The finance industry is one of the most important in the world, and many may take it for granted. In fact, some may assume that nearly everyone in the world has a bank account and is connected to a bank. This, however, is a false assumption. In fact, nearly a fourth of the population remains “unbanked” – without access to existing financial infrastructure. According to a recent report from the World Bank Group, approximately 1.7 billion people worldwide still do not have any connection to a bank whatsoever. There is, nevertheless, a light at the end of this tunnel. The solution to this problem? Well, it could well be that of Decentralized Finance, or “DeFi”.

The fact that one out of four people on the globe still does not have regular access to financial infrastructure is just the most visible manifestation of a larger problem. Specifically, it exposes how customers are essentially at the mercy of financial service providers. Current centralized banking systems, which a majority of the people in the world regularly use, can be biased and take advantage of the consumers. The financial service providers of today, whether these are banks, exchanges, or insurers, are powerful intermediaries who can charge unnecessary fees and exclude whomever they want.

To ensure that everyone in the world has access to similar possibilities and conditions requires an entirely new system. This is where DeFi comes into the picture. DeFi, or Decentralized Finance, is the name of a new ecosystem of decentralized finance solutions that could enable a slew of advantages.

As such, DeFi could not only provide banking access to the 25% without a bank, but it could also revolutionize the entire financial sector. Those familiar with this site will know that we have previously gone through various innovative DeFi projects, as well as why DeFi solutions are necessary. This article, instead, goes through the fundamentals of DeFi.

The Ins and Outs of Decentralized Finance – DeFi

The primary technology underpinning Decentralized Finance – or DeFi – is blockchain technology. Specifically, blockchain technology makes this type of a decentralized financial ecosystem possible to implement to begin with.

Large, powerful banks are central authorities who dominate existing financial systems. This is something that DeFi aims to eliminate. Furthermore, this financial revolution is trying to create a permissionless, transparent, and open-source financial services ecosystem – that is accessible to anyone.

Since DeFi aims to get rid of central authorities in finance, this entails that anyone will be able to have total control over their financial assets. Moreover, since DeFi does not require intermediaries between parties, everyone within the ecosystem would interact with each other through peer-to-peer (P2P) systems.

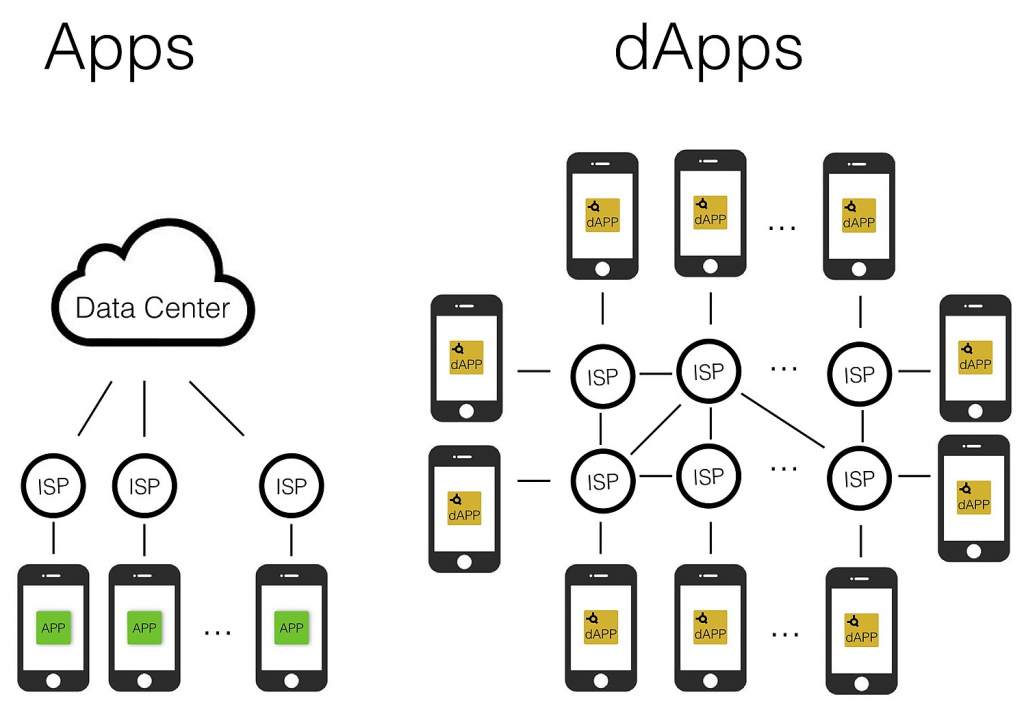

Moreover, at the very core of Decentralized Finance, we find dApps. These are also known as Decentralized Applications. dApps can be understood as being somewhat similar to regular smartphone applications, but way more powerful than your average application. Specifically, these dApps are what allows for more innovative and sophisticated financial solutions. The reason that they are more powerful than regular applications is that decentralized applications are built on a blockchain network.

