What is DeFi Lending?

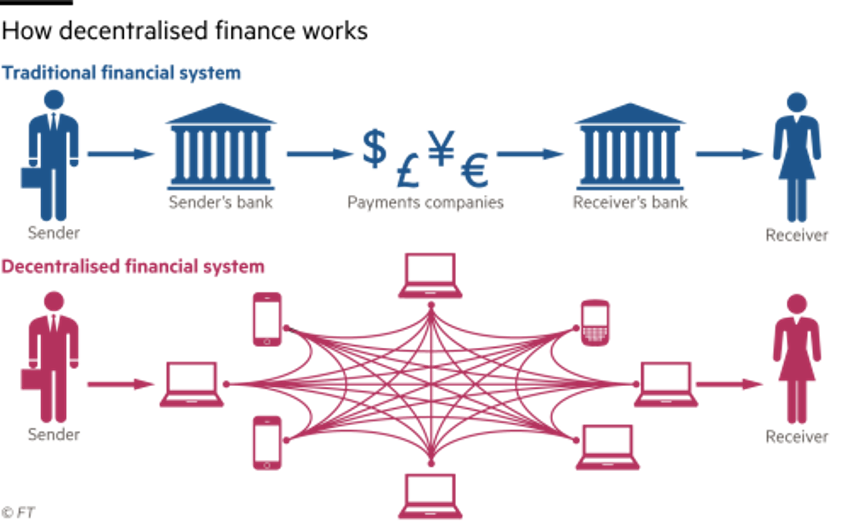

The DeFi lending space plays the same role as any traditional bank giving loans to a user or business. But as with any other blockchain application, DeFi lending has much more to offer than its conventional peers.

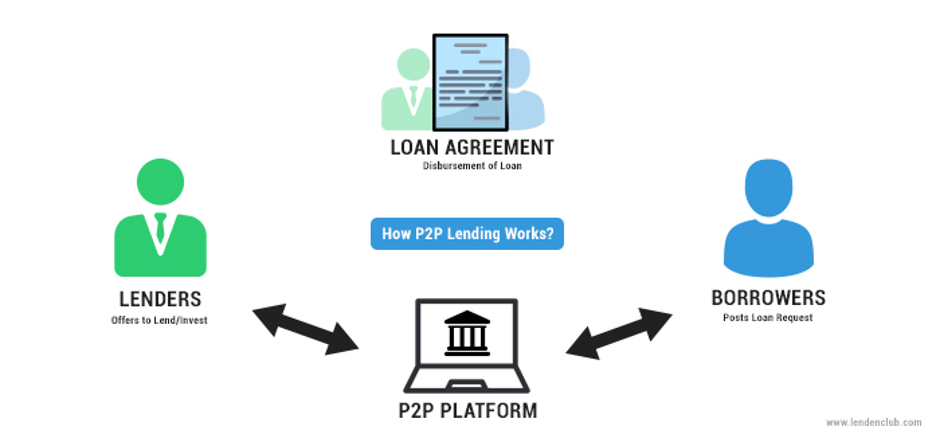

The DeFi crypto lending platforms offer crypto loans to anyone in a trustless manner, i.e., without intermediaries. Any user can enlist the crypto coins they own in the DeFi lending platforms for lending purposes. A borrower will directly take a loan from the platform, which can also be called DeFi P2P lending. The lending protocol enables the lender to earn interests.

Out of all the other DApps available in the decentralized finance space, the DeFi lending growth rate is highest, making it the most significant contributor to locking crypto assets. According to crypto research company Messari, the DeFi lending space is the top-performing section in terms of ROI (return of investment), followed by decentralized exchanges (DEX) and DeFi payments.

What Benefits do DeFi Lending Platforms offer over Traditional Lending?

Because of the underlying blockchain technology, DeFi crypto lending offers some clear key advantages over traditional lending.

- Transparency – Instead of a centralized authority, smart contracts handle the lent and borrowed assets and save it in the blockchain for everyone to verify. Therefore it offers complete transparency in any fund movement.

