, the project’s name was EthLend. But a rebranding campaign settled on “Aave” in 2018, while they kept the “LEND” portion around for their native token.

By hodling LEND, users can get discounted fees. LEND will also be staked for governance. This means LEND hodlers would have a say in the future direction of the project. What’s more, hodlers will be able to stake it to earn fractional fees off the interest paid. As such, the aforementioned pool of staked tokens can function as emergency reserves in case of malicious liquidity or black swan events.

Also, whenever users pay fees on the protocol, it burns LEND. As previously mentioned, this makes it a deflationary asset. The implication being, if the supply is consistently decreasing, the value may improve over time.

The Future of Aave

Like other protocols in the year of DeFi 2020, Aave has carved out a nice slice of the market pie. And while still relatively new and unfinished, Aave already has some of the best yields in the marketplace.

It offers a myriad of assets, features, and tools so that other devs can integrate some of these features into their projects. After all, building with Lego blocks is what DeFi is all about. Aave already holds the number 3 position in terms of total value locked (TVL), according to DeFi Pulse. They also offer strong liquidity and utilize Nexus Mutual for protection against smart contract risk.

But Aave will face the same challenges of other DeFi projects. Namely, how to onboard “normies” from the traditional world of finance. After all, who outside of DeFi would ever want to use these protocols? Can services like Customer Support ever be anything but centralized? We shall see.

Flash Loans to the Rescue

Loans historically have been transacted for one reason—to get more money. Borrowers seek more capital than they currently own. So, who in the heck would want to borrow less than they currently own? It is kind of like saying, “Okay, I’ll give you $500 in collateral to borrow $100. Such a deal!”

These kinds of loans only make sense to those who know they can hustle and move funds around staking and Yield Farming to earn enough interest to make it worthwhile. But who besides DeFi Wizards could pull off such transactions?

The argument could be made that Flash Loans allow people with no assets to try to turn a profit in DeFi. If that opportunity alone on-boards more outsiders, then that can only be good for DeFi, right?

One story covered a hacker who turned a $360k profit off a $10 Flash Loan. Not that anyone wants to promote hacking, but just the fact that it could be done is rather interesting. One could never attempt to rake in such huge profits in traditional finance without incurring massive risks in leverage, collateral, etc. Therein lies the beauty of Flash Loans. If the borrower’s masterplan doesn’t work, the transaction is simply canceled. Crazy. These kinds of loans are crazy cool, and they present early adopters with loads of opportunities.

Conclusion

Aave’s founder Stani Kulechov believes that mainstream investors can be onboarded once the risks have been quantified and put out in the open. Volatile cryptocurrencies are still scary for the risk-intolerant class, and fair enough. However, the Aave team is working on new ways to safeguard liquidity providers with risk-management mechanisms to protect the capital held in their protocol.

Stani Kulechov

One thing’s for sure; the DeFi landscape is growing ever more complex with new products and tools that continually seem to one-up their predecessors. It is a very exciting space to be in for sure.

If you are interested in Aave, you can track its growth with Aave Watch. You can also track how many protocol fees have been used to burn LEND at Aave Burn.

If you want to learn more about DeFi, head over to the Ivan On Tech Academy. There you will learn how to get started with Aave and other bleeding-edge projects in the DeFi 101 and DeFi 201 courses.

Author: MindFrac