It is easy to associate both Bitcoin and Ethereum with just being cryptocurrencies, but there is more to it. Bitcoin and Ethereum are two different types of open-source networks that the public can use to create applications. These applications can be of a financial nature and enable people to conduct financial activities without relying on a central authority.

Real-World Application of Decentralized Finance

The potential for DeFi is vast, and could likely have a significant impact on how people conduct their financial activities in the future. First and foremost, it seems probable that Decentralized Finance will have a significant impact on the people that are currently unbanked. These people are most likely in great need of a banking system, and this suddenly becomes possible when using DeFi technology-driven solutions.

The DeFi use cases are essentially endless

Secondly, the advent of DeFi could bring down the costs for all financial transactions massively. This is, of course, excellent for the consumer – but companies and large organizations can also benefit from it. There is no doubt that DeFi can bring significant benefits to the world, but the interesting question here is how these benefits will be brought to light.

Lending and Borrowing

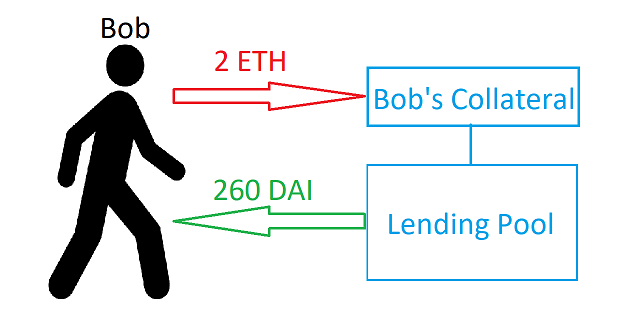

One area where we might see the implementation of Decentralized Finance is in money markets. A money market is where lending and borrowing of assets takes place. In a decentralized money market, the currency traded is generally crypto assets.

One of the most popular functions in the DeFi ecosystems are lending protocols. Lending protocols essentially allow one person to lend money to another. This is done through smart contracts, which contain the conditions and terms that apply when someone is borrowing and lending cryptocurrency.

The main difference between a traditional money market and a decentralized one is the fact the latter is available to anyone. It doesn’t matter where in the world you live or if you have access to existing financial services infrastructure – a decentralized money market would still be an option.

Decentralized Marketplaces

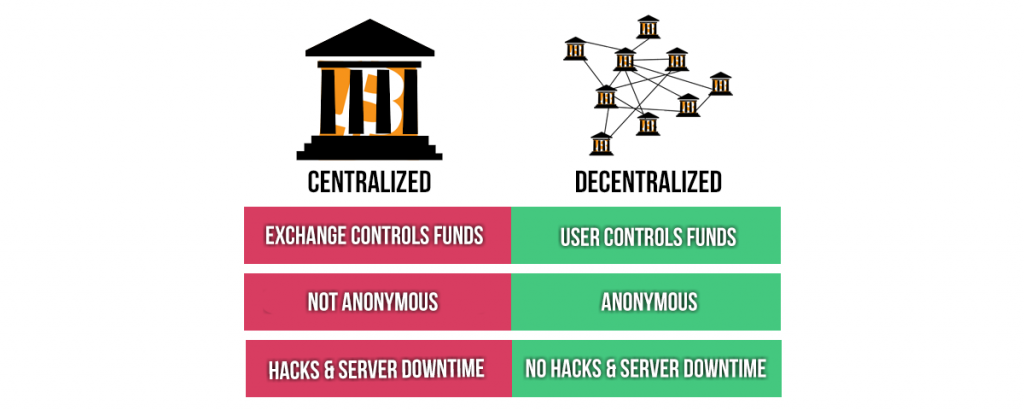

One of the fields that DeFi can have the most significant innovative impact on is in decentralized marketplaces for financial affairs. For example, one example of this is something known as a decentralized exchange (DEX). These DEX platforms are developed to create a place where people can trade digital assets without needing a go-between actor or intermediary.

Traditionally, the marketplace for trading financial assets is a stock market exchange. In this marketplace, the funds and assets that people are trading need a middleman. Such financial assets need a bank acting as a trusted intermediary. Smart contracts replace this intermediary party in a decentralized marketplace, allowing individuals to trade directly from one wallet to another.

Most existing DEXes focus on allowing people to trade cryptocurrencies between each other, but the sky is really the limit. The underlying technology is not limited to cryptocurrencies and can be used to trade virtually any financial assets.