- Easier Access to Asset – As there’s no middleman, DeFi lending platforms enable peer to peer lending and borrowing i.e. direct asset transfer, offering much easier access for users.

- Greater Speed, Utility, and Flexibility – To borrow or borrow, you need to create an account on a DeFi lending platform, have a crypto wallet, and take just a few seconds to open smart contracts. All these can be verified using your mobile and in just a couple of minutes.

- Price Efficiency – Market demand defines asset prices. So, the ability of DeFi to attract more users quickly due to ease of access, arbitrage opportunity, and transparency in financial disclosure promotes price efficiency.

- Censorship Resistance and Immutability – Decentralization guarantees there’s no preferential treatment and equal right to information and opportunity are maintained, with transactions saved in blockchain promising immutability.

Are there any Disadvantages with DeFi P2P Lending?

Though DeFi lending platforms are in a very advantageous position with multiple benefits, there are a few issues associated with it as well.

- Higher Interest Rate – The interest rate for borrowing in DeFi space is relatively higher at the moment – while it’s 6-10% for USDC, for DAI is about 17.5%. The global interest rate for borrowing varies depending on the countries. While many first world countries like the US commands about 5-6% interest rate on average, several countries are charging 10-20% interest rates, with many charging higher. According to Worldbank data, Brazil, in 2019, charged about 37.5% interest rate.

Talking about turning this con into an opportunity, this also shows DeFi lending can offer the same interest rate across borders, contributing to the DeFi lending growth rate.

- Unable to Influence Economy – If there’s low liquidity, that restricts lending and borrowing at the present interest rate without really affecting the equilibrium interest rates. This leads to DeFi not being able to influence and therefore replicate the economy enough.

The equilibrium interest rate is the rate at which the supplied money and demand are equal.

What User Benefits do DeFi Lending Platform Offer?

Apart from conventional earning interest from lending crypto assets, DeFi lending brings on some great and rather unique benefits for both lenders and borrowers.

- Margin Trading: A user can purchase an asset and then directly trade it on another exchange for any other cryptocurrency. This replicates margin trading in centralized exchanges and furthermore offers margin trading options in unsupported platforms.

- Reward from Long-term Investment: Instead of leaving his crypto assets idle, a long-term investor can lend this asset on DeFi lending platforms and earn an additional amount from interest besides a HODL strategy or capital appreciation.

- Arbitrage between DEXs and CEXs: A user having access to credit in fiat currencies can borrow it at a lower rate than the DEX’s, sell it on a CEX for a cryptocurrency, and then lend it on the DEX for earning an arbitrage fee. Usually, a platform with stricter KYC requirements offers this opportunity.

Since the lending and borrowing rates vary widely between two DEXs, there’s also an opportunity to gain arbitrage fees.

DeFi Lending Platforms

Ethereum completely dominates the DeFi crypto lending space with more than 15 lending platforms. Though EOSREX.io is the sole lending platform on EOS it holds substantially high (over $600 million) assets locked in it.

Due to the scope of the article, discussing only the top 5 DeFi lending would be possible.

DeFi Lending #1: Compound

Blockchain Type: Ethereum

Founder: Robert Leshner is also the CEO of Compound. A Chartered Financial Analyst, he’s a former economist, Product Lead at delivery apps Postmates, and 2x startup founder.

Total Value Locked: $648.5 million USD at the time of writing

Asset Supported: Compound supports 9 ERC-20 type tokens – ETH, DAI, SAI, USDT, REP, WBTC, BAT, and ZRX

Out of all the tokens, Compound has the most DAI worth 705.108 million USD in its vault earning 1.45% interest while USDT locked worth 24.6 million USD earning the highest interest of 8.11%.

Minimum collateral: 133%

Investors: Compound has some leading investors in its list – Polychain Capital, Andreessen Horowitz, Coinbase, and Bain Capital.

Description:

First launched in September 2018, the mainnet upgraded to its second version in 2019.