Furthermore, since the marketplaces are based on decentralized systems, it will make the exchanges safer. One major point in favor of DeFi is that there does not exist a single point of failure, as it does not have a central technological architecture. Blockchain technology ensures this, and subsequently lowers the risk of theft and financial fraud. The underlying peer-to-peer (P2P) technology allows people to transfer their assets directly to other people, without first moving the assets to a marketplace.

Muddying the waters somewhat, there are several different forms of exchange on a decentralized exchange. For example, some marketplaces are using stocks; meanwhile, others are using tokens to represent assets. There are a few different decentralized exchanges today and here are some examples of the most popular ones:

- Loopring DEX

- Uniswap

- dYdX

Decentralized Stablecoins

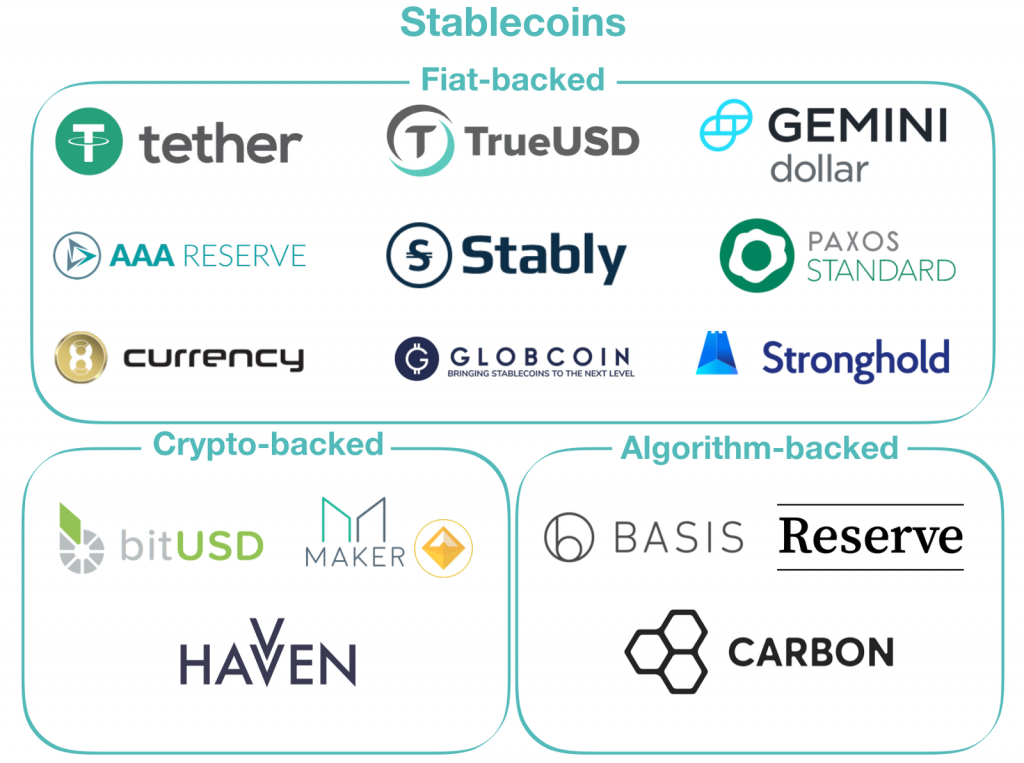

An oft-cited issue with cryptocurrencies is that of volatility. For example, the price of Bitcoin can vary relatively much from day to day, which makes it an uncertain investment. Looking at altcoins, this issue is even more significant. One day, an altcoin could increase by 100%, just to fall by the same percentage the next day. Due to the volatile nature of cryptocurrencies, they are a high-risk investment.

To solve the issue of the fluctuating price of a cryptocurrency, decentralized stablecoins were introduced. Decentralized stablecoins are a low-volatile class of cryptocurrencies. This means the stablecoins still have the favorable properties of regular cryptocurrencies, i.e., the same decentralized blockchain technology underpinning them, but come with lower rates of volatility.

This sounds like a great deal, but how is it possible? Decentralized stablecoins achieve their low volatility by pegging their value to another asset or group of assets. One popular way of doing this is to peg the value of a stablecoin to another currency, such as the Euro or the US dollar. However, connecting the coin to another currency is just one of the options. The stablecoins can also, for example, be connected to other assets like gold.

This lower volatility is then achieved since the decentralized stablecoins are backed by another asset, which some call a “reserve asset.” The idea of a stablecoin is excellent since it achieves the best of both cryptocurrencies and fiat money. There are several different stablecoins out there today that can be bought and here are a few examples:

- Tether— This stablecoin is connected to the US dollar at a 1-1 ratio.

- USDC— This coin is also pegged to the US dollar at the same proportion as Tether.

- DAI— This is the last coin, and DAI is also pegged to the US dollar.