Lenders lend their assets to the Compound liquidity pool and borrowers borrow from this pool. This pool is a series of smart contracts that match the borrowers with the assets available in the pool.

When deposited, the algorithm tokenizes the locked assets creating its native cTokens – examples would be cBAT token for BAT coin, cDAI token for DAI, etc. This token represents the assets moved in or out of the pool, hence allowing the actual assets to be moved, traded, or use for other applications.

Using the Compound algorithm, the smart contracts automatically determine the interest rate and shuffle them based on each crypto asset’s supply-demand ratio. The generated cToken automatically keeps earning interest for the depositor over time. You can redeem your cToken for the relevant asset (BAT) plus interest paid in the same token (BAT).

The collateral factor or ratio (how much another crypto asset you can borrow against the deposited asset) for each asset can be different. The maximum borrow amount allowed (called borrow limit) is determined by the Comptroller contract which calculates your account’s liquidity in an ETH-denominated value.

When the loan amount exceeds the borrowing limit, your position is liquidated. Compound allows other users to repay this debt up to 50% and doing so they can receive the collateral at a 5% discount rate. This liquidation incentive rate may vary.

Instead of paying interest regularly for the loaned amount, you can pay all at once.

To tackle situations like lenders withdrawing deposited funds all at once, Compound utilizes the interest rate model. The utilization rate increases when borrowers borrow more.

Other Features

- Compound doesn’t require any ID verification or KYC making it truly permissionless, therefore anyone can lend and borrow assets from anywhere.

- There’s no lower limit to lending or borrowing.

- Interest rates kick in every time Ethereum mines a block. Therefore, lenders receive interest about every 15 seconds.

- The Compound protocol reserves 10% of interest paid while the rest goes to lenders.

- In June 2020, Compound launched its governance token COMP. It gives token holders voting rights over things like protocol upgrades, the addition of new assets for borrowing/lending, a future voting possibility to distribute fees, or for token buybacks.

Note: Some of the other DeFi crypto lending platforms discussed here are similar to Compound. Hence the working principle is discussed in a bit detail here to facilitate understanding.

DeFi Lending #2: Maker

Blockchain Type: Ethereum

Founder: Rune Christensen is the co-founder and Maker CEO

Total Value Locked: $925.3 million USD

Asset supported: Maker is different from Compound as it lets borrow only DAI token. To use as collateral, it allows ETH and BAT for now, with Augur (REP), OmiseGo (OMG), Golem (GNT), DigixDAO (DGD), and 0x (ZRX) coins in the queue.

Minimum collateral: 150%

Investors: Some of the investors include Andreessen Horowitz, Dragonfly, Paradigm, etc.

Description

The Maker is a unique DeFi crypto lending platform. It primarily offers DAI stablecoin as a loan to borrowers. The stablecoin to USD peg ratio is 1:1. However, instead of USD, Maker allows only ETH and BAT (at the moment) as collateral.

Users lock up their collateral into a core Maker smart contract called CDP or Collateralized Debt Position to produce DAI. Over collateralization lower the system’s exposure to risk. The ratio of ETH collateral needed to acquire dai is fixed at 1.5:1 as opposed to 1:1.

MKR Features

- Governance – For voting and implementing various policies in the Maker network such as annual stability fee, collateral ratio, etc.

- Utility – To create CDP to generate DAI and, as mentioned, pay as the stability fee in addition to the borrowed DAI to close a position.

- Recapitalization – As a failsafe, the Maker system mints MKR when total collaterals locked in CDP are not enough to cover the existing DAI and sell MKR in the open market to raise capital to cover the deficit. It also acts as a counter-balance to keep DAI value stable.

Note that no lender puts their asset in a liquidity pool. Instead, a borrower must collateralize their asset in CDP to get a loan. Therefore the DAI buyers can be considered lenders, though indirectly.

More interesting point to note:

- The single-asset collateralized stablecoin is called SAI, as opposed to DAI.