Decentralizing Synthetic Instruments

To explain what Decentralized Synthetics are, we first need to grasp the financial instruments that are traditional Synthetics. Most people might associate Synthetics with a material that is supposed to imitate a natural substance. An example of this might be synthetic leather.

In the world of finance, synthetics are not too different. Financial “synthetics” are created to imitate another instrument, but changes some of its main characteristics. Example of synthetics are either options or leverages.

The reasoning behind why people purchase synthetics is in order to change the risk profiles and cash flow patterns of certain assets, among other things. Another more common example of a synthetic occurs when investing in gold, where the security papers are not actual gold, but only a representation of the metal.

Synthetix

Some would argue that decentralizing synthetics bring the most significant value to the unbanked. It would give them the possibility to actually invest in synthetics such as for gold and other natural resources. Put simply, one can say that decentralized synthetics could allow universal access to investing in various assets.

Decentralizing Monetary Services

Decentralized finance will also significantly impact the insurance industry, and the decentralization of this field is increasing. Specifically, the advent of blockchain technology and distributed ledger technology (DLT), might make traditional insurance companies lose their footing if they don’t adapt.

In today’s insurance industry, there are intermediaries that make sure the risk of something is spread out among individuals. This intermediary often comes in the form of a bank or an insurance company. However, in Decentralized Finance, this distribution of the risk can instead be achieved through blockchain technology.

Smart contracts on a blockchain can carry out anything that an insurance company or bank is doing. Some of these tasks include setting premiums, payments, or assessing the risk of something.

Since the implementation of insurance on a blockchain would eliminate the role of this middleman, e.g. the insurer, it would also allow for lower premiums while still providing the same essential service. Here are two examples of insurance service offerings coming from the field of Decentralized Finance:

- Opyn

- Nexus Mutual

The Risks with Decentralized Finance

Even though there is a lot of room for growth for DeFi, there are still some problems that need to be dealt with. One major issue is that there are not a lot of people trading cryptocurrencies, relatively speaking. As of late 2018, there were around 35 million verified crypto users. But even though this number is relatively small, the market is growing at a rapid rate. Just at the start of 2018, the number of users was only 18 million, which almost doubled in that same year.

Another problem is the capacity of the blockchains. If hundreds of millions, or even billions of people, were to join the DeFi system, this traffic might lead to problems. For example, Bitcoin can only process a few transactions per second, and this is nothing compared to the 24,000 transactions that Visa is capable of processing in the same amount of time. Nevertheless, one should acknowledge that the cryptocurrency community is actively working on developing scaling solutions.

Vitalik Buterin

Furthermore, the scaling capabilities of Ethereum are finite as well, which is something Ethereum founder Vitalik Buterin readily admits. The rapid growth in crypto users is high, but this will not matter if the underlying blockchains’ scalability are not up to par. Failing to accommodate willing users would only displease people, and could ultimately even turn them against Decentralized Finance.

How Will Decentralized Finance Benefit the World?

The main benefit of DeFi, in comparison with traditional finance, is that no intermediaries are needed. Instead of third parties driven by greed or self-interests, DeFi relies on code that will solve every dispute, and the individual will always be in full control of their assets.

The immediate implication of eliminating the middlemen is lower costs. Banks and other financial institutes provide services that they need to finance in some way. These costs could decrease somewhat in order to compete, but not entirely – as there will still be costs for providing these legacy services. As such, DeFi will be substantially cheaper than current systems.

Arguably the most critical aspect of DeFi is that it lacks a single point of failure. The data, verifications and information are spread out on thousands and thousands of nodes in the network. This makes hacking it and changing information a lot harder, which is also the case for potentially censoring the services from anyone.

Will DeFi bank the unbanked?

The last advantage worth bringing up is the fact that Decentralized Finance will be available to anyone. A large proportion of the people that are currently unbanked are so since they do not live near a bank. Since DeFi is entirely digital, it will not require people to be there in person to set up an account. Banks also rely on people with a lot of money, which only motivates them to provide services for people with more money. Since DeFi will bring down costs, it will also give low-income individuals access to the same services.

Decentralized Finance Conclusion

Almost a fourth of the population is unbanked due to several reasons, such as the lack of financial infrastructure; and it has been well overdue to decentralize finance. The potential that DeFi brings to the table is enormous and genuinely can revolutionize the world of finance.

DeFi faces many challenges ahead and will inevitably face opposition from the large banks. If successful, decentralized finance will take power from the large banks and distribute the influence between the large open-source community instead.

Will this work? This is a hard question to answer since nothing like this has been tested before. The problems and challenges are there, but so is the potential for a new era of Decentralized Finance. And since more and more services are proving to be successful, the odds are in favor of DeFi.

If you are interested in learning more about Decentralized Finance, make sure to visit the number one blockchain education platform Ivan on Tech Academy. This platform provides a selection of blockchain and DeFi courses for everyone.