CDP is now called Vault to accommodate the new multi-collateral DAI. But for each asset-backed DAI a separate vault is created, e.g. ETH vault or BAT vault.

- With the help of the DAI Saving Rate or DSR feature, users can hold their DAI in a DSR smart contract to earn additional DAI per variable saving rate. This rate is currently at 2%.

DeFi Lending #3: Aave

Blockchain Type: Ethereum

Founder: Stani Kulechov is the founder and CEO of Aave

Total Value Locked: $548.3 million USD

Asset Supported: Aave supports 16 coins out of which 13 can be used as collateral. This includes ETH, DAI, USDC, WBTC, REP, ZRX, BUSD, TUSD, and MANA crypto coins.

Minimum Collateralization: 133%

Investors: Some of the investors include Framework Ventures, Three Arrows Capital, Carnaby Capital, SVK Crypto, YouBi Capital, etc.

Description

When Aave rebranded from ETHLend, it shifted from a DeFi P2P lending strategy to a liquidity pool-based strategy like the other DeFi crypto lending platforms. It is an open-source non-custodial type DeFi lending protocol that has quickly drawn substantial users since its mainnet launch in 2020.

Lenders can deposit the above-mentioned cryptocurrencies in the pool and receive an equivalent (1:1) amount of aTokens, similar to cTokens of Compound. Holding this aTokens automatically generates an interest fee that starts compounding continuously. Since the Aave algorithmically adjusts the interest rate as per demand and supply, holding more aTokens will earn a higher interest fee. Aave allows this interest to be either saved with the tokens in the same wallet or it can be streamed into a separate address.

Aave’s native protocol token is called LEND, which is used to pay interest, reduce fees, and grant governing and voting rights to the holders. The token gets burned as fees are paid, therefore increasing its value.

By locking collateral, a borrower can withdraw a particular crypto from its pool at the collateralized rate. It allows borrowers to opt-in or out of a stable rate. A liquidity reserve is maintained to ensure withdrawal at any time. But Aave also offers an alternate trustless loan route called Flash loan.

Aave Features

Flash Loan – Aave allows a borrower to take a loan without locking any collateral but for a limited amount of time. If the loan is not paid back within the same transaction time or block time, it gets automatically reversed. The repayment of the loan attracts a very nominal fee of 0.09% in LEND. Flash loans are specially designed for developers who may need it to pay for capital for arbitrage, refinancing, or asset liquidation.

Rate Switching – This is another unique feature of Aave allowing borrowers to switch between stable and variable interest rates. The volatile nature of the interest fee in DeFi makes it hard to estimate interest costs for long-term borrowing. Hence, using this feature, a borrower can choose a fixed rate in case of a predicted interest fee increase, and shuffle back to a floating fee upon interest reduction

DeFi Lending #4. dYdX

Blockchain Type: Ethereum

Founder: Antonio Juliano. He’s also founded Weipoint and worked as a software engineer at Coinbase and Uber.

Total Value Locked: $38.7 million USD

Asset Supported: It currently supports Dai, ETH, and USDC with more to be added in the future.

Minimum collateralization: 115%

Investors: Some of the investors include Coinbase, Polychain Capital, Dragonfly Capital, Craft Ventures, Vy Capital, etc.

Description

Geared toward more experienced users, dYdX is a non-custodial DeFi crypto lending platform based on its open-source protocol Solo. Apart from the usual borrowing and lending services, dYdX also offers financial tools like options, margin trading, and derivatives. It’s known as a very low-risk DeFi lending protocol.

Like Compound, dYdX protocol also uses a pooled lending model where lenders’ assets are put into a liquidity pool through smart contracts and can be withdrawn anytime. The interest rate for borrowing adjusts with the demand and supply of an asset. This interest gets added continuously and reserves 15% of all interest earned into an insurance fund as position recovery backup. Rest is paid to the lenders.

Loans are collateralized with 125% of the borrowed value. But if the collateralization ratio falls below 115%, the system automatically liquidates the collaterals, thus securing lender repayment. The liquidation rate is 5%, which the borrower must pay to sell the collateral to the third-party buyer as loan pay-off.

It has no native token; therefore, it seems similar to a DeFi P2P lending platform, but not a direct peer-to-peer service because of the pool.

To facilitate trading, dYdX provides its own off-chain order books while trades are settled on-chain. It offers cross margin trading as well as Isolated margin trading. The platform charges a trading fee of 0.15%-0.5% for takers and no fee for makers.

dYdX allows traders to take leveraged short positions up to 4 times the value of their collateral and up to 5 times for long positions. Such margin trades and loans can remain open for a maximum of 28 days, after which the positions are automatically closed out with a 1% expiration fee.

DeFi Lending #5. Nuo Network

Blockchain Type: Ethereum

Founder: Varun Despande, Ratnesh Ray, Siddharth Verma

Total Value Locked: $3.3 million USD

Asset Supported: It supports ETH, SAI, DAI, MKR, KNC, ZRX, REP, WBTC, BAT, USDC, TUSD, and LINK crypto coins

Minimum collateralization: 150%

Investors: Some of the investors include Dragonfly Capital, ConsenSys Tachyon, Consensys Labs, etc.

Description

Nuo Network is a non-custodial platform referred to as a DeFi debt marketplace.

Like dYdX, Nuo Network adopts a pooled debt reserve where lenders deposit their assets as collateral to earn interest. This interest is a percentage of the interest fee paid daily by the users who take loans. This funded asset is then used for giving loans and facilitates trade.

The platform allows a borrower to take a loan of up to 70% of the value of their collateral. Nuo Network also allows lenders/borrowers to over-collateralize their loans that can later be revoked from the platform. Depending on the status of debt reserves, the protocol adjusts the interest rates algorithmically and offers 0.1% – 7% of interest rate based on the asset type. The interest rate on the network varies for lenders but is fixed for borrowers.

The platform doesn’t have a native token for internal asset representation. It also does not charge fees and instead covers the majority of user gas fees.

Nuo observes margin positions off-chain but executes it on-chain when a position has gone under the margin maintenance. If the price feed confirms it, Nuo auto-executes liquidation at a 2% rate. For margin trading, the platform offers up to 3x leverage on their collateral for 4 trading pairs including WBTC and ETH. It utilizes Uniswap and Kyber to execute trades.

Other Features

The lending platform has added mobile compatibility and Wyre integration (meta transactions) for converting fiat to ETH or DAI.

- Nuo is very user-friendly compared to other leading platforms discussed in this article. Its traditional email and password-based accounts offering can be easier for some users.

- Nuo’s liquidation fee of 2% is lower than other DeFi crypto lending protocols.

- It has the largest variety of assets available and offers the highest interest rates.

#6. Other DeFi Lending Platforms

Among other DeFi lending platforms, InstaDApp and Dharma require special mention. While the amount of total asset value locked in InstaDApp is $235.7 million USD, it’s $1.4 million USD for Dharma, hence making them two such platforms with colossal potential.

Conclusion

According to MarketWatch, the crypto lending market can be worth an $8 trillion market within the next two years. This is not surprising as According data from Defipulse showcases that lending DApps command the largest share of the DeFi market.

It’s no surprise that the DeFi lending growth rate is showing an overall upward trend even in this situation. The current crypto loan market valuation was about $4.7 billion in February 2020, substantially up since February 2019. Thanks to the higher interest rate, crypto lending platforms are being adopted quickly.

Due to the pandemic situation worldwide, a slow movement of the DeFi lending growth rate is expected as the economy shrinks a bit. As the physical lending market shrinks, this opens up a clear opportunity for the digital space or rather the DeFi lending space to boom.

Do you want to learn more about DeFi and dip your toes in this weird, yet amazing world? Check out our blockchain courses at Ivan on Tech Academy. We have some of the industry’s best experts on the subject, giving you hours of valuable content on DeFi.